About Laso Finance

Laso Finance is a cutting-edge crypto payment solution that bridges the gap between digital assets and everyday spending. With its instantly issued crypto prepaid cards, users can convert cryptocurrency into USD in real time and use it anywhere prepaid cards are accepted worldwide. The platform is designed for privacy-conscious users, requiring no personal information for issuance, making it an accessible and secure choice for global crypto holders.

By eliminating the friction of traditional banking, Laso Finance empowers individuals to spend crypto seamlessly in retail, online, and international transactions. Whether using reloadable cards available in multiple countries or non-reloadable options for the U.S. and Canada, the service offers instant issuance, global acceptance, and zero Laso transaction fees (deposit and FX fees may apply). As part of its commitment to compliance and transparency, Laso Finance operates as a registered Money Services Business (MSB) with FinCEN in the United States, ensuring operations meet regulatory standards while maintaining user privacy.

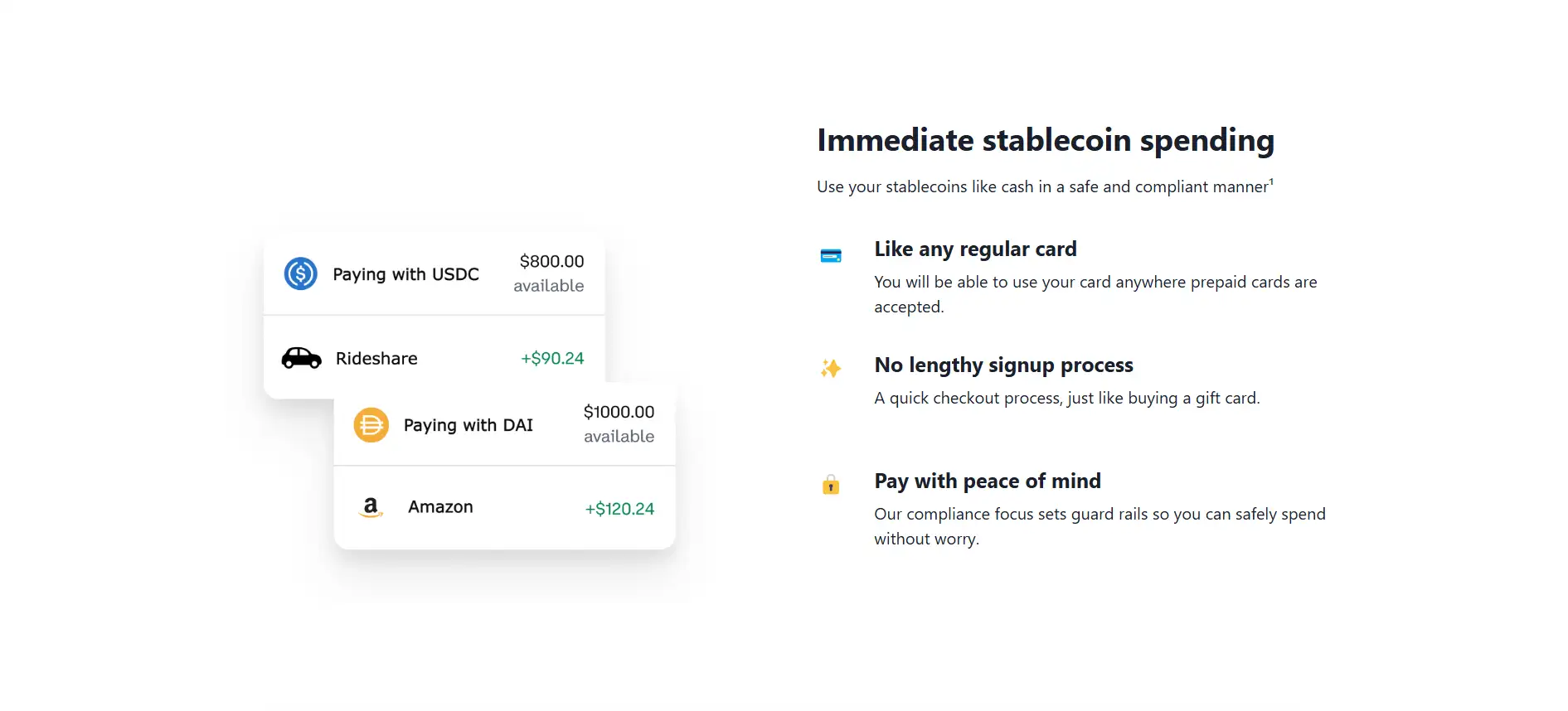

Laso Finance was created to solve one of cryptocurrency’s biggest limitations — the inability to easily use digital assets for day-to-day purchases. By offering virtual prepaid cards that instantly convert crypto to fiat at the point of sale, Laso Finance removes barriers between blockchain wealth and the traditional payment ecosystem. The cards are accepted anywhere prepaid cards work, from major online retailers to physical stores worldwide, making them highly versatile for global users.

The platform currently offers two types of cards: reloadable cards (available internationally, excluding the U.S.) and non-reloadable cards (available in the U.S., Canada, and internationally). Reloadable cards are ideal for frequent use, enabling top-ups directly from supported cryptocurrencies, while non-reloadable cards provide a fixed balance perfect for one-time purchases or gifting. All cards are issued instantly, with no credit checks or invasive KYC for many jurisdictions, enhancing accessibility for underbanked or privacy-focused customers.

While Laso Finance does not charge transaction fees on spending, a deposit fee applies when loading funds, and some issuers may apply foreign exchange fees for non-USD transactions. To maintain compliance with global financial regulations, Laso Finance is registered as an MSB with the U.S. Department of the Treasury’s FinCEN and operates under stringent security and anti-fraud measures.

In the growing crypto payments industry, Laso Finance competes with other live projects such as Crypto.com Visa Card, Wirex, and Plutus. However, it differentiates itself through its instant card issuance, global availability, and minimal information requirements, appealing to a wide range of crypto users who value both convenience and privacy.

With its combination of regulatory compliance, rapid issuance, and worldwide acceptance, Laso Finance is positioning itself as a major player in the crypto-to-fiat bridge market, enabling everyday adoption of cryptocurrency for millions of users.

Laso Finance offers a wide range of benefits and features for crypto users:

- Instant Virtual Card Issuance: Get a crypto prepaid card in seconds without lengthy approval processes.

- No Personal Information Required: Issue cards without sharing sensitive personal data in supported regions.

- Global Acceptance: Use your card anywhere prepaid cards are accepted, both online and offline.

- Crypto-to-Fiat Conversion: Automatic conversion of supported cryptocurrencies into USD at the point of purchase.

- Low Fees: No Laso transaction fees, with only deposit and applicable FX fees.

- Reloadable and Non-Reloadable Options: Choose between reloadable cards for regular spending or non-reloadable cards for one-time purchases and gifting.

- Privacy-Focused: Enjoy enhanced financial privacy with minimal personal information required for issuance in many regions.

- International Availability: Accessible to users in multiple countries, with card types tailored to different regions.

- Regulatory Compliance: Operates as a registered Money Services Business (MSB) with FinCEN, ensuring secure and lawful operations.

Getting started with Laso Finance is simple and quick, thanks to its instant issuance process:

- Visit the Website: Go to Laso Finance and select the type of crypto prepaid card you want (reloadable or non-reloadable).

- Create Your Account: Depending on your region, you may not need to provide personal information. Follow the on-screen instructions to register.

- Deposit Cryptocurrency: Choose a supported cryptocurrency and deposit it to your Laso Finance account. A small deposit fee applies.

- Instant Card Issuance: Your virtual prepaid card will be generated instantly and displayed in your dashboard.

- Start Spending: Use your card anywhere prepaid cards are accepted, with crypto-to-USD conversion handled automatically at the time of purchase.

- Reload or Replace: For reloadable cards, top up anytime with supported cryptocurrencies. For non-reloadable cards, simply order a new one when the balance is used.

Laso Finance FAQ

Laso Finance offers global acceptance for its crypto prepaid cards wherever prepaid cards are supported. Reloadable cards are available internationally (excluding the United States), while non-reloadable cards are offered in the U.S., Canada, and internationally. For the latest regional availability, visit Laso Finance.

With Laso Finance, virtual card issuance is instant. Once your crypto deposit is confirmed, your card details will be displayed in your dashboard within seconds, allowing you to start spending right away.

In many jurisdictions, Laso Finance does not require traditional KYC verification to issue a card, making it a privacy-friendly option for crypto users. Requirements may vary depending on local regulations.

All cryptocurrency loaded onto your Laso Finance card is automatically converted into USD at the point of purchase. This ensures you can spend anywhere prepaid cards are accepted without worrying about price volatility or manual conversions.

Laso Finance charges no transaction fees for spending. A deposit fee applies when loading funds, and certain issuers may charge a currency exchange fee for non-USD purchases. Full fee details are available at Laso Finance.

You Might Also Like