About Ivorypay

Ivorypay is a crypto-native payment gateway built to empower African businesses by enabling them to accept Stablecoin payments from anywhere in the world. The platform removes borders and banking limitations, giving entrepreneurs, SMEs, nonprofits, and global brands the ability to transact efficiently with digital currency. By offering infrastructure that leverages blockchain technology, Ivorypay bridges the gap between traditional finance and the growing demand for secure, fast, and low-cost payments in the African economy.

With support for widely-used stablecoins like USDT, USDC, and BUSD, Ivorypay provides diverse tools including checkout widgets, QR pay, payment links, and storefronts. Its API suite allows developers to build personalized payment flows, while merchants benefit from fast settlement, fiat off-ramping, and zero chargeback risks. Ivorypay is making it possible for anyone—from freelancers to large corporations—to engage in seamless, borderless commerce powered by Stablecoins.

Ivorypay is a next-generation Stablecoin payment infrastructure built specifically for the African market, where businesses and individuals often face high banking fees, limited access to international payments, and regulatory friction. It provides a fast, secure, and flexible alternative by using blockchain rails and stable digital currencies to power cross-border commerce. Whether it’s a social media entrepreneur in Ghana, a SaaS startup in Kenya, or a nonprofit organization in South Africa, Ivorypay offers an accessible, easy-to-use platform for sending and receiving digital payments.

A core strength of Ivorypay lies in its diverse product suite. Businesses can integrate Ivorypay Checkout directly into their e-commerce stores for seamless customer experiences, or use Payment Links for one-click invoicing and donations—ideal for freelancers and nonprofits. The Ivory Store acts as a fully hosted storefront for creators and online sellers looking to monetize without the need for complex setups. All transactions are powered by stablecoins, offering price stability and global reach without the volatility of typical cryptocurrencies.

The platform supports a wide range of business models. Subscription-based services benefit from recurring payments powered by smart contracts. Online retailers gain fast settlement and reduced fraud risk through blockchain transparency. Creators can monetize content globally, and NGOs can accept donations from any country with full transparency and traceability. These tailored solutions are part of Ivorypay’s mission to make decentralized finance (DeFi) accessible for everyone.

On the technical side, developers have access to well-documented APIs that enable full customization of payment flows. Whether building apps for recurring billing, micropayments, or digital asset sales, Ivorypay offers the backend support to scale products fast. Transactions are confirmed in minutes and settled at a fraction of the cost of traditional bank transfers.

One of the most compelling value propositions is chargeback fraud prevention. Because all transactions on Ivorypay are final and recorded on-chain, merchants are protected against fraudulent reversal claims—a persistent problem in fiat systems. Additionally, businesses can receive payouts directly in fiat currencies, eliminating the need to manage crypto wallets or navigate exchanges. Ivorypay handles the conversion and transfers funds to local or international bank accounts seamlessly.

Backed by prominent Web3 and fintech investors, Ivorypay is actively expanding its reach across Nigeria, Ghana, Kenya, South Africa, and beyond. It provides tailored support for entrepreneurs, fintech startups, betting platforms, global brands, and online marketplaces looking to adopt secure, fast, and cost-effective Stablecoin payments. Compared to traditional processors like Paystack or Flutterwave, and even global crypto players like CoinPayments or Coinbase Commerce, Ivorypay stands out with its localized support, lower fees, and deeper blockchain integration.

Ivorypay offers powerful benefits and features that make it a leading solution for Stablecoin payments in Africa:

- Borderless Stablecoin Payments: Businesses can accept USDT, USDC, and BUSD payments from customers around the world, enabling global transactions without relying on traditional banks.

- Multiple Payment Tools: From Checkout integrations to Payment Links, QR Pay, and the hosted Ivory Store, users have access to flexible, secure, and user-friendly payment tools.

- Developer-Friendly APIs: Ivorypay provides well-documented APIs that allow developers to build custom payment experiences for a wide range of applications, including recurring payments and app monetization.

- Fast and Low-Cost Transactions: Receive payments in minutes with transaction fees significantly lower than banks and traditional payment processors, improving cash flow and profitability.

- Secure and Fraud-Resistant: By leveraging blockchain technology, Ivorypay eliminates chargeback frauds and offers end-to-end transparency in all transactions.

- Instant Fiat Conversion: Merchants can receive fiat deposits into local or international bank accounts, removing the complexity of managing crypto assets.

- Tailored Business Solutions: Ivorypay serves a wide range of users, including e-commerce businesses, freelancers, nonprofits, service providers, and creators.

- Localized African Support: The Ivorypay team understands African markets and offers personalized guidance to help regional businesses grow in the digital payments ecosystem.

Getting started with Ivorypay is simple and takes just a few minutes:

- Create a Free Account: Visit ivorypay.io and click on “Create Free Account” to sign up with your email and business details.

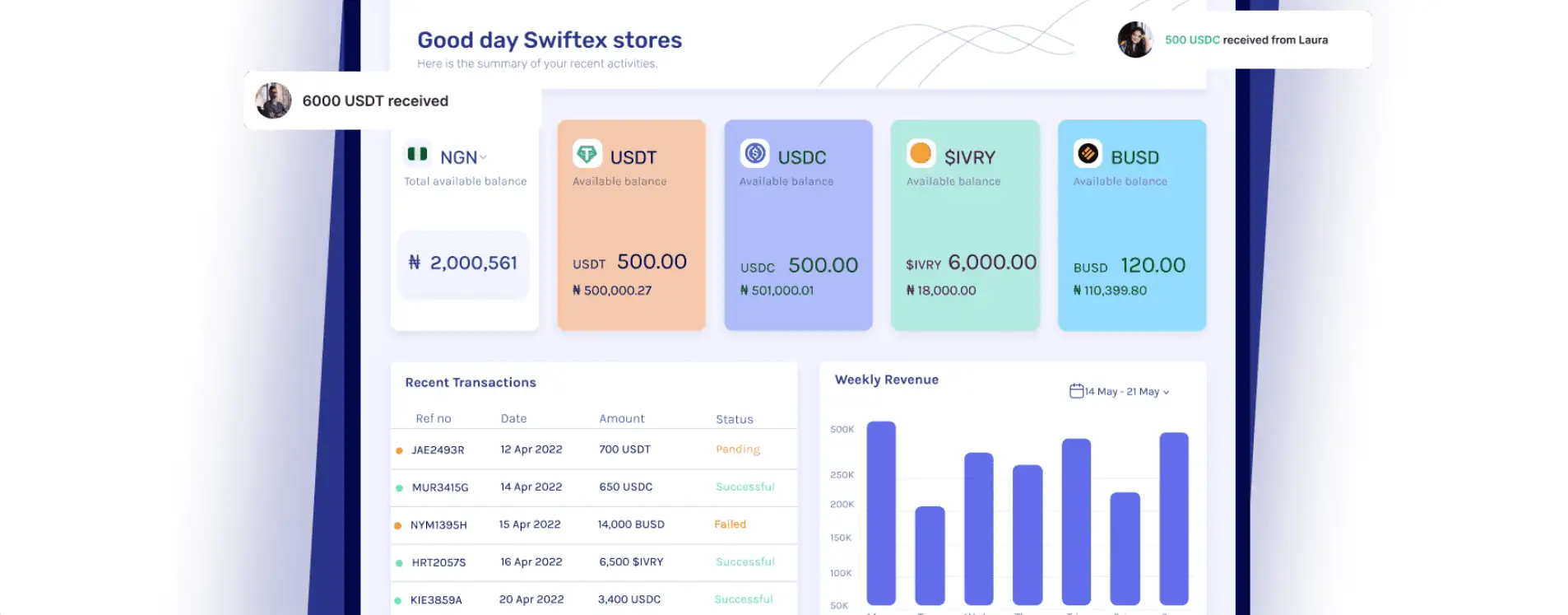

- Set Up Your Dashboard: Once registered, access the Ivorypay dashboard to configure your payment preferences, select supported stablecoins, and set your payout details.

- Choose a Product: Decide whether you want to use Checkout, Payment Links, QR Pay, or the hosted Ivory Store. You can also use the API if you’re a developer building a custom integration.

- Integrate or Share: Integrate Ivorypay into your app or website, or start sharing payment links with customers through social media, messaging apps, or email.

- Start Accepting Payments: Begin receiving payments in USDT, USDC, or BUSD. Ivorypay will automatically convert funds to fiat and send them to your preferred account.

- Explore More Tools: Dive into Ivorypay’s developer documentation to explore advanced capabilities like subscription billing, webhook integrations, and transaction analytics.

Ivorypay FAQ

Ivorypay is tailored for regions where local currencies are unstable. By enabling businesses to accept payments in Stablecoins such as USDT, USDC, and BUSD, it allows entrepreneurs to preserve the value of their earnings and avoid currency devaluation. The platform supports cross-border commerce and removes barriers caused by foreign exchange restrictions, making it a strong solution for African markets impacted by inflation and regulatory challenges.

Freelancers can easily receive payments by creating a free account on Ivorypay. Once registered, they can generate personalized payment links or integrate Ivorypay Checkout into their website. Payments are processed in Stablecoins, ensuring fast, secure, and borderless income without the high fees of traditional banking systems.

Yes, Ivorypay is a perfect solution for non-profits looking to receive global donations. Organizations can create payment links or a branded Ivory Store page to securely accept Stablecoin contributions from supporters worldwide. This approach ensures low transaction fees, transparency, and access to real-time reporting on donor activity. Learn more at ivorypay.io.

Ivorypay offers faster, cheaper, and more secure transactions compared to legacy payment systems. By using blockchain technology and Stablecoins, it eliminates long settlement times and minimizes fees. Additionally, it supports global payments without the need for complex bank integrations, making it an excellent choice for businesses in Africa and beyond. Start at ivorypay.io.

Ivorypay leverages the inherent features of blockchain transactions, which are irreversible and verifiable. This completely removes the risk of chargeback fraud, a common issue with card-based systems. Merchants benefit from a secure, fraud-resistant environment where every payment is final, improving trust and operational efficiency. See details on Ivorypay.io.

You Might Also Like