About Meridian Lend

Meridian is a next-generation DeFi infrastructure protocol designed to support the incubation, deployment, and scaling of decentralized financial applications. Built around modular and composable components, Meridian Finance empowers developers and communities to launch products quickly and securely while benefiting from shared liquidity and robust tokenomics.

Through a combination of ready-to-deploy DeFi forks, a decentralized stablecoin (USDM), staking opportunities, and community-driven governance via the MST token, Meridian provides a unified user experience for DeFi participants across chains like Base, Telos, and Taraxa. Its emphasis on real yield, transparency, and ecosystem incentives positions it as a major force in multichain decentralized finance.

Meridian was created as a response to the fragmented DeFi landscape, aiming to simplify access to complex financial instruments while offering sustainable value to both users and developers. The protocol’s journey began after the pivot from the OmniDex ecosystem, which operated on Telos but was affected by external issues related to cross-chain infrastructure. The Meridian team regrouped, learned from the experience, and launched a more robust and forward-looking ecosystem with a fair launch and clear tokenomics model.

At its core, Meridian is an incubator for DeFi products. It offers plug-and-play solutions based on popular and audited protocols like Aave v2 (for lending), Liquity (for CDP stablecoin mechanisms), GMX v1 (for perpetual trading), and Uniswap v2 (for DEX infrastructure). These battle-tested architectures allow projects to launch in less than 10 days using Meridian’s full development and marketing suite.

Meridian has deployed multiple products across three major chains:

- Base: Meridian Mint, Lend, and other financial primitives

- Telos: Lend, Mint, and memecoin launchpad TelosPump

- Taraxa: USDM, Lend, and TaraPerps for perpetual trading

The ecosystem is governed by the community through the MST token, and every major decision goes through governance voting. The buyback-and-burn strategy ensures value capture is directly aligned with ecosystem usage. Meridian offers long-term support and exposure for new projects via its marketing, tech, and advisory channels, making it a full-stack launchpad.

Meridian’s closest competitors include:

- Aave – Lending protocol on Ethereum

- Liquity – Interest-free borrowing and stablecoin minting

- GMX – Decentralized perpetuals exchange

- Uniswap – Automated token swaps and liquidity

What differentiates Meridian is its bundled delivery approach: projects receive full-stack deployment including UI, smart contracts, mainnet hosting, marketing materials, and integration with tools like DefiLlama, Debank, and Dexscreener. Combined with the deflationary mechanics of the MST token and fast time-to-market, Meridian positions itself as the go-to DeFi launch infrastructure.

Meridian offers powerful features and benefits for users, developers, and communities:

- Multi-Chain Ecosystem: Projects are deployed across Telos, Base, and Taraxa for wider adoption and cross-chain liquidity.

- Battle-Tested Protocol Forks: Ready-to-deploy versions of Aave, GMX, Uniswap, and more, audited and optimized for performance.

- Revenue Sharing via MST: MST holders earn real yield from all product lines through staking and loyalty programs.

- Deflationary Tokenomics: 10% of all protocol fees go to weekly MST buybacks, reducing circulating supply.

- Fast Launch Timeline: Full DeFi protocols can be launched in 10 days, including branding, frontend, and integrations.

- Affiliate Program: Earn up to $1,500 per successful DeFi project referral with no upfront costs.

- Governance Participation: MST holders vote on protocol upgrades, treasury use, and strategic decisions.

Getting started with Meridian is simple and requires just a few steps:

- Visit the Website: Go to https://www.meridianfinance.net and explore available products like Lend, Mint, and Swap.

- Connect a Wallet: Use MetaMask or WalletConnect to access the platform across supported chains.

- Get MST: Buy MST via Aerodrome, Oku.trade, or TaraSwap.

- Stake MST: Access the staking dashboard from the main app and deposit MST tokens to start earning protocol fees.

- Launch a Project: Use the incubation program to deploy a new DeFi product in 10 days with full support.

- Become an Affiliate: Apply through the affiliate page to earn rewards by referring DeFi teams and startups.

Meridian Lend Token

Meridian Lend Reviews by Real Users

Meridian Lend FAQ

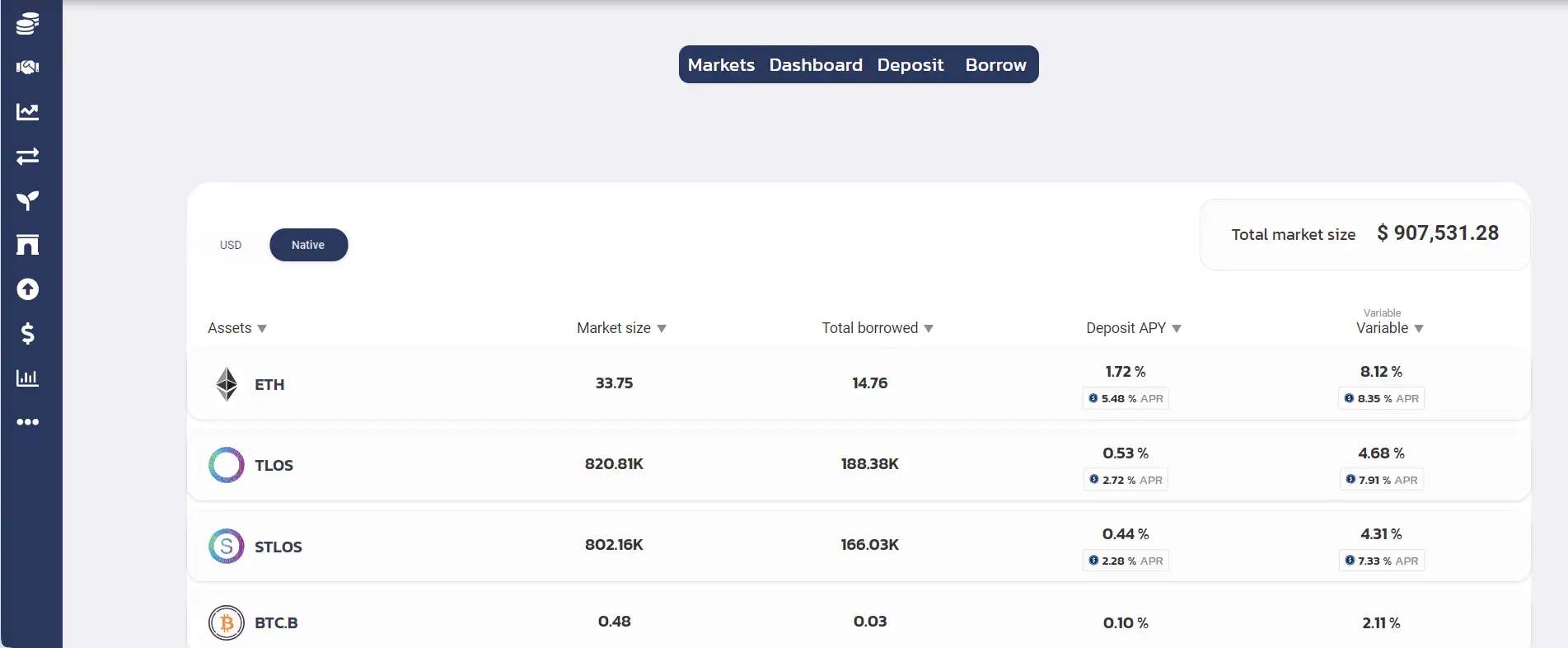

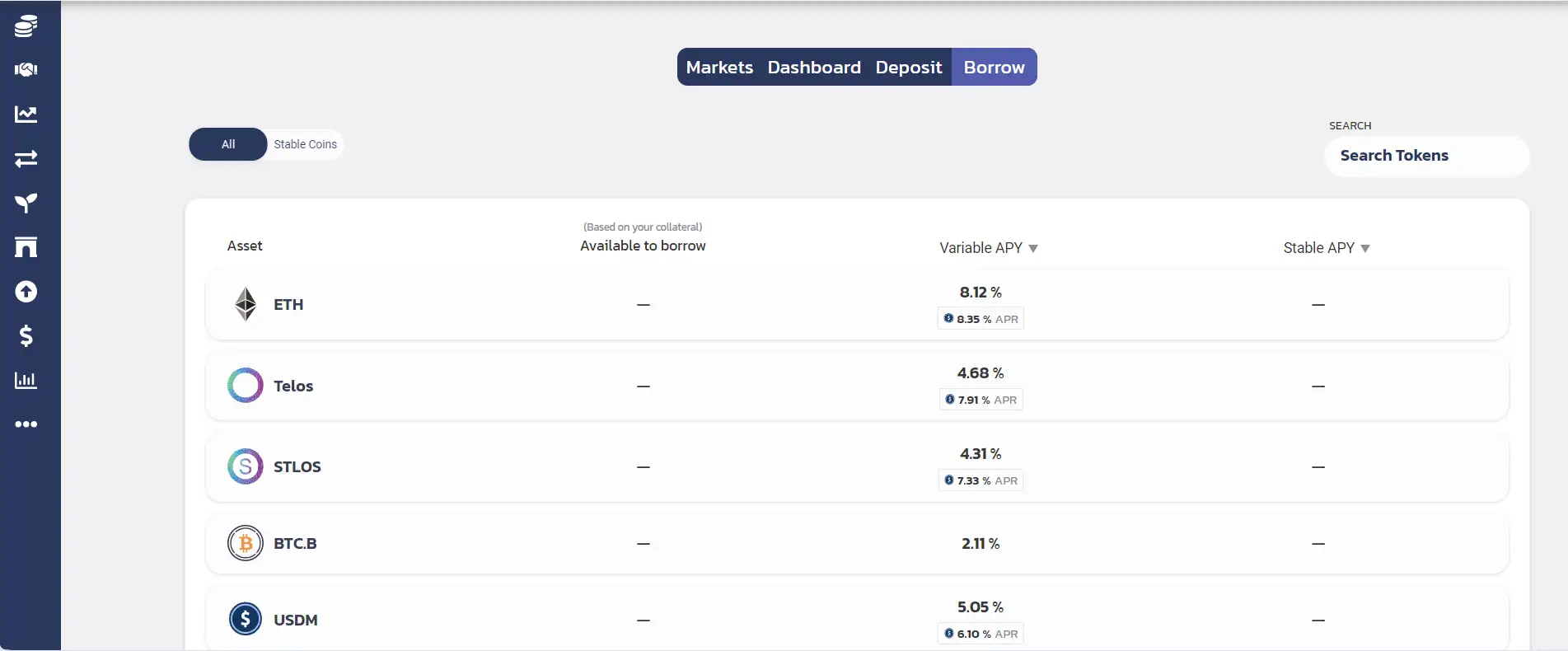

Meridian Lend integrates a robust security framework built upon the audited Aave v2 protocol, ensuring that all lending and borrowing operations are executed via verified smart contracts. The platform uses a transparent risk management model that relies on community-approved parameters to maintain system stability. In addition, each contract is independently verified and accessible on-chain, allowing users to inspect the Meridian Lend protocol directly. This approach provides full decentralization without compromising security, ensuring that collateral and liquidity remain under user control at all times.

The weekly buyback mechanism is one of the most distinctive aspects of the Meridian Finance ecosystem. Every week, the system automatically purchases $MST tokens on decentralized exchanges using revenue generated from borrowing fees, USDM redemptions, trading fees, and partnership revenues. These tokens are then burned or added to the staking pool, creating deflationary pressure. Over time, this process reduces the circulating supply, aligns incentives, and reinforces the value of MST for long-term holders and stakers.

Affiliates are an integral part of Meridian’s decentralized growth model. Any user can apply to become a Meridian Affiliate and earn up to $1,500 per successful partnership. Affiliates help onboard DeFi projects that seek incubation, guiding them from initial contact to deal closure. This community-driven expansion strategy empowers everyday users to act as ecosystem ambassadors, while the MST governance system ensures transparency in tracking affiliate rewards and referrals.

Meridian Lend eliminates recurring interest by using an algorithmic borrowing and redemption fee that automatically balances supply and demand for USDM. This model enables users to access liquidity without ongoing debt costs. The collateral requirements are dynamically adjusted to optimize capital efficiency, allowing borrowers to maintain healthy leverage ratios while safeguarding lenders. This approach mirrors a non-custodial liquidity pool design that redistributes fees among participants instead of charging interest to borrowers.

The multi-chain infrastructure of Meridian Finance allows developers to deploy DeFi products seamlessly across networks such as Telos, Base, and Taraxa. By using a shared incubation layer, teams can access pre-built, audited protocol templates—such as Aave v2, Uniswap v2, and GMX v1—without the burden of building infrastructure from scratch. This ecosystem offers built-in liquidity, oracle integrations, customizable branding, and 10-day delivery timelines, making it one of the most developer-friendly DeFi frameworks available today.

You Might Also Like