About maxAPY

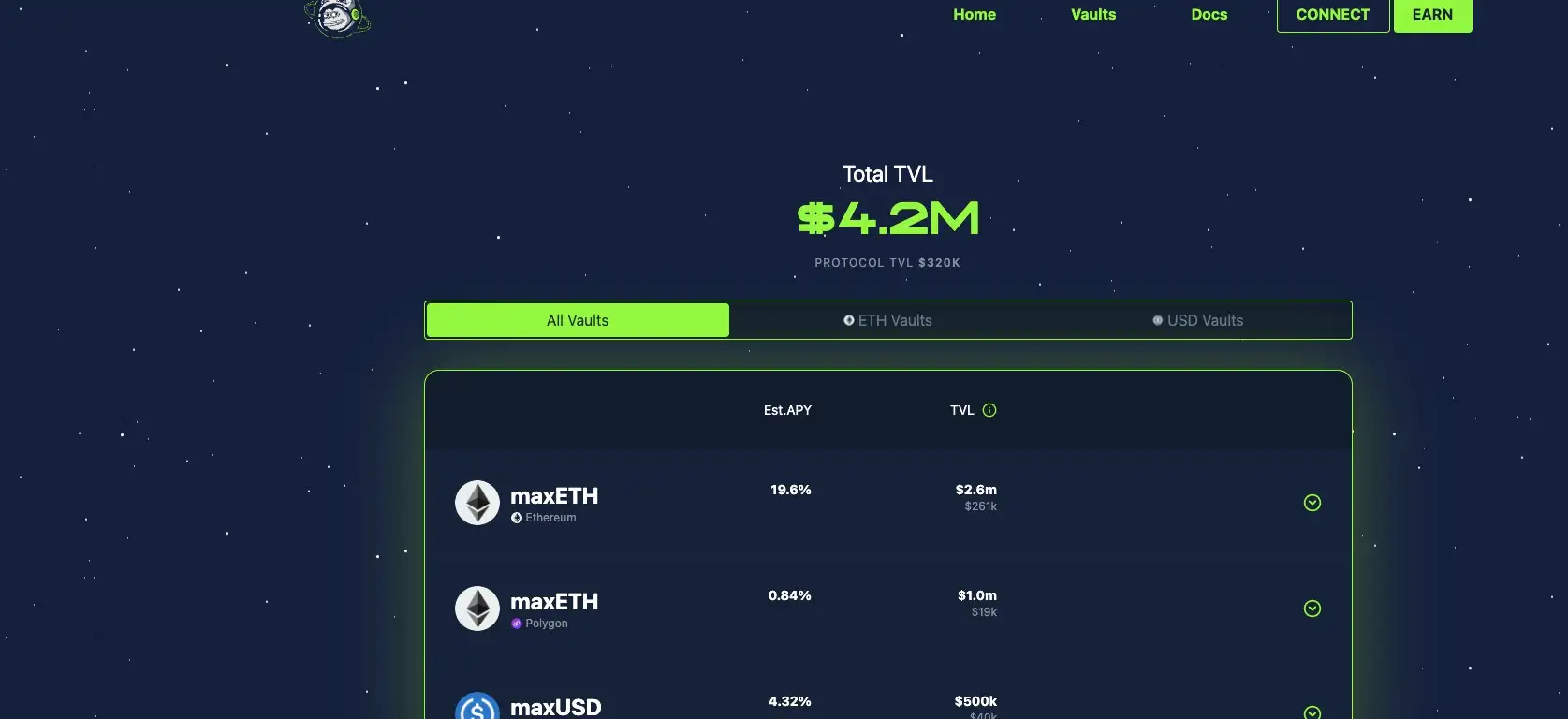

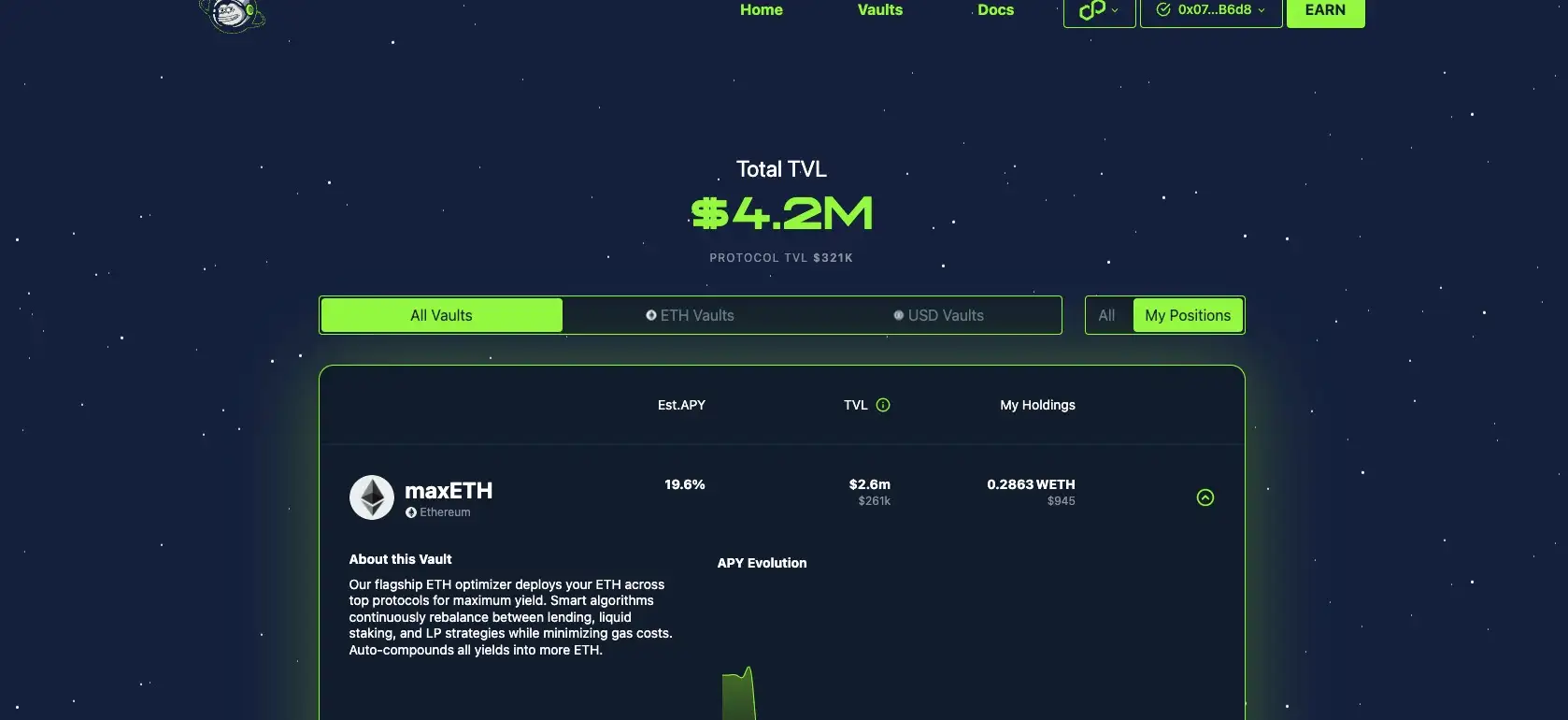

maxAPY is a next-generation cross-chain yield optimizer designed to automate and maximize DeFi yield farming across multiple chains. By continuously scanning, selecting, and reallocating liquidity across 700+ strategies, 70+ protocols, and 9+ chains, maxAPY ensures that capital is always deployed in the most efficient way possible while users do absolutely nothing.

At its core, maxAPY operates with two primary vaults, ETH and USDC (BTC coming soon), that dynamically allocate funds across DeFi protocols, removing the need for users to manually manage their positions. The protocol focuses exclusively on high-quality, liquid, and non-lockup strategies, ensuring that assets are never trapped in underperforming pools.

maxAPY is an omnichain DeFi automation platform that simplifies yield farming by using advanced algorithms to seamlessly allocate and reallocate funds across the highest-yielding strategies on multiple chains. Unlike traditional yield farming, which requires constant monitoring and manual intervention, maxAPY provides an autopilot solution that ensures optimal performance 24/7 across multiple networks.

The platform is built on a straightforward yet highly efficient model: 1 asset = 1 vault. Users can deposit ETH or USDC into a designated vault, eliminating the need to manage multiple platforms or manually search for the best opportunities. maxAPY’s system continuously scans 100+ DeFi strategies across multiple EVM chains, automatically reallocating funds to the most profitable and secure options.

Omnichain execution ensures capital moves efficiently between chains, leveraging the best yield sources at any given time. Users don’t need to worry about bridges, complex cross-chain swaps, or managing fragmented liquidity—maxAPY handles everything behind the scenes.

Gas-optimized pooled transactions further enhance efficiency, reducing transaction costs and ensuring higher net yields. The platform’s auto-compounding feature reinvests earned rewards in real-time, maximizing compounding effects for exponential growth.

Security is a top priority. maxAPY partners with leading audit firms to secure its smart contracts and only integrates with battle-tested, well-established protocols that have a track record of stability and sustainability.

Unlike legacy yield aggregators such as Beefy Finance or Yearn Finance, maxAPY offers:

- Omnichain yield farming with real-time rebalancing

- Automated cross-chain capital movement for maximum returns

- Gas-optimized execution to minimize costs

- Seamless vault deposits with zero manual strategy selection required

With maxAPY, users get true omnichain yield automation—one vault, one click, optimized yield across chains.

maxAPY provides numerous benefits and features that make it a standout platform in the omnichain DeFi yield farming industry:

- Algorithmic Yield Optimization: maxAPY continuously scans over 100+ DeFi protocols across multiple EVM chains, ensuring assets are always allocated to the most profitable strategies.

- Fully Automated, Omnichain Yield Farming: No need for manual rebalancing, bridging, or strategy switching—maxAPY moves capital seamlessly across chains to capture the best yields.

- Gas-Optimized Transactions: Pooled transactions reduce gas fees and execution costs, ensuring higher net yields for all users.

- Auto-Compounding for Maximum Returns: Earned yields are reinvested automatically in real-time, amplifying earnings through continuous compounding.

- Omnichain & Multi-Protocol Integration: Supports top-tier DeFi platforms such as Curve, Aave, Uniswap, Yearn, and Lido across multiple chains for the best yield opportunities.

- Institutional-Grade Security: Smart contracts are fully audited, ensuring maximum safety and reliability across chains.

- No Lockups or Withdrawal Restrictions: Users can deposit and withdraw funds at any time without penalties—full flexibility with omnichain access.

With maxAPY’s omnichain automation, users get one vault, one deposit, and access to the best yield opportunities across chains, without any manual effort.

Getting started with maxAPY is a seamless process that allows users to integrate algorithmic, omnichain yield farming into their investment strategy.

- Bridge from Ethereum to Base: To access maxAPY’s vaults, first bridge your ETH or USDC from Ethereum to Base using a supported bridge. This ensures seamless participation in the platform.

- Connect your wallet: Visit the maxAPY website and connect your web-compatible wallet, such as MetaMask or WalletConnect.

- Deposit assets: Choose your preferred vault (ETH or USDC) and deposit your funds. Make sure to keep some ETH in your wallet for gas fees.

- Automated yield farming begins: Once deposited, maxAPY’s algorithms start scanning the market, allocating funds to the highest-yielding strategies across chains—fully automated.

- Monitor your earnings: Track earnings in real-time through the vault dashboard. No manual management is required—maxAPY optimizes everything.

- Withdraw anytime: When you’re ready to claim your returns, simply click the “Withdraw” button, confirm the transaction, and receive your assets instantly.

One vault, one deposit, omnichain yield, fully automated.

maxAPY Reviews by Real Users

maxAPY FAQ

maxAPY uses an advanced omnichain execution system that allows assets to move between chains automatically. The protocol continuously scans 100+ DeFi strategies across multiple EVM-compatible chains and reallocates liquidity to the most profitable and secure options. This means users don’t need to manually bridge funds, swap assets, or monitor different platforms—maxAPY handles everything behind the scenes.

maxAPY is built for real-time optimization. If a strategy starts underperforming, the platform's algorithmic monitoring system instantly detects it and shifts funds to a better-performing yield source. This ensures that capital is always allocated efficiently, reducing exposure to low returns. The system prioritizes liquid strategies to prevent funds from being locked in underperforming pools.

Absolutely! maxAPY is designed to simplify DeFi yield farming for everyone, even those with zero prior experience. Users simply deposit ETH or USDC into a vault, and the platform takes care of everything—from strategy selection to cross-chain movement and auto-compounding. No technical knowledge is required, making maxAPY one of the most user-friendly DeFi automation platforms.

Ethereum gas fees are required for blockchain transactions, such as depositing funds into maxAPY vaults. Since transactions on Base or other chains still require gas payments, users need to maintain a small amount of ETH to cover fees. However, maxAPY optimizes transactions to minimize costs, making yield farming far more efficient compared to manual methods.

Security is a top priority for maxAPY. The platform partners with leading blockchain security firms for smart contract audits and only integrates with battle-tested DeFi protocols. Additionally, all funds remain in non-custodial vaults, ensuring that users maintain full control of their assets at all times. Regular security updates and audits further enhance protocol safety.

You Might Also Like