About Hyperliquid

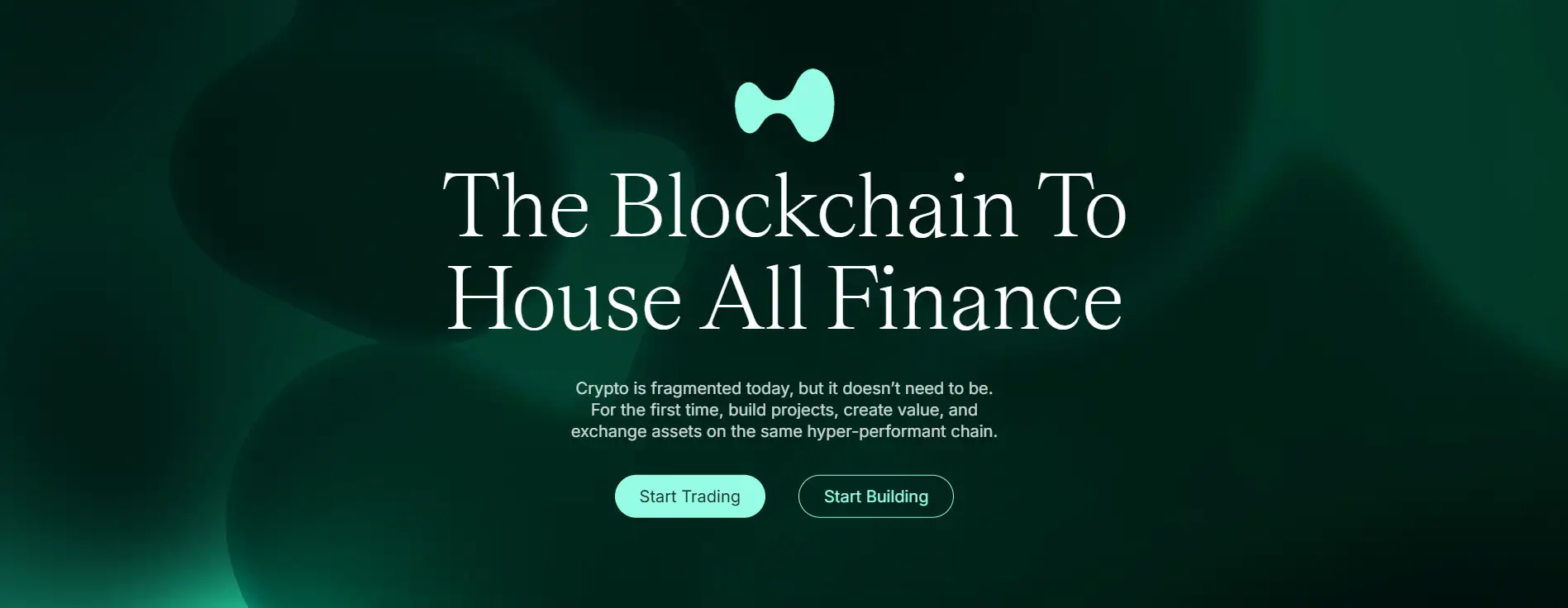

Hyperliquid is a next-generation Layer 1 blockchain purpose-built to unify all financial applications on a single high-performance, fully decentralized infrastructure. With its flagship application — a powerful onchain order book DEX — and robust performance stats like 0.07-second block time and over 200,000 TPS, Hyperliquid positions itself as the foundation for a future where finance is fully transparent, community-owned, and borderless.

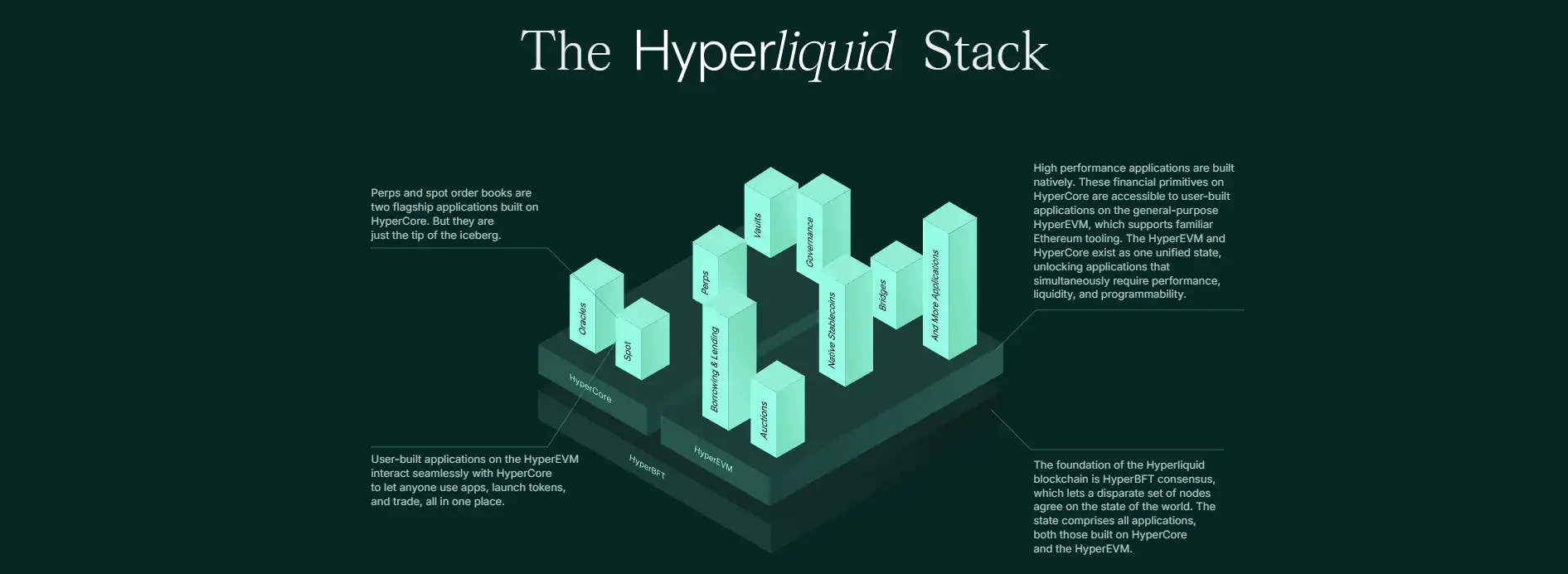

Unlike fragmented systems that split liquidity and performance across chains and layers, Hyperliquid integrates trading, building, and governance into a single protocol. Through the combination of HyperCore (financial primitives like perpetuals and spot markets) and HyperEVM (a general-purpose smart contract layer), Hyperliquid unlocks a powerful composable ecosystem that’s designed for both performance and programmability.

At its core, Hyperliquid is designed to serve as a foundational chain that can host the entire spectrum of decentralized finance — from high-frequency trading to complex dApps and smart contracts. It is not just a trading platform; it is a purpose-built L1 blockchain written from first principles with its own custom consensus algorithm: HyperBFT. Inspired by HotStuff and optimized for performance, HyperBFT ensures fast finality, high throughput, and secure state management for all applications deployed on the network.

The blockchain architecture is divided into two synergistic components: HyperCore and HyperEVM. HyperCore includes fully onchain order books for both perpetuals and spot trading. Every trade, order, and liquidation is executed with one-block finality and zero gas costs. This performance-first approach allows for up to 200,000 orders per second, making it the most scalable onchain DEX available today. At the same time, HyperEVM brings Ethereum-compatible smart contract functionality, allowing developers to leverage existing tooling to build on Hyperliquid.

The combination of deep liquidity, fast execution, and full composability makes Hyperliquid uniquely positioned compared to competitors like dYdX, Injective, and Perpetual Protocol. However, Hyperliquid distinguishes itself with its unified onchain architecture and community-first principles — no VCs, no token allocations to insiders, and no rent-seeking behavior.

The project is led by a high-caliber team of engineers and traders from Harvard, MIT, and Caltech, with past experience at top-tier firms like Citadel, Hudson River Trading, Airtable, and Nuro. Having started as proprietary market makers in 2020, the team grew frustrated by the limitations of existing DeFi platforms and set out to build an ecosystem that could match and eventually outperform its centralized counterparts — without compromising decentralization or user control.

As a fully self-funded and neutral protocol, Hyperliquid puts community at the center. All governance and security are handled through the native HYPE token, which allows anyone to own a stake in the network and help shape its future.

Hyperliquid offers cutting-edge features and benefits that set it apart from other DeFi ecosystems:

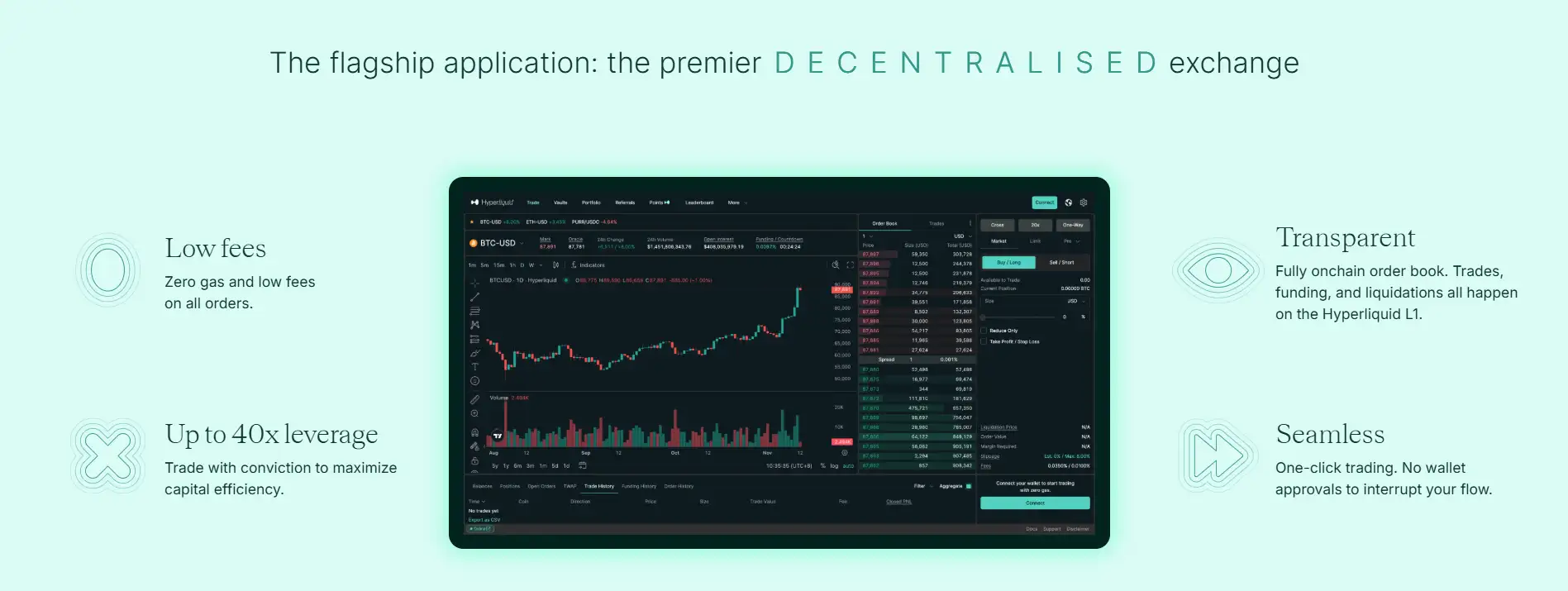

- Fully Onchain Order Book: Every order, trade, liquidation, and funding payment is executed transparently onchain with one-block finality via HyperBFT.

- Zero Gas Fees: Users pay no gas fees for trading, making it one of the most cost-efficient platforms for active traders.

- Up to 40x Leverage: Maximize capital efficiency with high leverage trading on a low-latency, fully decentralized exchange.

- Unified Liquidity and Application Layer: Hyperliquid integrates smart contracts and financial primitives on the same chain, enabling seamless composability.

- Ethereum Compatibility: Build with familiar tooling using HyperEVM, and tap directly into the HyperCore order books through built-in Solidity precompiles.

- Ultra-Fast Performance: With a 0.07-second block time and 200K TPS, Hyperliquid is built for real-time, high-frequency financial applications.

- No Insiders, No VC: Governance and value accrual are driven by the community through the HYPE token. The protocol is fully self-funded and neutral.

Hyperliquid provides an intuitive and powerful onboarding experience for both traders and builders:

- Choose an Interface: Access app.hyperliquid.xyz or third-party apps like Based, Dexari, or Phantom — available on web, iOS, and Android.

- Connect Your Wallet: Use any EVM-compatible wallet such as MetaMask, Rabby, or Coinbase Wallet. Alternatively, log in with your email to auto-generate a blockchain address.

- Deposit Collateral: Deposit USDC on Arbitrum via native bridge or centralized exchange. Supported assets include ETH, BTC, SOL, and many others that can be converted to USDC on-chain.

- Start Trading: Enable trading with one click (no gas), choose your asset, select long or short, set your leverage, and click "Place Order."

- Explore HyperEVM: Builders can deploy contracts, launch tokens, and plug into native liquidity via precompiled system contracts. Check out community-built tools like ASXN.

- Bridge Assets: Use bridges like Arbitrum Bridge, Synapse, or Jumper Exchange to bring USDC onto Hyperliquid.

- Govern with HYPE: Participate in network governance and help shape the protocol by holding and using the native HYPE token.

Hyperliquid FAQ

Hyperliquid uses a custom consensus algorithm called HyperBFT, inspired by HotStuff but optimized from the ground up for high-performance finance. This allows the network to process over 200,000 transactions per second with 0.07-second block times while maintaining a decentralized validator set. Every application built on Hyperliquid benefits from this performance, ensuring secure, transparent, and low-latency execution without compromising decentralization.

The HyperEVM brings familiar Ethereum tooling directly onto Hyperliquid, letting developers deploy smart contracts that plug into native onchain order books like perpetuals and spot markets. This unified state removes bridging risks and behind-the-scenes negotiations common on other chains. Builders gain instant access to deep liquidity and high-performance infrastructure, allowing them to create lending protocols, token launches, and advanced financial dApps with just a few lines of Solidity code.

Hyperliquid operates on a community-first principle. There are no venture capital allocations, no paid market makers, and no hidden fees. All trading activity — including orders, liquidations, and funding rates — happens fully onchain with one-block finality. By eliminating preferential treatment and ensuring open data, Hyperliquid creates a fair, transparent environment where every user competes on equal footing.

To trade on Hyperliquid, users can bridge USDC from Arbitrum using the platform’s native deposit flow. Simply visit app.hyperliquid.xyz, click “Deposit,” and follow the prompts. ETH on Arbitrum is used only for gas. Alternatively, you can use popular bridges like Arbitrum Bridge, Synapse, or Jumper Exchange. Once USDC is deposited, you’re ready to trade on Hyperliquid with zero gas fees.

The HYPE token is the native asset of Hyperliquid and serves as the cornerstone of its community-driven governance and security model. Holders can participate in network decisions, validator selection, and protocol upgrades. By distributing ownership to users instead of insiders, Hyperliquid ensures its future is shaped by the people who use and secure it, aligning incentives for builders, traders, and validators alike.

You Might Also Like