About Fungify

Fungify is a pioneering DeFi protocol that transforms how non-fungible tokens (NFTs) interact with financial systems. Built on Ethereum, Fungify introduces a dual-layer solution—Index and Pools—that unlocks liquidity, yield generation, and lending opportunities for NFT holders and DeFi users alike. At its core, Fungify provides a market-driven infrastructure to make NFTs fungible, tradeable, and usable within broader DeFi ecosystems.

Through an elegant integration of permissionless vaults, decentralized pricing oracles, and tokenized NFT exposure, Fungify allows users to borrow, lend, stake, and index NFTs just like traditional assets. It aims to address the core challenges of illiquidity, pricing volatility, and fragmented markets, offering a seamless protocol experience backed by leading collections like Bored Ape Yacht Club, CryptoPunks, and Azuki.

Fungify operates at the intersection of NFTs and DeFi, enabling a new financial framework where digital collectibles function as capital-efficient, productive assets. The protocol is composed of two primary components: Index and Pools. The Index mechanism is centered around a smart contract-based ETF model that tokenizes floor-value NFTs into a fungible, yield-bearing token known as $NFT. Users can deposit their NFT into the MarketVault and receive $NFT tokens that represent the underlying floor value of those assets. This allows for fractional ownership, arbitrage opportunities, and liquidity provisioning across the broader NFT ecosystem.

Meanwhile, the Pools component introduces a cross-margin lending market for NFTs and $NFT tokens. For the first time, users can utilize NFTs as collateral to borrow fungible assets, or lend assets to earn yield—combining the sophistication of legacy DeFi protocols with NFT-native infrastructure. Pools synergize with Index to provide a complete marketplace where NFT tokens earn yield and NFTs serve real financial functions.

The heart of Fungify’s architecture is the MarketVault, a permissionless smart contract that ingests NFTs, mints or burns $NFT tokens, and determines their market-pegged value via the Oracle system. Price feeds are derived from a mix of in-house and external data (such as Reservoir), processed using TWAP and EMA to maintain accurate pricing and reduce volatility. A key feature of Fungify is the Redemption Mechanic—a user can burn $NFT tokens and redeem them for NFTs from the vault, determined randomly via Chainlink VRF, ensuring fairness and index neutrality.

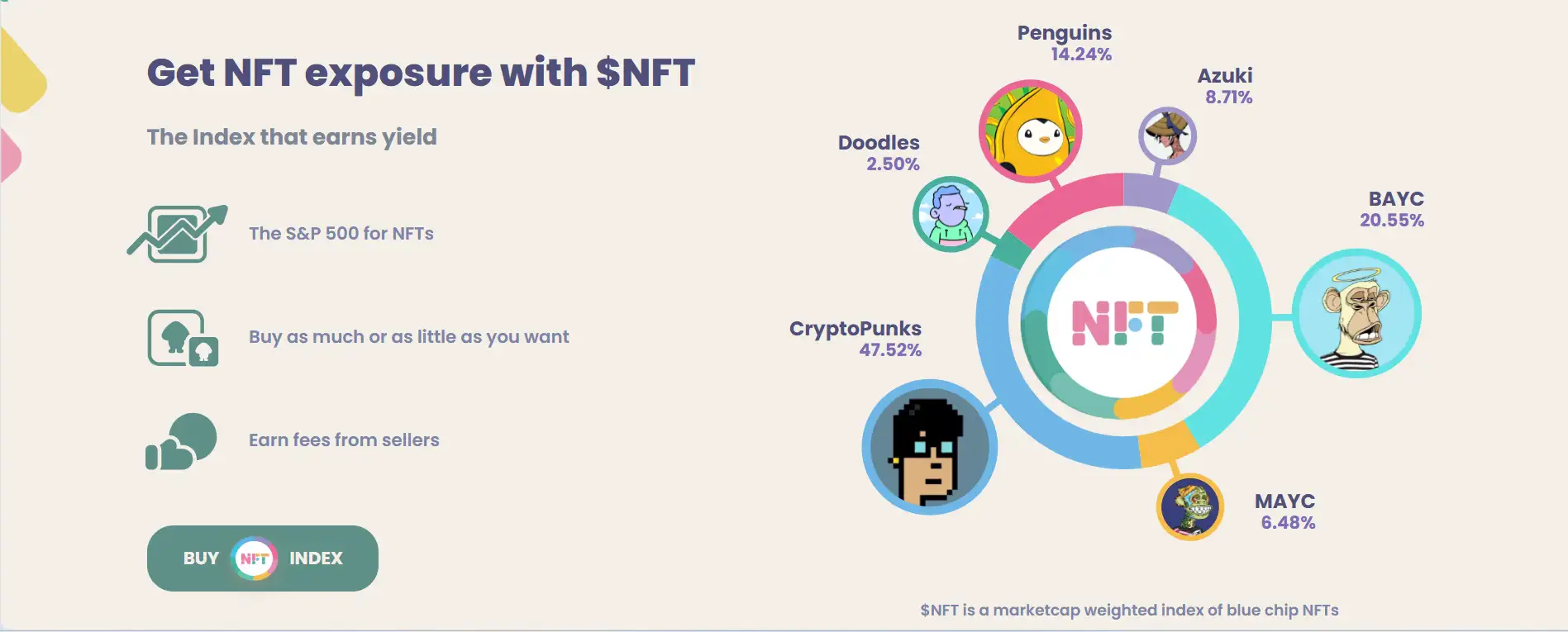

With the whitelist currently including collections like Bored Ape Yacht Club, CryptoPunks, Mutant Ape Yacht Club, Pudgy Penguins, Azuki, and Doodles, Fungify has positioned itself as a scalable infrastructure protocol. By mitigating value extraction through selective redemptions and maintaining market cap-weighted balance, it achieves both liquidity and stability. Competing with protocols like NFTfi, and Arcade, Fungify stands out with its elegant design and true fungibility layer.

Fungify introduces a set of unique DeFi-native features tailored for NFTs:

- $NFT Index Token: A fungible, yield-bearing token backed by floor-value NFTs stored in the MarketVault, allowing fractional exposure to blue-chip NFT collections.

- MarketVault Redemptions: NFTs can be redeemed randomly using $NFT tokens via Chainlink VRF, preserving beta and fairness in asset distribution.

- Dynamic Index Rebalancing: Fungify uses dynamic spread logic to rebalance over- and under-weighted collections, ensuring a true market-weighted index.

- Pools Lending Protocol: Users can lend or borrow NFTs and $NFT tokens in a cross-margin, trustless environment, combining the best of legacy DeFi and NFT finance.

- sNFT Yield Staking: Stake your $NFT tokens to earn fees from the protocol. Stakers receive sNFT tokens which grow in value as vault activity generates protocol revenue.

Getting started with Fungify is simple for both NFT holders and DeFi-native users:

- Visit the official app: Go to fungify.it and click “USE APP” to enter the interface.

- Connect your Ethereum wallet: Ensure you’re using a supported Web3 wallet such as MetaMask to interact with the Ethereum-based protocol.

- Deposit NFTs into the MarketVault: From the Index tab, deposit approved NFTs to receive $NFT tokens. You can hold, trade, or stake them.

- Borrow or Lend with Pools: Navigate to the Pools section to start earning yield or accessing liquidity using your NFTs or $NFT tokens as collateral.

- Stake for Yield: Convert your $NFT into sNFT to participate in protocol revenue distribution. The longer you stake, the higher your claim on yield.

- Read the Docs: For deeper understanding of pricing mechanics, oracle design, and spread models, check the official documentation at docs.fungify.it.

Fungify FAQ

Fungify converts blue-chip NFTs into a fungible asset called the $NFT Index Token by allowing users to deposit their NFTs into a smart contract vault. In return, they receive $NFT tokens that represent the floor value of their deposited NFTs. These tokens can be traded, staked, or used as collateral across the protocol. This approach makes NFTs usable in the broader DeFi landscape, removing the issue of fragmented and illiquid markets. Learn more at fungify.it.

Chainlink VRF is used during the redemption process to generate provably fair, random NFT selections. When a user redeems their $NFT tokens to claim an NFT, the system doesn’t let them choose the specific asset. Instead, Chainlink VRF randomly selects one from the vault. This prevents manipulation and maintains the integrity and neutrality of the index. The process is trustless and tamper-proof thanks to the verifiable randomness Chainlink provides.

The value of the $NFT Token is pegged to the floor prices of the NFTs inside the MarketVault. Arbitrage mechanisms ensure the peg remains tight: if the token is undervalued on the open market, users can redeem it for valuable NFTs, reducing supply. If overvalued, users can mint new tokens by depositing NFTs. This two-way arbitrage system uses the Oracle’s real-time pricing to keep $NFT closely aligned with the true market value of the assets it represents.

Allowing users to choose which NFT they redeem creates a risk of “free optionality”, where users cherry-pick the most valuable NFTs and leave behind the less desirable ones. This siphons value from the vault and distorts the index’s beta. Instead, Fungify uses randomized redemption via Chainlink VRF to maintain a balanced, representative pool. It ensures no one can exploit the system and the index remains reflective of the overall market.

Yes. By staking your $NFT tokens in the protocol, you receive sNFT tokens which automatically accrue yield from fees generated by the MarketVault’s minting and redemption activity. 80% of all fees are distributed to sNFT holders, making it a passive income mechanism for long-term participants. The protocol updates token price during each fee distribution, and your earnings grow over time as activity increases. Stake at fungify.it to start earning.

You Might Also Like