About EYWA Cross-chain DEX

Eywa is an innovative Web3 ecosystem designed to address the complexities and inefficiencies of cross-chain communication and liquidity in decentralized finance (DeFi). The project's core mission is to create a more integrated, accessible, and user-friendly DeFi experience by unifying fragmented blockchain networks. This goal is pursued through Eywa's robust infrastructure, which enables seamless cross-chain transactions, liquidity provision, and yield farming opportunities.

Eywa seeks to empower users by providing them with the tools to move assets freely across different blockchain networks, thus breaking down the barriers that currently exist in the DeFi space. By offering a decentralized and secure platform, Eywa aims to become a cornerstone of the DeFi ecosystem, bringing together disconnected liquidity. The project’s emphasis on decentralization and user-centric design ensures that even those new to DeFi can participate without facing overwhelming technical challenges.

Eywa was conceived to tackle the pressing issue of fragmented liquidity across blockchain networks, which has long been a significant barrier to the wider adoption of decentralized finance. The project's development history is marked by a series of strategic milestones aimed at building a robust cross-chain infrastructure that facilitates seamless asset transfers and liquidity management across multiple blockchains.

One of the key developments in Eywa's journey was the creation of the Eywa Consensus Bridge, a decentralized solution that enables secure and efficient cross-chain transactions. This bridge is at the heart of Eywa's ecosystem, allowing users to move assets across different blockchain networks such as Ethereum, Binance Smart Chain (BNB Chain), Polygon, and many more without the need for intermediaries. The Consensus Bridge uses a unique consensus mechanism to validate transactions across chains, ensuring that all transfers are secure, accurate, and decentralized.

Another significant milestone in Eywa's development was the introduction of the CrossCurve protocol, which integrates with the popular Curve Finance platform. This integration allows Eywa to optimize liquidity across multiple chains, providing users with better trading conditions and enhanced yield farming opportunities. The CrossCurve protocol is designed to attract liquidity providers by offering competitive rewards, distributed in EYWA tokens, for those who contribute to the ecosystem’s liquidity pools.

Eywa's approach to cross-chain liquidity and interoperability sets it apart from other projects in the space. While competitors like Thorchain and Polkadot offer cross-chain solutions, Eywa distinguishes itself through its emphasis on decentralization, user accessibility, and community-driven governance. The project is designed to be as inclusive as possible, with a user-friendly interface that makes it easy for even newcomers to participate in DeFi. Additionally, the governance model empowers EYWA token holders to have a direct say in the protocol's future, ensuring that the community remains at the forefront of the project’s development.

As Eywa continues to evolve, the project has set its sights on expanding its support to additional blockchain networks, further enhancing its cross-chain capabilities. Future updates are expected to include the introduction of new features that will make the platform even more versatile and user-friendly, solidifying Eywa's position as a leader in the cross-chain DeFi space.

- Cross-Chain Liquidity: Eywa provides a seamless and efficient solution for transferring liquidity across multiple blockchain networks. This feature addresses the issue of fragmented liquidity in DeFi, enabling users to move assets freely between different chains.

- Decentralization: Eywa is built on the principle of true decentralization. All aspects of the protocol, from governance to transaction validation, are designed to be decentralized, ensuring that users retain full control over their assets and decisions.

- User Accessibility: One of Eywa's primary goals is to make decentralized finance accessible to everyone. The platform's user-friendly interface simplifies DeFi interactions, making it easier for beginners to participate without needing extensive technical knowledge.

- Unique Token Design: Following the footsteps of the battle-tested veCRV model, EYWA is the governance token of Eywa/Crosscurve, granting access to the EYWA DAO. veEYWA follows a modified voting escrow model, meaning that EYWA can be locked up to gain access to DAO voting power, directing emissions and other benefits.

- Security: Eywa employs a robust consensus mechanism that ensures the security and integrity of cross-chain transactions. This mechanism is designed to protect users' assets and data, making Eywa a reliable platform for DeFi activities.

- Yield Farming & Rewards: Liquidity providers on the Eywa platform can earn competitive rewards in EYWA tokens. These rewards incentivize users to contribute to the ecosystem's liquidity pools, which are essential for maintaining efficient trading conditions.

- Interoperability: Eywa's infrastructure is designed to be highly interoperable, supporting multiple blockchain networks and enabling smooth cross-chain operations. This interoperability is key to providing a unified DeFi experience across different blockchain ecosystems.

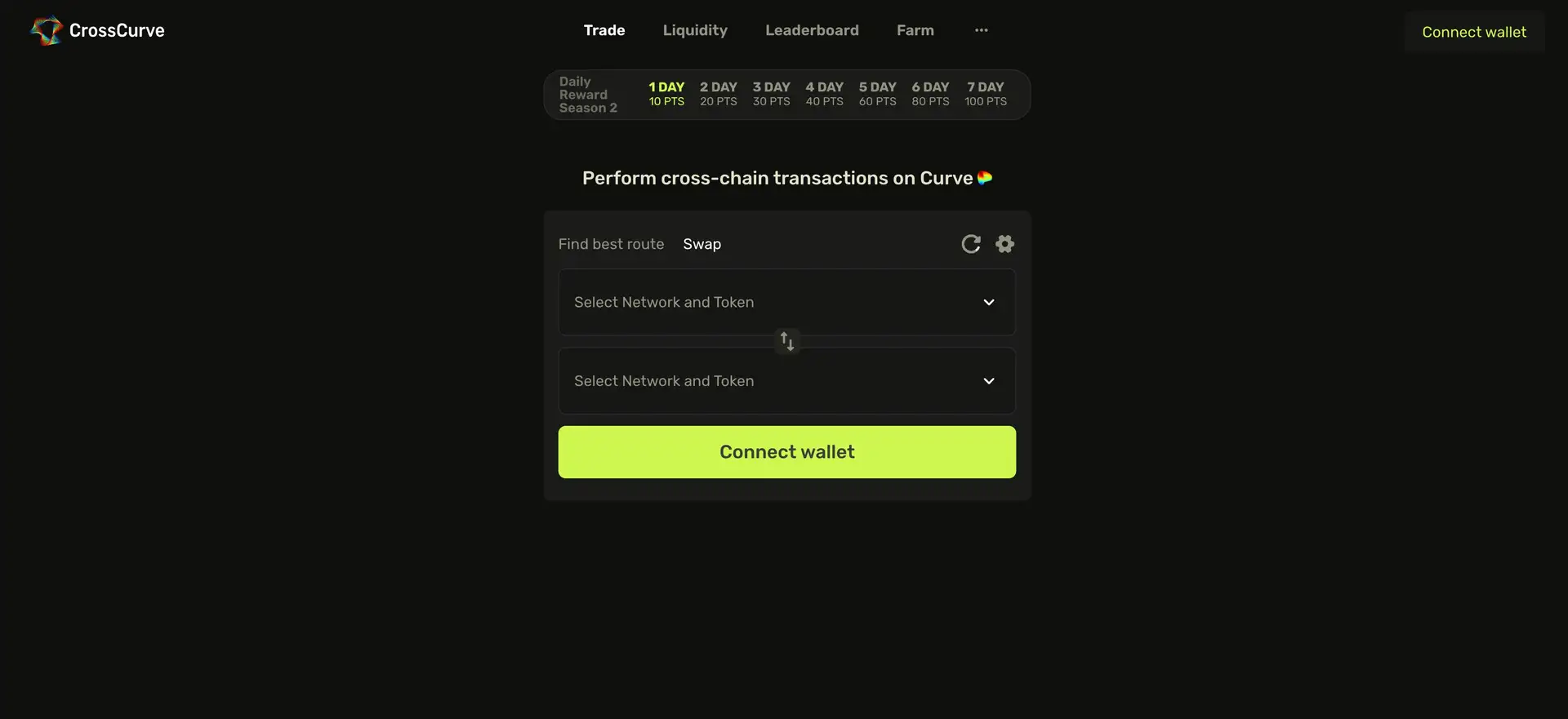

Connect to the dApp: Make sure you have an EVM-compatible wallet, visit app.crosscurve.fi, and connect your wallet. Once connected, you can swap assets between any given chain freely. If you wish to further explore farming opportunities, visit: https://crosscurve.fi/airdrop.

There you can:

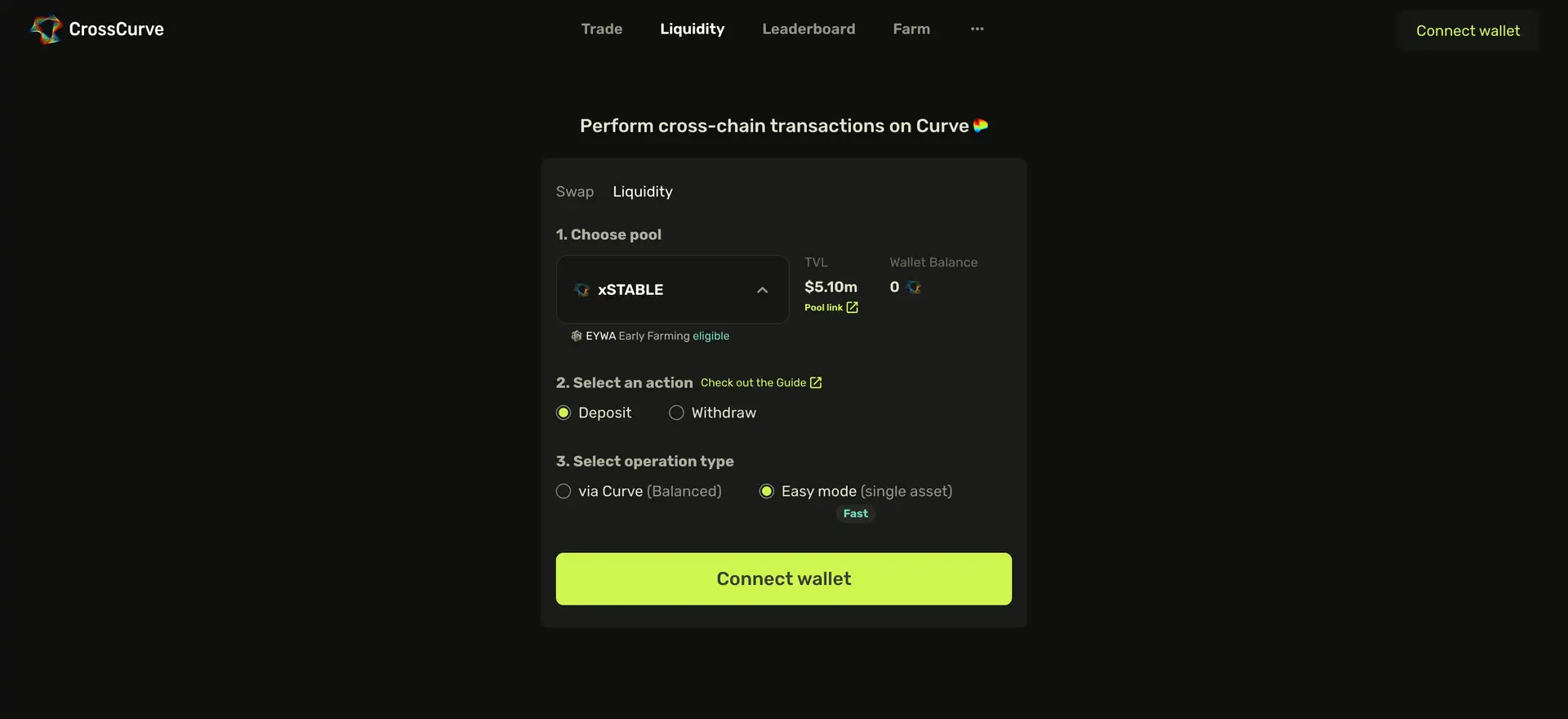

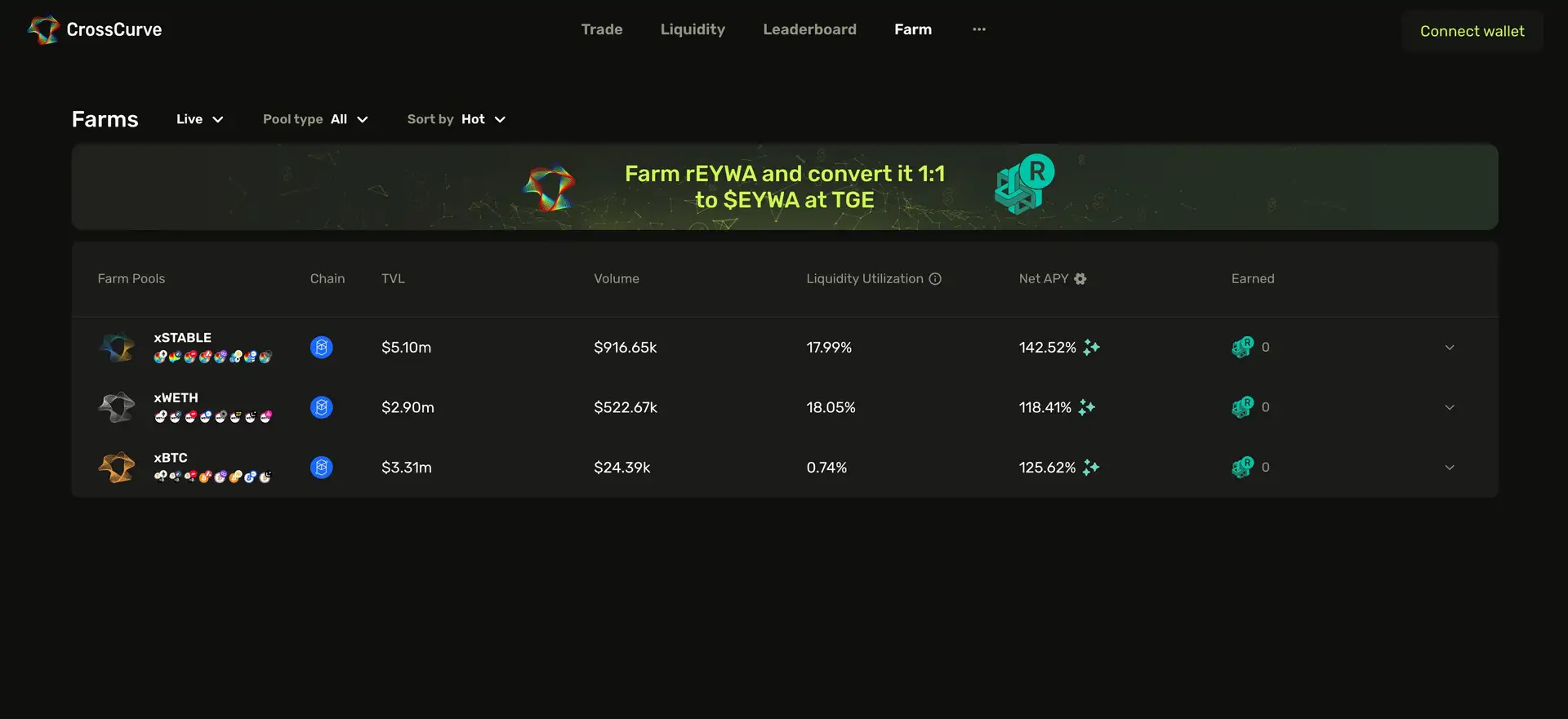

- Early Farming:

Provide and stake liquidity in either of the pools: xSTABLE, xWETH, xBTC: https://app.crosscurve.fi/farm

- Choose the pool;

- Use “CrossCurve” to obtain an LP position;

- (Optional) Manual liquidity provision through the Curve interface, guide;

- Stake LP to earn rewards.

Rewards: rEYWA (1:1 exchangeable to $EYWA after TGE, details).

- Cross-chain Swaps on DEX:

Perform cross-chain swaps daily on DEX: https://app.crosscurve.fi/

- Choose asset A on chain X;

- Choose asset B on chain Y;

- Make a cross-chain swap.

Rewards: Up to 250 points per day (consecutive daily activity stacks and increases point accruing, details).

- Referral Activity:

Invite users with the referral code up to 3 levels: https://app.crosscurve.fi/leaderboard

- Share referral link with friends;

- Get 10% for the first level, 6% for the second level, and 4% for the third level.

Rewards: Points from referred users' activities.

- Llamaville Mini App:

Partake in a crypto journey in our fun and DeFi educational Telegram Mini App: https://t.me/llamaville_bot/llamavile?startapp=951cc201c4508117e1

Immerses into the world of crypto; Go through all the stages of growth, from fear and greed to success.

Rewards: TMA users will receive a share of the $EYWA airdrop.

EYWA Cross-chain DEX Reviews by Real Users

EYWA Cross-chain DEX FAQ

Eywa employs a unique consensus mechanism specifically designed for cross-chain transactions. This mechanism involves multiple layers of validation and cryptographic security, ensuring that all asset transfers between blockchains are executed securely and transparently. The use of decentralized validators and a rigorous auditing process further guarantees the safety of users’ assets in the Eywa ecosystem.

The main feature of the CrossCurve architecture is the use of Hubchain, an intermediate blockchain for aggregating synthetic derivatives - s-tokens that are exchanged in Curve pools. Currently, the Fantom blockchain serves as the Hubchain. Essentially any blockchain-to-blockchain swap transaction goes through the Hubchain in a star topology. This approach connects all the necessary assets and blockchains in one place, significantly reducing the amount of liquidity needed to achieve profitable exchanges.

Eywa utilizes its CrossCurve protocol, which is integrated with Curve Finance, to optimize liquidity across multiple blockchains. This protocol automatically balances liquidity pools, ensuring that there is always sufficient liquidity available for cross-chain transactions. Liquidity providers are incentivized with competitive rewards in EYWA tokens, making it an attractive option for those looking to contribute to the ecosystem.

Eywa is continuously evolving, with plans to expand support to additional blockchains and introduce new features that will further enhance the user experience. Upcoming developments include more advanced cross-chain functionalities, enhanced security measures, and greater integration with other DeFi protocols. The project’s roadmap is community-driven, meaning that EYWA token holders can influence future updates and improvements through governance votes.

You Might Also Like