About InsurAce

InsurAce is a decentralized insurance protocol designed to provide comprehensive risk protection services to DeFi users. Its mission is to enhance the safety and stability of the DeFi ecosystem by offering reliable, transparent, and cost-efficient insurance solutions. By leveraging blockchain technology, InsurAce aims to deliver decentralized coverage that mitigates risks associated with smart contracts, stablecoins, and other DeFi assets. The protocol prioritizes capital efficiency, user-centric design, and transparency, making it a significant player in the decentralized insurance space.

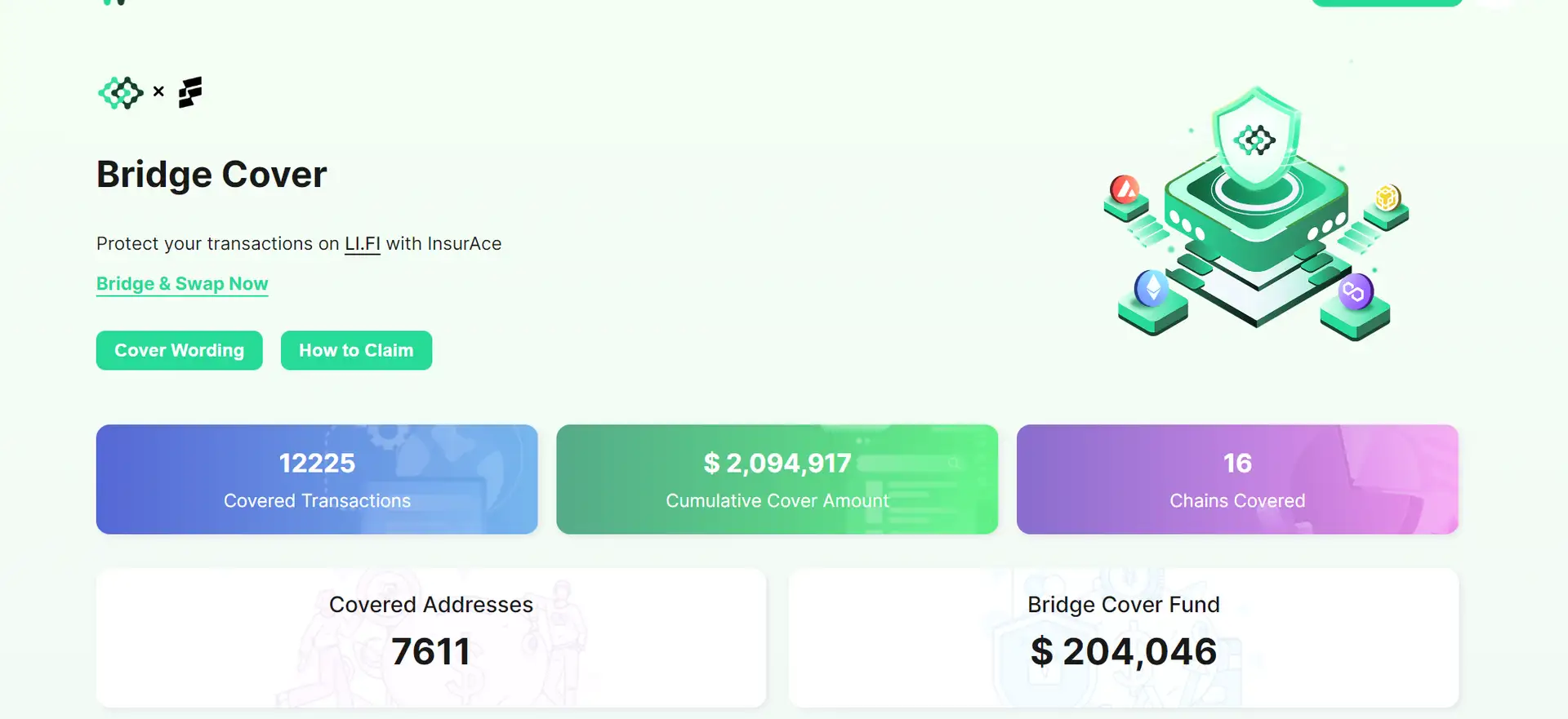

InsurAce was launched with the objective of creating a more secure DeFi environment. The project has made significant strides since its inception, including the development of a multi-chain insurance protocol and partnerships with key players in the DeFi space. InsurAce’s coverage solutions include smart contract covers, stablecoin de-pegging risk covers, and more. The protocol operates across multiple blockchain networks, ensuring wide accessibility and enhanced security. InsurAce has successfully integrated with major blockchains such as Ethereum, Binance Smart Chain, and Polygon, enhancing its reach and reliability.

The project was founded in response to the increasing need for reliable insurance solutions in the DeFi sector. With the rise of decentralized finance, the risks associated with smart contracts and stablecoins have also grown. InsurAce addresses these risks by providing tailored insurance products that cater to the specific needs of DeFi users. The protocol's innovative approach to risk assessment and management sets it apart from traditional insurance models.

InsurAce employs a capital-efficient model that ensures users receive maximum coverage at minimal costs. This is achieved through a combination of risk pooling, reinsurance, and advanced risk assessment algorithms. The platform's user-friendly interface allows users to easily purchase and manage their insurance policies, ensuring a seamless experience.

In terms of competition, InsurAce stands out due to its comprehensive coverage options and multi-chain support. Its main competitors in the decentralized insurance sector include Nexus Mutual, which offers a mutual-based insurance model; Bridge Mutual, which focuses on discretionary coverage; and Cover Protocol, which provides peer-to-peer insurance solutions. Each of these competitors offers unique features, but InsurAce's holistic approach to DeFi insurance and capital efficiency gives it a competitive edge.

InsurAce has also been active in community engagement and education. The team regularly hosts webinars, publishes research reports, and participates in industry conferences to raise awareness about DeFi insurance. By building a strong community and fostering partnerships with other DeFi projects, InsurAce aims to drive the adoption of decentralized insurance solutions and contribute to the overall growth of the DeFi ecosystem.

Looking ahead, InsurAce plans to expand its range of insurance products, improve its risk assessment algorithms, and explore new blockchain integrations. The team is committed to continuous innovation and development, ensuring that InsurAce remains at the forefront of the decentralized insurance industry.

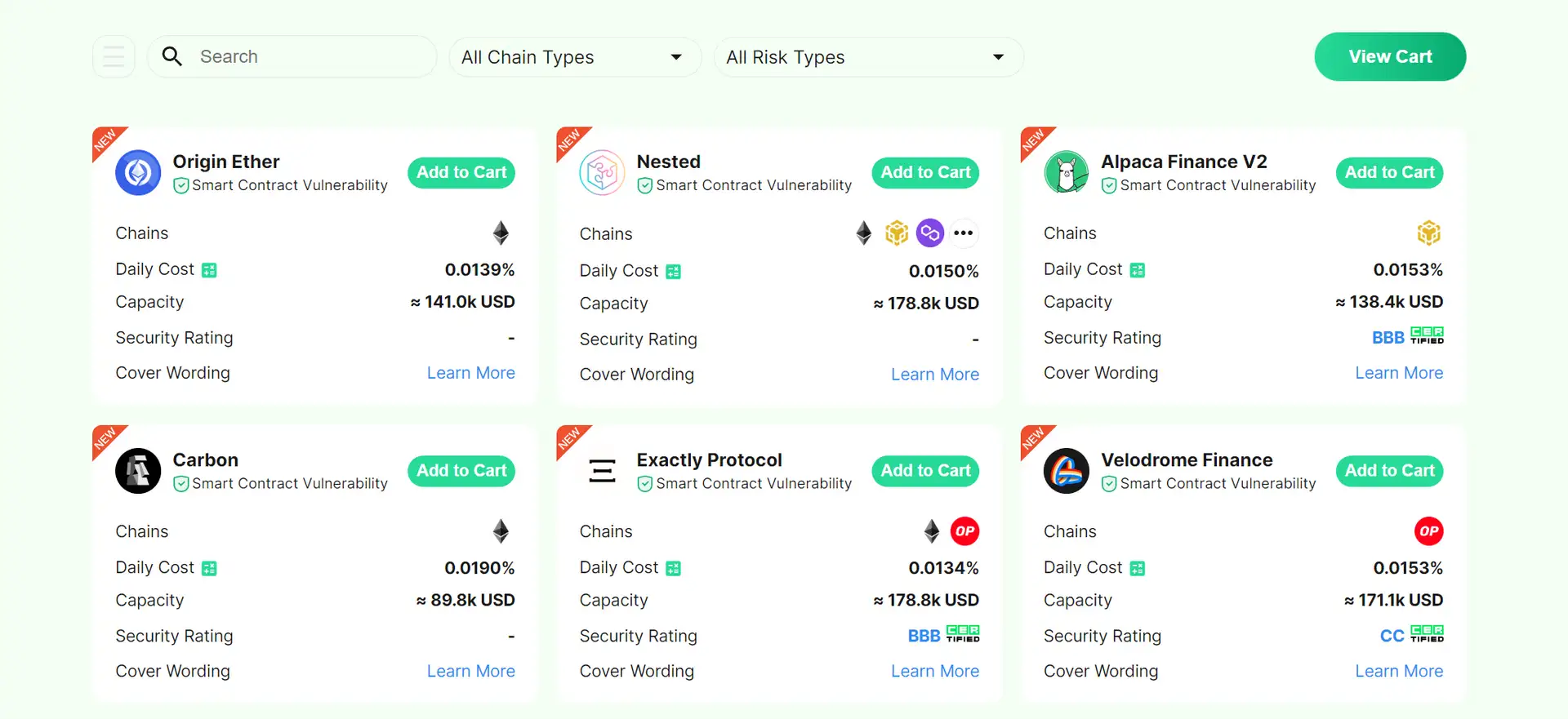

- Comprehensive Coverage: InsurAce offers a variety of insurance products, including smart contract covers and stablecoin de-pegging risk covers, catering to diverse risk protection needs.

- Multi-Chain Support: Operates across multiple blockchain networks, enhancing security and accessibility.

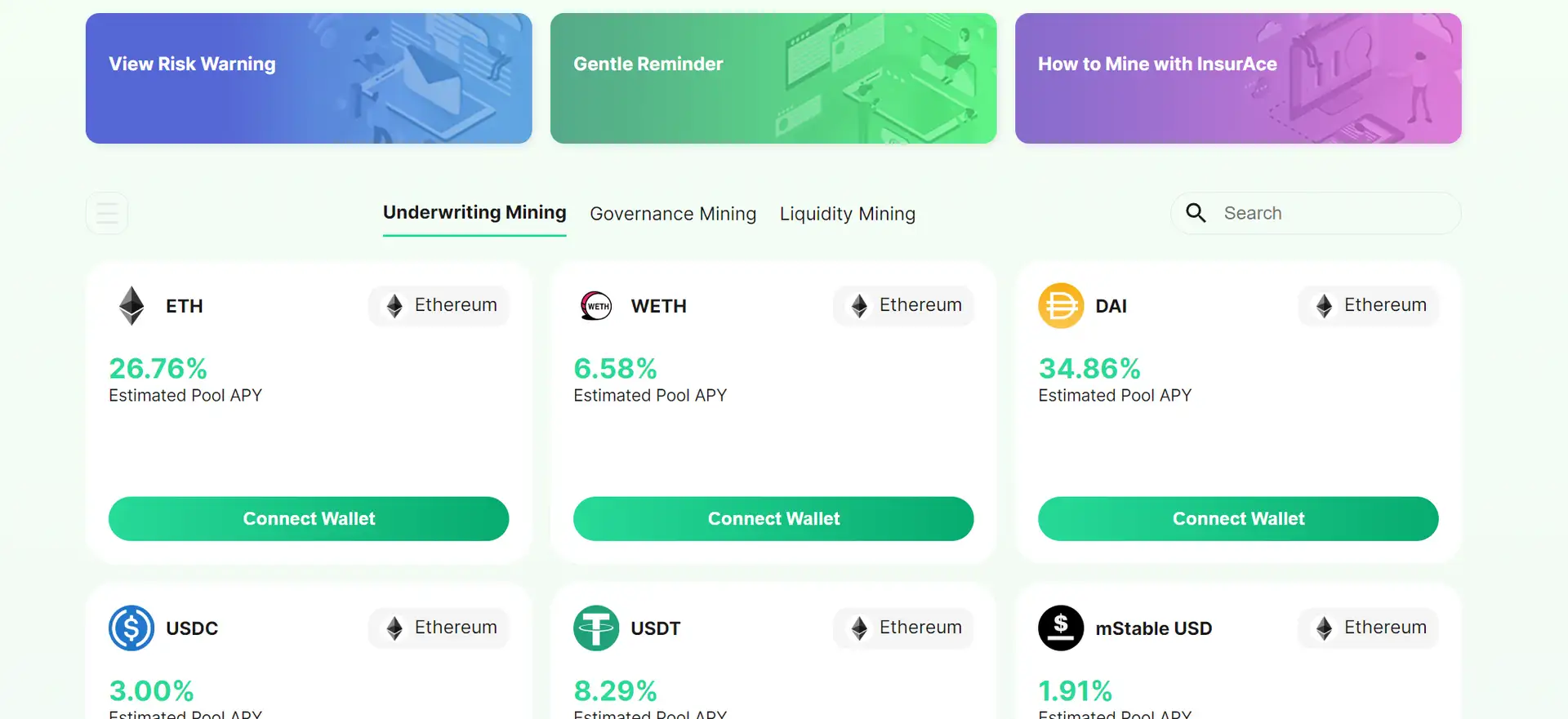

- Cost Efficiency: Utilizes a capital-efficient model to provide affordable premiums without compromising on coverage quality.

- Transparency: Leveraging blockchain technology ensures transparency in the insurance process, including claims and payouts.

- User-Friendly Interface: Provides an intuitive platform for users to purchase and manage insurance policies easily.

- Risk Assessment: Employs advanced algorithms and risk pooling techniques to accurately assess and manage risks.

- Community Engagement: Regular webinars, research publications, and industry participation to educate and involve the DeFi community.

- Continuous Innovation: Ongoing development and expansion of insurance products and blockchain integrations.

- Create an Account: Visit the InsurAce website and sign up using your email or connect your Web3 wallet.

- Select Insurance Coverage: Browse through the available insurance products and select the one that fits your needs. You can explore detailed information about each coverage option to make an informed decision.

- Purchase a Policy: Follow the prompts to purchase your desired insurance policy. InsurAce supports both fiat and cryptocurrency payments, making it convenient for a wide range of users.

- Manage Your Policy: Use the dashboard to manage and monitor your insurance policies. You can file claims, check coverage status, and view policy details all in one place.

- Stay Informed: Regularly check InsurAce updates and announcements for the latest features and coverage options. Participate in community discussions and attend webinars to stay updated on industry trends.

For more details, visit the InsurAce website.

InsurAce Token

InsurAce Reviews by Real Users

InsurAce FAQ

InsurAce employs a capital-efficient model by using a combination of risk pooling, reinsurance, and advanced risk assessment algorithms. This approach ensures that users receive maximum coverage at minimal costs, making insurance premiums more affordable without compromising on the quality of coverage.

InsurAce provides a range of insurance products, including smart contract covers, stablecoin de-pegging risk covers, and comprehensive DeFi asset protection. These offerings cater to the diverse risk protection needs of DeFi users, ensuring a broad spectrum of coverage options.

InsurAce leverages blockchain technology to maintain transparency in its insurance process. This includes clear documentation of policies, transparent claims processes, and verifiable payouts, all recorded on the blockchain to ensure accountability and trustworthiness.

Yes, InsurAce supports both fiat and cryptocurrency payments for purchasing insurance policies. This flexibility ensures that a wide range of users can easily access and purchase the coverage they need.

InsurAce operates across multiple blockchain networks, including Ethereum, Binance Smart Chain, and Polygon. This multi-chain support enhances the protocol's accessibility and security, allowing users to choose their preferred blockchain for purchasing and managing insurance policies.

You Might Also Like