About Mangrove

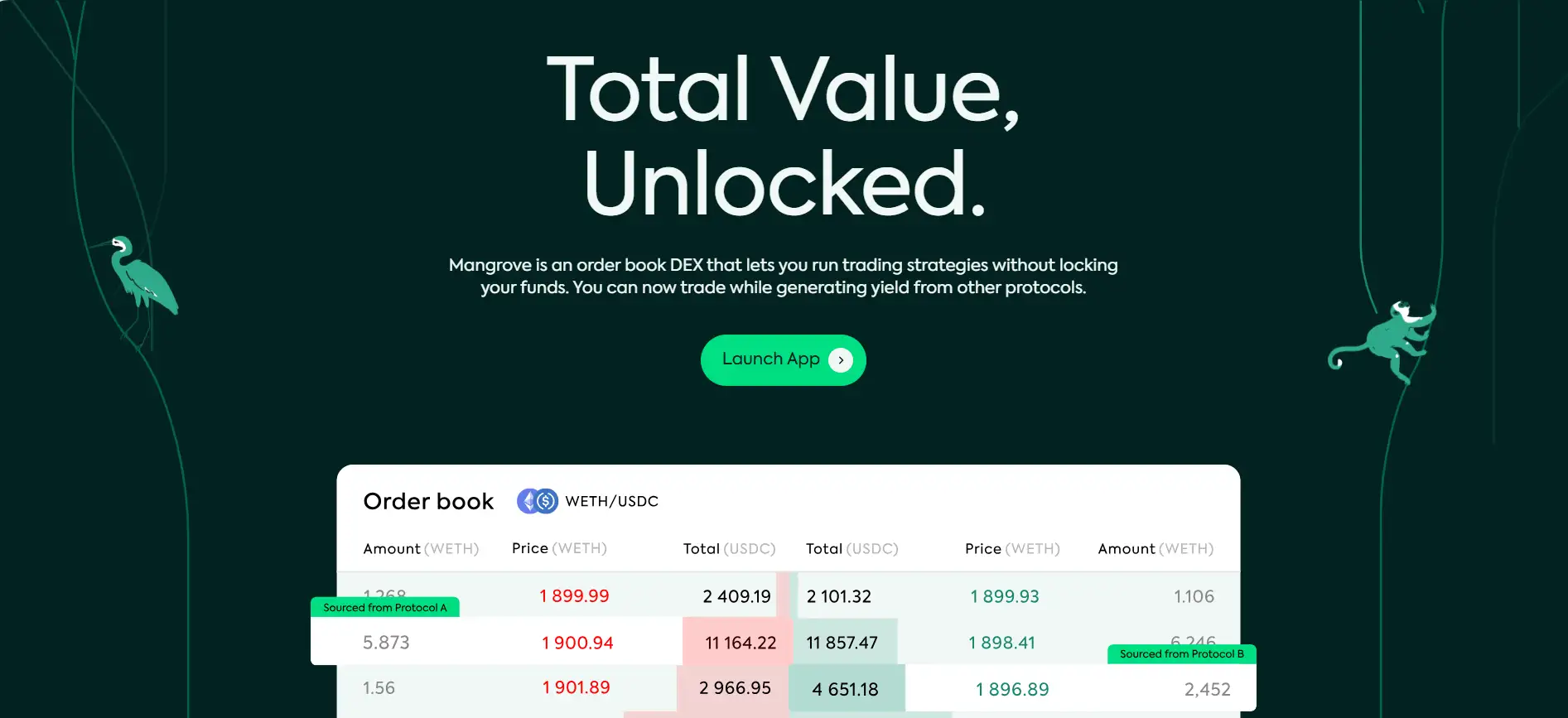

Mangrove is a decentralized, EVM-compatible order book DEX that redefines how liquidity is deployed and monetized in DeFi. Unlike traditional decentralized exchanges, Mangrove introduces an innovative "offer-is-code" model, allowing liquidity providers to post offers that execute dynamic trading strategies via smart contracts — all without locking funds.

With Mangrove, liquidity becomes programmable and flexible. Offers listed on the order book are not static orders but contracts that source liquidity at execution time. This groundbreaking design empowers users to simultaneously earn yield elsewhere while participating in active markets, marking a major shift from capital inefficiency to smart liquidity reuse in DeFi.

Mangrove is a next-generation decentralized exchange built around the concept of programmable liquidity. Its core innovation lies in the “offer-is-code” architecture, where each offer on the order book is a smart contract capable of sourcing liquidity on demand. Instead of requiring assets to be locked up, liquidity providers can post executable strategies that activate when matched, giving rise to highly composable, capital-efficient trading experiences. Mangrove runs entirely on-chain and is designed to integrate with any EVM-based ecosystem.

Traditional AMMs like Uniswap or Curve suffer from capital inefficiency, fragmentation, and passive pricing models. In contrast, Mangrove gives liquidity providers total control through smart contract automation. They can implement strategies like lending on Compound, borrowing with leverage, or posting limit orders with "last look" logic — all within a single DEX. Offers can persist on the book, self-repost after execution, or cancel themselves based on price feeds, enabling sophisticated financial behavior previously seen only in centralized markets.

By supporting both maker- and taker-driven modes, Mangrove accommodates high-frequency trading strategies, yield maximization, and even flash loan markets. Moreover, its protocol-level enforcement of offer credibility through refundable provisions prevents spam and ensures a clean, functioning marketplace. Smart governance mechanisms, gas-efficient architecture, and integration potential with other DeFi protocols make Mangrove a foundational layer for building the next generation of decentralized financial products.

Mangrove introduces a new paradigm in decentralized trading with its unique set of features and benefits:

- Offer-Is-Code Architecture: Each offer is a smart contract capable of executing dynamic strategies, enabling unprecedented flexibility in DeFi trading.

- No Locked Liquidity: Funds are not locked in the order book. Liquidity providers retain full control and can earn yield elsewhere while orders sit on Mangrove.

- Composable Strategies: Users can create complex financial behaviors like lending, leveraging, or automated reposting directly within the DEX.

- Persistence & Reactivity: Offers can reappear after execution and adapt to on-chain/off-chain signals in real-time, creating a “living” order book.

- Integrated Flash Loans: Flash-loanable liquidity can be posted directly in the order book, consolidating fragmented sources into a single marketplace.

- Slashing Incentives: Misbehaving offers can be slashed by the protocol, ensuring reliability and deterring spam or failed executions.

- Multi-Pair Support with Shared Liquidity: Liquidity providers can expose assets to multiple trading pairs simultaneously with atomic execution across pairs.

Getting started with Mangrove is quick, intuitive, and designed for both developers and traders:

- Visit the App: Navigate to the Mangrove website and click on "Launch App" to enter the trading dashboard.

- Connect Your Wallet: Use MetaMask or any Web3-compatible wallet to access Mangrove’s ecosystem on supported EVM chains.

- Explore Strategies: Access ready-to-deploy strategies like the Kandel AMM or browse the strategy library on GitHub.

- Post Offers: Choose an asset pair, write or reuse a smart contract strategy, and post it as an active order in the book.

- Trade or Earn: Place limit orders, run AMMs, provide reactive liquidity, or simply trade via the UI while maximizing capital efficiency.

- Integrate Your Protocol: Developers can connect DeFi apps to Mangrove via SDKs and open new functionalities for users without sacrificing TVL.

- Join the Community: Connect with the Mangrove ecosystem on Discord and follow updates on the Mangrove Blog.

Mangrove FAQ

"Offer-is-code" is Mangrove’s revolutionary model where each order on the DEX is a smart contract rather than a static token deposit. This means that every offer includes executable logic that activates when matched, allowing the liquidity provider to fetch, generate, or redirect the promised assets in real time. It enables a new level of programmability and control in decentralized trading. Learn more at Mangrove.

With Mangrove, you don’t have to lock tokens in a pool. Instead, you can post smart contract offers that reference assets held elsewhere — even in yield strategies like Aave or Compound. When your offer is matched, your contract retrieves the required tokens on demand, allowing you to generate yield while still participating in active markets. This approach transforms passive liquidity into dynamic, yield-optimized capital.

Mangrove enables a dedicated flash loan market directly within its order book. By allowing users to post “A/A” offers in taker-driven mode, Mangrove creates a unified, competitive space where flash loan liquidity is transparently priced and aggregated. This is far more flexible than traditional DEXes, which rely on isolated or hard-coded flash loan logic. Through this mechanism, both takers and providers benefit from better fees and more efficient liquidity discovery.

Unlike AMMs, which use fixed formulas and lock assets into static pools, Mangrove lets you write fully programmable liquidity strategies. You can incorporate lending, borrowing, dynamic repricing, and even external data feeds within your offers. Strategies can update, repost, or cancel themselves based on live market data. This makes Mangrove a true DeFi strategy layer for builders looking to compose complex behavior into a single DEX interface.

When an offer fails to execute, Mangrove uses the offer’s provision to fully reimburse the taker’s cost. Offers must include a small bond that covers gas and execution risk. If a taker encounters a failing offer, their funds are restored automatically, and the protocol incentivizes third-party “keepers” to clean the order book. This bond-and-slash mechanism ensures that all offers listed on Mangrove are credible and reduces the chance of spam or malicious liquidity promises.

You Might Also Like