About io.finnet

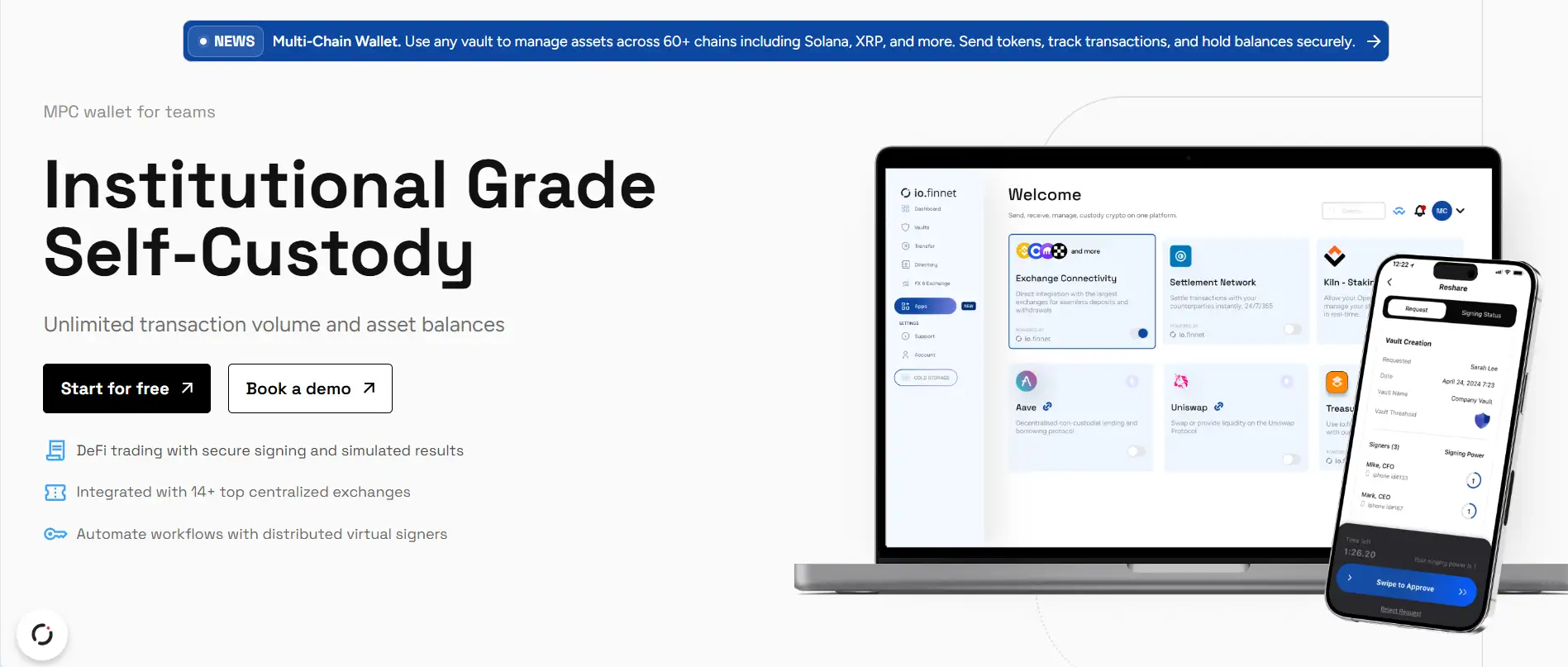

io.finnet is a cutting-edge digital asset infrastructure provider that delivers enterprise-grade blockchain security through a suite of powerful tools, including trustless Multi-Party Computation (MPC) and self-custody vault systems. Headquartered in the US with a global presence in the UK, Spain, the Cayman Islands, and Singapore, the project aims to democratize access to MPC security for developers, institutions, and businesses worldwide. At its core, io.finnet is about giving users complete control over their assets without sacrificing compliance or usability.

Founded in 2021, the company was created in response to rising demand for secure, scalable solutions in the wake of high-profile collapses in the custodial sector like FTX, Celsius, and BlockFi. The platform provides 24/7 access to digital asset infrastructure via io.network (a private blockchain settlement engine) and io.vault (a flexible self-custody wallet platform). With zero third-party dependencies, developer-first APIs, and compliance-ready modules, io.finnet is redefining how organizations manage digital assets across 90+ chains.

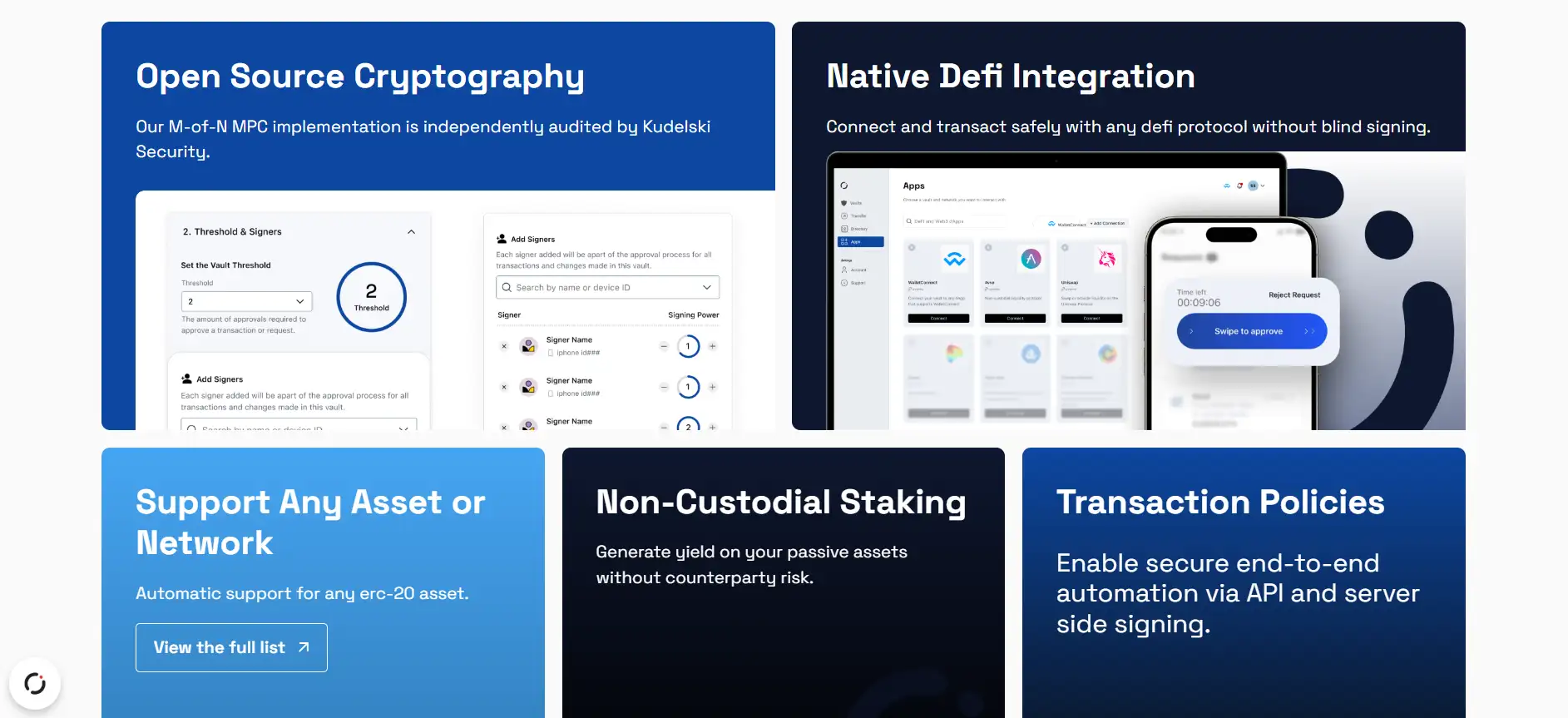

io.finnet began with a mission to bridge the gap between blockchain innovation and enterprise-level security. Recognizing that legacy custodianship posed significant risks and inefficiencies for institutional players, the platform was developed as a resilient, modular, and highly secure alternative. It uses a unique trustless MPC architecture (tMPC), which enables secure transaction signing through distributed cryptographic protocols. This model enhances decentralization while preserving operational efficiency and regulatory compliance.

Its core products include:

- io.vault: A flexible custody and wallet solution supporting 90+ chains with customizable signing policies, disaster recovery, staking, and team access management.

- io.network: A private blockchain designed for near-instant, global settlement that offers the scalability and performance needed for high-volume financial workflows.

With seamless integration into 14+ centralized exchanges and robust DeFi capabilities, the platform facilitates both manual and automated signing methods through its Virtual Signer and API automation tools. This makes it suitable for diverse use cases—ranging from hedge funds and trading firms to developers and DeFi protocols looking for safe, scalable asset management. io.finnet also supports Wallet-as-a-Service with HD address generation, role-based access control, native WalletConnect support, and future-ready risk monitoring modules.

Competitors in this space include Fireblocks, AnchorWatch, and Copper. However, io.finnet differentiates itself by eliminating AUC fees, offering unlimited vaults, and emphasizing open-source cryptographic tools audited by Kudelski Security. This emphasis on cost efficiency, modularity, and open infrastructure makes it a forward-looking platform for both Web3-native teams and traditional financial institutions transitioning into crypto.

io.finnet provides numerous benefits and features that make it a standout project in the digital asset custody landscape:

- Trustless MPC Security: Uses multi-party computation for secure signing without reliance on third-party custodians or centralized points of failure.

- Automated & Manual Signing Options: Users can approve transactions manually via mobile or automate them via the Virtual Signer and REST API for high-frequency needs.

- Multi-Chain Support: Native compatibility with 90+ blockchain networks, including Ethereum, Solana, XRP, and Tron, plus automatic support for any ERC-20 token.

- DeFi & Exchange Integration: Direct integrations with major exchanges and DeFi protocols, allowing secure transactions without blind signing.

- Non-Custodial Staking: Generate yield without relinquishing asset control, removing counterparty risk.

- Disaster Recovery Tools: Open-source, trustless recovery mechanisms ensure ongoing access even in worst-case scenarios.

- No Fees on AUC: All plans provide unlimited transactions and storage with zero AUC fees.

- Flexible Pricing: Flat-fee tiers tailored to startups, professionals, and large institutions starting at $0/month.

- Audited & Compliant: Certified and audited by independent security firms such as Kudelski Security.

io.finnet makes it simple to onboard both individuals and enterprises onto its secure platform. Here’s how to get started:

- Create a Free Account: Visit the io.finnet website and click “Sign up for free” to open a basic account with support for 10 vaults and 10 users.

- Select a Pricing Plan: Choose between Free, Startup ($299.99/month), Professional ($749.99/month), or Enterprise ($1,499.99+/month). Each plan includes unlimited AUC and transaction volume, with flexible seat options.

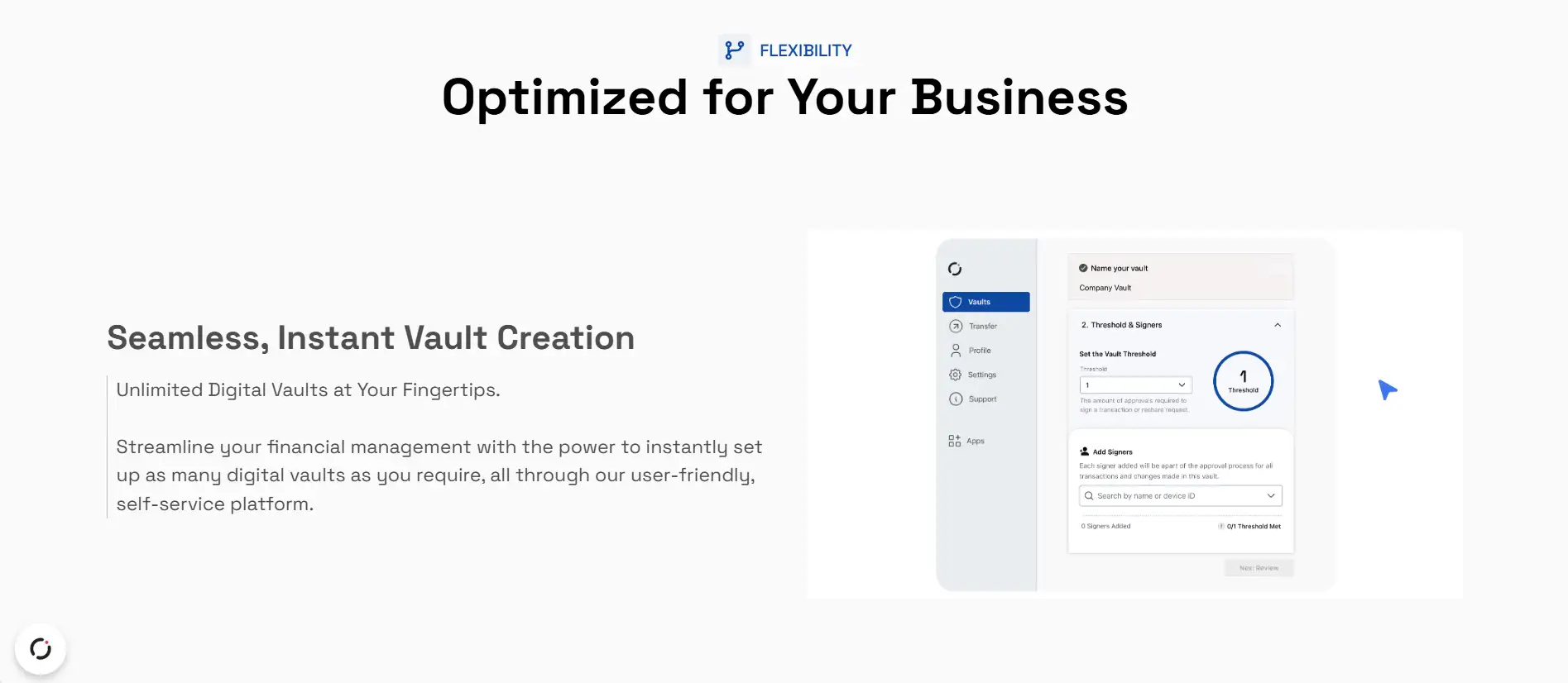

- Set Up Vaults: Instantly create unlimited vaults using the self-service dashboard. Customize signers and define thresholds via approval policies.

- Integrate APIs: Developers can access full REST API documentation, Postman collections, and SDKs to integrate io.finnet into Web3.js, Ethers.js, or SolanaKit environments.

- Deploy a Virtual Signer: One-click deployment via Intel SGX enclaves allows organizations to automate transaction workflows with fine-grained policy enforcement.

- Connect Exchanges & Wallets: Link your accounts from 14+ exchanges to manage balances, simulate transactions, and automate withdrawals securely.

- Access Support: All plans include ticketing or live support, with tailored onboarding and Virtual Signer assistance for enterprise users.

- Use Developer Tools: Explore the extensive toolset including Wallet-as-a-Service, HD addresses, risk engines, and workspace features to extend your use case.

- Mobile Access: Approve transactions on the go via the mobile app available on the App Store and Google Play.

io.finnet FAQ

io.finnet implements a fully open-source disaster recovery mechanism that eliminates reliance on any third-party service. If a user's infrastructure is compromised, the system provides tools that can restore access using distributed MPC shards without needing to trust or contact io.finnet or an external custodian. This approach ensures full autonomy and zero single points of failure.

Yes, io.finnet offers real-time transaction simulation to preview the outcome of actions before committing them on-chain. This helps institutions detect errors, assess risks, and validate policies through dry runs, significantly reducing the chance of failed or unauthorized transactions. It’s a key feature for compliance teams and automated systems needing auditability before execution. Visit io.finnet to learn more.

The Virtual Signer is a powerful automation tool built into io.finnet that leverages Intel SGX enclaves to execute secure transaction signing under custom-defined policies. It acts as a programmable agent within the trustless MPC signing framework, making it possible to automate approvals while preserving security and compliance. It's ideal for institutions needing fully automated yet policy-governed workflows.

io.finnet provides an advanced policy engine where users can define custom workflows including multi-level signatory thresholds, role-based access control, pre-transaction checks, whitelisting, and governance vaults. Enterprises can create bespoke signing hierarchies across teams and regions while maintaining strict compliance protocols. These policies can be managed via UI or integrated directly through the io.finnet API.

By offering unlimited vaults and removing Assets Under Custody (AUC) fees, io.finnet enables institutions to scale their digital asset operations without cost restrictions. Teams can segment assets, implement custom workflows, and manage environments for different business units—all without worrying about escalating costs. This pricing model promotes both operational flexibility and cost efficiency.

You Might Also Like