About Liquity

Liquity is a decentralized borrowing protocol designed to let users unlock liquidity using their ETH and Liquid Staking Tokens (LSTs) as collateral. At its core, Liquity empowers borrowers to mint BOLD, a resilient, fully decentralized USD-pegged stablecoin, at interest rates they set themselves. By offering user-controlled interest rates and over-collateralized loans, Liquity V2 gives users a high level of autonomy and capital efficiency in an immutable and governance-minimized ecosystem.

Unlike many DeFi protocols, Liquity V2 enhances decentralization by not operating a centralized frontend—users instead access the protocol via multiple third-party integrations. With a focus on transparency and user empowerment, the protocol introduces advanced features such as one-click ETH multiplication, custom interest rates, and dedicated Stability Pools for each collateral asset. Liquity has emerged as a vital protocol for users seeking predictable borrowing, sustainable yield, and full control over their financial strategies.

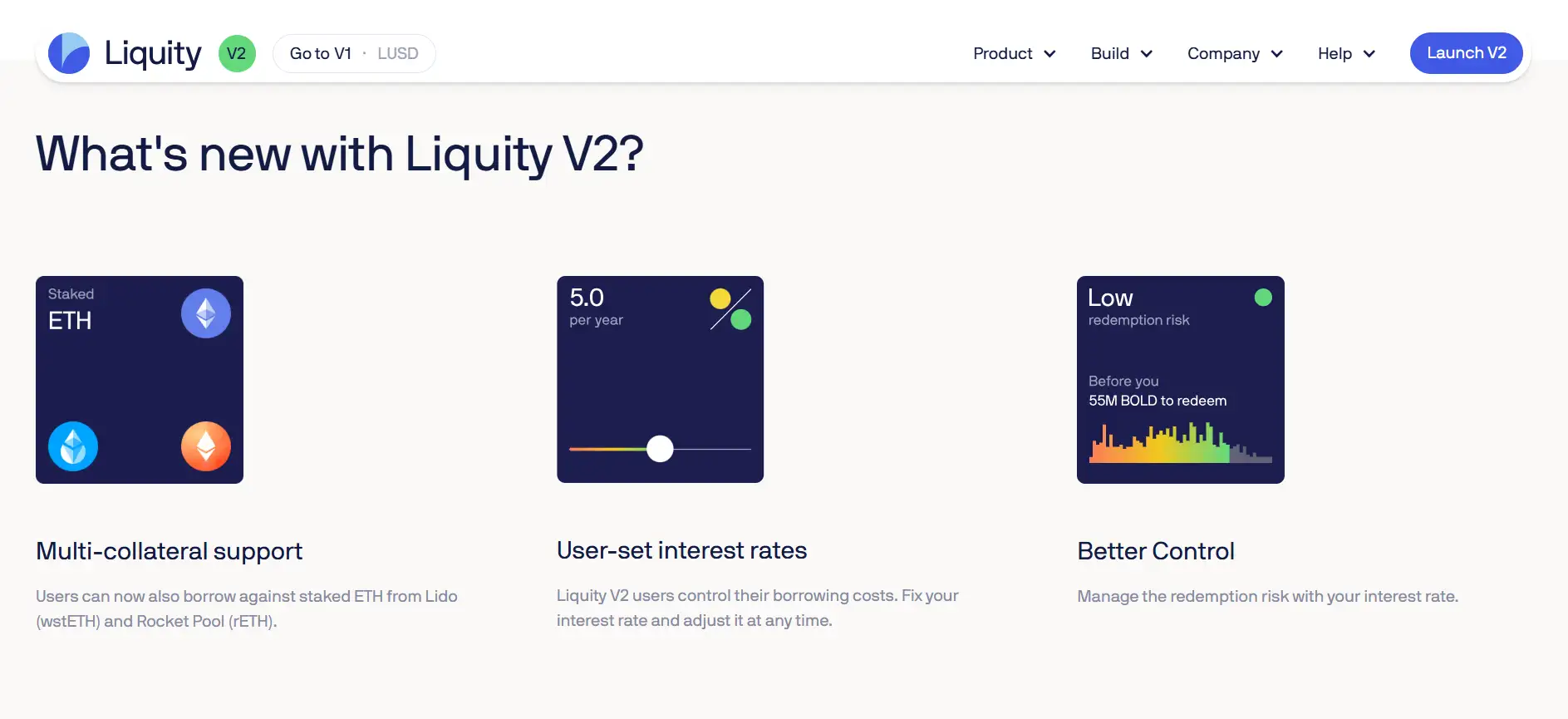

Liquity is a next-generation decentralized borrowing protocol that builds upon the foundation laid by its original version (V1), which pioneered a governance-free, immutable architecture in the DeFi landscape. With the release of Liquity V2, the protocol evolves even further, introducing innovations such as user-defined interest rates, multi-collateral borrowing, and sustainable on-chain yield. The protocol’s stablecoin, BOLD, offers a crypto-native alternative to traditional USD-backed stablecoins by being fully overcollateralized with decentralized assets—ETH, wstETH from Lido, and rETH from Rocket Pool.

At the heart of Liquity’s design is its commitment to immutability and minimal governance. The smart contracts powering Liquity V2 are not upgradeable, which guarantees predictability and minimizes external dependencies. Liquity's core borrowing mechanism is built around the concept of "Troves"—self-managed, transferable vaults that give users complete control over their collateral, debt, and interest rate exposure. With a maximum Loan-To-Value (LTV) ratio of 91% on ETH and 83.33% on LSTs, the platform allows highly capital-efficient strategies. Additionally, the integration of one-click looping (multiplying) features lets users easily increase exposure to ETH in a seamless and secure manner.

Another major pillar of Liquity V2 is the introduction of Stability Pools, one for each collateral type. These pools are used to manage liquidations, redistribute collateral, and deliver real yield to users through a dual stream: protocol revenues and liquidation proceeds. 75% of all protocol revenues go to Stability Pool depositors, while the remaining 25% is directed to incentivize liquidity for BOLD on external platforms through a mechanism known as Protocol Incentivized Liquidity (PIL). This ensures ongoing liquidity for the stablecoin and supports its peg without relying on traditional incentives or inflationary token emissions.

Liquity operates in a competitive landscape with several other DeFi borrowing protocols. Its primary competitors include MakerDAO, which offers DAI loans through overcollateralized vaults, and Abracadabra, which provides similar looping functionality using MIM. Another key player is Spark Protocol, Maker’s lending arm. However, Liquity differentiates itself through its uncompromising decentralization, absence of governance over critical protocol parameters, and native yield generation that doesn’t rely on token emissions. These features make Liquity one of the most resilient and user-centric protocols in DeFi, catering especially to users who value full control and transparency.

Liquity provides numerous benefits and features that make it a standout project in the decentralized finance (DeFi) space:

- User-Defined Interest Rates: Borrowers on Liquity V2 can set and adjust their own borrowing interest rates, giving them complete control over loan costs and redemption risks.

- Multi-Collateral Borrowing: Supports not only ETH but also major Liquid Staking Tokens (LSTs) like wstETH (Lido) and rETH (Rocket Pool), allowing greater flexibility and capital efficiency.

- High Capital Efficiency: Offers up to 91% Loan-to-Value (LTV) on ETH and 83.33% on LSTs, allowing users to access significant liquidity without over-leveraging.

- Immutable Protocol: The Liquity V2 smart contracts are fully immutable and not upgradable, ensuring high predictability and trustlessness.

- No Centralized Frontend: To promote decentralization, Liquity AG does not operate a frontend. Users can access the protocol via multiple independent community-hosted interfaces.

- Real Yield from Protocol Revenue: 75% of all protocol revenue is distributed to Stability Pool depositors, while 25% supports external liquidity incentives, all without inflationary token emissions.

- One-Click Looping: Liquity offers seamless looping (multiply) functionality that lets users easily increase exposure to ETH or LSTs with a single transaction.

- Fully On-Chain Operations: Liquity V2 relies solely on price oracles as external dependencies, with all other operations executed fully on-chain.

- Staking for Dual Rewards: Users staking LQTY receive protocol revenue from V1 and gain governance rights over Liquity V2’s liquidity incentive direction.

Liquity offers a powerful and intuitive way for users to borrow, multiply, earn, and stake using ETH and Liquid Staking Tokens (LSTs). Here’s how to get started with Liquity V2:

- Step 1 – Choose a Frontend: Since Liquity AG does not host a frontend, users must access the protocol through a verified third-party interface. You can find a list of available frontends at Liquity.org/frontend-v2.

- Step 2 – Connect Your Wallet: Use a Web3-compatible wallet such as MetaMask, Rabby, or WalletConnect to interact with your chosen frontend.

- Step 3 – Open a Trove: A Trove is your personal borrowing vault. Deposit ETH, wstETH, or rETH as collateral and set your own interest rate. You’ll be able to mint BOLD immediately.

- Step 4 – Earn Yield (Optional): Deposit your BOLD into one of the protocol’s Stability Pools to earn real yield from protocol revenues and liquidation proceeds. No lockups required.

- Step 5 – Multiply Exposure (Optional): Use the built-in one-click looping tool to increase your exposure to ETH or LSTs. Liquity automatically uses your BOLD to buy more collateral in one transaction.

- Step 6 – Stake LQTY (Optional): For users holding LQTY tokens, staking allows you to earn protocol revenue from Liquity V1 and vote on revenue distribution initiatives in V2.

- Step 7 – Monitor and Adjust: Trove management is completely self-custodial. You can adjust your LTV, interest rate, or collateral amount at any time. Just be sure to monitor the health of your position to avoid liquidations.

Liquity FAQ

Yes, you can use Liquity V2 entirely without relying on a single centralized frontend. The protocol was designed with maximum decentralization in mind—Liquity AG itself does not operate a frontend. Instead, users are encouraged to interact with the protocol through multiple community-hosted frontends, giving you complete control over which interface you trust. This structure improves censorship resistance, reduces single points of failure, and offers more flexibility in terms of UI/UX and risk management strategies.

In Liquity V2, your interest rate determines your place in the redemption queue. Redemptions target Troves with the lowest interest rates first. So, if your interest rate is among the lowest in the system, you're more likely to be redeemed if BOLD drops below $1. Setting a higher interest rate reduces your redemption risk but increases your borrowing cost. This market-driven mechanism gives users full control over the balance between cost and risk, a concept that is rare in DeFi lending protocols.

If a Stability Pool in Liquity V2 is emptied during a liquidation, the system has built-in fallback mechanisms. These include Just-In-Time (JIT) liquidations and Redistribution. In JIT mode, liquidators send BOLD to buy collateral at a discount. If that fails, debt and collateral are redistributed proportionally among borrowers within the same collateral market. These mechanisms ensure the protocol stays solvent and functional—even in extreme market conditions—without relying on centralized intervention or emergency governance.

Each Trove in Liquity V2 is a fully transferable ERC-721 NFT. This means your loan—along with its associated collateral and debt—can be moved or sold across wallets and even on secondary markets. It unlocks advanced financial use-cases like collateralized NFT trading, liquidity pooling of debt positions, or even permissionless portfolio transfers. This feature enhances capital mobility and is a powerful tool for DeFi power users looking to manage positions flexibly.

Liquity V2 doesn’t rely on inflationary rewards or emissions to incentivize users. Instead, it generates real, sustainable yield from two sources: borrower interest payments and liquidation profits. 75% of protocol revenue is automatically distributed to Stability Pool depositors, while the other 25% is used for incentivizing external BOLD liquidity through Protocol Incentivized Liquidity (PIL). This approach aligns rewards with actual usage and system health, avoiding the unsustainable token printing seen in many other DeFi protocols.

You Might Also Like