About Lifinity

Lifinity is a revolutionary proactive market maker and decentralized exchange (DEX) built on the Solana blockchain, designed to maximize capital efficiency and reduce impermanent loss. Unlike traditional AMMs, Lifinity uses a unique mechanism powered by oracle-based pricing, allowing trades to occur only when real-time price data is updated, resulting in front-running resistance and minimal slippage. Through a blend of oracle pricing, delayed rebalancing, and protocol-owned liquidity, Lifinity redefines how liquidity is deployed and how profits are earned in DeFi.

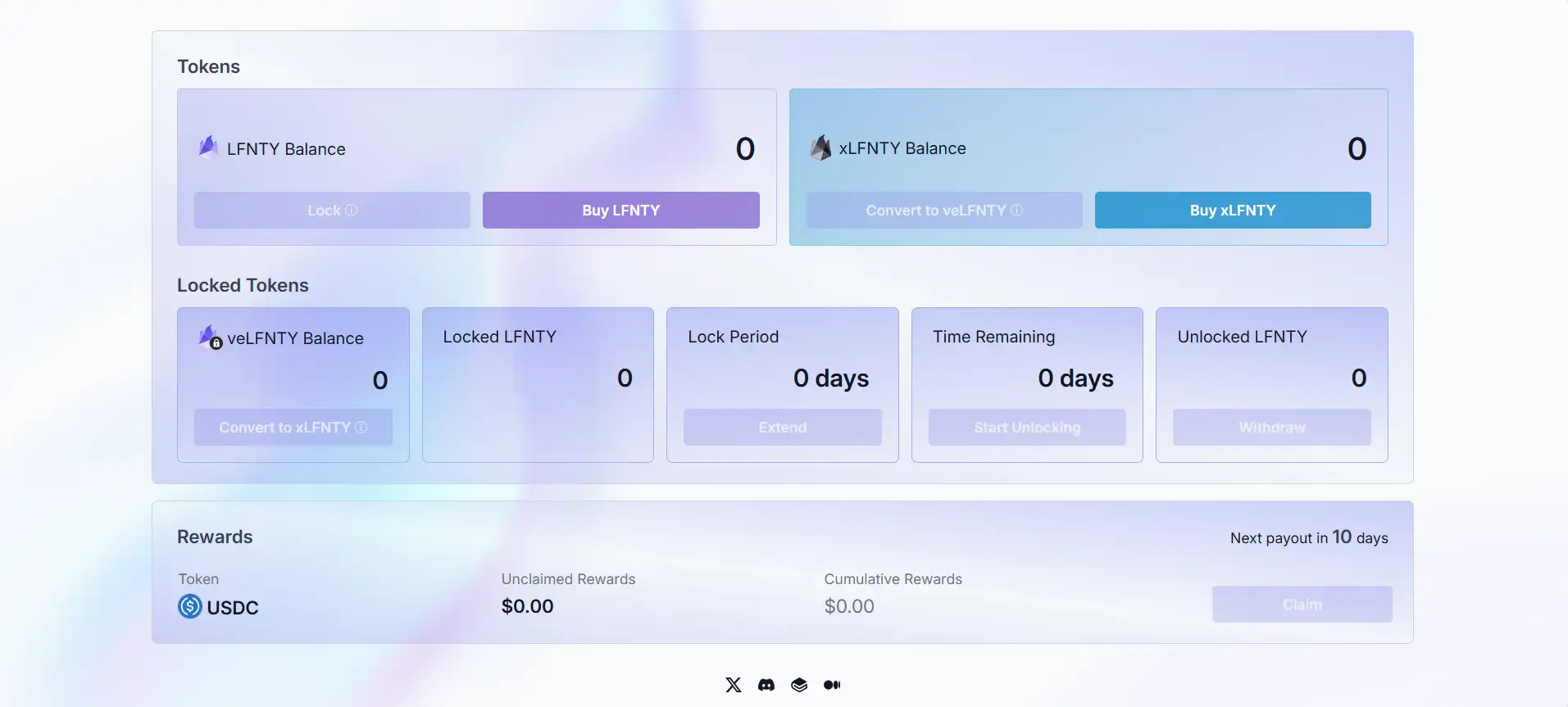

The protocol integrates a native governance token, LFNTY, alongside innovative tools like veLFNTY and xLFNTY. These token models support long-term alignment through vote-escrowed governance, revenue sharing, and a liquid form of locked participation. Lifinity also offers MMaaS (Market Making as a Service) and LaaS (Liquidity as a Service), enabling other protocols to benefit from its advanced infrastructure while outsourcing their liquidity strategies.

Lifinity introduces a set of powerful innovations to the DEX space. Its most defining feature is the use of a custom oracle for pricing assets, eliminating reliance on arbitrage traders and mitigating impermanent loss—traditionally a major drawback in automated market makers. Unlike constant product models (x*y=k), Lifinity concentrates liquidity within tighter price bands by applying leverage to the value of k, thereby improving capital efficiency significantly.

Each pool on Lifinity rebalances liquidity on every trade or oracle price change using a formula that incentivizes price correction through strategic liquidity redistribution. This automated rebalancing drives profitability from market making, turning impermanent loss into potential gain. Fees are set manually to maximize profitability based on external factors like competing DEX liquidity and market volatility.

All liquidity on Lifinity is protocol-owned (POL), removing the need for user-deposited liquidity and strengthening the long-term sustainability of the system. This liquidity underpins both the DEX and the LFNTY token, ensuring full alignment between the protocol's incentives and tokenholders’ interests. Additionally, Lifinity’s upcoming v2 upgrade allows pools to target base asset allocations with delayed 50/50 rebalancing, offering new avenues to hedge price risk and improve capital deployment.

Key competitors in the Solana and wider DeFi space include Raydium, Orca, and Uniswap, but Lifinity stands out with its oracle-driven pricing, fully owned liquidity pools, and innovative staking models that directly benefit long-term holders.

Lifinity offers a rich suite of features that provide superior efficiency, security, and yield opportunities:

- Oracle-Based Market Making: Uses a proprietary oracle to determine pricing, eliminating front-running and arbitrage inefficiencies.

- Concentrated & Lazy Liquidity: Maximizes capital efficiency with no need for manual adjustments.

- Protocol-Owned Liquidity: All DEX liquidity is owned by Lifinity, removing reliance on external LPs and strengthening the LFNTY token.

- veLFNTY Governance: Lock LFNTY to receive veLFNTY, granting voting rights and access to 70% of protocol revenue.

- xLFNTY Token: Liquid, tradable representation of 4-year locked veLFNTY, allowing flexible access and DeFi integrations.

- Flare NFTs: 10,000 animated NFTs that seed liquidity pools and share in protocol revenue via buybacks and royalties.

- MMaaS & LaaS: Offers market-making and liquidity services to other projects using Lifinity’s infrastructure and custom oracles.

Getting started with Lifinity is easy whether you're a trader, tokenholder, or NFT enthusiast:

- Visit the App: Head to lifinity.io and connect your Solana wallet to access the dashboard.

- Trade on Lifinity DEX: Use the swap interface powered by Lifinity’s oracle and automated rebalancing.

- Stake LFNTY: Lock your LFNTY to receive veLFNTY and begin earning protocol revenue. Choose lock periods from 7 days to 4 years.

- Convert to xLFNTY: If you prefer liquidity, convert 4-year locked veLFNTY to xLFNTY and use it in DeFi applications.

- Track Your Rewards: Check your veLFNTY and protocol earnings directly in the Lifinity dashboard.

- Explore Flare NFTs: Discover the Flare collection that powers protocol liquidity and earns rewards through trading and royalties.

- Participate in Governance: Use veLFNTY to vote on treasury usage, development updates, and more.

Lifinity FAQ

Lifinity minimizes or even reverses impermanent loss by using an oracle-based pricing model instead of relying on traditional pool balances. Trades only execute when the oracle updates with a narrow confidence interval, removing the need for arbitrageurs to correct prices. Combined with concentrated liquidity and delayed rebalancing, this system turns potential loss into market-making profit. Learn more on lifinity.io.

veLFNTY is a non-transferable vote-escrowed token that gives users access to governance rights and protocol revenue. You receive veLFNTY by locking LFNTY tokens for a period between 7 days to 4 years. In return, you earn 70% of Lifinity’s collected revenue (trading + market-making profits) and can participate in protocol decisions. The longer you lock, the more veLFNTY you receive.

xLFNTY is a tokenized version of 4-year locked veLFNTY and is freely tradable on Solana as a standard SPL token. veLFNTY, by contrast, is non-transferable and tied to your governance power and revenue share. You can convert between the two 1:1. To earn protocol rewards or vote, you must hold veLFNTY—not xLFNTY. This design allows users to choose between liquidity or utility.

Flare NFTs are a collection of 10,000 animated NFTs that helped seed Lifinity’s liquidity pools. All proceeds from the mint were deposited into the DEX, and all trading fees and royalty revenue are used for LFNTY buybacks and reinvestment. If Flare prices fall below 50% of mint, Lifinity buys them back using pooled funds. Holding a Flare also made users eligible for an LFNTY token airdrop and other future perks.

Lifinity uses a custom-built price oracle to determine trading conditions. Unlike traditional AMMs, trades are only executed when the oracle has updated within the current Solana slot and meets a predefined confidence level. This prevents front-running, improves execution accuracy, and enables profit-generating rebalancing without relying on arbitrageurs, setting it apart from constant-product pools.

You Might Also Like