About Mage DEX

Mage DEX is an advanced decentralized exchange (DEX) built on the Solana blockchain, designed to power a new generation of capital-efficient, community-driven trading. Focused on enabling sustainable wealth distribution and hyper-optimized trading mechanics, MageLabs aims to serve the underrepresented $5k transaction flow — a $1.8B/day opportunity — with a unique combination of ultra-low fees and layered rewards.

Through its optimized Lamport dynamics and commitment to rewarding long-term liquidity providers, Mage DEX introduces a more equitable DeFi model. From fee sharing and NFT-based staking to multi-tier execution paths and cross-chain integrations, MageLabs is positioning itself as a cornerstone protocol for the next era of community-first finance on Solana.

Mage DEX is a decentralized exchange purpose-built on the Solana blockchain, offering radically low fees, optimized liquidity provisioning, and a sustainable reward model for users and liquidity providers. Designed by MageLabs, the platform shifts the DeFi paradigm by focusing on underserved, smaller-value traders — the <$5k flow — representing over $1.8 billion in daily trading potential. Mage delivers an advanced infrastructure that empowers these users with ultra-low swap fees, passive liquidity opportunities, and equitable revenue distribution models. This makes Mage a compelling solution for traders and LPs who have historically been overlooked by mainstream DeFi platforms.

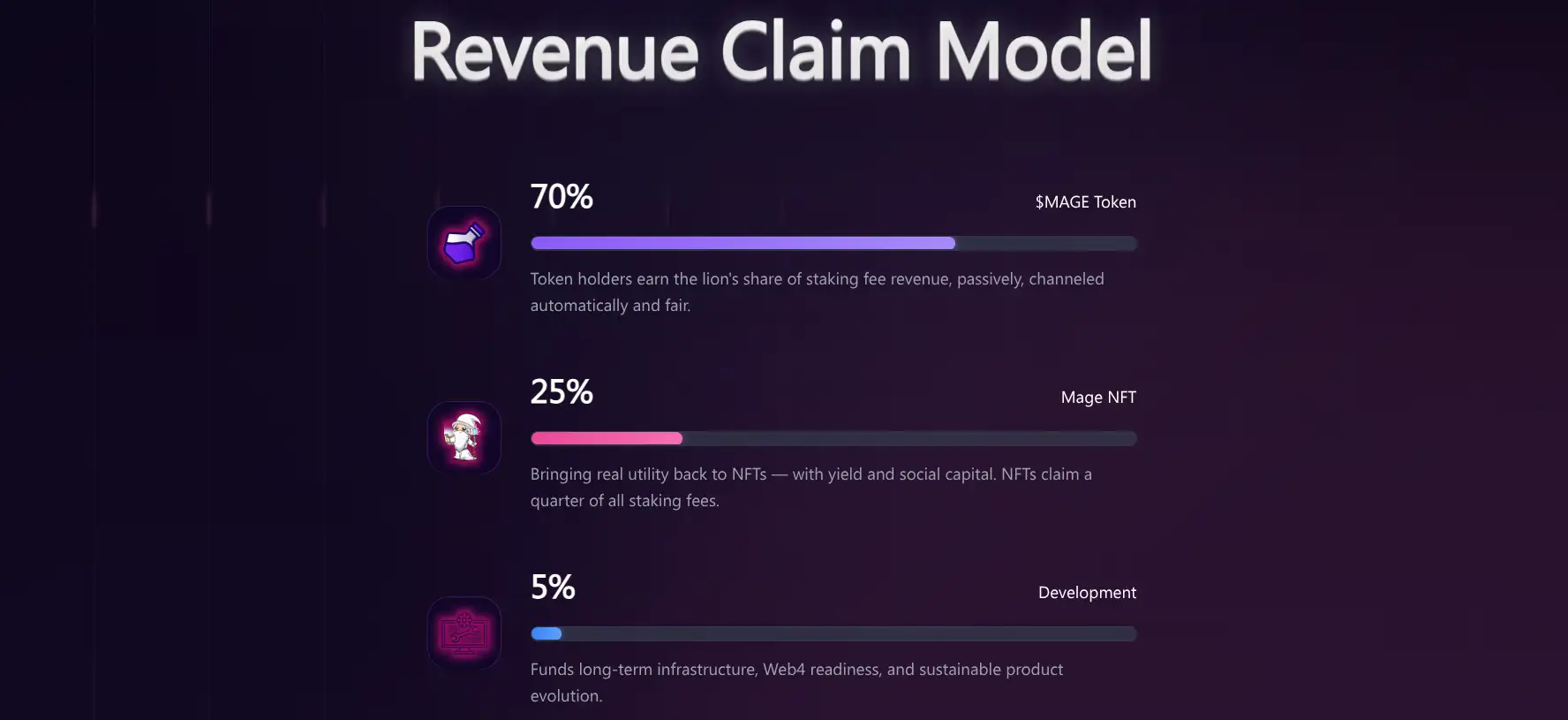

What makes Mage DEX unique is its long-term vision for community alignment and value sharing. Instead of incentivizing only high-volume activity, Mage rewards loyalty and early participation. After its ICO, the protocol is designed to redistribute up to 95% of all revenue back to users through staking mechanisms for both $MAGE tokens and Mage NFTs. This includes claimable revenue paid in SOL, giving stakers access to real, recurring yield. This structure is intentionally designed to support a decentralized, inclusive financial ecosystem where long-term participants receive the most benefit.

From a technical standpoint, Mage DEX introduces several innovations that support scalability and composability. The protocol is designed to integrate with leading Solana-based aggregators like Jupiter, and is fully compatible with automated trading bots and arbitrage strategies. The platform’s pool engine is optimized for both retail traders and programmatic execution, while its flat-fee system (under 0.001%) reduces the cost of large trades, attracting serious volume without penalizing smaller participants. By simplifying execution and maximizing efficiency, Mage significantly enhances the trading experience for all user types.

MageLabs positions Mage DEX as a long-term alternative to traditional Solana DEXs such as Raydium and Jupiter. While many competitors focus on incentivizing temporary liquidity spikes, Mage prioritizes horizontal wealth distribution and sustainable growth. Its reward structure benefits LPs and stakers over time, rather than encouraging extractive practices. With a focus on protocol revenue sharing, optimized fee structures, and strong aggregator integrations, Mage DEX is engineered to become a core infrastructure layer in Solana's decentralized financial future.

Mage DEX provides numerous benefits and features that make it a standout project in the Solana DeFi landscape:

- Loyalty-Based Rewards: LPs enjoy up to 3x yield boosts over time, ensuring passive liquidity providers benefit from long-term participation, not just trade volume.

- Ultra-Low Flat Fees: Mage operates with sub-0.001% trading fees and a multi-tier routing system, eliminating hidden slippage and maximizing trade value.

- Post-ICO Revenue Sharing: 95% of revenue is distributed back to the community, with 30% allocated directly to token and NFT stakers.

- Cross-Chain and Aggregator Integrations: Compatible with Solana's top aggregators like Jupiter, while enabling bot-based trading strategies and arbitrage systems.

- Claimable Yield in SOL: Rewards from staking $MAGE or Mage NFTs are paid in SOL, not illiquid tokens, supporting real, recurring yield.

- Fair, Transparent Model: A flat, PPP (Player-Pump-Player) economic system designed to reward participation instead of extraction.

- Robust Infrastructure: Built with high-performance Solana-native architecture optimized for scalability and capital efficiency.

Mage DEX is easy to use for both beginners and experienced Solana DeFi users. Here’s how to get started:

- Install a Solana Wallet: Use a wallet like Phantom, Solflare, or Ledger Live with Solana support.

- Visit the Platform: Go to https://magelabs.xyz and click ‘Connect Wallet’.

- Trade or Provide Liquidity: Choose to swap tokens, or browse the Liquidity Pools to deposit assets and start earning yield.

- Stake to Earn: Stake your $MAGE tokens or Mage NFTs to claim a share of protocol revenue. Rewards are distributed in SOL on a recurring basis.

- Track Performance: Use the Portfolio dashboard to monitor rewards, staked assets, and pool activity in real-time.

- Learn More: Read the official documentation at docs.magelabs.xyz for advanced guides and support.

Mage DEX Reviews by Real Users

Mage DEX FAQ

Mage DEX introduces a loyalty-driven reward model where liquidity providers (LPs) earn compounding yield boosts the longer they stay in the pool. Unlike traditional models that reward only on volume, Mage offers 3x yield boosts for users who remain consistent LPs over time. This approach encourages deeper liquidity and reduces the churn of mercenary capital. Mage rewards passive participation and supports the emergence of social money ecosystems powered by sustained trust.

The Player-Pump-Player (PPP) economy is a system designed by MageLabs to shift financial value back to users. Instead of extracting fees and channeling them to centralized treasuries or VCs, Mage re-routes earnings to liquidity providers, token stakers, and NFT holders. This model ensures that users who "pump" the protocol by adding liquidity or staking are directly rewarded by fellow participants. It’s a peer-reward system focused on horizontal wealth distribution and decentralization.

Yes, Mage DEX is explicitly optimized for traders with <$5k positions. Its flat fee model—with trades costing as little as 0.001%—means that smaller trades don’t suffer from the disproportionately high fees seen on other platforms. Combined with transparent routing and passive liquidity pools, Mage offers cost-efficiency and predictability for users who may not have access to whales’ capital but want fair execution.

Mage DEX is built with a modular architecture that supports real-time integrations with Jupiter, Solana’s leading aggregator, and is optimized for arbitrage bots. The pool engine is tailored for automated execution, and the system allows bots to access flat fees and high-throughput routing. This makes Mage a preferred backend for algorithmic strategies and institutional-level arbitrage operations on Solana.

Post-ICO, Mage DEX activates a community-centric revenue distribution model. 30% of LP revenue is distributed to stakers of $MAGE tokens and Mage NFTs, with rewards claimable in SOL. An additional 10% goes to the protocol treasury for upgrades and security, while the remaining 60% supports liquidity providers. This ensures ongoing value accrual for ecosystem participants and reinforces Mage’s commitment to decentralized ownership.

You Might Also Like