About LaraProtocol

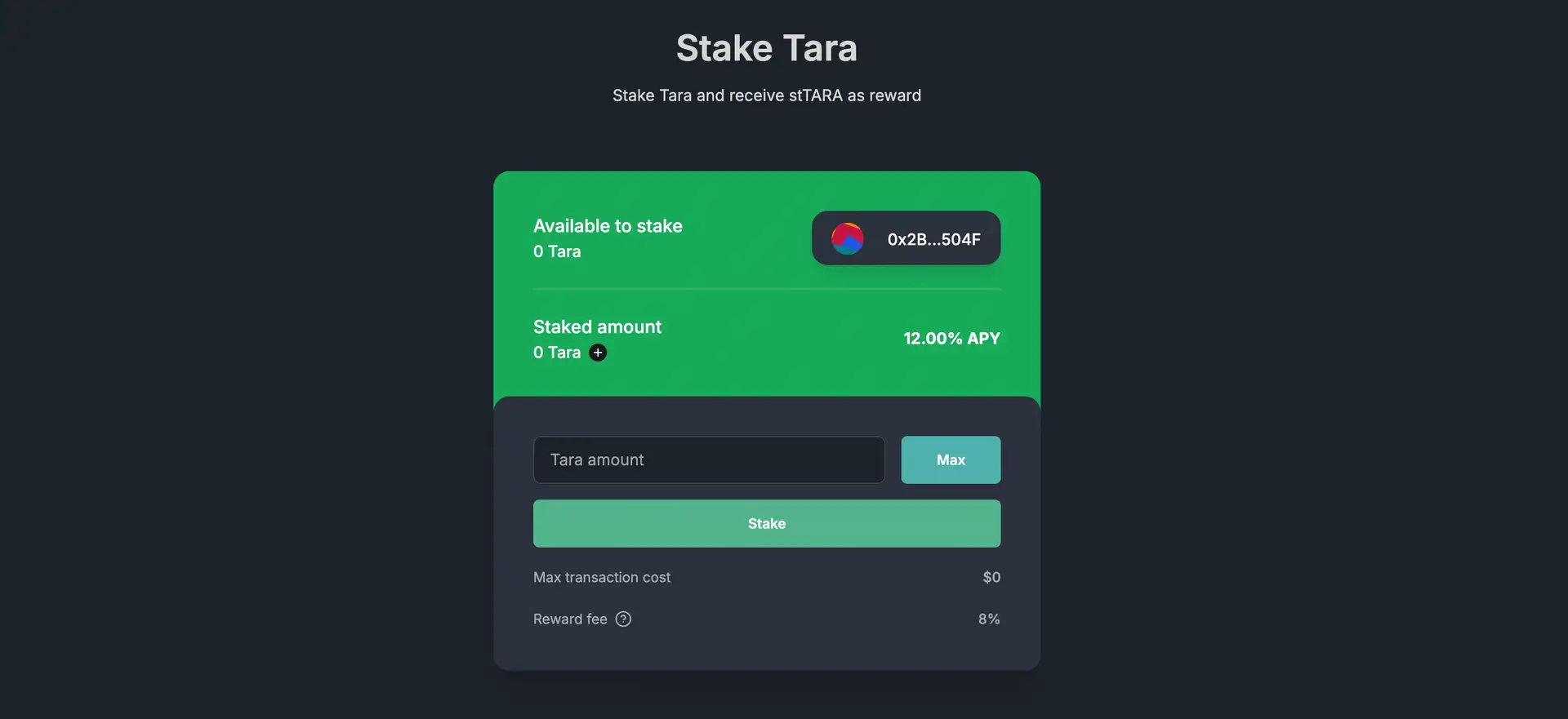

Lara Protocol is the first liquid staking solution on the Taraxa blockchain, offering users the ability to stake TARA tokens and receive stTARA in return—liquid assets that continue to accrue staking rewards in real-time. With a mission to make staking accessible, transparent, and DeFi-compatible, Lara Protocol opens up yield opportunities to all Taraxa users, regardless of their technical knowledge or validator status.

Through its unique mechanisms—including smart delegation, real-time APY tracking, and DAO-based governance—Lara challenges the conventional staking model. Instead of favoring select validators or custodial node sets, the protocol dynamically reassigns stake based on performance metrics to ensure fairness, decentralization, and optimal returns.

Lara Protocol introduces a new paradigm in liquid staking by solving the centralization and inefficiency issues that plague existing systems. On Ethereum, platforms like Lido have been criticized for consolidating validator power and lacking transparent mechanisms for node selection. Lara avoids this by using a validator-agnostic approach: it delegates to any validator meeting basic participation criteria and regularly rotates based on APY, commission volatility, and uptime.

The protocol is built entirely for Taraxa, a blockchain focused on real-world data auditability. Lara helps secure the Taraxa network while empowering users through liquid staking tokens (stTARA) and wstTARA. stTARA offers real-time yield, while wstTARA (ERC-4626) enables deeper DeFi integration by maintaining non-rebasing balances. Both are designed to work seamlessly within emerging Taraxa-native DeFi protocols.

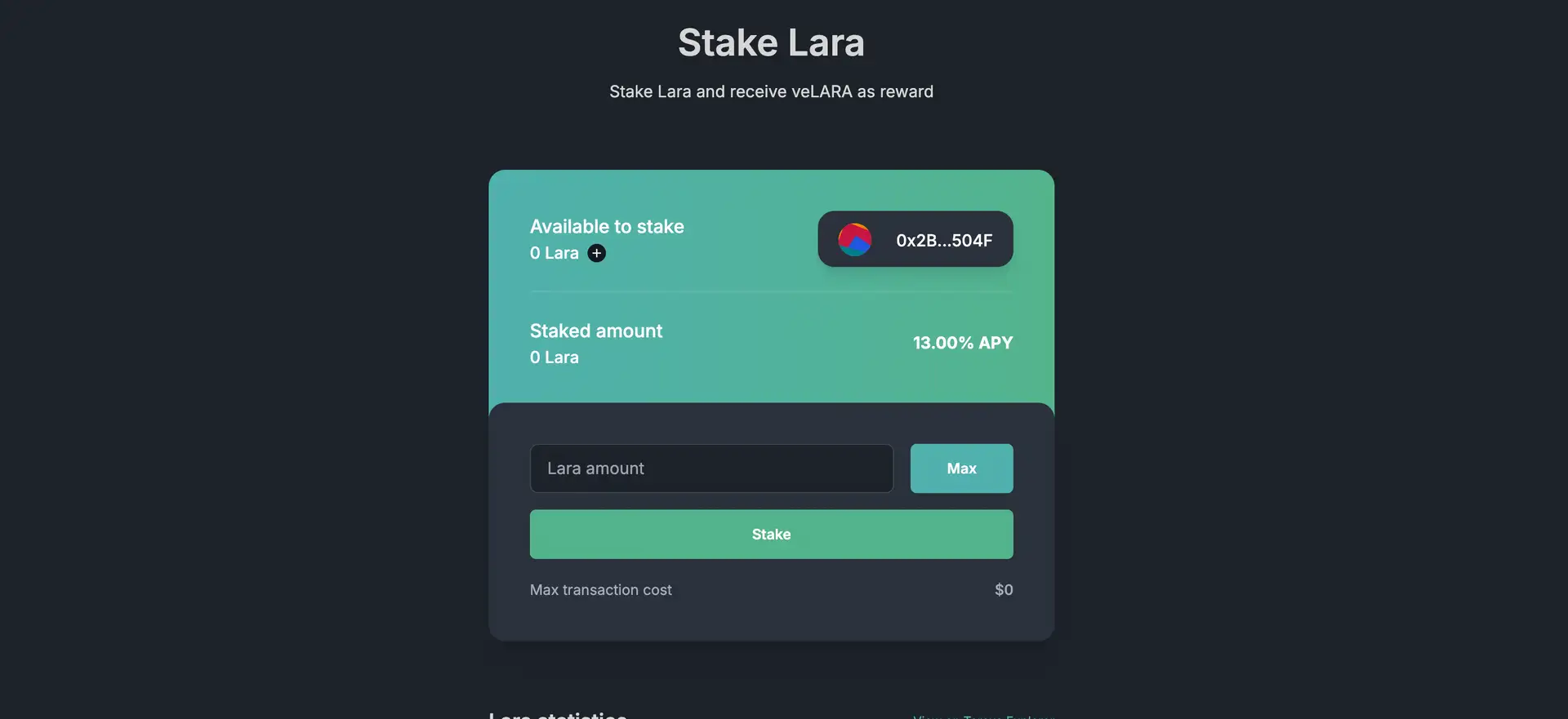

Lara’s governance is driven by the LARA token and the veLARA vesting system. Voting on DAO decisions, validator oracle registration, protocol upgrades, and treasury use all require staking LARA. Additionally, users hitting staking milestones unlock discounts on fees, early access to new features, and the ability to propose alternative validator rankings—essentially becoming contributors to the network’s consensus health.

Competitors like Rocket Pool, Stader, and Puffer on Ethereum offer liquid staking, but none focus exclusively on decentralized validator inclusion or dynamic delegation based on on-chain metrics. Lara fills this gap for the Taraxa ecosystem while setting standards for fairness and automation in DPOS networks.

With its roadmap aiming toward restaking, lending, and a fully automated validator oracle registry, Lara Protocol plans to become not just a staking solution—but the backbone of decentralized finance on Taraxa.

Lara Protocol provides numerous benefits and features that make it a cornerstone of the Taraxa DeFi ecosystem:

- Real-Time Rewards: stTARA tokens receive rewards instantly through snapshot-based distribution—no need to claim manually.

- Validator-Agnostic Delegation: Stake is assigned to any validator meeting consensus criteria and offering competitive APY.

- wstTARA Integration: DeFi-compatible wrapped token solves rebasing challenges for DEXs, lending platforms, and aggregators.

- DAO Governance: Vote on fees, treasury allocations, and upgrades using staked or vested $LARA.

- Staking Milestones: Unlock commission discounts and future oracle registration rights by staking more LARA over time.

- Unbiased Validator Landscape: No preferred validators; Lara ensures merit-based delegation to improve decentralization.

- Cross-Protocol Potential: Roadmap includes restaking services and lending protocol using stTARA as collateral.

Getting started with Lara Protocol is easy and designed for every Taraxa user, no matter their experience level:

- Visit the Website: Head to laraprotocol.com.

- Connect Your Wallet: Use a Web3 wallet connected to the Taraxa Mainnet. Ensure your TARA tokens are available.

- Stake TARA: Choose your amount, approve the contract, and stake your tokens. You will immediately receive stTARA.

- Track Your Rewards: Rewards are distributed frequently and automatically to stTARA holders through snapshots.

- Use stTARA or wstTARA in DeFi: Stake further, provide liquidity, or participate in lending protocols using your derivative tokens.

- Join the DAO: Stake LARA tokens to participate in governance, propose improvements, or register validator oracles.

- Read the Docs: For technical details and smart contract flows, refer to the official Lara Protocol Documentation.

LaraProtocol Token

LaraProtocol Reviews by Real Users

LaraProtocol FAQ

Lara Protocol introduces a validator-agnostic delegation strategy to promote fairness and decentralization. Rather than selecting a fixed group of preferred validators like many staking protocols, Lara continuously monitors validator metrics such as APY, uptime, and commission. Delegation is automatically rotated to high-performing, consensus-participating nodes—ensuring no centralization around any validator group and offering everyone a fair opportunity to earn delegation.

stTARA is the liquid staking token you receive after staking your TARA via Lara Protocol. It represents your staked TARA and continues to earn rewards in real-time. Rewards are distributed through frequent snapshots; if you hold stTARA at the moment of a snapshot, your wallet automatically receives a proportional share of staking rewards—no manual claiming required.

wstTARA is the wrapped version of stTARA designed for use in DeFi. It complies with the ERC-4626 vault standard, converting stTARA’s rebasing model into a non-rebasing, value-accruing token. This makes it easier to integrate into DEXs, lending markets, and aggregators. While stTARA rewards are visible as token balance increases, wstTARA keeps the balance stable while its redeemable value grows—offering seamless DeFi compatibility with full staking rewards exposure.

$LARA is the governance and utility token of Lara Protocol. Holding it grants you voting rights in the Lara DAO via Snapshot, allowing you to influence decisions like fee changes, validator oracle rules, or treasury usage. When staked, LARA also earns yield (~13% APY) and unlocks benefits like reduced commission fees and eligibility to register validator oracles. veLARA, the vested version, adds time-based voting power to align long-term protocol incentives.

Yes, if you transfer stTARA right before a snapshot, the recipient wallet—not yours—will receive the staking rewards. Lara Protocol uses snapshot-based distribution, so it's important that your wallet holds stTARA at the moment of the snapshot. If you're using DeFi protocols, ensure they support stTARA mechanics properly. Read their documentation and smart contract code to confirm that staking rewards will be correctly attributed to your address.

You Might Also Like