About Hedgey

Hedgey is a comprehensive platform designed to help onchain teams distribute, manage, and automate token vesting, grants, lockups, and claims. Focused on eliminating the complexity and overhead typically associated with token infrastructure, Hedgey provides a user-friendly and fully onchain experience for DAOs, foundations, pre-token startups, and established Web3 projects. Whether you're managing equity-like vesting plans, distributing community tokens, or automating investor lockups, Hedgey provides the tooling and flexibility necessary to meet your governance and compliance standards.

Built with the needs of modern Web3 organizations in mind, Hedgey offers a robust suite of no-cost token infrastructure tools including vesting schedules, periodic distributions, lockups, and token streams. All contracts are deployed onchain and are accessible with or without the Hedgey interface. With endorsements from major blockchain names like Arbitrum DAO, Celo, Gitcoin, Gnosis, and Shapeshift, the platform is trusted by over 50 DAOs and thousands of token recipients across multiple chains.

Hedgey has emerged as one of the most advanced and versatile platforms for token vesting and distribution in the decentralized economy. Launched to serve the growing need for efficient and secure token release management, Hedgey has quickly become the go-to choice for Web3-native teams and DAOs. The platform offers a wide array of tools that support custom-built, programmatic distribution plans for team members, investors, contributors, and communities, ensuring every token release is transparent, trackable, and fully onchain.

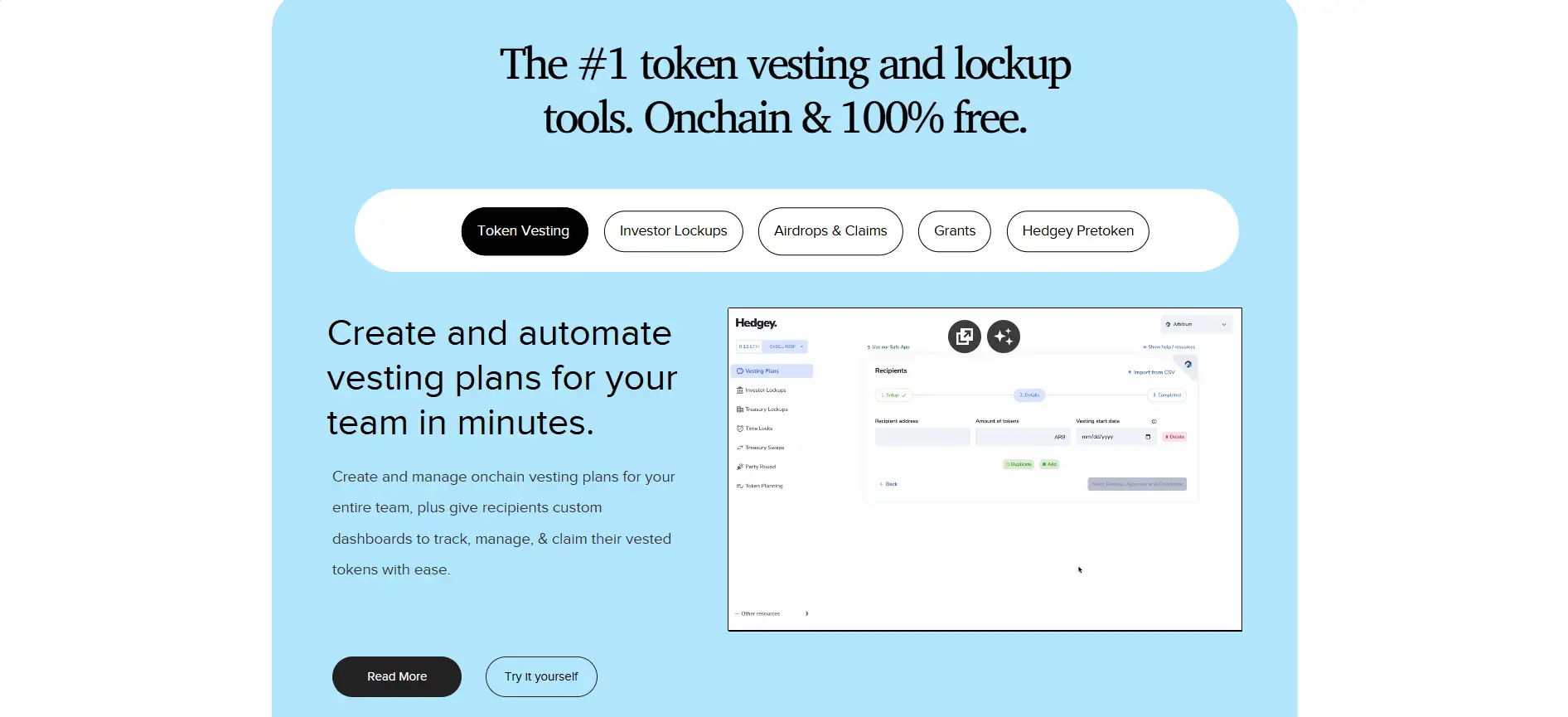

At the heart of Hedgey are its five core infrastructure products: Vesting Plans, Investor Lockups, Token Grants, Treasury Lockups, and Token Claims. These features support both linear and periodic release schedules, customizable vesting logic, onchain voting delegation, claim dashboards, and integrations with common DeFi governance frameworks. For token issuers, Hedgey simplifies what would otherwise require expensive, custom development. For recipients, it means seamless interaction with vesting schedules, claims, and governance rights—all from an intuitive dashboard.

The platform is chain-agnostic and supports over 20 networks including Ethereum, Polygon, Arbitrum, Optimism, Celo, zkSync, Scroll, Base, Avalanche, and BSC. This multi-chain support ensures accessibility for users across diverse ecosystems. The infrastructure is designed to integrate tightly with Safe (formerly Gnosis Safe) wallets and comes pre-audited by top-tier firms such as ConsenSys Diligence, Hacken, Resonance, AuditOne, and Salus.

In addition to its tools, Hedgey plays a strategic role for pre-token projects. Through Hedgey Pretoken, teams that haven’t launched a token yet can simulate and structure token release schedules, lock in vesting agreements, and prepare for investor negotiations using the same infrastructure that live protocols use. This service has proven valuable to organizations navigating the pre-token phase, allowing them to get organized before going to market.

Hedgey competes in a space alongside platforms like Token Tool, Coinvise, and Sablier, but distinguishes itself by offering every feature completely free and 100% onchain. Its ability to scale from small teams to billion-dollar protocols, its tight integration with DAO tooling, and its flexibility across token release scenarios makes it one of the most comprehensive token infrastructure platforms currently available in the Web3 ecosystem.

Hedgey provides numerous benefits and features that make it a standout solution in the onchain token infrastructure space:

- Completely Free and Onchain: All of Hedgey’s token tools are 100% free to use and fully onchain, ensuring transparency and immutability.

- Customizable Vesting Plans: Linear or periodic schedules, cliffs, backdated start dates, revocability, governance rights, and optional delegation support.

- Investor Lockups: Create large-scale investor lockups with CSV uploads and optional transferability or voting rights.

- Token Grants Engine: Issue multiple grants in a single transaction with revocable or non-revocable settings, stream-based releases, and recipient dashboards.

- Treasury Lockups: Protect community trust with timed treasury unlocks and public dashboards that show lockup schedules.

- Mass Token Claims: Handle claims for 100,000+ recipients using Merkle-tree-based infrastructure with streaming, clawbacks, and airdrop protection.

- Multichain Support: Ethereum, Polygon, Arbitrum, Optimism, Base, zkSync, Avalanche, and many more.

- Audited and Secure: Audited by Consensys Diligence and several leading firms with transparent GitHub repos and open documentation.

- DAO & Pre-Token Ready: Tools for pre-token startups and DAOs like Gitcoin, Celo, Arbitrum DAO, and IndexCoop.

Hedgey makes it easy to set up and manage your onchain token distribution needs:

- Visit the Platform: Go to hedgey.finance and click “Explore App” to access the dashboard.

- Create a Vesting Plan: Use the Vesting interface to issue team or advisor vesting schedules with full customization (cliffs, voting, delegation, etc.).

- Distribute Lockups: Upload CSVs for investor lockups or treasury time-locks and configure schedules.

- Issue Grants: Use the Grants dashboard to set up revocable or periodic token streams for contributors.

- Launch Claims: Whitelist up to 100K recipients and create a Merkle tree claim page with streams or locks.

- Monitor Progress: Use built-in dashboards to track token unlocks, recipient activity, and claimed balances.

- Secure & Scale: All contracts are audited and supported across top L1s and L2s to ensure scalability and compliance.

Hedgey FAQ

Hedgey enables DAOs to issue secure, programmable onchain token grants using its audited infrastructure. Grants can be streamed linearly or released periodically, and configured as revocable, non-transferable, and even include governance rights. Issuers can create and manage multiple grants in a single transaction, while recipients access a self-serve dashboard to monitor and claim tokens. This system reduces overhead and increases transparency for DAOs like Arbitrum and Gitcoin.

Yes! Through Hedgey Pretoken, teams can build their token vesting and distribution strategy even before launching a token. You can simulate distributions, model token allocations, and draft infrastructure using the same tools available to live protocols. This gives pre-token startups a structured way to negotiate with investors and onboard contributors without building custom infrastructure from scratch.

Yes. Hedgey includes an optional admin delegation feature that allows the issuer to transfer vesting plans to a new wallet in case of loss or compromise. This feature is controlled by the recipient and can be turned off for added decentralization. This flexibility balances security and user protection, ensuring recipients maintain access to their tokens even in edge cases.

Hedgey Claims uses a Merkle tree-based whitelist to verify eligible wallets, allowing founders to securely manage up to 100,000 recipients. Token claims can be time-locked, streamed, and even include a clawback feature for unclaimed or botted tokens. This means that airdrops and claims issued through Hedgey can be defended against sybil attacks and automated bot farming.

Absolutely. Hedgey supports governance delegation and voting rights on vesting tokens through integrations with Snapshot and onchain voting strategies. Token recipients can participate in community governance using unvested or locked tokens, maintaining full DAO engagement even while tokens are still vesting. This feature is optional and customizable per vesting plan.

You Might Also Like