About HyperBrick

HyperBrick is a decentralized exchange (DEX) purpose-built for the Hyperliquid EVM ecosystem. With a focus on modularity and performance, it introduces next-gen liquidity architecture optimized for high throughput and capital efficiency. HyperBrick empowers traders and liquidity providers through deep customization and adaptive design, offering both flexibility and speed for the modern DeFi user.

Designed around a community-first philosophy, HyperBrick goes beyond typical AMMs by offering a Liquidity Book framework that allows zero-slippage swaps within bins, granular LP control, and programmable fee mechanics. With its architecture aligned to scale with Hyperliquid, HyperBrick is laying the foundation for future DeFi innovation—one where users and protocols alike can trade, build, and earn with precision.

HyperBrick represents a bold reimagining of decentralized trading for the modular blockchain age. Built from the ground up for Hyperliquid, this DEX leverages a Liquidity Book AMM design that segments liquidity into discrete price bins—allowing trades to execute with zero slippage inside each bin. Unlike traditional AMMs that follow a fixed curve like constant product or stableswap models, HyperBrick provides a more granular and efficient trading experience where liquidity is shaped, not just deposited.

The platform takes inspiration from LFJ-style concentrated liquidity models but goes several steps further with innovations such as adaptive fee mechanics. During volatile market conditions, HyperBrick activates Surge Pricing, scaling fees proportionally with risk to reward LPs for supplying liquidity during high-demand periods. This encourages deeper liquidity precisely when it's needed most.

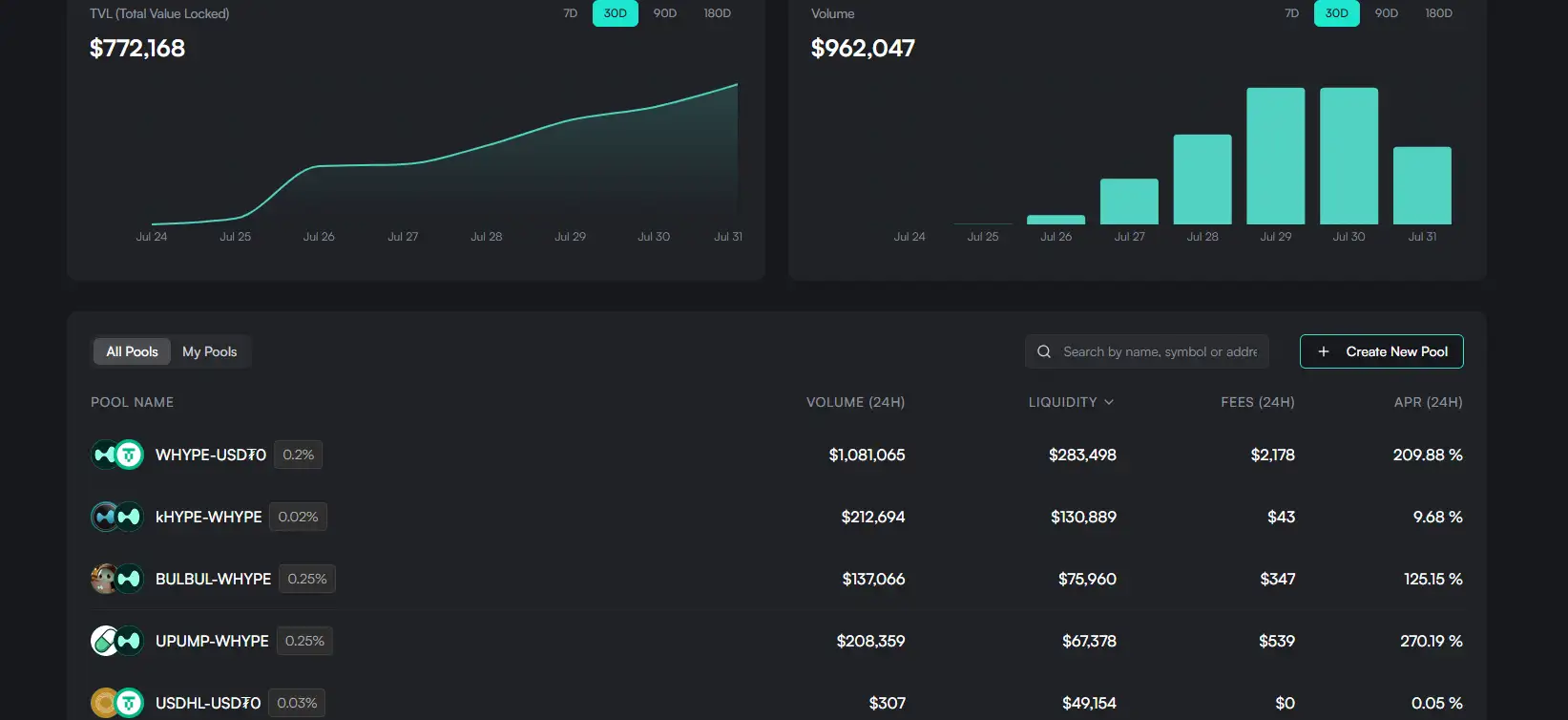

Liquidity providers (LPs) are empowered with tools to create custom liquidity shapes—from tight limit orders and DCA bands to passive volatility farming. LP tokens are fungible, composable, and can be split, merged, or used across external DeFi vaults. HyperBrick’s ecosystem is also powered by the BRICK Point system, an on-chain rewards mechanism that distributes points based on genuine usage—such as trading volume, LP activity, and strategic commitment to active bins.

In addition to its technical stack, HyperBrick emphasizes transparency and anti-abuse mechanisms. The system actively monitors for manipulative behaviors like wash trading and Sybil farming, ensuring that BRICK Points are awarded based on meaningful participation. This focus on fair distribution supports a long-term, sustainable incentive structure.

In terms of market positioning, HyperBrick competes with platforms like Uniswap, Camelot, and Trader Joe (specifically its Liquidity Book implementation). However, HyperBrick stands out as the first DEX purpose-built for Hyperliquid’s modular architecture, bringing unmatched optimization, speed, and composability to its native ecosystem.

HyperBrick delivers several unique features and benefits that distinguish it in the DeFi trading landscape:

- Liquidity Book Architecture: Breaks price into discrete bins to enable zero-slippage swaps within bins and tighter pricing for larger trades.

- Custom LP Strategies: LPs can target specific price bins, create DCA bands, and deploy volatility farming setups with high flexibility.

- Adaptive Surge Pricing: Fees increase automatically during high volatility to reward LPs and attract liquidity during critical moments.

- Composable LP Tokens: LP positions are fungible and modular, allowing for use across external vaults, lending protocols, and yield aggregators.

- Real Yield + BRICK Points: LPs earn from both swap fees and BRICK Point rewards that track active, valuable participation across the protocol.

- Passive and Active Rewards: Even LPs not currently involved in swaps earn BRICK Points when liquidity is placed in active bins—supporting deeper market depth.

- Badge & Tier Boosts: Users unlock protocol-issued badges and leaderboard tiers that enhance their BRICK Point earnings, recognizing real impact and loyalty.

- Security & Transparency: The system enforces anti-gaming measures against Sybil attacks, wash trading, and liquidity cycling, ensuring fair reward distribution.

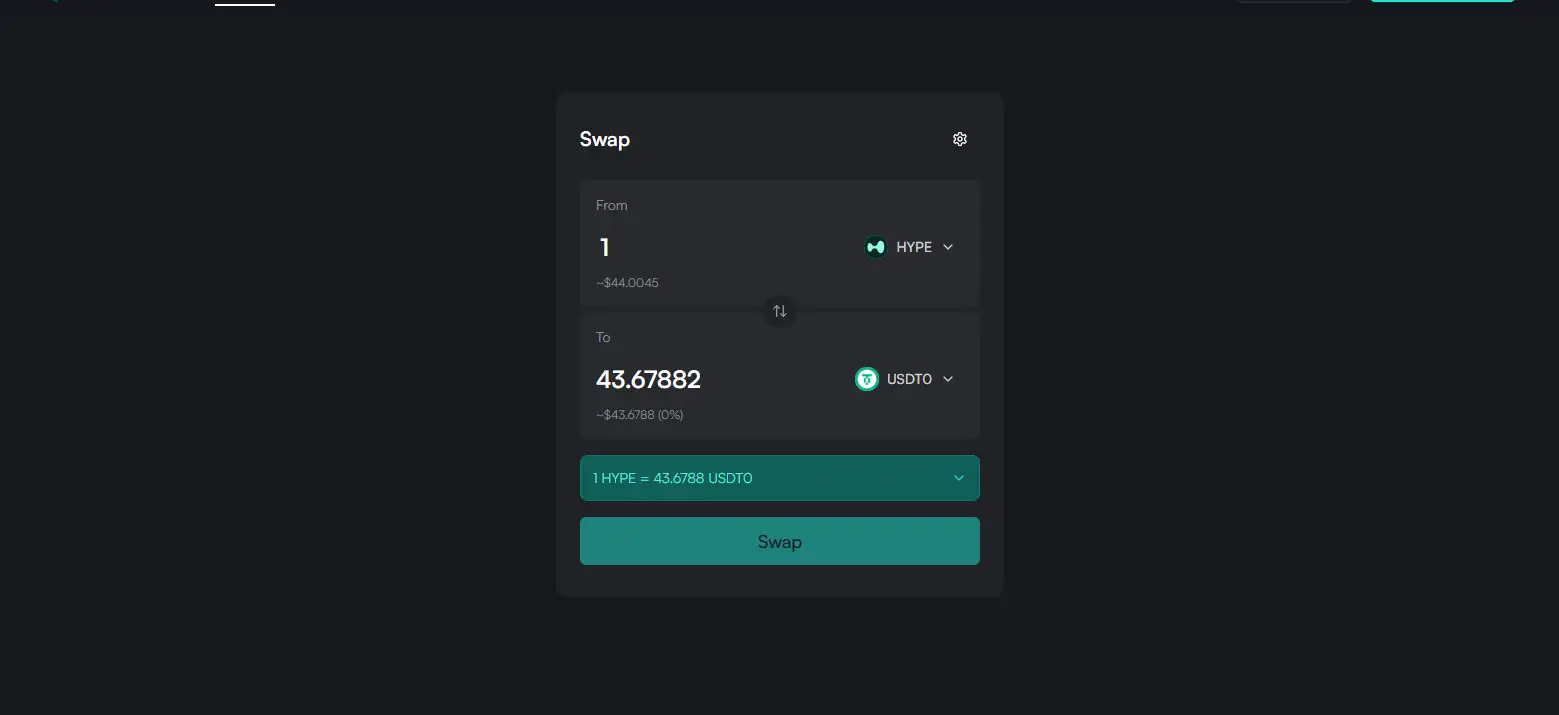

Getting started with HyperBrick is simple and designed to accommodate both DeFi newcomers and experienced LPs:

- Visit the App: Navigate to the official HyperBrick website and click "Launch App" to access the trading interface.

- Connect Your Wallet: Use a supported wallet like MetaMask or any EVM-compatible option to connect to the Hyperliquid EVM network.

- Trade or Provide Liquidity: Select token pairs from the “Trade” tab or choose a pool under “Pool” to deposit liquidity in targeted bins.

- Earn BRICK Points: Start generating BRICK Points through active trading or LP activity. Check your point accumulation in the “Point” section of the app.

- Monitor Your Portfolio: Use the “Portfolio” tab to view LP positions, accrued fees, and your BRICK Point score in real time.

- Maximize Rewards: Enhance your earnings with badge boosts and leaderboard tiers. Join the community early to qualify for OG-level badges.

- Join the Community: Connect with others and stay updated via Twitter, Telegram, and Discord.

- Learn More: For detailed mechanics, read the official GitBook documentation and follow updates via the Medium blog.

HyperBrick Reviews by Real Users

HyperBrick FAQ

BRICK Points are designed to reward actual economic contribution to the HyperBrick protocol. You earn them by paying swap fees, earning LP fees, or committing liquidity to active bins. The system includes volume-based multipliers and time-weighted calculations to recognize consistent, meaningful engagement—whether you're a small trader or a strategic LP. These aren't arbitrary airdrop points—they track real performance.

HyperBrick uses a bin-based AMM architecture, meaning liquidity in specific price ranges (bins) directly affects trade execution. LPs earn more BRICK Points when their liquidity is used in trades (i.e., “active bins”), as this creates real value through fee generation. Passive LPs still earn, but at a lower rate, ensuring fairness while motivating LPs to deploy capital where it’s most useful in the market.

Surge Pricing is HyperBrick’s dynamic fee adjustment mechanism. When volatility increases, fees rise, offering higher rewards for LPs who take on additional risk. This encourages deeper liquidity during uncertain times and ensures the protocol can maintain tight spreads. It’s a way to align risk-taking with incentive—those who provide during volatility are rewarded more generously.

Yes. Badges (earned through on- and off-chain activities) and Tier boosts (from leaderboard rankings) are both stackable. They multiply your daily BRICK Point earnings. For example, if you have three badges with a 5%, 10%, and 15% boost, they combine to a 30% multiplier. These boosts apply to both trading and LP activity, allowing committed users to maximize their rewards efficiently.

HyperBrick implements anti-exploit logic to monitor suspicious behaviors like wash trading, Sybil farming, and fake LP cycling. If your activity is flagged as manipulative, your BRICK Points may be withheld, reduced, or revoked. The system is designed to reward real value creation—not artificial volume or repeated low-impact interactions. Play fair and earn long-term rewards.

You Might Also Like