About Gravita Protocol

Gravita Protocol is a decentralized borrowing platform aimed at transforming how users engage with decentralized finance (DeFi). Its innovative model allows users to unlock liquidity from their crypto assets without selling them, providing a seamless way to preserve asset ownership while gaining access to much-needed funds. By focusing on zero-interest loans and transparent mechanisms, Gravita Protocol is removing traditional barriers in the financial sector. Discover more on their official website.

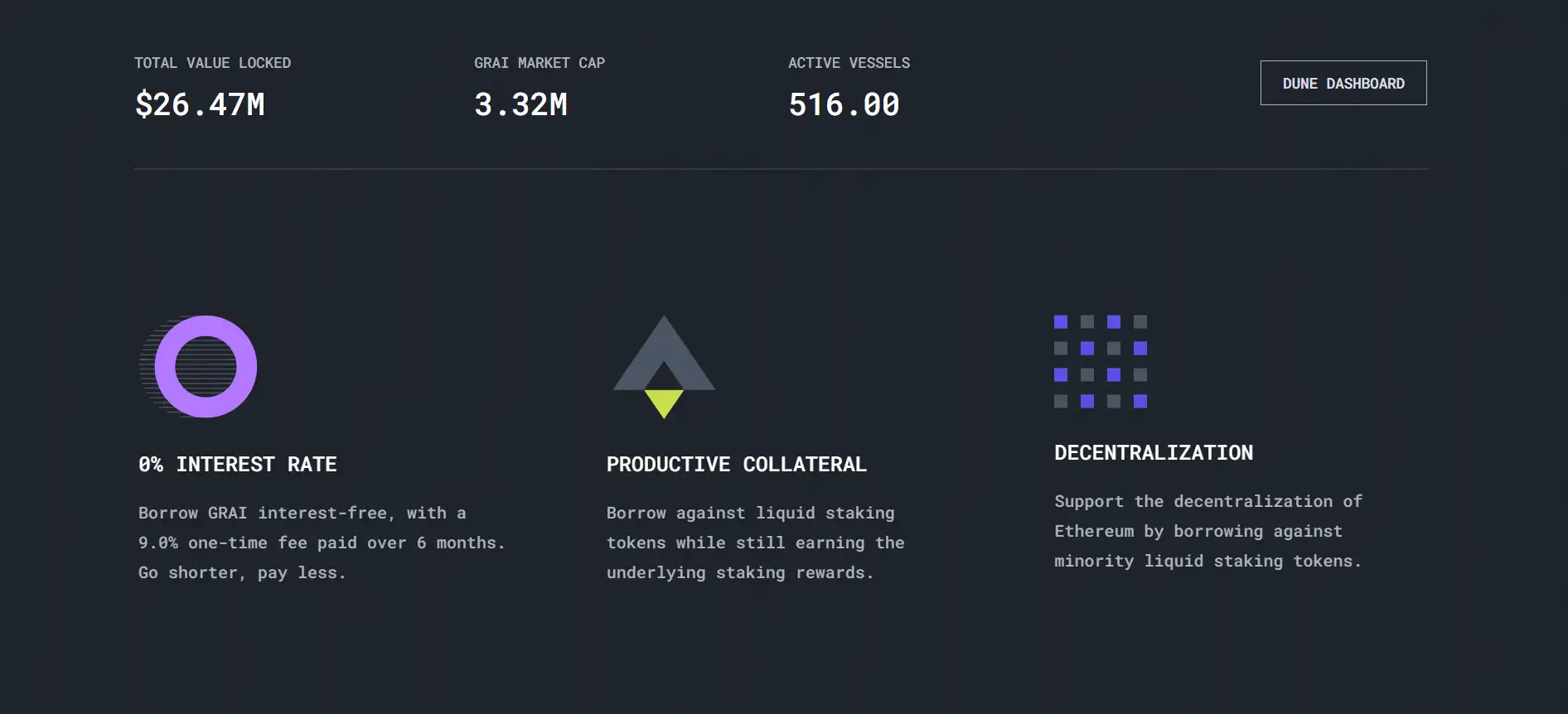

Built on the secure and scalable Ethereum blockchain, Gravita Protocol offers features like zero-interest borrowing, automated liquidation mechanisms, and reward-earning stability pools. These components are designed to ensure a highly efficient and user-centric borrowing experience. By prioritizing decentralization and transparency, Gravita Protocol is setting a new standard for borrowing in the DeFi ecosystem, empowering users with financial freedom while maintaining full control over their assets.

Gravita Protocol addresses key challenges in the DeFi space by offering an interest-free borrowing solution that ensures stability and preserves asset value. Launched to serve both individuals and institutions, the platform enables users to unlock liquidity by depositing their crypto assets as collateral, with the assurance of retaining ownership. Borrowers can access stablecoins while the protocol maintains strict collateralization mechanisms to ensure loans remain secure and solvent.

What makes Gravita Protocol unique is its zero-interest loan model, which eliminates the financial strain associated with traditional borrowing. Unlike other DeFi lending platforms, the protocol integrates a stability pool that rewards depositors while helping maintain system solvency. Additionally, its automated liquidation mechanism ensures that collateralized loans remain sustainable without requiring manual interventions from users.

Gravita’s competitors include established platforms like Liquity, which also offers interest-free loans, and Venus Protocol, known for its diverse borrowing and lending options. However, Gravita distinguishes itself with a stronger emphasis on transparency and user-focused features. By leveraging the Ethereum blockchain, the protocol combines decentralization, security, and cost-efficiency, solidifying its place in the ever-evolving DeFi landscape. Learn more on their official website.

Gravita Protocol provides a wide array of benefits and features that make it a standout choice for decentralized borrowing. Here are its key highlights:

- Zero-interest borrowing: Unlike traditional platforms, users can borrow stablecoins without accruing any interest, enabling them to retain maximum value.

- Preservation of asset ownership: Users can unlock liquidity from their assets without selling them, allowing them to benefit from long-term price appreciation.

- Stability pool rewards: The platform rewards users who contribute to the stability pool, offering an additional layer of financial incentives.

- Decentralized governance: Gravita Protocol is built with community involvement in mind, ensuring the platform evolves according to the needs of its users.

- Automated liquidation mechanism: Loans are managed efficiently through automated liquidations, reducing risk and ensuring system stability.

- User-friendly interface: The platform’s simple and intuitive design makes it accessible to beginners and experienced users alike.

- Security and decentralization: Built on the Ethereum blockchain, Gravita Protocol ensures that transactions are secure, immutable, and transparent.

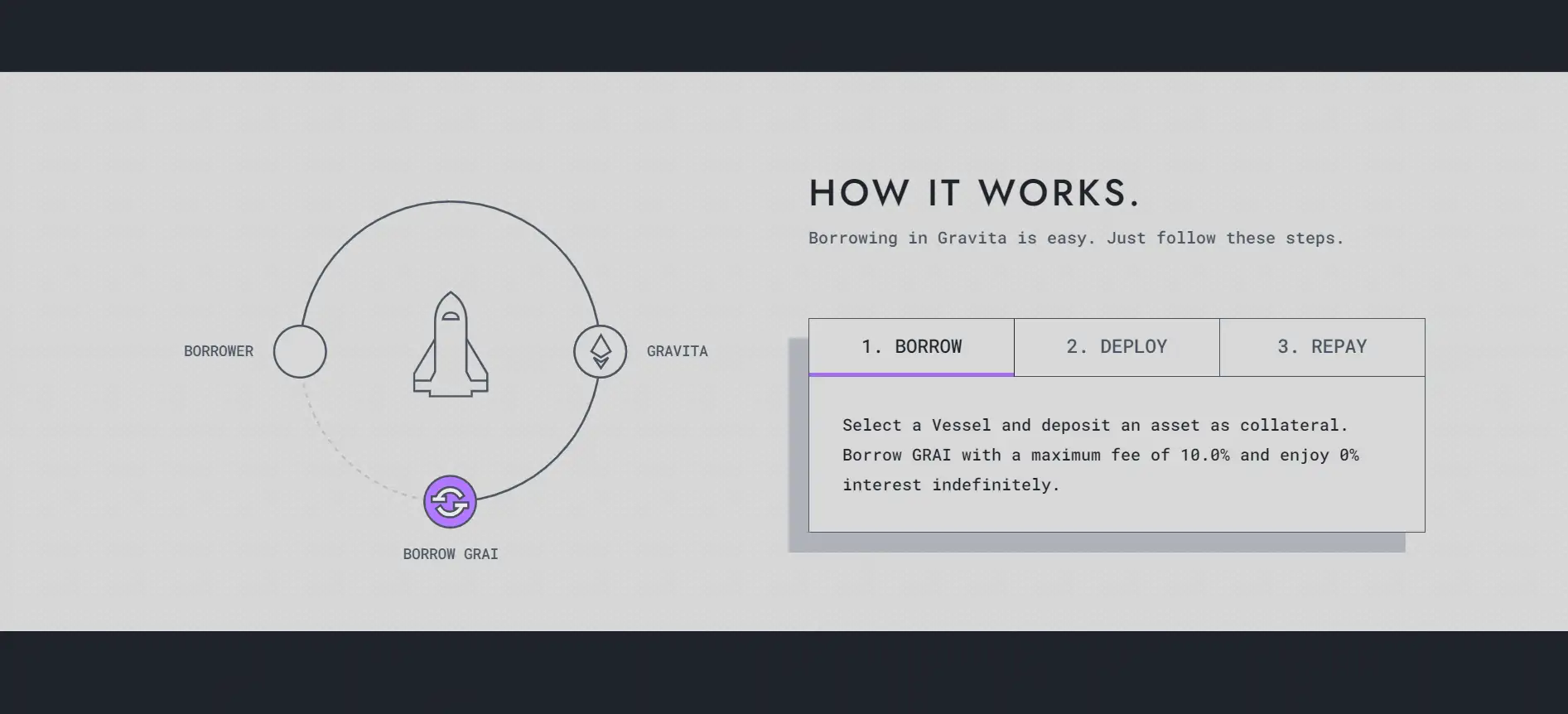

Getting started with Gravita Protocol is easy and straightforward. Follow these steps to begin:

- Create a crypto wallet: Ensure you have a supported wallet like MetaMask or WalletConnect. If you don’t have one, download and set it up first.

- Visit the platform: Go to the Gravita Protocol website and click “Connect Wallet” to link your crypto wallet to the platform.

- Deposit collateral: Select a supported asset (e.g., ETH) and deposit it as collateral. The platform will guide you through the process and display the required collateralization ratio.

- Borrow stablecoins: Once your collateral is deposited, specify the amount of stablecoins you want to borrow. Ensure your collateralization ratio meets the requirements to avoid liquidation.

- Manage your loan: Monitor your collateralization ratio regularly through the platform’s dashboard to avoid liquidation and ensure your position remains stable.

- Repay your loan: When you're ready, repay the borrowed amount to unlock your collateral and close your loan position.

Gravita Protocol FAQ

Gravita Protocol ensures stability through its robust collateralization mechanisms and the implementation of a stability pool. The protocol requires borrowers to maintain a collateralization ratio above a certain threshold, which safeguards the value of the borrowed stablecoins. If the collateral value drops below the threshold, the protocol uses funds in the stability pool to cover the shortfall, ensuring the system remains solvent. This unique design enables the platform to operate without charging interest on loans. Learn more on their official website.

If the value of your collateral drops below the required collateralization ratio, your loan may be subject to liquidation. In such cases, the protocol automatically sells a portion of your collateral to cover the outstanding debt. This process ensures the stability of the system and protects other participants. To avoid liquidation, borrowers are encouraged to monitor their collateralization ratio regularly using the platform’s dashboard. Visit the official website for more details.

While participating in the stability pool offers the opportunity to earn rewards, there is a risk that some of the deposited funds may be used to cover liquidations. However, participants are compensated with a portion of the liquidated collateral, which often exceeds the value of their contribution. Rewards are distributed proportionally based on the amount deposited in the pool.

Currently, Gravita Protocol supports single-asset collateral for each loan. Borrowers need to select one supported asset, such as ETH, to back their loan. However, the protocol continuously evolves, and additional features like multi-collateral support may be introduced in the future. Stay updated on any changes by visiting the official website.

Gravita Protocol is designed with decentralization in mind, enabling the community to play a central role in governance. Key decisions regarding upgrades, fee structures, and system parameters are made through a transparent voting process. Token holders and contributors have the ability to propose changes and vote on them, ensuring the platform evolves to meet the needs of its users.

You Might Also Like