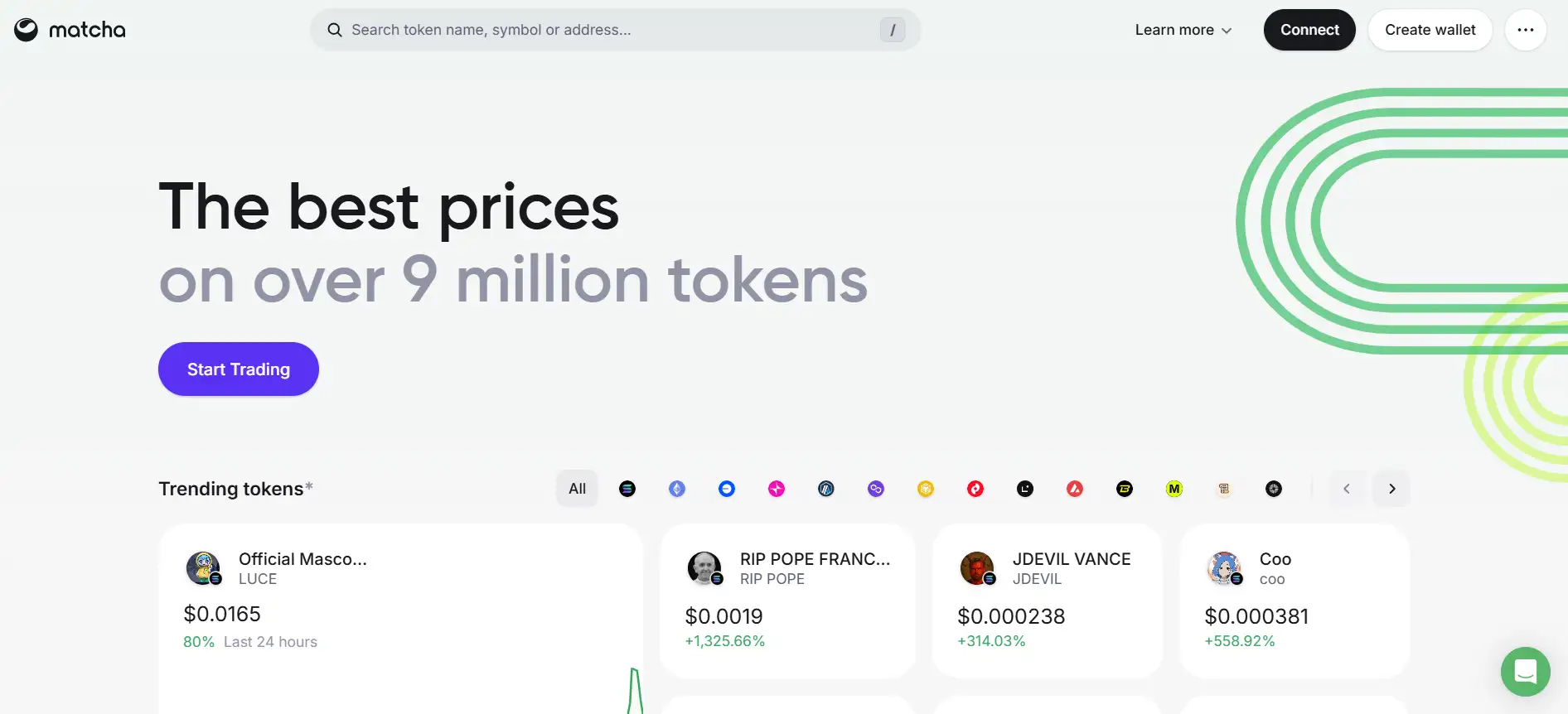

About Matcha

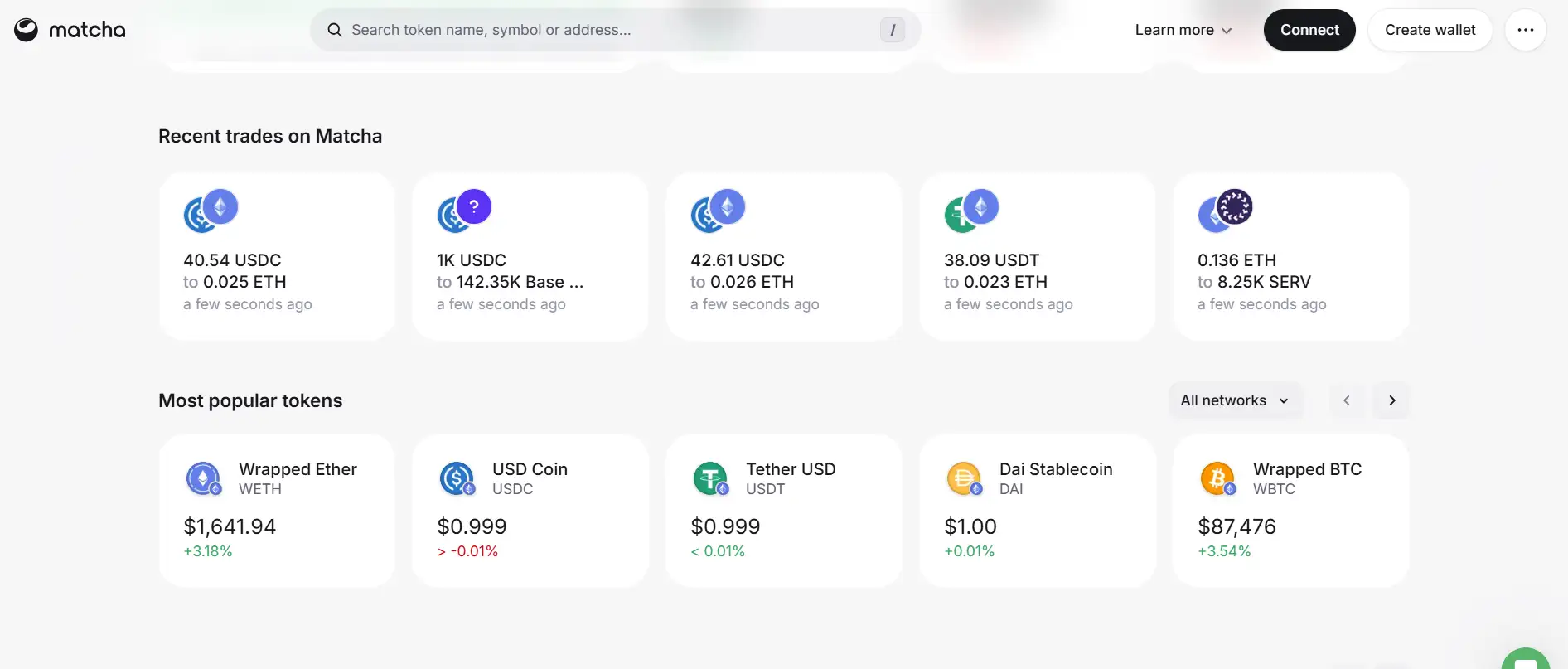

Matcha is a powerful decentralized exchange (DEX) aggregator built to help users find the best prices on over 9 million tokens across 130+ liquidity sources and 13 blockchains. Created by 0x Labs, Matcha streamlines token swaps, cross-chain trades, and onchain limit orders, all within a secure and intuitive interface that requires no sign-up or KYC.

Whether you’re a DeFi beginner or an advanced trader, Matcha offers seamless access to liquidity across networks like Ethereum, Solana, Arbitrum, Base, Polygon, BNB Chain, and more. With built-in safety tools like contract audits and liquidity scoring, Matcha ensures users trade safely and efficiently while optimizing every transaction for price and gas. All of this is done directly from your wallet with zero platform fees.

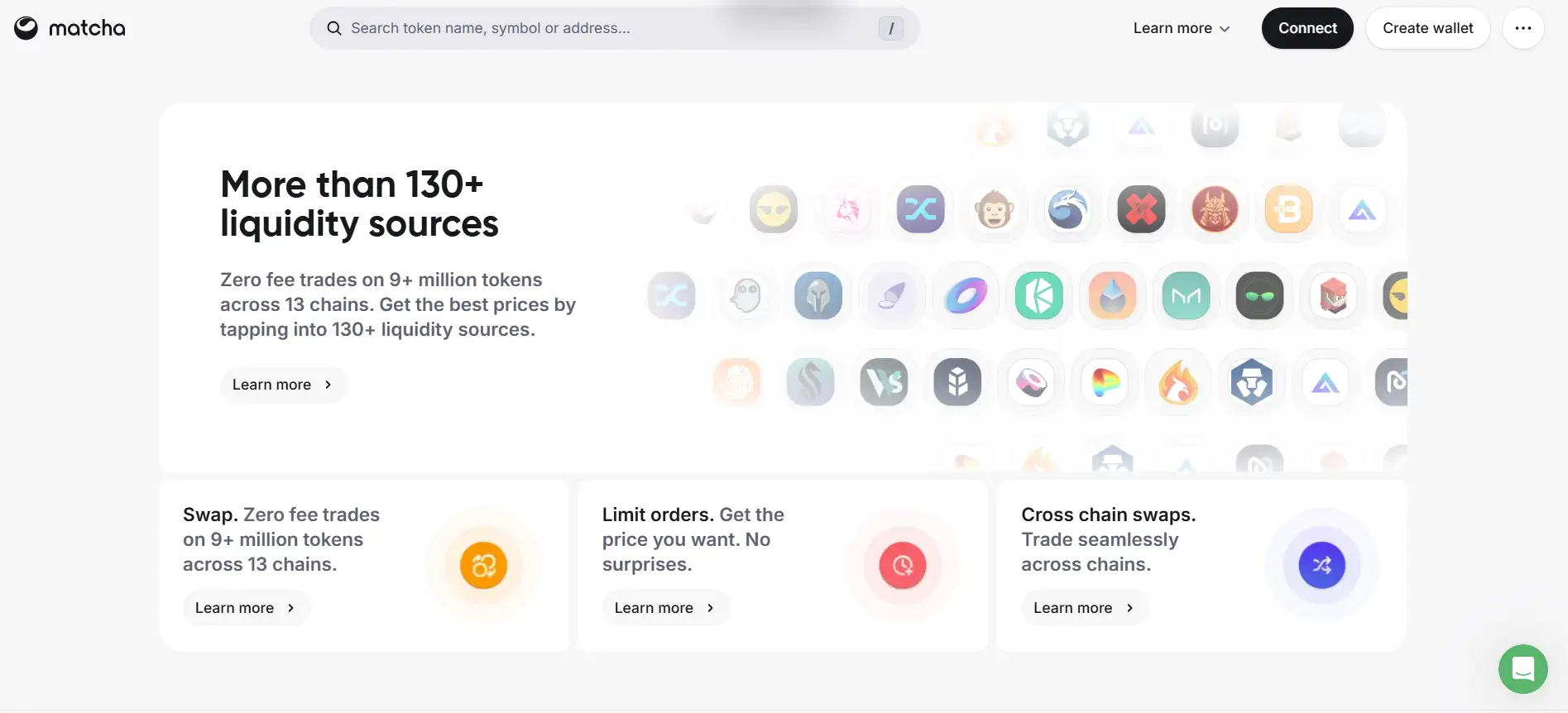

Built by 0x Labs, Matcha is a leading DEX aggregator that simplifies and enhances the decentralized trading experience. It aggregates liquidity from over 130 decentralized exchanges and liquidity sources, giving users access to zero-fee trading on more than 9 million tokens across 13 blockchains — including Ethereum, Solana, Base, Polygon, Arbitrum, Optimism, and more.

Unlike standard DEXes, Matcha intelligently routes trades to achieve the best possible execution, accounting for slippage, gas costs, and MEV protection. Users can perform standard swaps, create limit orders, or initiate cross-chain swaps with just a few clicks. Matcha even supports bridging between major L2s like Base and Arbitrum, allowing for direct token-to-token swaps across chains without having to manually bridge or wait for finality delays.

The platform prioritizes user security with features like real-time contract risk alerts, token audit overlays, and liquidity scores to avoid slippage and low-liquidity pitfalls. Matcha is also integrated with TradingView for live price charts and analytics, and supports major wallets including MetaMask, Rainbow, Coinbase Wallet, and WalletConnect.

Compared to competitors like CowSwap, 1inch, and Velora, Matcha stands out with its zero-fee model, deep liquidity access, and unmatched multi-chain support. Its intuitive interface is beginner-friendly yet powerful enough for pro traders, making Matcha a top-tier choice for DeFi trading across networks.

Matcha delivers a rich set of features and benefits that make it a must-have tool for DeFi traders:

- Zero-Fee Trades: Swap tokens across 130+ sources with no additional platform fees.

- 9M+ Tokens Aggregated: Access tokens from Ethereum, Solana, Base, Arbitrum, Optimism, and more.

- Cross-Chain Swaps: Bridge and trade tokens across blockchains in a single seamless transaction.

- Onchain Limit Orders: Set buy or sell prices in advance for optimal entries and exits.

- Smart Routing: Matcha auto-routes your trade for the best execution, factoring in slippage and gas fees.

- Liquidity Scoring: Built-in metrics help you avoid trades in low-liquidity markets.

- Security Features: On-page token audit alerts protect users from malicious smart contracts.

- TradingView Charts: Perform technical analysis with high-quality charting tools.

Getting started with Matcha is simple and requires no registration:

- Visit Matcha: Head over to the Matcha homepage and click “Connect” to link your wallet.

- Select a Network: Choose from supported chains like Ethereum, Solana, Base, Arbitrum, Polygon, and more.

- Search or Select a Token: Browse trending tokens or search by name, symbol, or address.

- Choose a Trade Type: Swap instantly, place a limit order, or perform a cross-chain swap.

- Approve & Confirm: Confirm your trade and sign the transaction in your wallet.

- Track Orders: Use the trade history dashboard to monitor pending or completed swaps.

- Join the Community: Connect on Discord or follow updates on Twitter.

Matcha FAQ

Matcha is powered by 0x’s API, which scans over 130+ liquidity sources across 13 networks to find the optimal trading route for your order. It considers slippage, gas fees, and MEV risk to provide the most efficient trade execution. Instead of using just one DEX, Matcha intelligently splits your order across multiple sources to secure the best final price.

Cross-chain swaps on Matcha allow users to trade one token for another across different blockchains in a single seamless transaction. Unlike traditional bridges, which require manual token transfers and multiple steps, Matcha combines bridging and swapping into one interface. This eliminates delays and complexity, and optimizes for price, liquidity, and user experience.

No, Matcha does not charge platform fees for token swaps. Users only pay the required network gas fees and any implicit fees from liquidity providers. Matcha’s zero-fee model ensures that you get the most out of your trades without unexpected charges, whether you're swapping, placing a limit order, or trading across chains.

Matcha includes built-in security tools that display alerts about risky smart contract functions directly on token pages. Tokens with suspicious behaviors are flagged, helping users avoid potential scams or rug pulls. Additionally, Matcha shows liquidity scores to help users avoid low-liquidity tokens that could lead to price impact or slippage.

Matcha supports major Web3 wallets including MetaMask, Coinbase Wallet, Rainbow, and WalletConnect. Users can trade on over 13 networks including Ethereum, Solana, Base, Arbitrum, Optimism, Polygon, BNB Chain, and more. This wide support enables users to connect their wallet and start trading without needing to transfer assets between platforms.

You Might Also Like