About Fireblocks

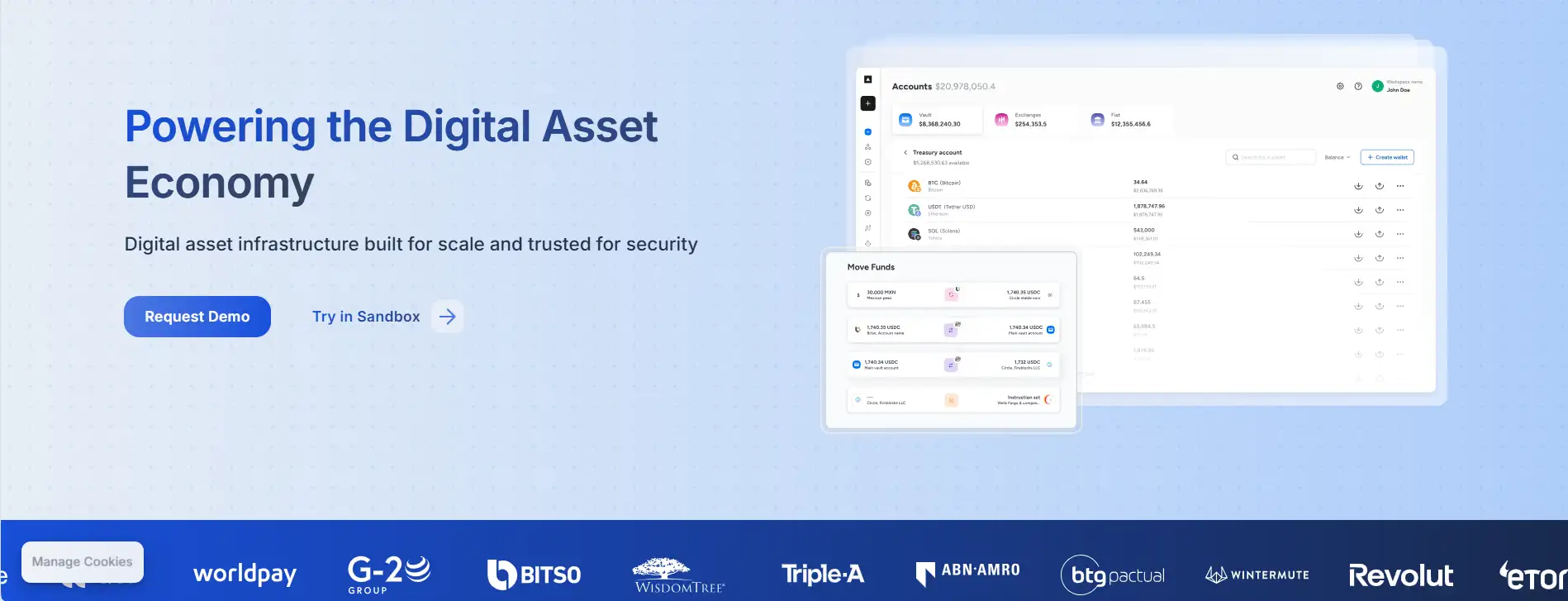

Fireblocks is a leading enterprise-grade platform designed to provide a secure and scalable infrastructure for the digital asset economy. By integrating multi-party computation (MPC) and secure hardware enclaves, Fireblocks empowers institutions to move, store, and issue digital assets safely. The company’s mission is to make digital assets accessible and manageable for enterprises without compromising on security, compliance, or efficiency.

The platform supports a range of use cases from crypto custody and DeFi access to payments, staking, and tokenization. It serves banks, exchanges, fintech companies, Web3 startups, and institutional investors, including industry leaders like BNY Mellon, Revolut, eToro, and Worldpay. Backed by years of cybersecurity experience, Fireblocks has grown into a trusted infrastructure layer with over $10 trillion in digital asset transfers and more than 300 million secured wallets. For more information, visit Fireblocks.

Fireblocks was founded in response to a 2017 cyberattack that exposed vulnerabilities in digital asset security. The co-founders, veterans from cybersecurity leader Check Point, were part of the investigation into the infamous Lazarus Group hack that targeted South Korean exchanges. Recognizing the gap in secure, enterprise-ready crypto infrastructure, they launched Fireblocks in 2019 with a $16 million Series A. The platform’s initial success stemmed from its innovative use of SGX hardware isolation and MPC cryptography, which eliminated the need for deposit addresses and mitigated risks tied to key theft or operational errors.

Since then, Fireblocks has grown rapidly, surpassing key milestones like $100 million in annual recurring revenue (ARR) and closing a $550 million Series E round by early 2022. Its infrastructure now underpins a wide array of digital asset services including Wallet-as-a-Service (WaaS), tokenization, treasury management, DeFi integration, compliance, and staking. Institutions can use Fireblocks’ Console to oversee operations across wallets, exchanges, and DeFi protocols with real-time auditing and policy governance. Additionally, Fireblocks' Developer Sandbox and robust API/SDK toolkit empower engineering teams to rapidly build and scale digital asset features.

In the evolving tokenization space, Fireblocks offers an end-to-end solution for minting, custody, distribution, and governance of tokenized assets. This includes financial instruments, stablecoins, NFTs, and even identity tokens. The Policy Engine ensures granular transaction controls and automates compliance workflows, allowing businesses to meet local and global regulatory requirements. With direct integrations into over 50 blockchains and secure connectivity to more than 2,000 counterparties, Fireblocks provides unmatched interoperability across the digital asset ecosystem.

As competition in the digital asset infrastructure space intensifies, Fireblocks stands out by combining institutional-grade security with operational ease. Key competitors in the space include BitGo, Anchorage Digital, and Copper.co. While these platforms offer digital asset custody and compliance services, Fireblocks’ edge lies in its integrated architecture—delivering not just custody but also payment orchestration, DeFi access, and programmable automation within a single secure environment. For deeper insight into the platform, explore Fireblocks.

Fireblocks provides numerous benefits and features that make it a standout project in the digital asset infrastructure space:

- Multi-Layer Security: Combines MPC cryptography, secure enclaves, and ISO/SOC/CCSS certifications to ensure no single point of failure.

- Wallet-as-a-Service: Offers white-labeled, non-custodial embedded wallets across 100+ blockchains with social recovery and backup support.

- DeFi and Web3 Access: Connect to 20+ EVM and Non-EVM blockchains and interact securely with DeFi apps and NFT platforms.

- Tokenization Engine: Supports minting, custody, and transfer of tokenized assets including CBDCs, stablecoins, and digital securities.

- Compliance Automation: Real-time AML/KYT monitoring via Chainalysis, Elliptic, and Notabene integrations.

- Fireblocks Network: Securely connects over 2,000 institutions and liquidity providers for real-time digital asset transfers.

- Staking Capabilities: Direct ETH and SOL staking support with intuitive reward tracking tools.

- Full Developer Suite: SDKs, APIs, and a sandbox environment to rapidly test and deploy new crypto features.

Fireblocks offers a streamlined onboarding experience tailored for institutions, developers, and enterprises that want to leverage secure digital asset infrastructure:

- Create an Account: Visit the Fireblocks website and click on “Request Demo” or “Try in Sandbox” to begin your journey.

- Request a Demo: Fill out the form with your business details to receive a tailored walkthrough of the platform’s capabilities.

- Explore the Developer Sandbox: Test the platform’s SDKs and APIs to build wallet infrastructure, payment flows, and tokenization logic.

- Integration & Deployment: Use the provided documentation to integrate Fireblocks Wallet SDKs or connect your operations to over 50 blockchains with MPC-powered wallets.

- Set Governance Policies: Use the Policy Engine to define transaction approvals, user roles, and compliance automation.

- Connect to Exchanges and DeFi: Use the Fireblocks Console to access exchanges, perform treasury operations, stake assets, and interact with Web3 protocols securely.

- Manage and Monitor: From a single interface, track wallets, transaction flows, staking rewards, and NFT collections.

Fireblocks FAQ

Fireblocks secures cross-chain operations using a combination of MPC cryptography and SGX-secured enclaves, which ensures private keys are never fully assembled or exposed. Instead, key shares are distributed across multiple secure environments and used in parallel for transaction signing. This eliminates the risk of a single point of failure and allows safe interaction with over 100 blockchains. Institutions can enforce granular controls with the Fireblocks Policy Engine to automatically approve or reject transfers based on pre-set criteria. Learn more at Fireblocks.

Fireblocks supports end-to-end tokenization through a secure and compliant infrastructure purpose-built for banks and capital markets. It enables institutions to mint, distribute, custody, and manage tokens using pre-audited smart contracts or custom APIs while maintaining full visibility and auditability across the token lifecycle. The Policy Engine enforces role-based permissions, minting approvals, and compliance checks across every stage of operation. Fireblocks also integrates with leading partners like OpenZeppelin and Tokeny to enhance smart contract governance. Explore tokenization tools at Fireblocks.

Unlike traditional custodial solutions, Fireblocks Wallet-as-a-Service offers both direct custody and non-custodial embedded wallet options that are fully customizable. Through Fireblocks’ Embedded Wallet SDK, developers can integrate secure wallets into apps without ever taking possession of private keys. Each key share is split between the user’s device and Fireblocks’ SGX-based servers, ensuring users retain full ownership and control. This seedless backup approach, combined with social recovery and multi-device sync, delivers a seamless Web2-like experience without compromising security or compliance. More info at Fireblocks.

Fireblocks offers a full Compliance Solution Suite that integrates directly into enterprise infrastructure. With real-time AML/KYT transaction monitoring through Chainalysis and Elliptic, and Travel Rule compliance via Notabene, Fireblocks helps institutions automate regulatory workflows. Enterprises can configure policy rules that screen transactions, block blacklisted addresses, and set alert thresholds based on risk profiles. These settings are controlled from the Fireblocks Console, enabling teams to maintain control over every transfer and wallet operation. For detailed compliance capabilities, visit Fireblocks.

Yes, the Fireblocks Payments Engine allows businesses to create and automate stablecoin payment workflows across multiple blockchains and currencies. With built-in integrations to on/off ramps, exchanges, and banks, users can convert, transfer, and settle funds using stablecoins like USDC and EURI in real time. The platform supports 24/7/365 merchant settlement, creator payouts, cross-border disbursements, and more—delivering full visibility through the Payments Dashboard. Everything is accessible via a no-code interface or customizable API. Learn how to build digital payment rails at Fireblocks.

You Might Also Like