About GasHawk

GasHawk is a non-custodial transaction optimization platform that dramatically reduces Ethereum gas fees for both retail and institutional users. By analyzing network conditions in real-time and leveraging historical data, GasHawk automatically submits transactions at the most cost-efficient time — delivering savings of up to 95%. Instead of relying on manual gas fee estimations or guessing when the network will be less congested, users can set a deadline window, and GasHawk will handle the rest. Transactions are routed through a secure RPC proxy and submitted only when the base fee falls within optimal parameters.

This makes GasHawk highly valuable for anyone transacting on Ethereum — whether it’s simple ETH transfers, NFT minting, DAO voting, staking, or deploying smart contracts. The service supports over 32+ wallets including MetaMask and Rabby, and offers integrations for developers via SDK and REST API. Designed with security and transparency in mind, all TXs are signed by the user and cannot be altered. With optional MEV protection via Flashbots or MEVBlocker, GasHawk ensures users stay protected and pay less on-chain.

GasHawk is built to solve a persistent and expensive issue within the Ethereum ecosystem — high and unpredictable gas fees. As gas fees fluctuate constantly depending on network activity, most users either overpay or risk failed and delayed transactions. GasHawk steps in as an intelligent transaction manager that enables users to save money while maintaining full control of their assets.

Operating at the transaction layer, GasHawk acts as a buffer between user wallets and the Ethereum blockchain. Users submit signed transactions through the platform’s RPC proxy, which then monitors network fees and executes the transaction at the most economical moment within the chosen time window. Time windows can range from 30 seconds to 24 hours, depending on how urgently a user needs the transaction confirmed. For example, a casual token transfer could be scheduled within a 24-hour deadline, while a mint with limited supply might use a shorter timeframe.

Security is central to GasHawk’s architecture. The platform only receives signed transactions and never has access to a user's private keys. Transactions are immutable once signed, and users can optionally route transactions through MEVBlocker or Flashbots Protect for additional privacy and frontrunning protection. With support for MetaMask, Rabby, and 30+ other wallets, it’s accessible and versatile for all users in the Web3 ecosystem.

For enterprises such as exchanges, custodians, Layer 2s, RaaS providers, and DeFi protocols, GasHawk offers tailored solutions and integrations. These include SDKs, APIs, and infrastructure-level optimizations. Enterprise users can leverage GasHawk’s predictive models to automate thousands of transactions per day, reducing costs at scale while maintaining audit trails and transparency.

As a platform, GasHawk draws comparisons to tools like Etherscan’s Gas Tracker and GasFees, but while those platforms merely provide data, GasHawk acts on that data for users. It's also positioned alongside automation services like Autonolas, and appeals to DAOs using Safe for multisig execution. With automation, savings, and privacy protection at its core, GasHawk.io stands out as a new infrastructure layer that enhances Ethereum usability and cost-efficiency for all participants.

GasHawk offers powerful benefits and features that make it essential for everyday Ethereum users and enterprises alike:

- Massive Gas Savings: Save up to 95% on Ethereum transaction fees by leveraging smart scheduling based on real-time gas data and historical trends.

- Non-Custodial: All transactions are signed by the user — GasHawk cannot access, alter, or manage funds at any time.

- MEV Protection: Use built-in Flashbots Protect or MEVBlocker integrations to defend your TXs against frontrunning and sandwich attacks.

- Wallet Compatibility: Compatible with over 32+ wallets including MetaMask, Rabby, and more.

- Custom Deadline Control: Set flexible deadlines for each transaction, from 30 seconds up to 24 hours, based on your urgency.

- Intelligent TX Queue Management: Prevents stuck or failed TXs using an advanced queue manager that resubmits when necessary.

- Enterprise-Ready: SDKs, APIs, and bulk transaction automation are available for institutional clients and developers.

- Private Order Flow: Keeps sensitive transactions hidden until final inclusion using private relayers.

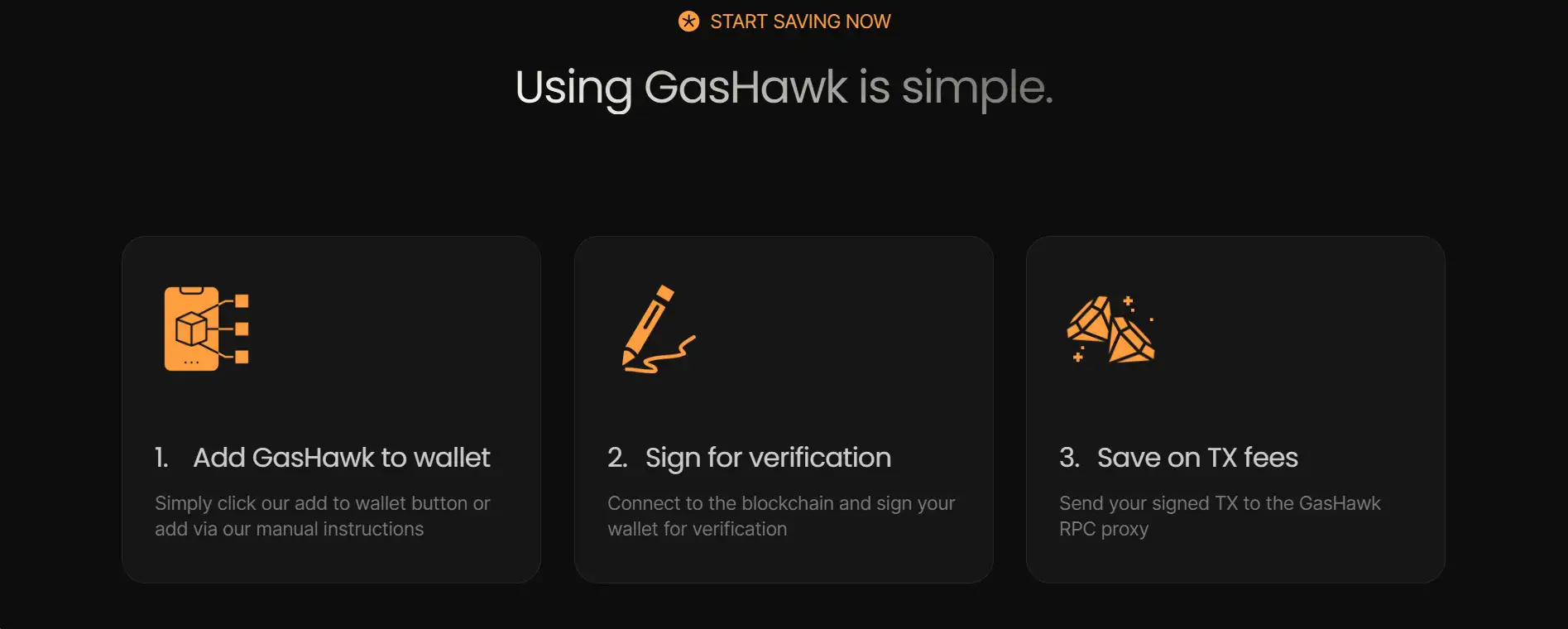

GasHawk makes it easy to start saving on Ethereum gas fees — here’s how to get started with GasHawk.io:

-

Step 1: Connect Your Wallet

Visit the GasHawk App and click "Connect Wallet." Choose your preferred wallet like MetaMask or Rabby. -

Step 2: Add GasHawk RPC

Add the GasHawk RPC manually or through their guided instructions. This connects your wallet to the optimized transaction flow. -

Step 3: Sign for Verification

After connecting, sign the prompt with your wallet to verify your account on the blockchain. -

Step 4: Create Your Transaction

Prepare the transaction as you normally would — for minting, swaps, transfers, or anything else. Select your deadline window based on urgency. -

Step 5: Monitor Open Transactions

Use the dashboard to track and manage pending transactions. You can delete or adjust them before execution if needed. -

Step 6: Finalize and Compare

Once the transaction is executed, view a performance chart comparing the estimated gas fee vs. the actual fee saved through GasHawk.

GasHawk FAQ

If your transaction urgency changes after submission, GasHawk allows you to manually adjust the deadline or even cancel the transaction from your dashboard before it is executed. Users can shorten the deadline to push the transaction sooner based on updated needs, or delete it entirely if it's no longer necessary. The ability to dynamically modify execution windows ensures that GasHawk adapts to real-time priorities.

GasHawk uses a real-time prediction model based on on-chain data, the EIP-1559 mechanism, and historical volatility patterns to avoid executing during temporary gas fee spikes. If a sudden spike occurs during your deadline window, the system intelligently delays the submission—if possible—until it detects the next dip. If the deadline is near, it ensures execution under the best conditions available at the time. This makes GasHawk particularly useful during periods of high network activity.

Yes, GasHawk supports scheduled revocations by allowing users to submit signed TXs with custom deadlines. If you’re planning to revoke token or NFT approvals using platforms like Revoke.cash, you can route your signed revocation transaction through GasHawk and choose a delay window that aligns with your security preferences. This prevents unnecessary on-chain costs while still ensuring revocation occurs within your desired timeframe.

GasHawk is designed to optimize even high-priority operations like contract deployments. Developers can specify a deadline window (e.g., 30 minutes or less) and GasHawk will monitor the mempool for the most cost-effective base fee within that range. Additionally, the option to route deployments through Flashbots Protect or MEVBlocker helps secure transactions from frontrunning. For critical use cases, this makes GasHawk a valuable tool in maintaining both cost control and deployment integrity.

Absolutely. GasHawk is particularly effective for DAO-related TXs such as voting, proposal execution, and treasury management. By integrating with tools like Safe and allowing deadline control, DAOs can submit voting transactions with a 24-hour buffer, letting GasHawk find the best execution time. This approach significantly reduces the cost of regular on-chain governance and ensures that community engagement remains economically sustainable.

You Might Also Like