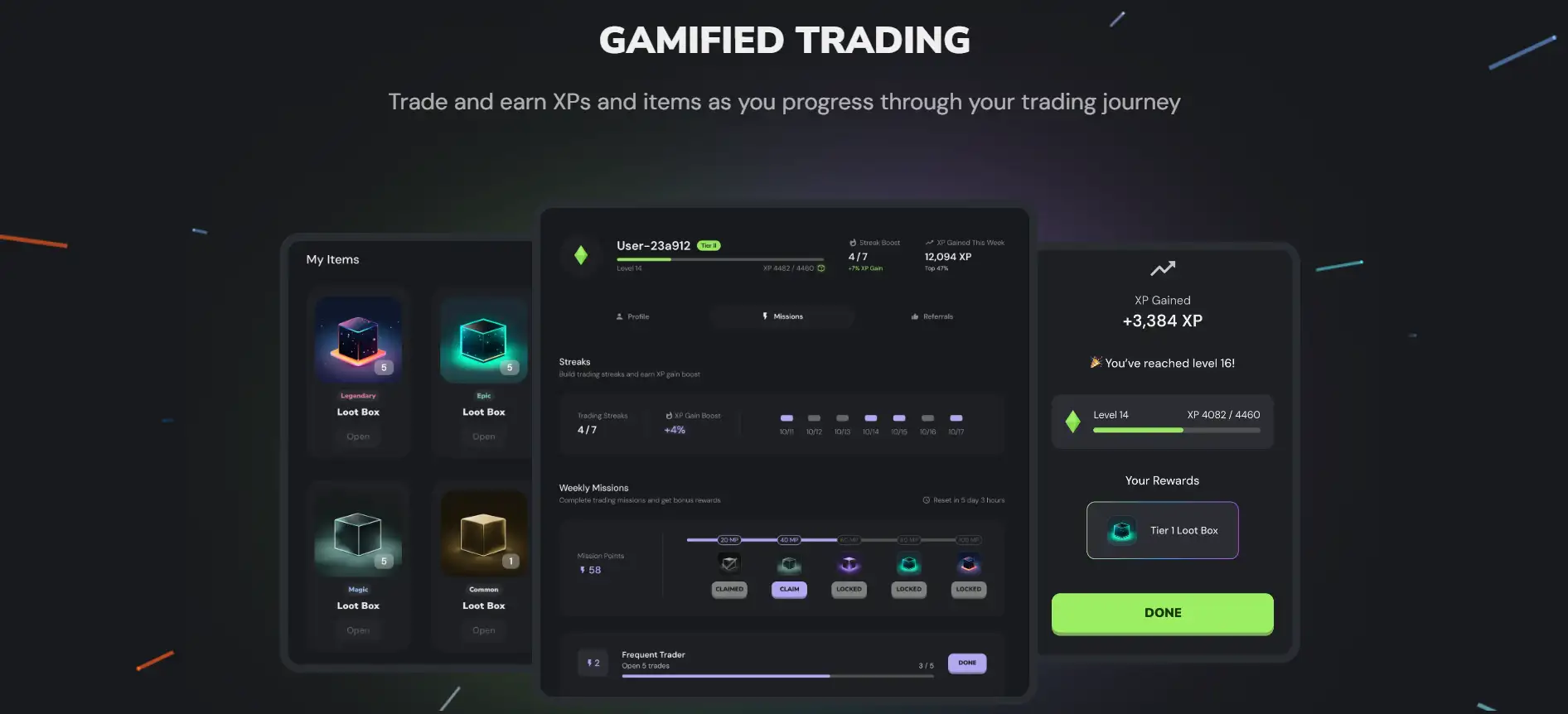

About Merkle Trade

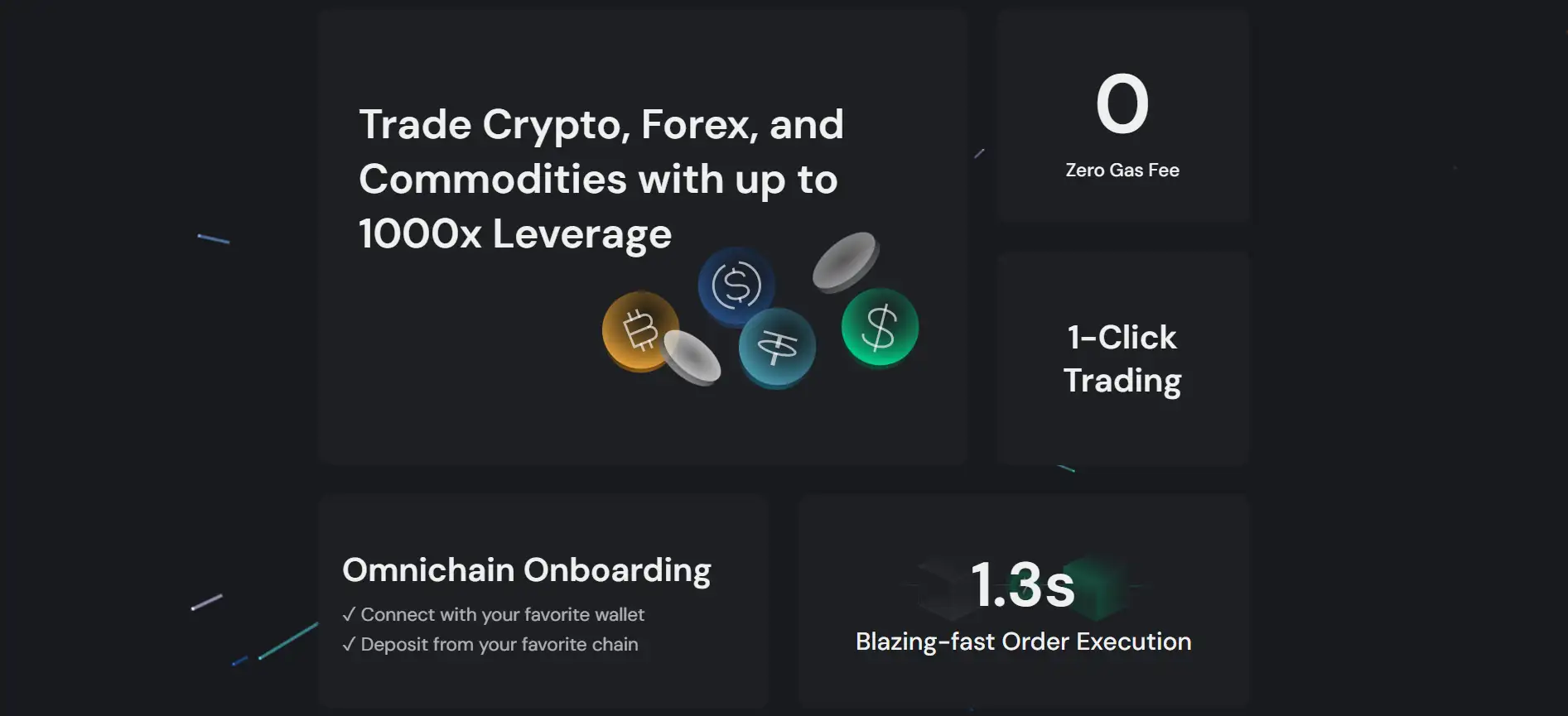

Merkle Trade is a cutting-edge decentralized trading platform that enables users to trade a variety of assets with high leverage and zero slippage. By eliminating intermediaries and offering trustless on-chain execution, it provides a seamless, transparent, and efficient trading experience. The platform supports multiple asset classes, including cryptocurrencies, forex, and commodities, allowing traders to diversify their portfolios while benefiting from a fully decentralized infrastructure.

Unlike traditional trading platforms, Merkle Trade removes counterparty risk by ensuring that all transactions are executed via smart contracts. This guarantees fair pricing, instant execution, and complete user control over funds. With its 100x leverage capabilities and zero price impact on trades, Merkle Trade is positioning itself as a leader in the evolving landscape of on-chain leverage trading.

Merkle Trade is revolutionizing decentralized finance by introducing a highly efficient, user-centric trading experience. Designed to address the limitations of both centralized and decentralized exchanges, the platform offers high-speed execution, deep liquidity, and trustless trading on multiple asset types. Unlike traditional decentralized exchanges (DEXs) that often struggle with issues like slippage, front-running, and limited leverage, Merkle Trade ensures that trades are executed at the exact price set by the user.

A major innovation of Merkle Trade is its use of on-chain price oracles to prevent manipulation and ensure accurate pricing. This, combined with a unique liquidity mechanism, allows users to trade without worrying about unexpected price movements. Unlike centralized exchanges, where users must deposit funds into custodial wallets, Merkle Trade enables direct wallet connections, ensuring full self-custody at all times.

Competitors in the space include dYdX, GMX, and Perpetual Protocol. However, Merkle Trade differentiates itself by offering zero slippage, instant execution, and high leverage, features that many other decentralized platforms struggle to provide. By eliminating common trading inefficiencies, Merkle Trade is setting new standards for on-chain trading.

Merkle Trade provides numerous benefits and features that make it a standout platform in the decentralized trading ecosystem:

- Zero Slippage: Every trade executes at the exact intended price, eliminating unexpected losses due to price movement.

- 100x Leverage: Users can maximize their trading potential with leverage up to 100x, offering greater exposure with smaller capital.

- Trustless & On-Chain Execution: Trades are executed via smart contracts, ensuring full transparency and eliminating reliance on intermediaries.

- Multi-Asset Trading: Supports trading across multiple asset classes, including crypto, forex, and commodities.

- Self-Custody: Users retain full control over their funds by connecting their wallets directly to the platform.

- Fair Pricing & No Front-Running: Powered by accurate on-chain oracles, ensuring fair market conditions and preventing manipulation.

Getting started with Merkle Trade is simple and takes just a few steps:

- Visit the official website: Go to Merkle Trade to access the platform.

- Connect Your Wallet: Use MetaMask, WalletConnect, or other supported wallets to connect securely.

- Deposit Funds: Transfer supported assets to your wallet to start trading.

- Select a Market: Choose from crypto, forex, or commodities trading options.

- Set Leverage & Execute Trades: Adjust leverage settings up to 100x and place trades with zero slippage.

- Monitor and Manage Positions: Utilize risk management tools like stop-loss and take-profit to protect your trades.

Merkle Trade FAQ

Merkle Trade eliminates slippage by using a unique off-chain price oracle combined with a synthetic trading model. Unlike traditional decentralized exchanges (DEXs), which rely on liquidity pools that can be affected by large orders, Merkle Trade executes trades at precise market prices. This ensures that traders receive the exact price they expect, with no unexpected losses due to price movement.

Yes! Merkle Trade offers more than just cryptocurrency trading. The platform supports forex, commodities, and indices, allowing users to trade assets like gold, oil, and fiat currencies. This makes it a versatile platform for traders looking to diversify their portfolios beyond crypto.

Merkle Trade ensures maximum security by operating on a non-custodial, smart contract-based system. All trades are executed directly on-chain, eliminating the risk of exchange hacks or mismanagement. Additionally, the platform integrates secure wallet connections through MetaMask and WalletConnect, ensuring users always retain full control of their funds. For extra protection, Merkle Trade employs price oracles to prevent price manipulation.

Merkle Trade provides 100x leverage through a synthetic trading system that prevents traditional liquidation risks. Instead of borrowing funds from a lender like in traditional margin trading, Merkle Trade uses a risk management pool that balances long and short positions across the platform. This allows traders to access high leverage while mitigating the risk of sudden liquidations.

Merkle Trade is a hybrid decentralized trading platform, meaning it combines the security of on-chain execution with the efficiency of off-chain pricing. While trade settlements happen on-chain, the platform uses an off-chain price oracle to provide accurate market rates in real time. This allows Merkle Trade to maintain decentralization while ensuring fast and precise trade execution.

You Might Also Like