About marginfi

MarginFi is a cutting-edge decentralized lending and borrowing protocol built on the Solana blockchain. It provides users with a capital-efficient and high-speed margin trading solution, addressing inefficiencies in traditional DeFi lending platforms. With its low transaction costs, fast execution speeds, and seamless composability, MarginFi is revolutionizing decentralized finance by allowing traders to optimize their liquidity across multiple platforms.

Unlike conventional lending protocols, MarginFi introduces a more flexible and interoperable lending system that reduces capital inefficiencies. It offers users the ability to borrow, lend, and trade assets in a permissionless environment while maintaining full transparency and security. By leveraging Solana’s high-throughput blockchain, MarginFi ensures that traders can execute transactions with minimal latency, making it a powerful tool for both institutional and retail users.

MarginFi is a decentralized lending and borrowing platform designed to provide capital-efficient margin trading solutions on the Solana blockchain. By leveraging Solana’s high-speed, low-cost infrastructure, MarginFi enables users to optimize their liquidity across multiple DeFi applications while maintaining full transparency and security. The platform addresses key challenges in the decentralized lending space, including fragmented liquidity, inefficient capital allocation, and high transaction costs.

At its core, MarginFi introduces a unique cross-margin lending system that allows users to borrow, lend, and trade assets seamlessly. Unlike traditional lending platforms where funds remain isolated in separate pools, MarginFi ensures that capital is efficiently utilized, reducing idle liquidity and maximizing yield opportunities. By integrating with other DeFi protocols, the platform enhances user experience by providing a more interconnected financial ecosystem.

A key differentiator of MarginFi is its ability to support high-frequency trading and real-time liquidity access. The Solana blockchain enables near-instant transaction finality, allowing traders to execute trades and adjust their positions with minimal delay. This is a crucial advantage compared to Ethereum-based lending platforms, where high gas fees and network congestion can slow down execution and reduce profitability. By eliminating these inefficiencies, MarginFi provides a smoother and more cost-effective trading experience.

MarginFi is built with a focus on composability, ensuring that users can interact seamlessly with other Solana-based DeFi protocols. This allows traders to move funds effortlessly between platforms, enhancing their ability to manage liquidity. In addition to lending and borrowing, users can take advantage of advanced risk management tools to protect their assets and optimize their trading strategies.

MarginFi competes with several well-established decentralized lending platforms. Some of its main competitors include Aave, an Ethereum-based lending protocol known for its innovative flash loans and decentralized governance; Compound, which allows users to lend and borrow digital assets while earning interest; and Marinade Finance, a Solana-based staking and liquidity optimization platform. Unlike these platforms, MarginFi is tailored specifically for traders seeking high-speed, low-cost margin trading solutions with deeper liquidity integrations.

With its emphasis on capital efficiency, fast execution, and interoperability, MarginFi is positioning itself as a leading alternative in the decentralized lending and margin trading space. By leveraging Solana’s technology, it provides a scalable, secure, and user-friendly solution for traders looking to maximize their liquidity in the evolving DeFi ecosystem.

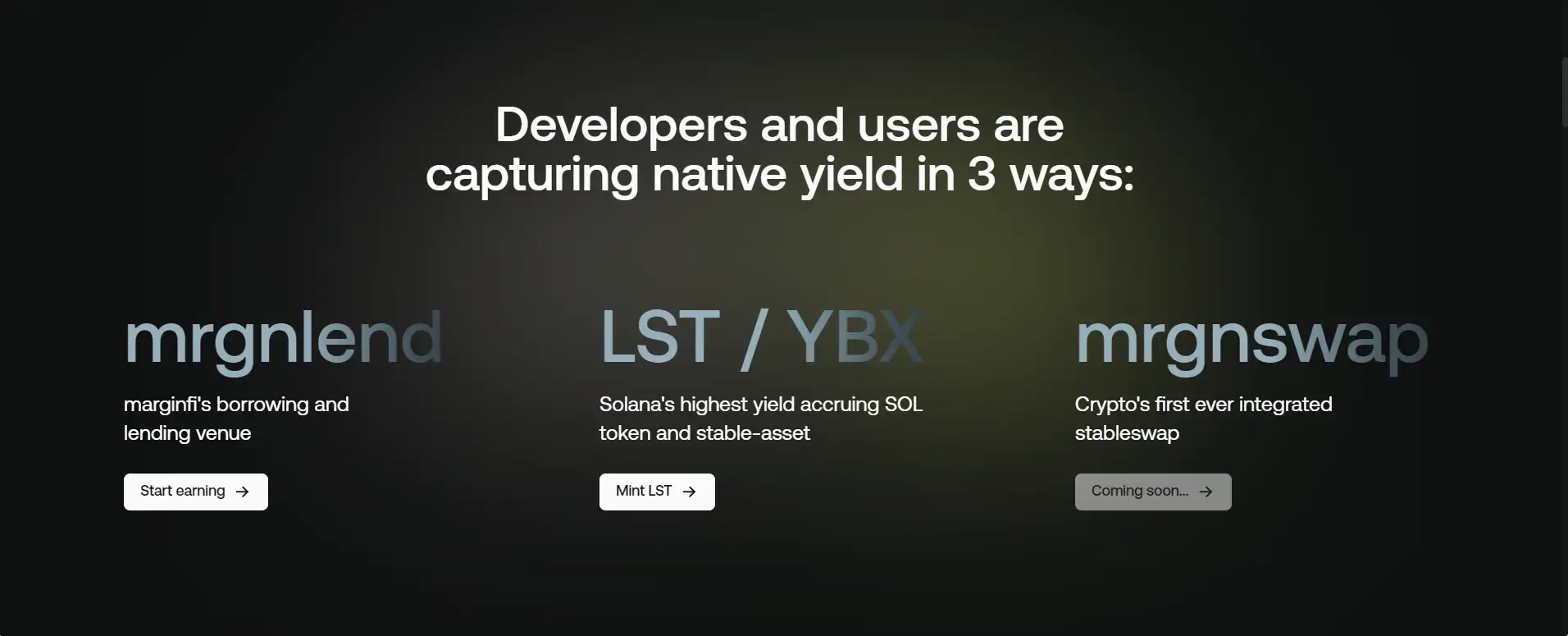

MarginFi offers a range of benefits and features that make it an attractive option for traders and liquidity providers:

- Capital Efficiency: Users can optimize their liquidity by leveraging a cross-margin lending system, allowing for more efficient capital utilization.

- Fast and Low-Cost Transactions: Thanks to Solana’s high-speed blockchain, transactions on MarginFi are executed quickly and at a fraction of the cost of Ethereum-based alternatives.

- Seamless DeFi Integration: The protocol is fully composable with other DeFi applications, enabling users to move assets across platforms effortlessly.

- Advanced Security and Transparency: MarginFi operates on a decentralized and permissionless infrastructure, ensuring full transparency and reducing counterparty risk.

- Flexible Lending and Borrowing: Users can lend or borrow a wide range of digital assets, giving them more options for portfolio management.

Getting started with MarginFi is simple and requires only a few steps:

- Create a Solana Wallet: You will need a Solana-compatible wallet such as Phantom or Solflare to interact with the platform.

- Deposit Funds: Transfer SOL or other supported assets into your wallet.

- Connect Your Wallet: Visit MarginFi and connect your wallet by clicking the "Connect" button.

- Choose Lending or Borrowing Options: Select the asset you wish to lend or borrow and specify the desired terms.

- Manage Your Positions: Regularly monitor your portfolio, collateral levels, and interest rates to optimize your strategy.

marginfi FAQ

Unlike traditional DeFi lending platforms, where funds are locked into isolated pools, MarginFi offers a cross-margin lending system that allows users to utilize their assets across multiple liquidity pools. This means that instead of capital sitting idle in one lending market, users can optimize their borrowing power by leveraging collateral across different positions. By reducing capital inefficiencies, MarginFi enhances liquidity usage, leading to more profitable lending and borrowing opportunities.

Since MarginFi is built on the Solana blockchain, it benefits from faster transaction speeds, lower fees, and greater scalability compared to Ethereum-based lending platforms. Solana’s high throughput allows transactions to settle almost instantly, reducing network congestion issues that often plague Ethereum-based DeFi platforms. Additionally, Solana’s low transaction costs make lending and borrowing more accessible to traders who want to avoid high gas fees. With this infrastructure, MarginFi provides a more efficient and cost-effective lending experience.

MarginFi implements advanced risk management mechanisms to ensure platform stability and protect both lenders and borrowers. The protocol uses real-time price oracles to monitor asset values and automatically adjust collateral requirements when needed. Additionally, automated liquidation systems help prevent under-collateralized loans, ensuring that lenders are protected from defaults. By combining smart contract security, liquidation protection, and transparent risk assessment, MarginFi minimizes systemic risk and provides a safe borrowing environment.

Yes! MarginFi is designed to be fully composable with other Solana-based DeFi applications, allowing users to seamlessly integrate their lending and borrowing positions across multiple protocols. This means traders can use MarginFi’s lending pools while interacting with DEXs, yield aggregators, and staking platforms to enhance their strategies. The ability to move liquidity freely across platforms makes MarginFi a powerful tool for DeFi traders looking for maximum flexibility.

Migrating to MarginFi is straightforward. First, withdraw your assets from your existing lending protocol (e.g., Aave or Compound) and ensure they are stored in your Solana-compatible wallet such as Phantom or Solflare. Next, visit MarginFi, connect your wallet, and deposit your assets into the MarginFi lending pools. Once deposited, you can start earning interest or use your assets as collateral for borrowing, all while benefiting from Solana’s low fees and fast execution speeds.

You Might Also Like