About ListaDAO

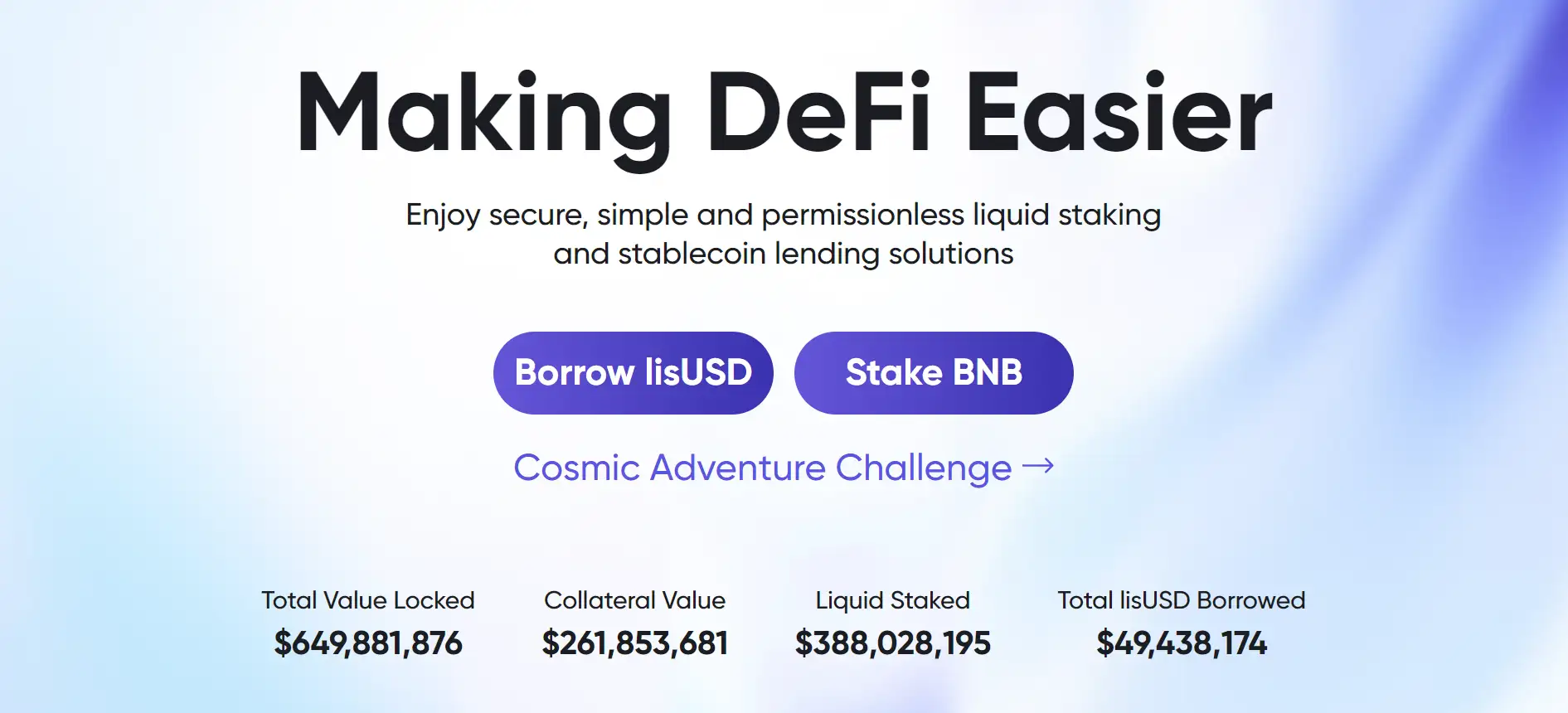

Lista is a powerful Web3 platform designed to enhance how users interact with decentralized finance (DeFi) and digital assets. By leveraging blockchain technology, Lista provides users with secure and transparent financial solutions, including liquid staking and decentralized stablecoins. These features allow users to maximize their crypto holdings while maintaining full liquidity and control over their assets.

With its focus on decentralization and efficiency, Lista bridges the gap between traditional finance and DeFi, ensuring accessibility for both beginners and experienced users. The platform enables users to stake assets, earn passive income, and participate in various blockchain-based financial activities. Through an interconnected ecosystem, Lista is set to redefine how digital assets are managed in the evolving Web3 landscape.

Lista is an advanced DeFi platform offering an ecosystem where users can stake assets, earn rewards, and access decentralized financial services without sacrificing liquidity. Unlike traditional staking, which requires assets to be locked up, Lista introduces a liquid staking mechanism that allows users to stake tokens while continuing to use them in other DeFi applications.

One of the core components of Lista is its integration with decentralized stablecoins. These stablecoins are backed by a diversified set of assets, ensuring price stability and usability across various Web3 financial services. The combination of liquid staking and decentralized stablecoins creates a comprehensive ecosystem where users can seamlessly manage their digital assets.

Security and transparency are at the heart of Lista. The platform ensures protection through audited smart contracts and decentralized governance mechanisms, allowing users to participate in decision-making. By maintaining a community-driven approach, Lista enhances trust and reliability within its ecosystem.

In the competitive DeFi space, Lista positions itself among leading platforms such as Lido, Aave, and MakerDAO. However, Lista differentiates itself by offering a unique combination of liquid staking and stablecoin solutions within a single ecosystem, making it an attractive choice for users looking to optimize their digital assets.

Lista provides a range of innovative features that enhance DeFi accessibility and efficiency. Some of the platform's key benefits include:

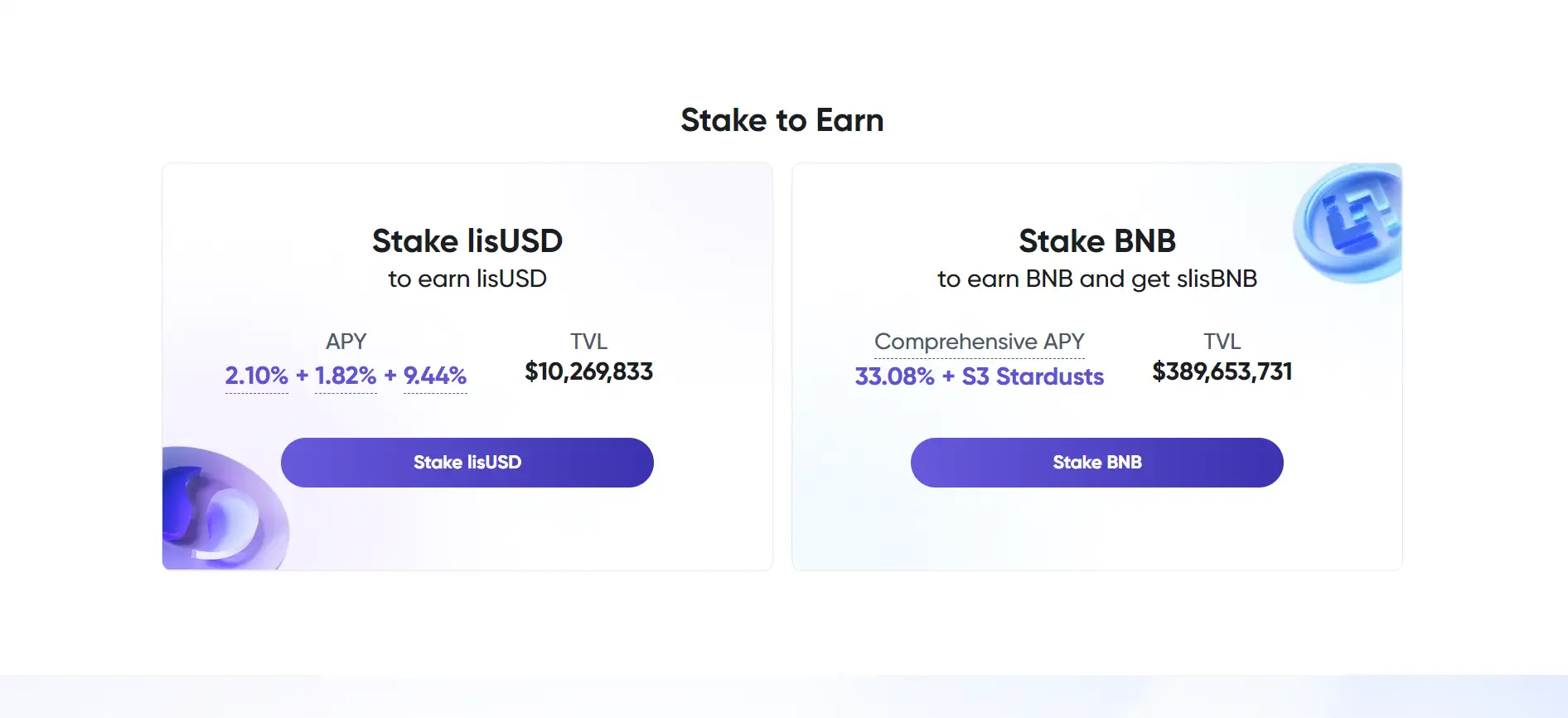

- Liquid Staking: Users can stake assets while maintaining liquidity, allowing them to earn rewards without locking up their holdings.

- Decentralized Stablecoins: Stable digital assets backed by various cryptocurrencies, ensuring price stability and usability.

- Smart Contract Security: All transactions and processes are secured through audited smart contracts, enhancing trust and reliability.

- Community Governance: Users have voting rights and can participate in governance decisions, ensuring decentralization.

- Integration with DeFi Protocols: Lista connects with multiple Web3 applications, enabling users to maximize asset utilization.

- Passive Income Opportunities: Users can generate consistent rewards through staking and liquidity provision.

Getting started with Lista is simple and accessible for both beginners and experienced users. Follow these steps to begin using the platform:

- Visit the Official Website: Go to Lista’s official website to explore the platform and its features.

- Create an Account: Sign up using a Web3 wallet such as MetaMask or Coinbase Wallet.

- Deposit Assets: Transfer supported cryptocurrencies to your Lista account to begin staking and accessing DeFi services.

- Start Staking: Choose assets to stake and earn rewards while maintaining liquidity.

- Use Stablecoins: Leverage Lista's decentralized stablecoins for transactions, lending, and other financial activities.

- Participate in Governance: Engage in decision-making by voting on proposals within the Lista ecosystem.

ListaDAO FAQ

Unlike traditional staking, which requires assets to be locked for a fixed period, Lista's liquid staking allows users to stake their assets while maintaining liquidity. When you stake tokens on Lista, you receive a tokenized version of your staked assets, which can be used across other DeFi applications. This means you can continue to trade, lend, or yield farm while still earning staking rewards.

Yes, Lista's decentralized stablecoins are designed to be interoperable with multiple Web3 applications and DeFi platforms. You can use them for lending, payments, liquidity provision, and even in other blockchain-based ecosystems that support stablecoins. Additionally, Lista ensures that these stablecoins are backed by a diversified asset pool, maintaining their stability across different use cases.

Even if the market value of your staked assets decreases, you will continue to earn staking rewards based on the staking rate set by Lista. However, the overall value of your holdings may fluctuate depending on market conditions. Because of Lista's liquid staking, you still have the flexibility to use your staked assets in DeFi protocols, allowing you to mitigate losses by participating in other yield-generating opportunities.

Lista prioritizes security by implementing multiple layers of protection, including smart contract audits, multi-signature authentication, and decentralized governance. The platform works with leading blockchain security firms to conduct regular security assessments, ensuring that vulnerabilities are identified and addressed before they can be exploited. Additionally, funds in Lista's staking and stablecoin systems are secured using decentralized mechanisms to reduce single points of failure.

Lista follows a decentralized governance model where users who hold governance tokens can participate in decision-making. By staking governance tokens, users gain voting rights and can propose or vote on key changes to the platform. This ensures that the future of Lista is shaped by its community rather than a centralized entity.

You Might Also Like