About IX Swap

IX Swap is a revolutionary DeFi platform focused on tokenizing real-world assets (RWAs) to make private market investments more accessible. Leveraging blockchain technology, IX Swap offers a secure, transparent, and compliant way for investors to access a wide range of asset classes, including private equity, real estate, infrastructure, and more. The platform’s mission is to democratize investment opportunities, breaking down barriers that have traditionally limited access to high-value markets.

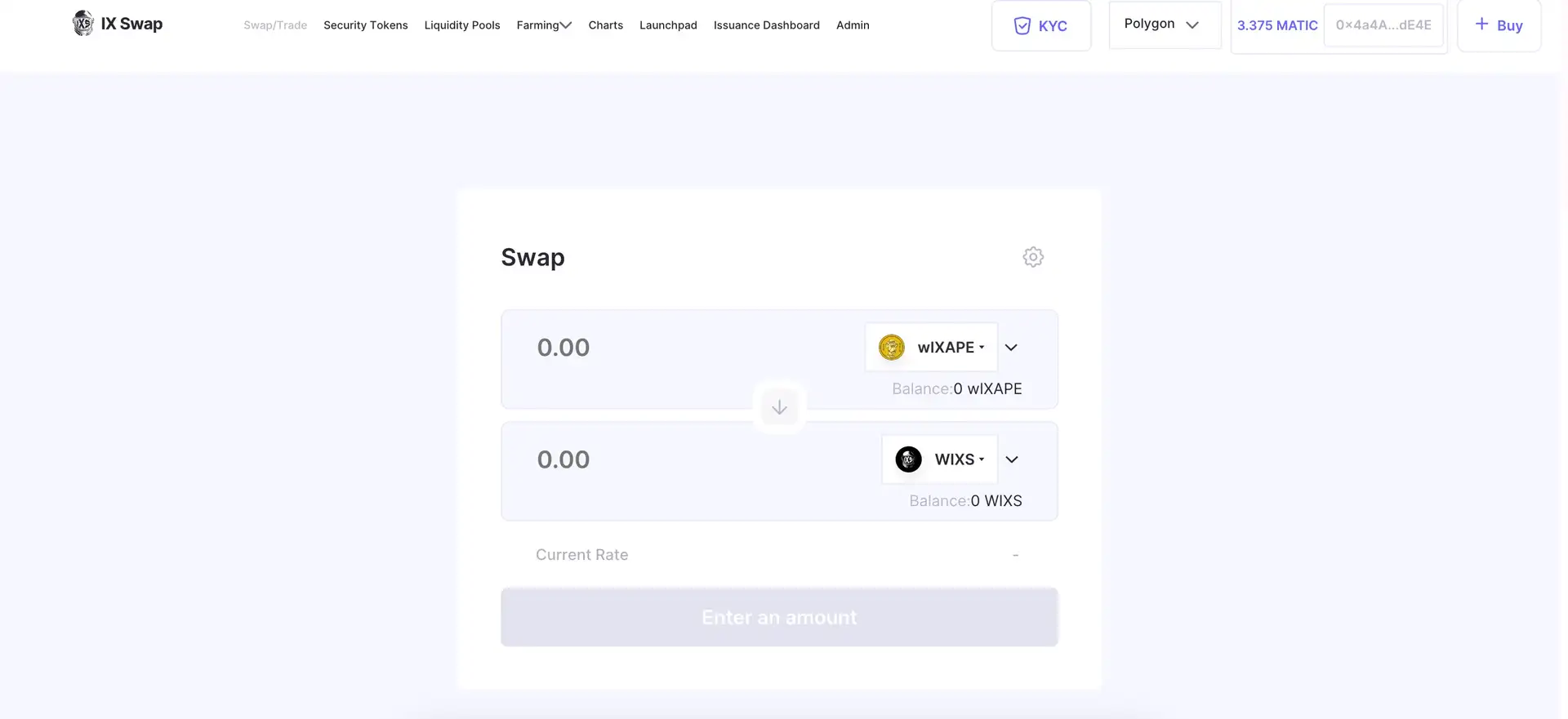

IX Swap addresses the liquidity challenges associated with tokenized assets through its innovative automated market maker (AMM) and liquidity pool solutions. By providing a secondary market for security tokens, IX Swap ensures that investors can trade assets with ease and confidence. The platform also features a launchpad for next-generation crowdfunding, supporting the issuance of security tokens and fractionalized NFTs.

The platform’s commitment to regulatory compliance and partnerships with licensed intermediaries ensures a secure and legitimate environment for all participants. IX Swap’s native IXS token plays a crucial role in the ecosystem, enabling transactions, governance, and participation in various platform features.

Founded with the vision to integrate traditional finance with decentralized finance, IX Swap has positioned itself as a leader in the tokenization of real-world assets. The platform’s development journey includes several key milestones that highlight its growth and innovation.

History and Development

- Foundation and Early Development: IX Swap was established to solve the liquidity issues in the tokenized asset market. Early development focused on creating a robust infrastructure to support the trading of security tokens and cryptocurrencies.

- Launch of AMM and Liquidity Pools: The introduction of the automated market maker (AMM) and liquidity pools was a significant milestone. These features allow for efficient trading and liquidity provision for tokenized assets.

- Partnerships and Compliance: IX Swap has forged partnerships with regulatory bodies and licensed intermediaries to ensure compliance with legal standards. This focus on regulation enhances the platform’s credibility and trustworthiness.

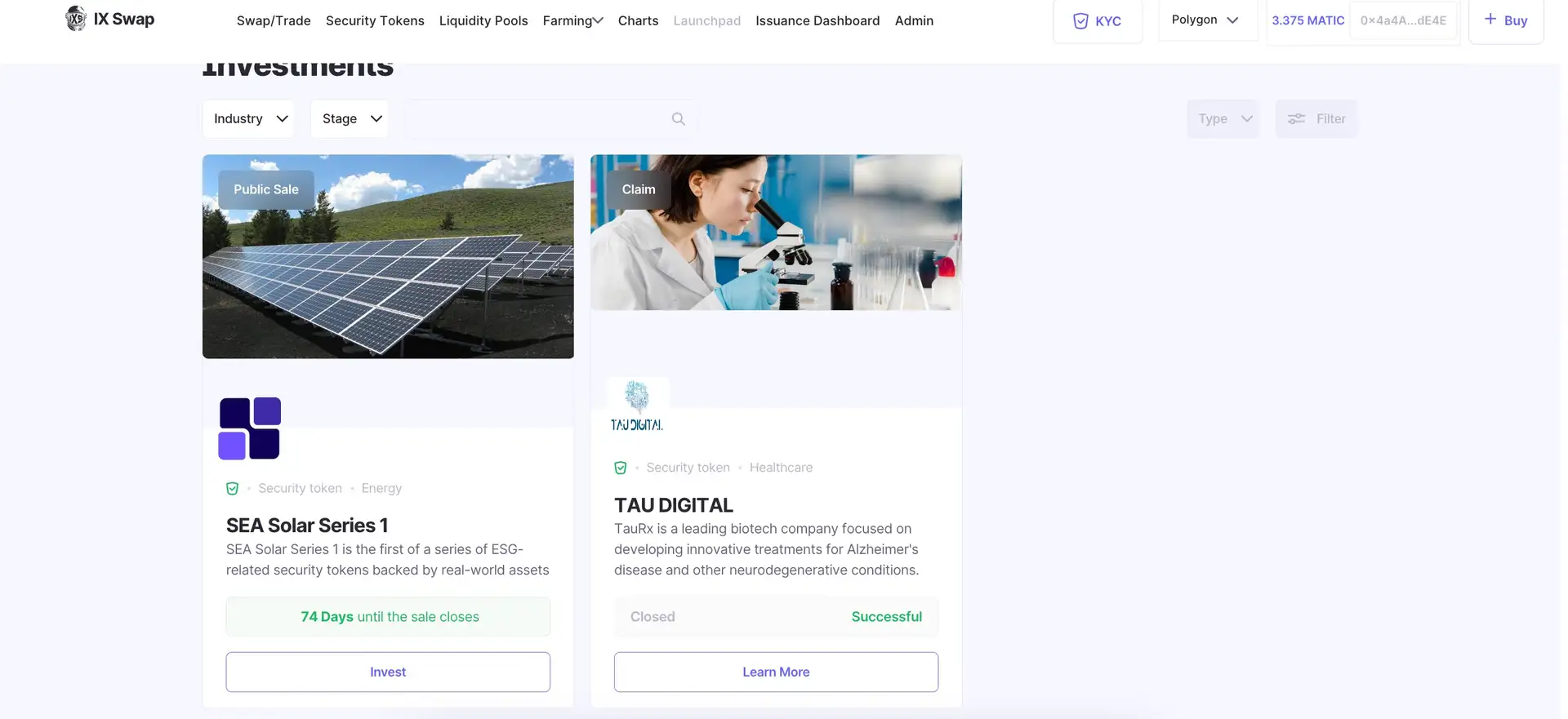

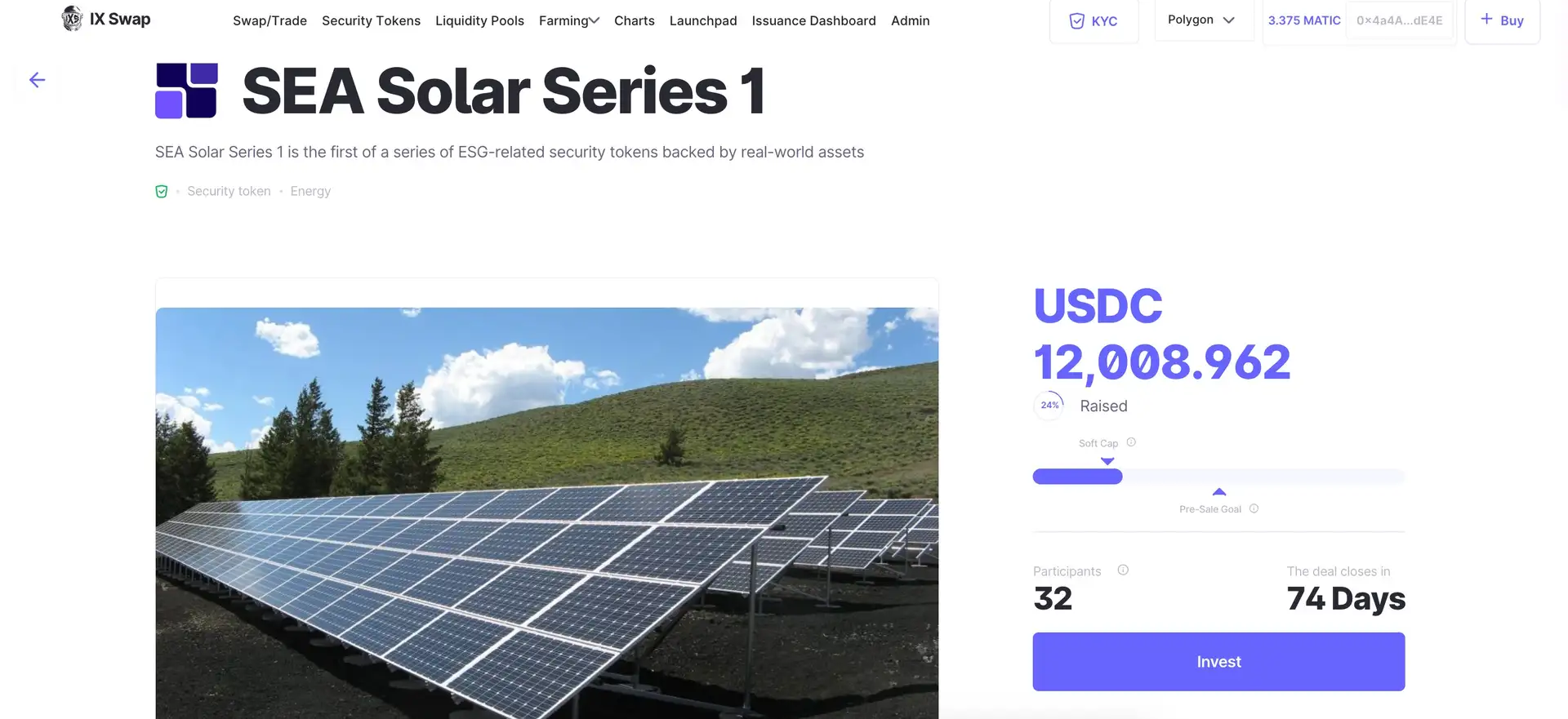

- Product Expansion: The platform has continually expanded its product offerings, including the launchpad for security token offerings and fractionalized NFTs. This diversification aims to provide a comprehensive suite of investment opportunities.

Competitors and Market Position

IX Swap operates in a competitive landscape with several notable platforms such as Securitize, Polymath, and Tokeny. These competitors also focus on security token offerings and the tokenization of assets. However, IX Swap differentiates itself through its unique AMM and liquidity pool solutions, regulatory compliance, and a strong focus on real-world asset tokenization.

- Security Token Exchange: IX Swap provides a regulated environment for the trading of security tokens and cryptocurrencies, ensuring compliance and security for users.

- DeFi Liquidity Solutions: The platform’s AMM and liquidity pools are designed specifically for tokenized assets, enhancing liquidity and market efficiency.

- IXS Launchpad: Supports the issuance and crowdfunding of security tokens and fractionalized NFTs, opening new avenues for investment.

- Regulatory Compliance: IX Swap partners with licensed intermediaries and adheres to regulatory standards, ensuring a secure and compliant trading environment.

- Cross-Chain Trading: Utilizes wrapper token technology to facilitate seamless asset trading across different blockchain networks.

- Income Opportunities: Users can earn rewards through liquidity mining and staking programs, contributing to the platform’s liquidity and stability.

- Transparent and Secure: The platform employs robust security measures and transparent processes to protect user assets and data.

- Create an Account: Visit the IX Swap website and sign up for an account. Ensure you provide accurate information for verification purposes.

- KYC Verification: Complete the Know Your Customer (KYC) process to comply with regulatory requirements. This step is crucial for accessing all features of the platform.

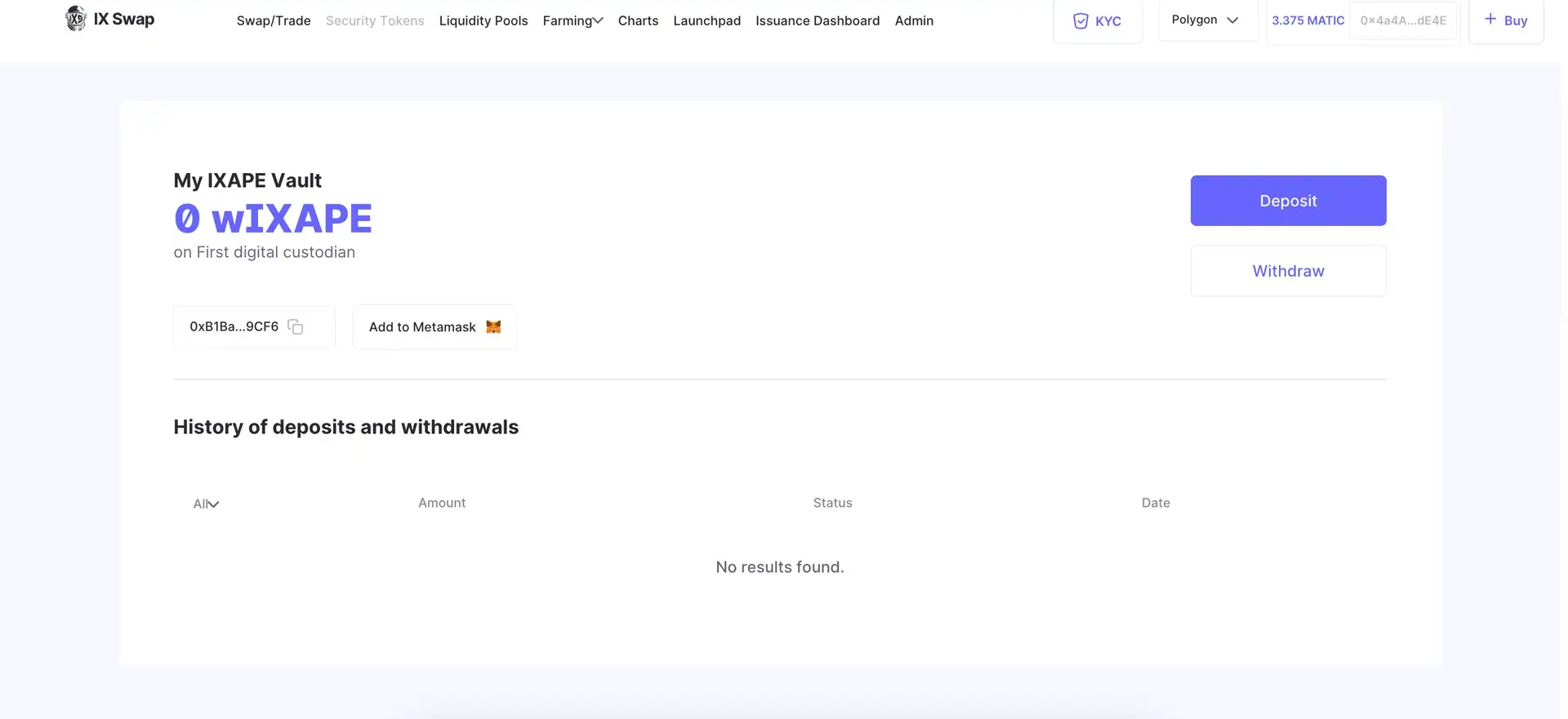

- Deposit Funds: Add funds to your account using supported cryptocurrencies or fiat options. Ensure you have sufficient funds to participate in trading and other activities.

- Explore Investment Opportunities: Navigate to the dashboard to explore a variety of tokenized assets available for investment. The platform offers detailed information on each asset to help you make informed decisions.

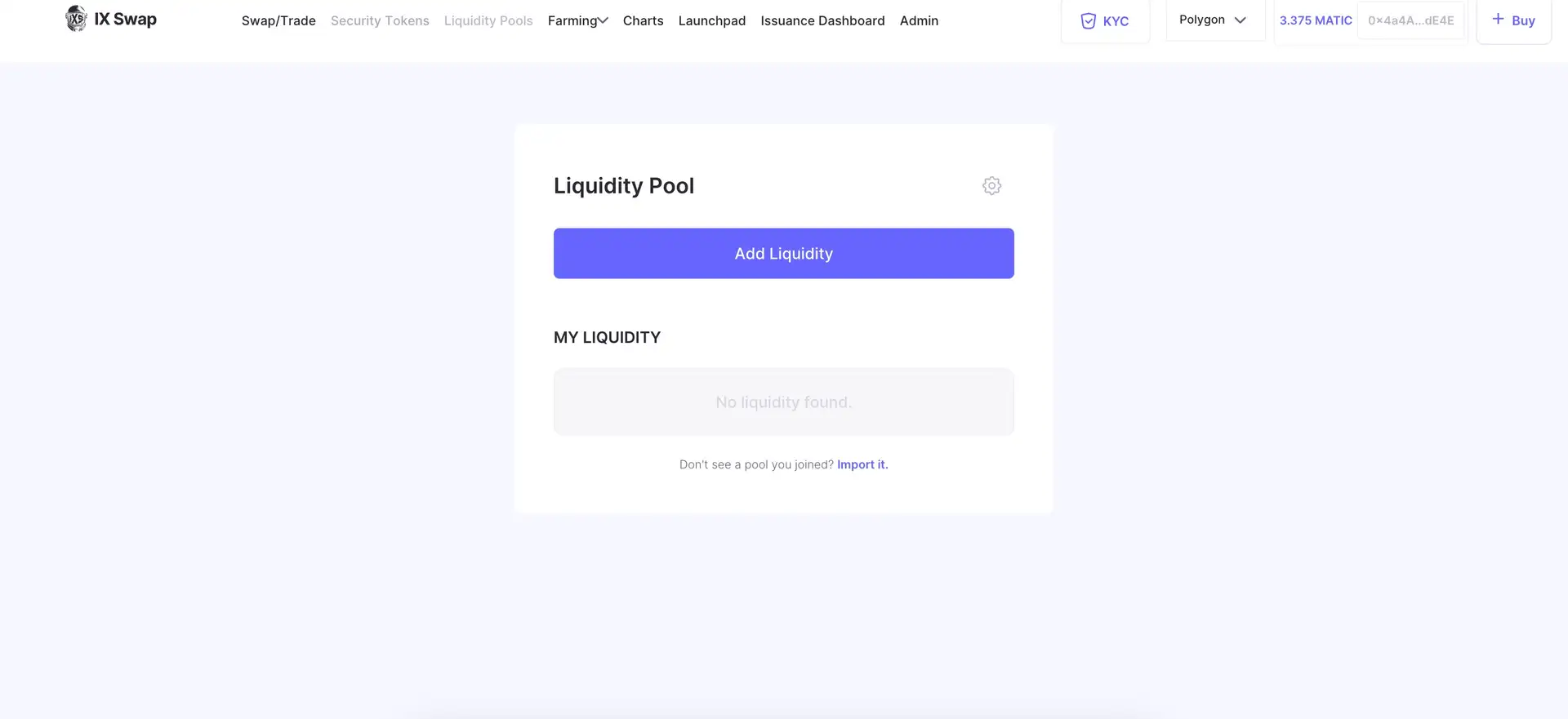

- Participate in Liquidity Pools: Provide liquidity to the AMM pools to earn rewards. You can choose from different pools based on your risk appetite and investment goals.

- Stake IXS Tokens: Stake your IXS tokens to earn additional rewards. Staking helps support the platform’s operations and stability.

- Access Educational Resources: Utilize the learning hub and tutorials available on the platform to enhance your understanding of tokenized asset trading and DeFi concepts.

- Engage with the Community: Join the IX Swap community on social media platforms and forums to stay updated on the latest developments and participate in discussions.

For more detailed guides and tutorials, visit the IX Swap Gitbook.

IX Swap Activities

IX Swap Reviews by Real Users

IX Swap FAQ

IX Swap partners with licensed intermediaries and adheres to international regulatory standards. This ensures a secure and compliant environment for trading security tokens, providing peace of mind for investors.

To participate in the IX Swap Launchpad, you need to hold IXS tokens and pass the KYC verification. The launchpad supports the issuance and crowdfunding of security tokens and fractionalized NFTs.

On IX Swap, you can tokenize a variety of real-world assets, including private equity, real estate, infrastructure projects, and natural resources, democratizing access to high-value investments.

Liquidity pools on IX Swap allow users to provide liquidity by depositing assets into the pool, earning rewards in the form of IXS tokens and transaction fees.

On IX Swap, you can earn rewards through liquidity mining, staking IXS tokens, and participating in various platform activities that contribute to its growth and stability.

You Might Also Like