About Invariant

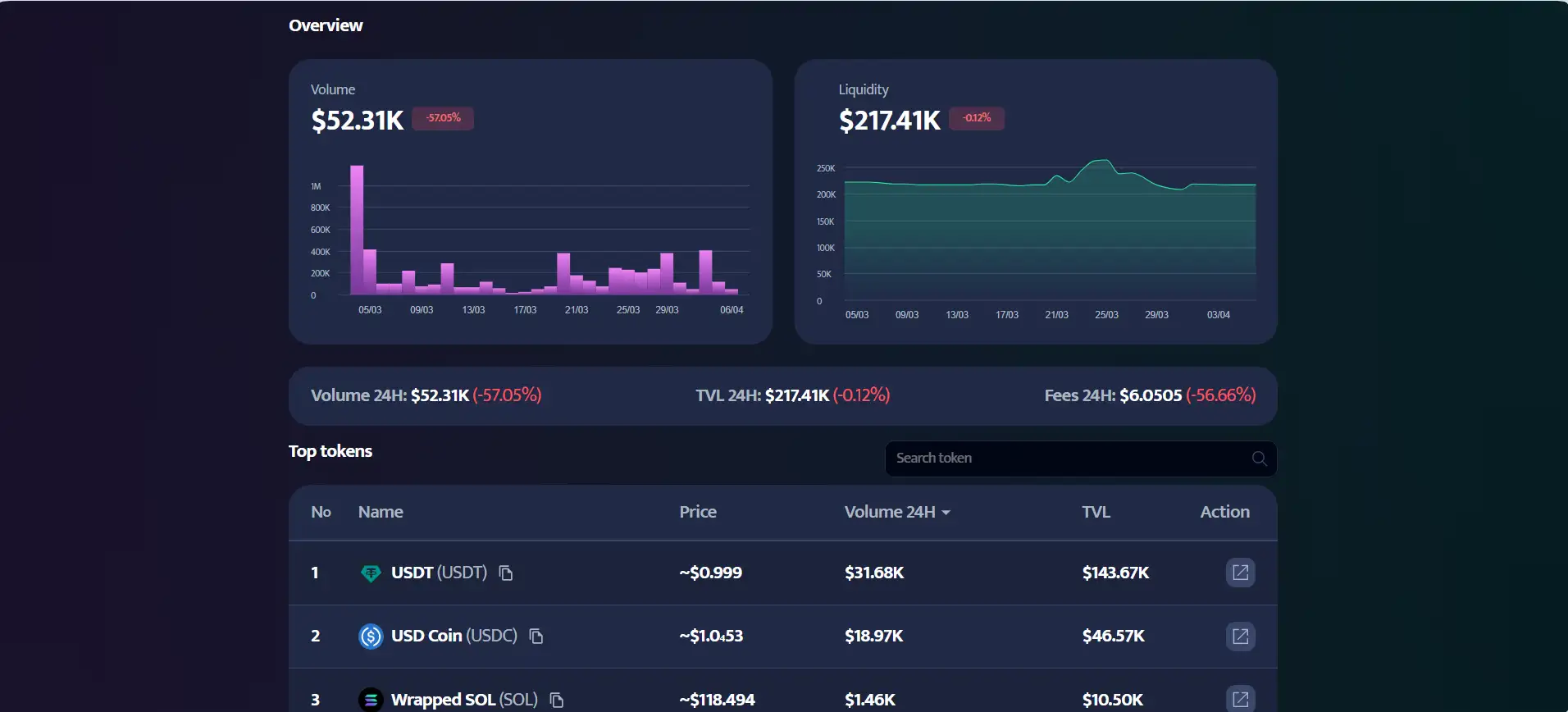

Invariant is a fully permissionless, multichain AMM DEX that leverages concentrated liquidity to revolutionize capital efficiency in DeFi. Originally developed for Solana and live since March 2022, Invariant was born from a desire to address inefficiencies in liquidity provisioning and access for average users. Its roots can be traced back to the Solana Riptide Hackathon, where the concept gained early recognition and validation.

Designed to reduce entry barriers and increase usability for non-technical participants, Invariant targets systemic issues such as liquidity separation, impermanent loss, MEV, and inefficient fee structures. By providing a seamless UI and support for flexible, customizable liquidity strategies, the platform empowers users to take control of their trading and liquidity decisions across multiple chains.

Invariant is an advanced decentralized exchange built around concentrated liquidity, enabling liquidity providers (LPs) to allocate capital within specific price ranges rather than across an entire curve. This highly targeted strategy results in significantly improved capital efficiency—up to 40,000 times greater than traditional AMMs. The exchange supports multichain operations, with early deployment and traction on Solana, and ongoing development for newer high-performance blockchains like Aleph Zero.

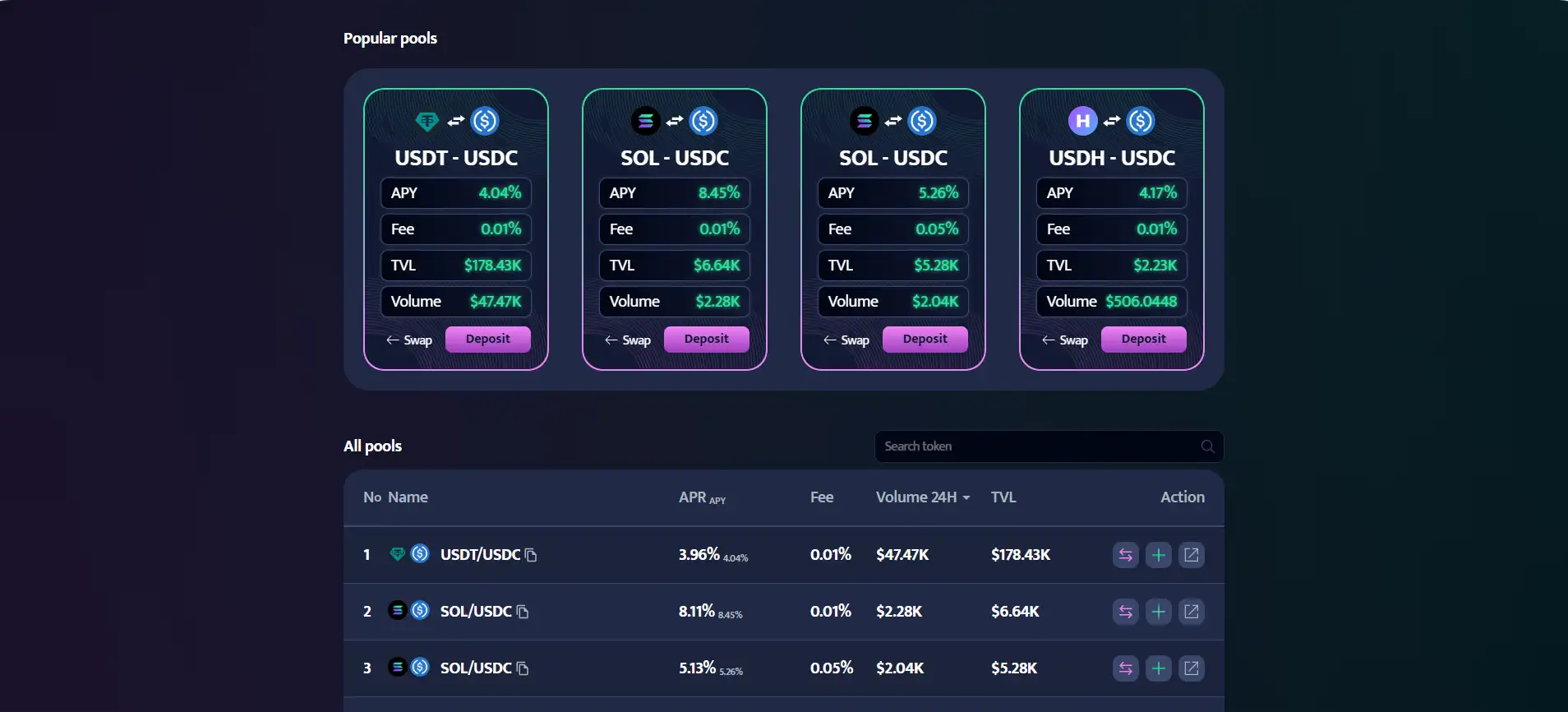

A key innovation of Invariant is its ability to create customizable liquidity positions with flexible fee tiers—ranging from as low as 0.01% to an exotic 10% tier. These tools are especially effective in volatile or experimental markets, like meme coin trading. With its fully-permissionless architecture, users can create, customize, and manage their positions without any centralized gatekeeping. The system is further enhanced by a tick-based architecture, allowing positions to be created with precise granularity and improving pricing on stable pairs.

Unlike conventional CLMMs that use NFTs to represent positions, Invariant introduces a more composable model using Program Derived Addresses (PDA). This design reduces costs, improves protocol integration, and avoids risks like accidental burns. Additional features include single-sided liquidity provisioning, auto-compounding through the Full Range Tokenizer, and AutoSwap, which automatically balances user assets to match required liquidity ratios—all through atomic transactions for maximum reliability and efficiency.

Competitors in the DEX and concentrated liquidity space include:

Invariant provides numerous benefits and features that make it a standout project in the AMM and DeFi ecosystem:

- Concentrated Liquidity Engine: Users can allocate capital within custom price ranges for maximum capital efficiency.

- Fully Permissionless Architecture: Anyone can create pools or liquidity positions—no approval required.

- Exotic Fee Tiers: Offers rare options like 10% fee tiers for volatile assets or experimental tokens.

- Single-Sided Liquidity: Allows LPs to participate with only one asset, reducing entry barriers and optimizing capital.

- AutoSwap: Automatically balances assets to match optimal ratios for entering liquidity pools.

- Full Range Tokenizer: Tokenizes LP positions for composability with lending/borrowing protocols and auto-compounds fees.

- NFT-less Positions: Uses Program Derived Addresses instead of NFTs for easier management and reduced costs.

- Multichain Support: Designed to operate across blockchains like Solana and Aleph Zero.

- Hackathon-Proven Tech: Originally conceptualized during the Solana Riptide Hackathon and refined through subsequent competitions.

Invariant makes it easy for users to get started on its multichain DeFi exchange. Here’s how:

- Connect Wallet: Visit Invariant and connect your wallet. Use wallets like Nightly for optimal experience.

- Request Testnet Tokens: For Aleph Zero testnet, use the AZERO Faucet and then claim testnet BTC, ETH, and USDC from Invariant’s faucet.

- Add Liquidity: Go to “Liquidity” → “Add Position.” Choose your token pair, fee tier, and desired price range, then deposit your tokens.

- Swap Tokens: Head to the “Exchange” tab, select your desired tokens, and perform swaps using the intuitive UI.

- Claim Fees: Navigate to “Liquidity,” open your position, and click “Claim Fee” to collect earned rewards.

- Close Position: If you're done providing liquidity, you can close your position at any time. This will return your tokens and fees.

- Advanced Tools: Experiment with AutoSwap and the Full Range Tokenizer to fine-tune your LP strategies and maximize returns.

- Need Help? Join the community on Discord or refer to the comprehensive user guide on the official Invariant website.

Invariant FAQ

Invariant lowers the complexity of concentrated liquidity by automating crucial decisions through tools like AutoSwap and intuitive price sliders. These remove the need for users to calculate precise token ratios or understand deep DeFi mechanics. The Invariant platform helps users focus on outcomes rather than configurations, allowing broader participation in capital-efficient liquidity strategies.

When the market price exits your specified range, your liquidity position becomes inactive and temporarily stops earning fees. However, your tokens remain safely in the protocol and are automatically reactivated if the price reenters the chosen range. Invariant ensures that your capital is never lost and that fee generation resumes without user intervention. Learn more on Invariant.

Yes, Invariant supports single-sided liquidity, enabling users to provide capital using only one token from a pair. This means you can join liquidity pools without the need to split assets, which is ideal for simplifying exposure and managing risk. Once the price falls within your selected range, you start earning fees. This inclusive design is part of Invariant's mission to make DeFi tools more accessible.

AutoSwap analyzes the ratio of your tokens, automatically swaps excess assets to meet the required ratio, and creates your position in one atomic transaction. This eliminates manual steps and reduces errors. It also prevents loss from price impact or slippage, ensuring that more of your capital is actively used. Users can configure settings for slippage and price impact directly in the app. For more details, visit Invariant.

Invariant replaces the common NFT-based position tracking system with Program Derived Addresses (PDAs), making positions lighter, cheaper, and more secure. This allows better composability with other DeFi protocols, avoids accidental burns, and enables easier integrations. With this model, users can hold fungible representations of their positions, which are easier to manage and leverage in lending, borrowing, or trading. Explore this innovation on Invariant.

You Might Also Like