About Messari

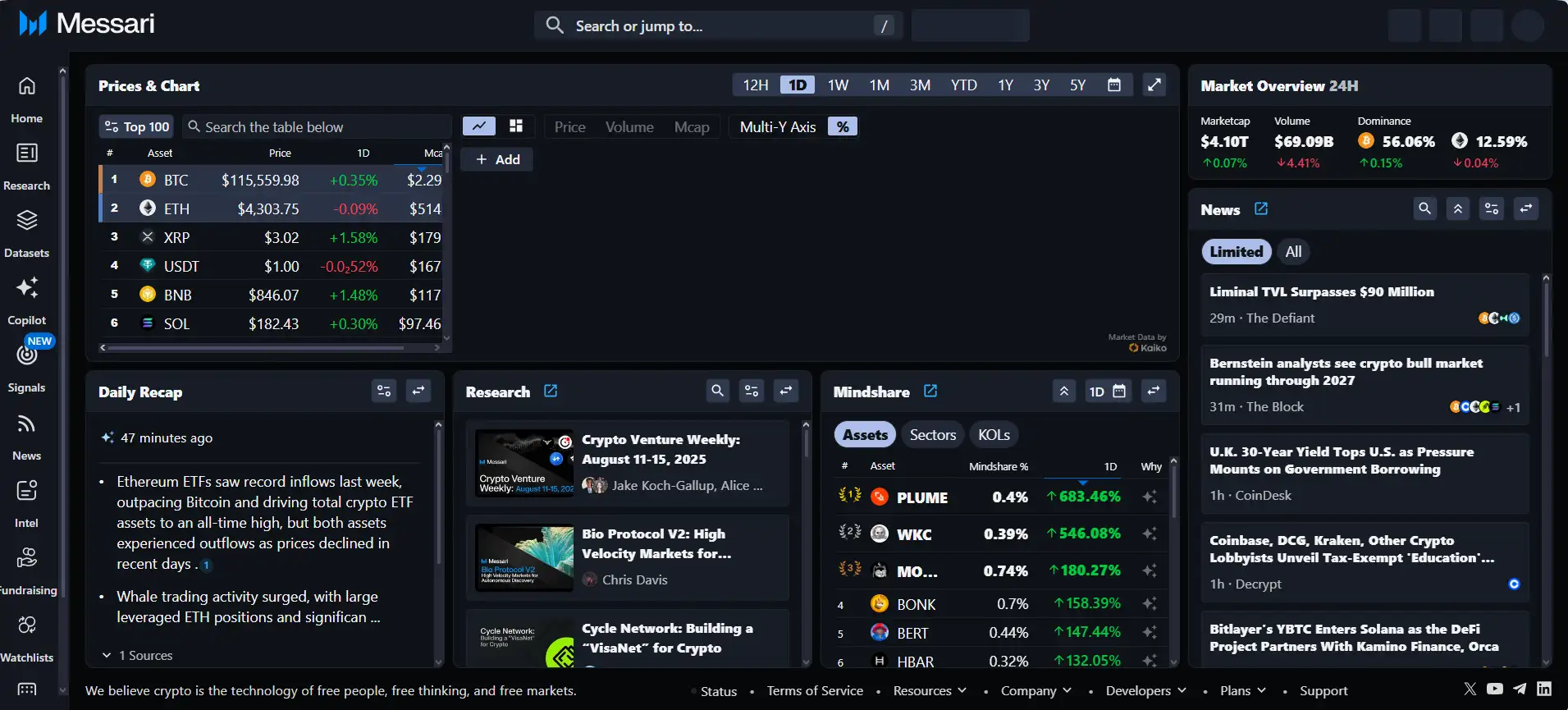

Messari is a leading crypto data and analytics platform that delivers institutional-grade intelligence for digital assets. Designed for both individual and enterprise-level users, Messari aggregates, organizes, and presents critical crypto market data with unmatched transparency and depth. The platform bridges the gap between traditional finance-grade research and the dynamic, decentralized world of Web3.

With features spanning real-time analytics, research, fundraising databases, protocol intelligence, and a developer-centric API suite, Messari equips investors, analysts, and developers with tools to navigate the fast-paced world of blockchain technology. Its commitment to transparency and data integrity has positioned it as a trusted resource in the crypto industry, widely used by institutions, VCs, and developers worldwide.

Messari is one of the most comprehensive platforms in the digital asset space, providing institutional-grade crypto data, analytics, and research tools to support informed decision-making across the ecosystem. Founded in 2018, the platform was built to address the growing need for transparency and quality insights in the rapidly evolving world of cryptoassets. Over the years, Messari has grown from a research publication into a multifaceted intelligence engine that caters to developers, investors, analysts, and enterprises building in Web3.

At the core of Messari’s offering is its expansive suite of data services. From real-time market prices and exchange volumes to deep dives into tokenomics, governance, and protocol analytics, Messari gives users access to insights that go far beyond surface-level tracking. Its advanced features—like token unlock tracking, curated on-chain metrics, and social sentiment signals—make it a favorite among fund managers, protocol teams, and institutions looking for data-driven clarity in an often opaque space. The platform’s tools are modular, catering to different tiers of users, from casual investors to global hedge funds.

In recent years, Messari has placed greater emphasis on developer-focused infrastructure. Its API suite lets developers integrate Messari’s extensive datasets into custom dashboards, research platforms, analytics tools, and DeFi apps. Meanwhile, Messari’s new AI-driven tool, Messari Copilot, delivers context-aware, real-time intelligence powered by both structured and unstructured crypto data. This AI assistant pulls from curated research, governance updates, funding data, and token performance to help professionals streamline analysis and decision-making.

The platform also plays a vital role in tracking crypto venture capital activity, mergers and acquisitions, token launches, and protocol developments. Its fundraising dashboards are widely used by investors to monitor early-stage projects, identify trends in sector allocations, and evaluate performance. For institutions navigating governance, Messari also provides real-time proposal monitoring and voting analytics for hundreds of DAOs and protocols, giving token holders and contributors a more informed position in shaping network outcomes.

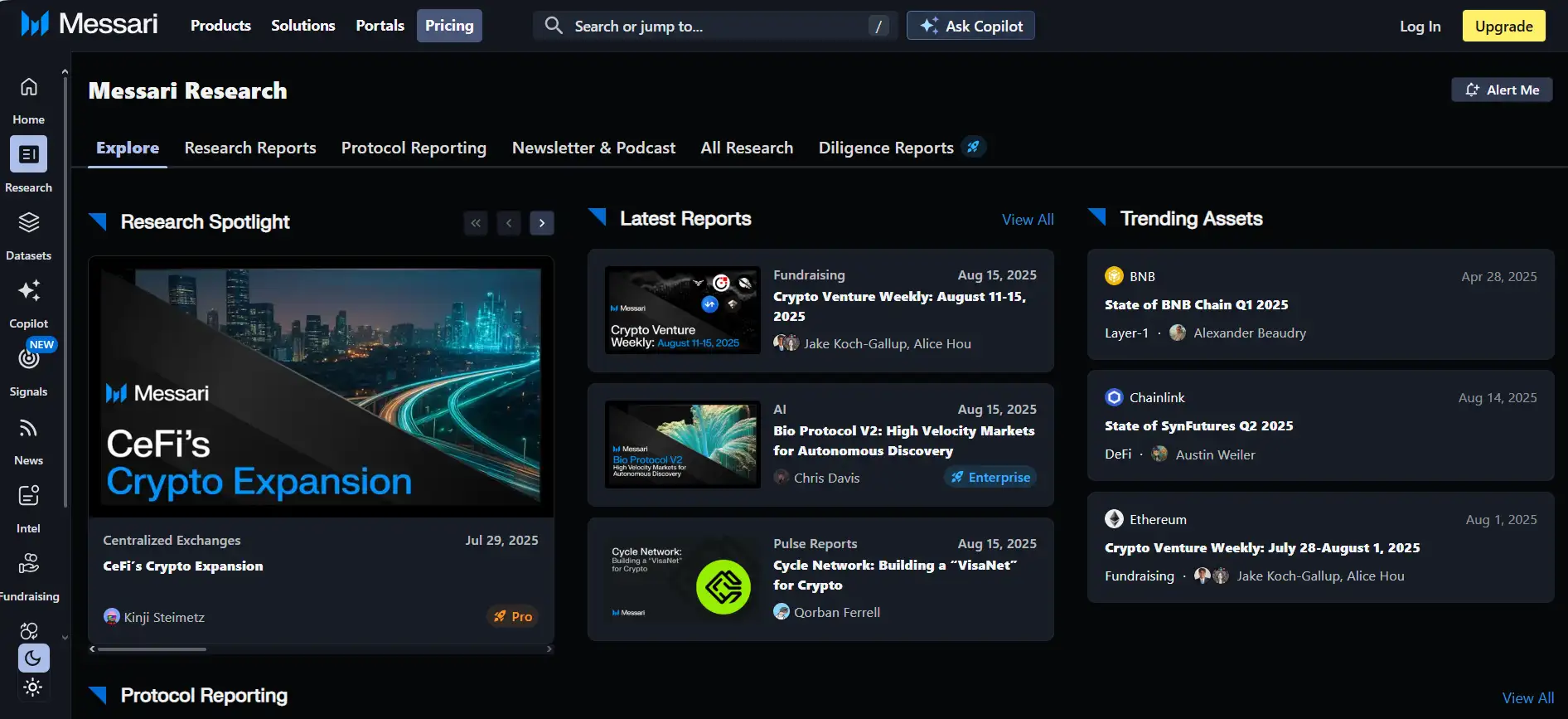

In addition to its tech and data services, Messari remains a leader in crypto research. Its in-house analysts publish high-impact reports covering everything from quarterly ecosystem trends and economic models to technical protocol reviews and governance structures. These resources are critical for keeping the community informed and for supporting broader education in the blockchain space. The platform’s commitment to regulatory transparency and due diligence further sets it apart as a responsible actor in a fast-changing industry.

Messari’s main competitors include CoinGecko, CoinMarketCap, Token Terminal, and Dune Analytics. However, while many of these platforms specialize in user-generated dashboards, broad token listings, or single-metric analysis, Messari excels through a curated, high-integrity approach with layered access to institutional-grade tools and professional insights.

Messari offers a broad range of features and benefits for professionals seeking actionable crypto intelligence:

- Institutional-Grade Research: Deep dive reports, industry analysis, and protocol-level due diligence powered by a professional research team.

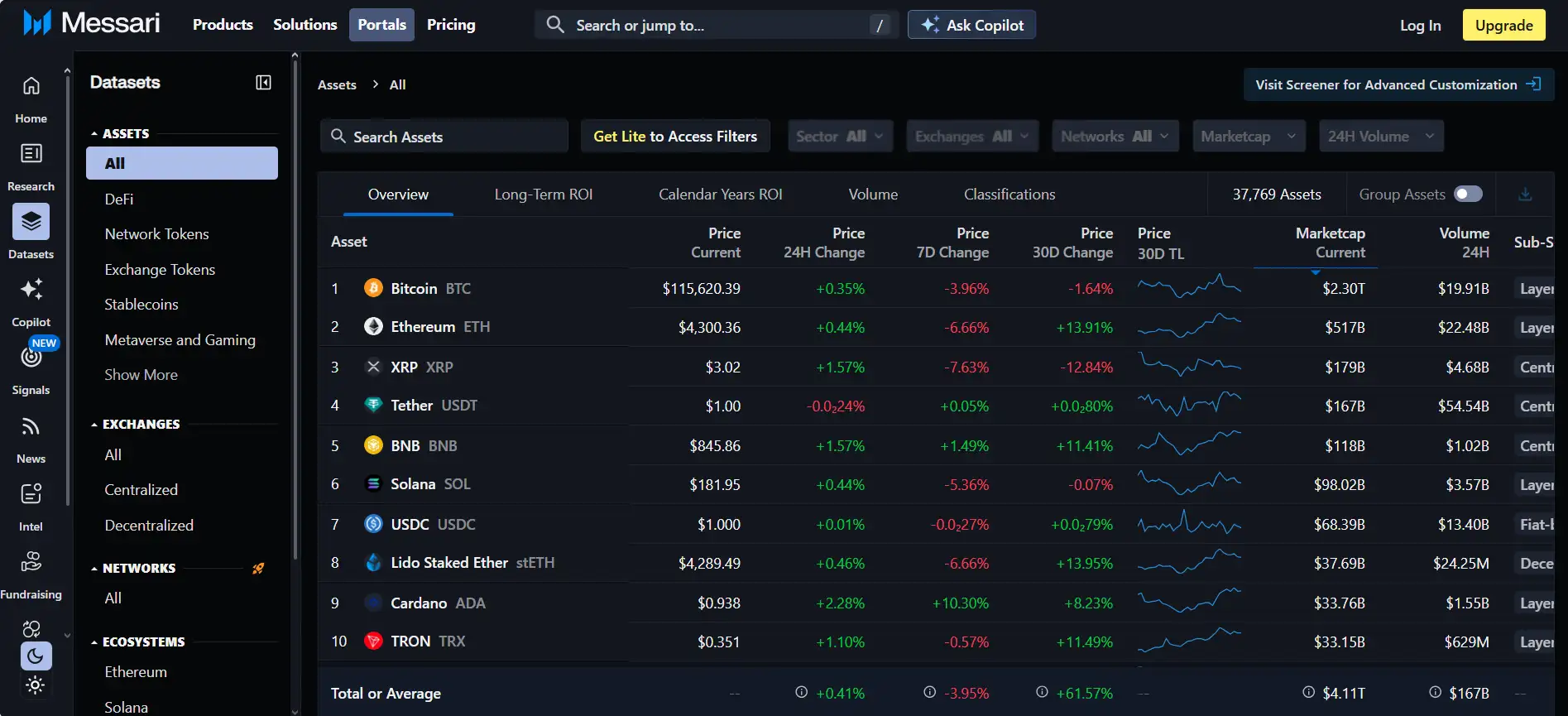

- Real-Time Market Data: Access comprehensive metrics on thousands of assets including price, volume, volatility, and on-chain statistics.

- Fundraising Database: Explore curated datasets on venture capital activity, token unlocks, investor portfolios, and M&A.

- Developer APIs: Use enterprise-ready APIs covering metrics, social signals, newsfeeds, and governance to build robust crypto applications.

- AI-Powered Copilot: An intelligent assistant trained on crypto-specific datasets, enabling natural language data queries and exploration.

- Custom Watchlists & Alerts: Personalized tracking and notifications based on asset movements, governance proposals, and research updates.

- News & Sentiment Tracking: Aggregated news and social signals curated from top-tier sources, delivering a pulse on market narratives.

Getting started with Messari is straightforward for both individuals and businesses:

- Create an Account: Visit Messari.io and click “Log In” or “Sign Up” to create a free or Pro account. A Pro account unlocks full access to research and dashboards.

- Explore the Dashboard: Use the main navigation to view live asset data, charts, fundraising tables, and research reports. Toggle between metrics like volume, dominance, and historical performance.

- Upgrade for Advanced Tools: Users can choose from Pro or Enterprise plans for access to exclusive reports, Copilot AI, historical datasets, and API integrations.

- Use the Screener: Filter and sort assets by market cap, sector, performance, and tokenomics to build a data-driven portfolio view.

- Access APIs: Developers can explore the Messari API documentation to integrate data directly into dashboards, bots, or analytics tools.

- Subscribe to the Newsletter: Stay updated with daily recaps, industry news, and governance votes directly from Messari’s newsletter portal.

Messari FAQ

Messari provides institutional-grade research tools that include detailed reports, tokenomics analysis, governance tracking, and VC deal flow data. Its professional research team delivers in-depth protocol reviews, market sector analysis, and investment-grade content tailored for funds, exchanges, and regulators. Users can access these insights directly on Messari through dashboards, newsletters, and the dedicated research portal.

Messari Copilot is an AI-powered assistant that combines real-time structured and unstructured crypto data to deliver fast, context-aware answers. Trained on Messari’s own datasets and research, Copilot can summarize project fundamentals, track governance proposals, explain on-chain metrics, and help investors or analysts find relevant data quickly. It’s built for professionals who need real-time intelligence without having to sift through multiple platforms. Available via Messari Copilot.

Messari offers an advanced fundraising tracker that aggregates deal flow, token launches, M&A activity, and investor portfolios in one place. This includes real-time updates on protocol raises, strategic investments, and detailed profiles of VCs involved. Users can filter by date, sector, funding round, and investor name. This tool is widely used by both crypto-native investors and institutional allocators. Explore it on the Messari Fundraising Dashboard.

Yes. Messari offers a powerful API suite tailored for developers building in crypto. These APIs include market metrics, protocol data, token unlock schedules, governance proposals, and more. Developers can use this to create custom dashboards, bots, trading tools, and analytics platforms. API access supports use cases across DeFi, wallets, exchanges, and VC research. Full documentation is available at the Messari API Portal.

Messari’s governance dashboard enables users to monitor DAO proposals, voting activity, and governance structures across multiple protocols. The platform provides real-time alerts for new proposals, status changes, and vote outcomes. It also includes delegate tracking and proposal-level analysis to help users make informed decisions. This is particularly useful for active token holders and delegates looking to participate in decentralized decision-making.

You Might Also Like