About Masternoded

Masternoded is a comprehensive DeFi platform that integrates the tokenization of real-world assets (RWA), peer-to-peer lending, and staking to offer decentralized financial services. Its mission is to democratize access to advanced financial tools traditionally monopolized by intermediaries. By using the NODED token, users can engage with a transparent, secure, and decentralized ecosystem that enables participation in P2P lending, staking, and governance.

Masternoded strives to bridge the gap between traditional finance and blockchain by providing decentralized alternatives to financial services like lending and borrowing. It also aims to empower users through its governance model, allowing them to vote on key decisions that shape the platform’s future. The project targets both individual users and institutional investors looking to diversify their portfolios with tokenized assets.

Masternoded was developed as a platform to provide decentralized financial solutions, focusing on real-world asset tokenization and P2P lending. The platform has undergone several key milestones, including the launch of the NODED token and the introduction of a decentralized peer-to-peer lending system. This system allows users to lend and borrow without intermediaries, reducing fees and increasing transparency.

One of the most significant features of Masternoded is its ability to tokenize real-world assets like real estate and commodities, which adds liquidity to traditionally illiquid markets. The platform also supports staking and governance, where token holders can vote on decisions that shape the platform’s future. The team behind Masternoded has prioritized security, conducting regular audits to ensure that user funds and data are protected.

In the competitive DeFi landscape, Masternoded distinguishes itself through its focus on real-world asset tokenization. Competitors such as MakerDAO, Aave, and Compound focus primarily on digital assets, whereas Masternoded integrates real-world assets, appealing to a broader range of users, including institutional investors.

- Real-World Asset Tokenization: Enables users to access traditionally illiquid assets like real estate through tokenization, making these assets more liquid and accessible.

- P2P Lending: The platform offers a decentralized peer-to-peer lending system, where users can lend and borrow assets without intermediaries, reducing costs.

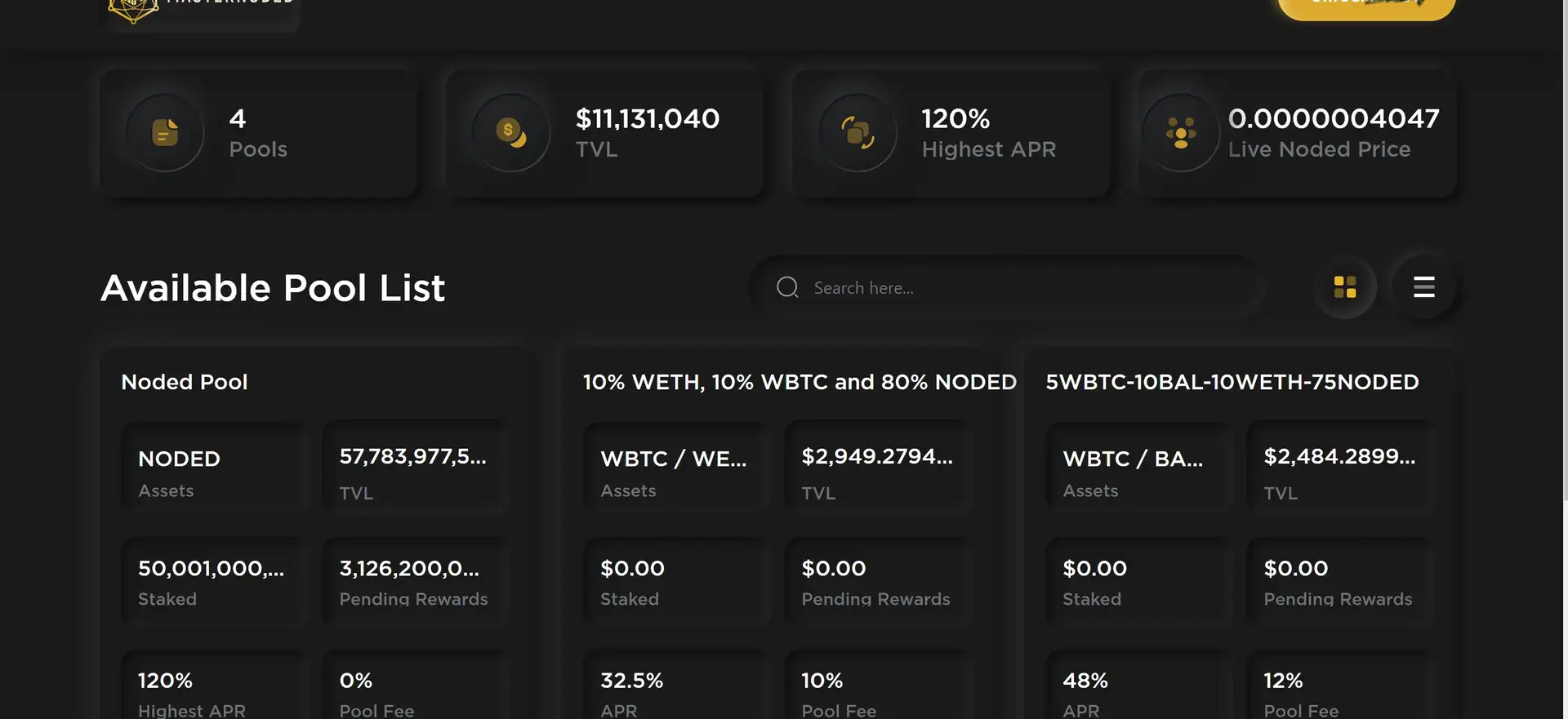

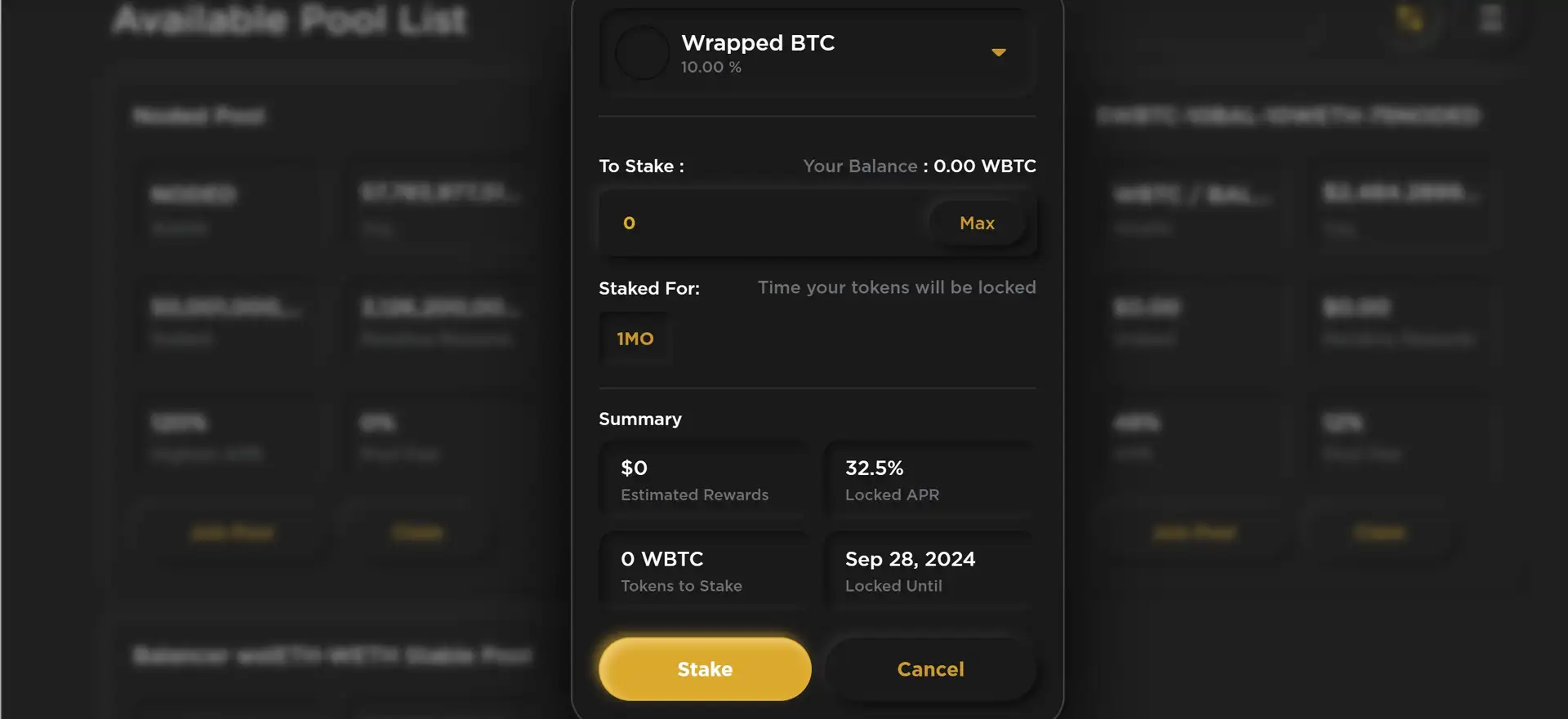

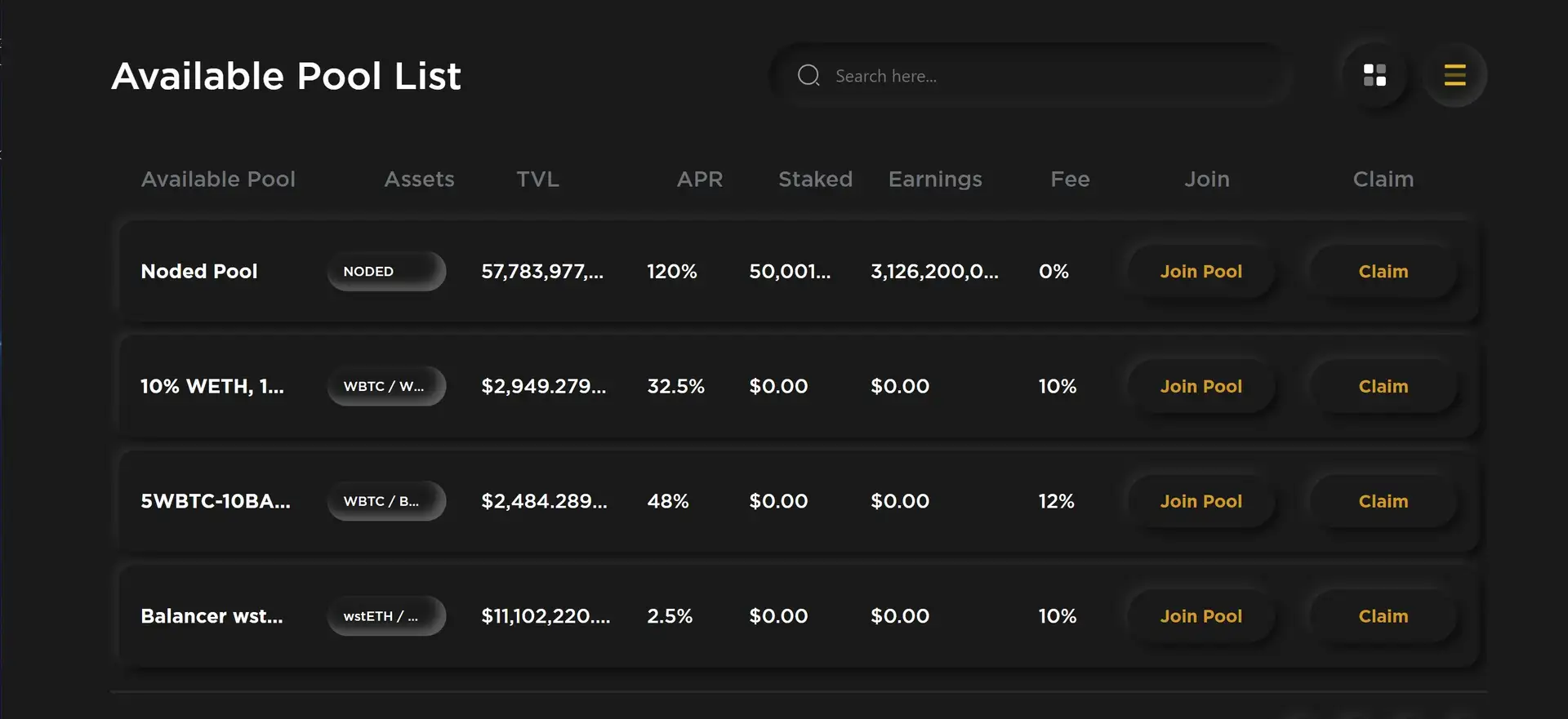

- Staking Rewards: Users can stake NODED tokens to earn passive income while supporting the platform's network security.

- Decentralized Governance: NODED token holders can participate in governance, voting on key platform decisions.

- Security & Auditing: Regular audits ensure the safety and security of user funds and data on the platform.

- Global Accessibility: The platform’s services are accessible globally, offering DeFi solutions to users worldwide.

- Create an Account: Visit the Masternoded website and sign up by providing your email and password. Verify your email to complete registration.

- Set Up a Wallet: Install a compatible wallet, like MetaMask, and connect it to the platform.

- Acquire NODED Tokens: Purchase NODED tokens on exchanges like Toobit or MEXC and transfer them to your wallet.

- Explore the Platform: Once you have tokens in your wallet, start using the platform's features, such as P2P lending and staking. You can also participate in governance by voting on important issues.

- Stake Tokens: Navigate to the staking section of the platform, select the amount of NODED tokens you wish to stake, and start earning rewards.

For more detailed instructions and resources, visit the Masternoded Lightpaper.

Masternoded Reviews by Real Users

Masternoded FAQ

Masternoded sets itself apart by focusing on the tokenization of real-world assets (RWA), enabling users to access traditionally illiquid assets like real estate and commodities. This is a unique feature compared to typical DeFi platforms that deal primarily with digital assets. By combining P2P lending and decentralized governance, Masternoded offers a holistic financial ecosystem.

Real-world asset tokenization on Masternoded allows users to represent physical assets like real estate as digital tokens on the blockchain. This increases the liquidity of assets that are typically hard to trade and allows fractional ownership. For example, users can buy tokenized shares of a property, unlocking new investment opportunities.

You can earn passive income on Masternoded by staking NODED tokens. When you lock up your tokens for a set period, you help secure the network and receive rewards in return. The more tokens you stake, the higher your potential rewards. It's a way to grow your holdings while supporting the platform’s decentralized operations.

Yes, NODED token holders can participate in decentralized governance by voting on key decisions such as protocol upgrades, fee adjustments, and new feature proposals. This ensures that the platform remains community-driven and that users have a say in its development. For more information on voting, visit Masternoded.

P2P lending on Masternoded allows users to lend and borrow assets without intermediaries. This results in lower fees, more transparency, and faster transactions compared to traditional lending. Borrowers can access loans more easily, while lenders earn interest on their loans, making it a win-win for both parties.

You Might Also Like