About LeechProtocol

Leech Protocol is a cutting-edge DeFi 2.0 cross-chain yield aggregator designed to automate and optimize the yield farming process across multiple blockchains. Founded in 2021, it enables users to deposit their liquidity into a single platform that then automatically distributes these assets across several blockchains to achieve the best returns. With built-in risk management strategies, it protects users from potential losses, offering a convenient solution for yield farming without the need for constant manual interventions.

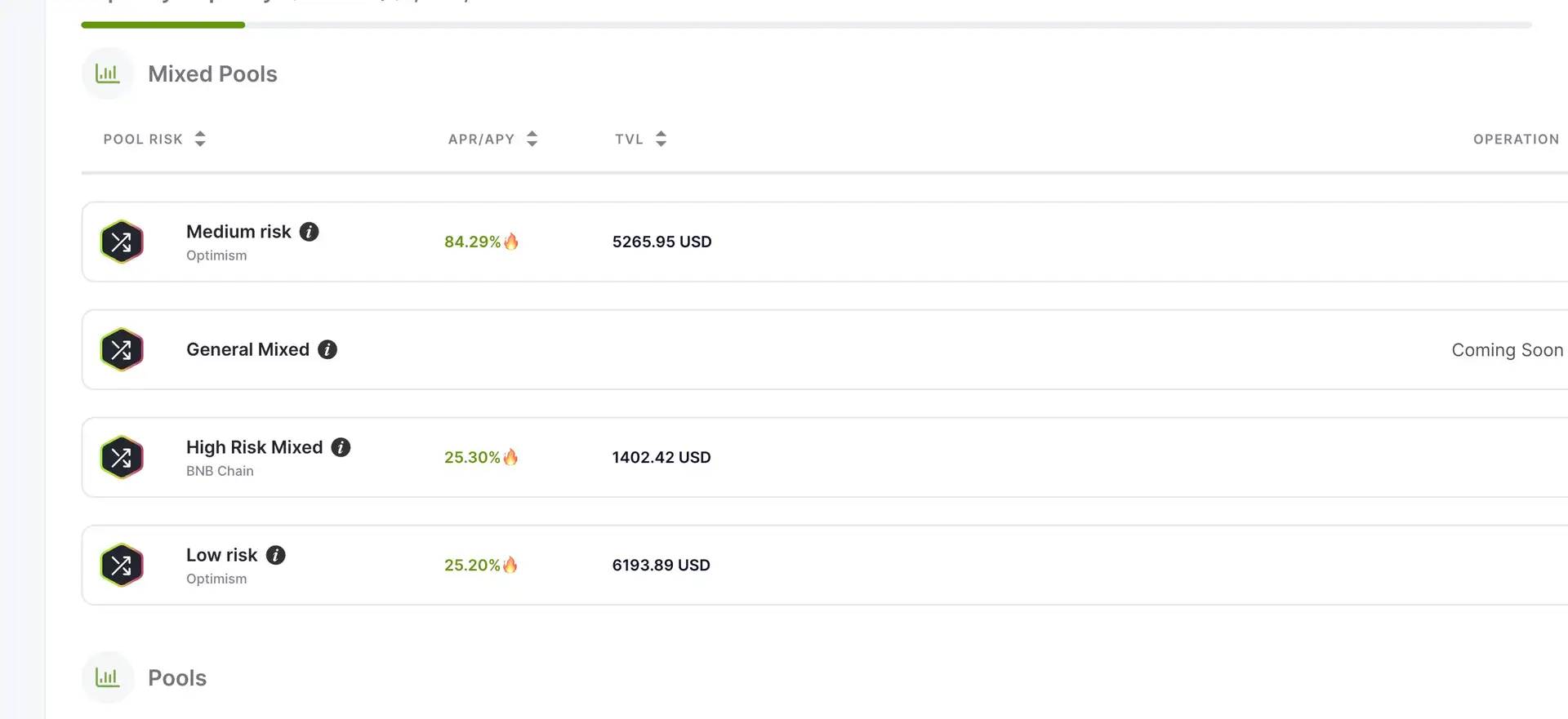

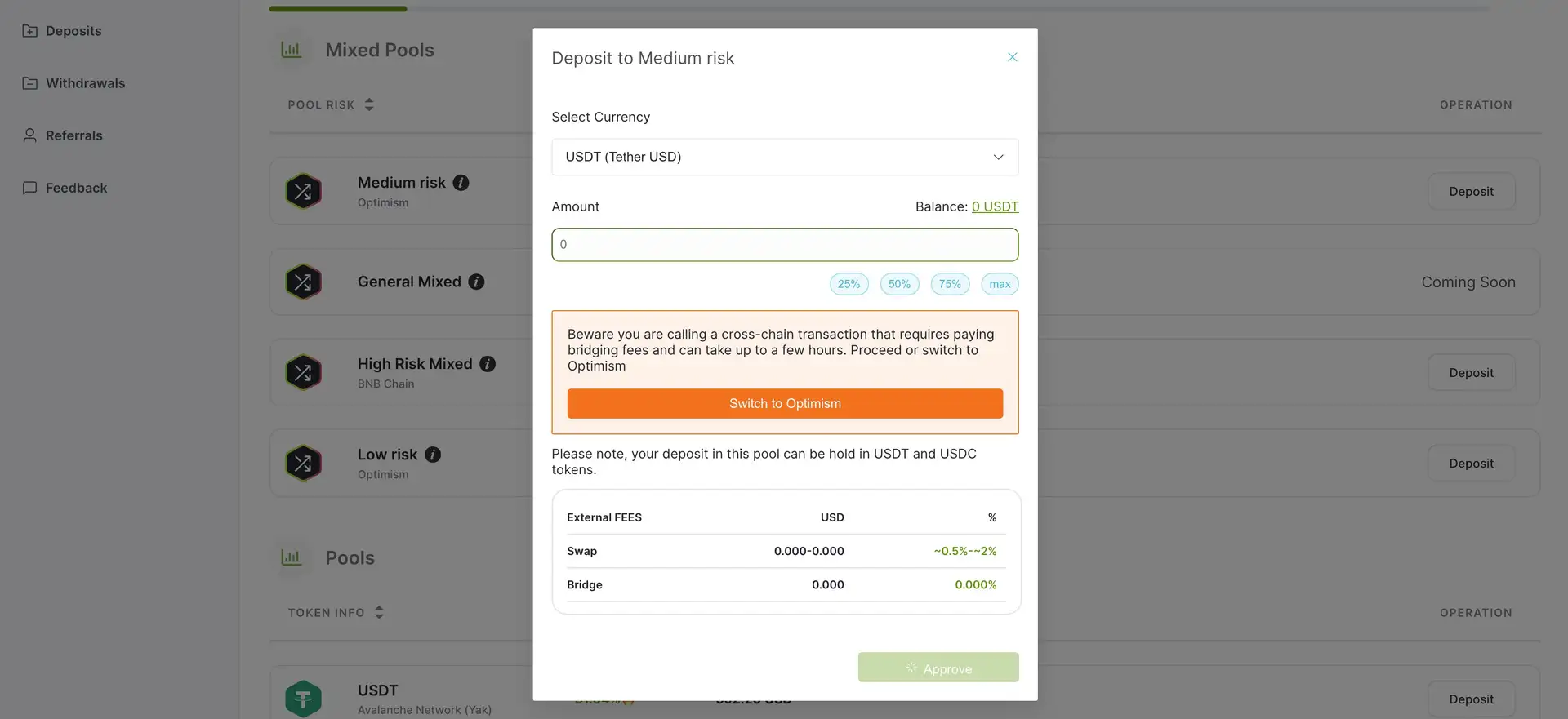

The platform integrates popular decentralized finance protocols such as Curve, PancakeSwap, and Uniswap to maximize yield generation. By continuously monitoring liquidity pools and rebalancing investments based on profitability, Leech Protocol ensures users earn the highest possible yields across multiple chains. Leech operates on more than 12 blockchains, including BNB Chain, Avalanche, and Optimism, providing seamless cross-chain liquidity transfers to optimize profits.

For more details, visit the official website Leech Protocol.

The core vision of Leech Protocol is to simplify the complexity of yield farming while maximizing returns for its users through automation and innovation. As the landscape of decentralized finance (DeFi) continues to grow, so does the complexity of managing liquidity across various blockchains. Leech Protocol aims to address this challenge by providing a solution that automates liquidity movements, reducing the time and effort required from users.

At its heart, the platform introduces an automatic strategy that evaluates the profitability of different blockchains and liquidity pools. If the yield on one chain decreases, Leech Protocol shifts the user's funds to a more profitable one. This dynamic strategy is key to its value proposition, ensuring that even in volatile markets, users can maintain stable returns. By incorporating partial liquidation options and other risk management techniques, the protocol further safeguards user assets.

Leech Protocol's mission is not only about profitability but also about offering a user-friendly solution that makes DeFi yield farming accessible to a broader audience. By combining advanced technology with intuitive interfaces, the platform caters to both crypto enthusiasts and newcomers who want to benefit from the opportunities in DeFi without needing extensive technical knowledge.

Leech Protocol has outlined a comprehensive development roadmap focused on expanding its yield farming capabilities and integrating with new blockchain ecosystems. Some key milestones include:

- Cross-chain farming MVP (5 Blockchains) - Q2 2023

- Security audits - Q2 2023

- CEX integration - Q4 2023

- New farming pools and hedging strategy testing - Ongoing through 2024

- Uni v3 strategy testing and CLMM stable pools integration - Q3 2024

- Development of a non-custodial app - Q1 2025

- Onboarding financial institutions to the protocol - Q2 2025

These milestones reflect the protocol’s commitment to improving security, expanding cross-chain functionality, and offering new yield strategies for users. Learn more about the project’s roadmap here.

Leech Protocol is led by a team of experienced professionals in the blockchain and DeFi space. The project was co-founded by Oleksandr Bondar (CEO), who brings years of experience in crypto investment and blockchain development. The leadership team also includes Artem Ramazanov (COO) and Slava Filonenko (CTO), each with deep expertise in blockchain technology and software development.

Other key members include Danil Sizov (Product Lead) and Yuri Cooliq (Lead Blockchain Engineer), both of whom have extensive experience in managing and developing blockchain products. The team is supported by a talented group of engineers, marketers, and advisors who are committed to pushing the boundaries of yield farming in DeFi.

Leech Protocol has not raised any formal funding rounds yet, and currently operates independently. For more insights about the team, visit Leech Protocol.

Leech Protocol is currently in the process of developing and testing several new strategies, including a Uni v3 safe rebalancing strategy and a Lido leverage yield farming strategy. The tests for these strategies are planned to continue through Q3 and Q4 2024, offering the community a chance to participate in early access and beta programs. By engaging with these beta programs, users can test new features and provide feedback before the official release.

To stay updated on these programs, users can join the official community channels, including Telegram and Discord.

LeechProtocol Suggestions by Real Users

LeechProtocol FAQ

Leech Protocol automatically evaluates various yield farming strategies across multiple blockchains. By monitoring liquidity pools on platforms like Curve and Uniswap, it selects the most profitable option for your assets. Once the yield on one chain decreases, Leech Protocol shifts your liquidity to a more profitable one, optimizing returns while minimizing risks.

In traditional lending, liquidation involves selling off all collateral. Leech Protocol offers a partial liquidation feature, which allows only a portion of your assets to be sold to cover a drawdown. This helps users avoid total liquidation and maintain a part of their assets while stabilizing their position, a feature designed to minimize losses in volatile markets.

Yes! Leech Protocol is continuously testing new strategies like Uni v3 safe rebalancing and Lido leverage yield farming. To join the beta program, users can participate in early access tests to explore new features and provide feedback on upcoming functionalities.

Leech Protocol employs sophisticated risk management techniques, such as automatic liquidity transfers and partial liquidations, to safeguard user assets. By allowing users to select their preferred risk levels, the protocol balances yield generation with risk mitigation, ensuring optimal profitability across a variety of blockchains.

Yes, Leech Protocol plans to integrate with centralized exchanges (CEX) as part of its Q4 2023 roadmap. This will allow users to access liquidity from both decentralized and centralized sources, increasing flexibility and maximizing yield opportunities across the platform.

You Might Also Like