About Loopscale

Loopscale is a groundbreaking modular lending protocol built on the Solana blockchain, offering a new model for decentralized credit markets. Unlike traditional DeFi platforms, Loopscale removes the limitations of pooled liquidity and utilization-based interest rates by introducing a credit order book model. This architecture allows for fixed-rate, fixed-duration loans, empowering users to borrow and lend with greater precision, flexibility, and efficiency.

Designed for the evolving landscape of onchain assets, Loopscale supports a wide range of collateral types including LP tokens, liquid-staked assets, and even real-world asset primitives. The protocol provides both passive earning opportunities through curated Vaults and advanced tools for experienced lenders to tailor risk and return preferences. With a focus on capital efficiency, risk isolation, and composable infrastructure, Loopscale is redefining what’s possible in decentralized lending.

Loopscale is a powerful, modular onchain lending protocol built on the Solana blockchain, offering a radically improved framework for decentralized credit markets. Unlike traditional DeFi lending platforms such as Aave or Compound, Loopscale replaces liquidity pools with a Credit Order Book architecture. This design enables fixed-rate, fixed-term borrowing and lending across isolated markets, allowing participants to define their own risk parameters, loan durations, and collateral types.

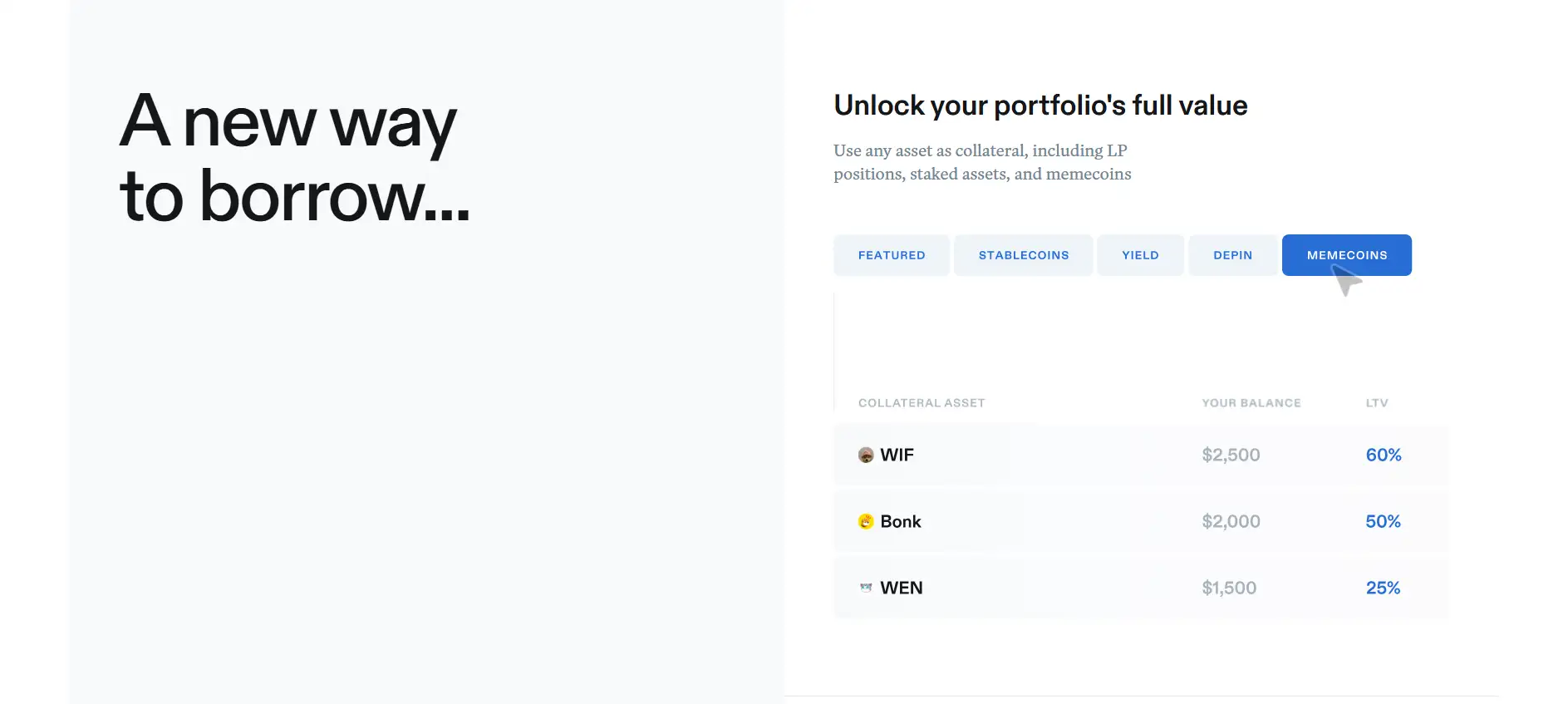

With Loopscale, borrowers can unlock capital using a broader spectrum of assets including LP positions, liquid-staked tokens, and even memecoins, while securing predictable costs through fixed interest rates. Meanwhile, lenders can achieve superior capital efficiency with direct matches to borrowers—eliminating idle liquidity and rate spreads common in pool-based protocols. Each market on Loopscale is independently priced, ensuring that collateral quality and volatility are factored directly into lending terms.

To simplify access, Loopscale Vaults offer passive earning strategies curated by trusted third-party experts. These Vaults automate market selection and risk management, making it easy for users to earn yield without micromanaging positions. For more advanced users, Advanced Lending unlocks full control over collateral preferences, interest rate targets, and loan terms. Through this dual-approach, Loopscale serves both institutional-grade lenders and casual DeFi participants.

In addition to superior lending functionality, Loopscale introduces Loops—structured products that allow users to amplify returns on staked assets through one-click leveraged positions. These loops use fixed-rate loans, helping users hedge against rate volatility and optimize for predictable returns. Popular strategies include market-neutral yield farming and directional leverage on high-performing tokens.

Compared to traditional protocols, Loopscale significantly reduces systemic risk by keeping collateral markets isolated. It eliminates the "one-size-fits-all" problem, where riskier assets degrade the lending experience for everyone. Furthermore, innovations like Virtual Markets and Optimized Liquidity tackle issues of fragmentation and usability that often plague order book lending models.

Loopscale not only improves capital efficiency and user control but also unlocks new asset classes, such as real-world assets (RWAs) and tokenized receivables, which were previously difficult to support in DeFi. Through this innovation-first approach, Loopscale is poised to become a critical infrastructure layer for next-generation credit markets on Solana.

Loopscale provides numerous benefits and features that make it a standout project in the DeFi lending landscape:

- Credit Order Book Architecture: Unlike pool-based models, Loopscale uses an order book system to match borrowers and lenders directly, ensuring fair pricing and capital efficiency.

- Fixed-Rate, Fixed-Term Loans: Borrowers can lock in rates for up to 3 months, enabling predictable borrowing costs and reduced exposure to interest rate volatility.

- Isolated Risk Markets: Each market on Loopscale operates independently, allowing users to avoid cross-asset contagion and customize risk profiles.

- Expanded Collateral Support: Accepts a broad spectrum of Solana-based assets, including LP tokens, liquid-staked tokens, and memecoins, unlocking greater capital utility.

- Loopscale Vaults: Passive earning strategies curated by expert managers let users lend with confidence—no active management required.

- Loops for Leveraged Yield: Structured leverage products offer one-click exposure to yield-bearing assets with fixed borrowing costs and minimal rate volatility.

- Virtual Markets: Aggregates lending liquidity across parameters defined by each user’s ruleset, solving the fragmentation problem common to other order book lending protocols.

- Composable Infrastructure: Loopscale integrates with external protocols and supports custom deployments via SDKs for advanced builders and developers.

Loopscale offers a streamlined onboarding experience for both new users and DeFi veterans looking to lend, borrow, or loop:

- Visit the official website: Go to loopscale.com and click on “Launch App” to access the protocol dashboard.

- Connect your wallet: Use a Solana-compatible wallet such as Phantom or Solflare to authenticate securely and begin interacting with the app.

- Choose your strategy: Decide whether you want to lend passively through curated Vaults or create custom lending positions via Advanced Lend.

- Borrow capital: Head to the Borrow page, choose your collateral asset, and select the most favorable loan offer based on duration and rate. Confirm your transaction to receive funds.

- Open a Loop: For yield optimization, go to the Loops page. Choose an asset (like mSOL or JLP), select your leverage, and create a leveraged yield position in one click.

- Track and manage: Monitor your loans, lending positions, or loops from the Portfolio tab. You can adjust, refinance, or close positions at any time.

- Earn Loopscale Points: Earn points for every lending, borrowing, or loop action—visible on the Points page. Invite others to earn referral bonuses and maximize your rewards.

- Stay engaged: For support and updates, join the community on Discord or follow Loopscale on Twitter.

Loopscale FAQ

Loopscale solves idle capital inefficiency by removing the concept of shared liquidity pools altogether. Instead of relying on a utilization-based model like Aave, it matches lenders and borrowers through a credit order book, ensuring that capital is only deployed when there's a direct match—maximizing active usage and minimizing unproductive deposits.

Curators on Loopscale can adjust terms like interest rates and loan durations at any time to optimize performance. However, all changes are time-locked and transparently visible in the vault’s activity log. Crucially, they cannot withdraw depositor funds or alter existing loan agreements, ensuring depositors remain in control with zero risk of rug pulls.

Yes. Loopscale allows lending markets to be created around non-traditional collateral, including LP tokens, liquid-staked tokens, and even memecoins. Through either Advanced Lending or curated Vaults, users can provide liquidity to highly specific markets, earning yield on assets that would typically be excluded from major lending platforms like Compound.

By replacing pool-driven interest models with market-defined fixed rates, Loopscale prevents manipulation by large depositors or traders. Users set their own terms in the order book, and loans execute only when there’s a matching offer. This structure ensures pricing transparency and removes reliance on utilization curves that can be gamed by whales or bots.

A Virtual Market on Loopscale is a custom ruleset defined by a lender to automatically participate in all compatible loan offers. Unlike a traditional lending pool where all funds share one risk profile, Virtual Markets allow users to segment risk and target specific loan terms—offering granular control without manual order placement.

You Might Also Like