About MiniPay

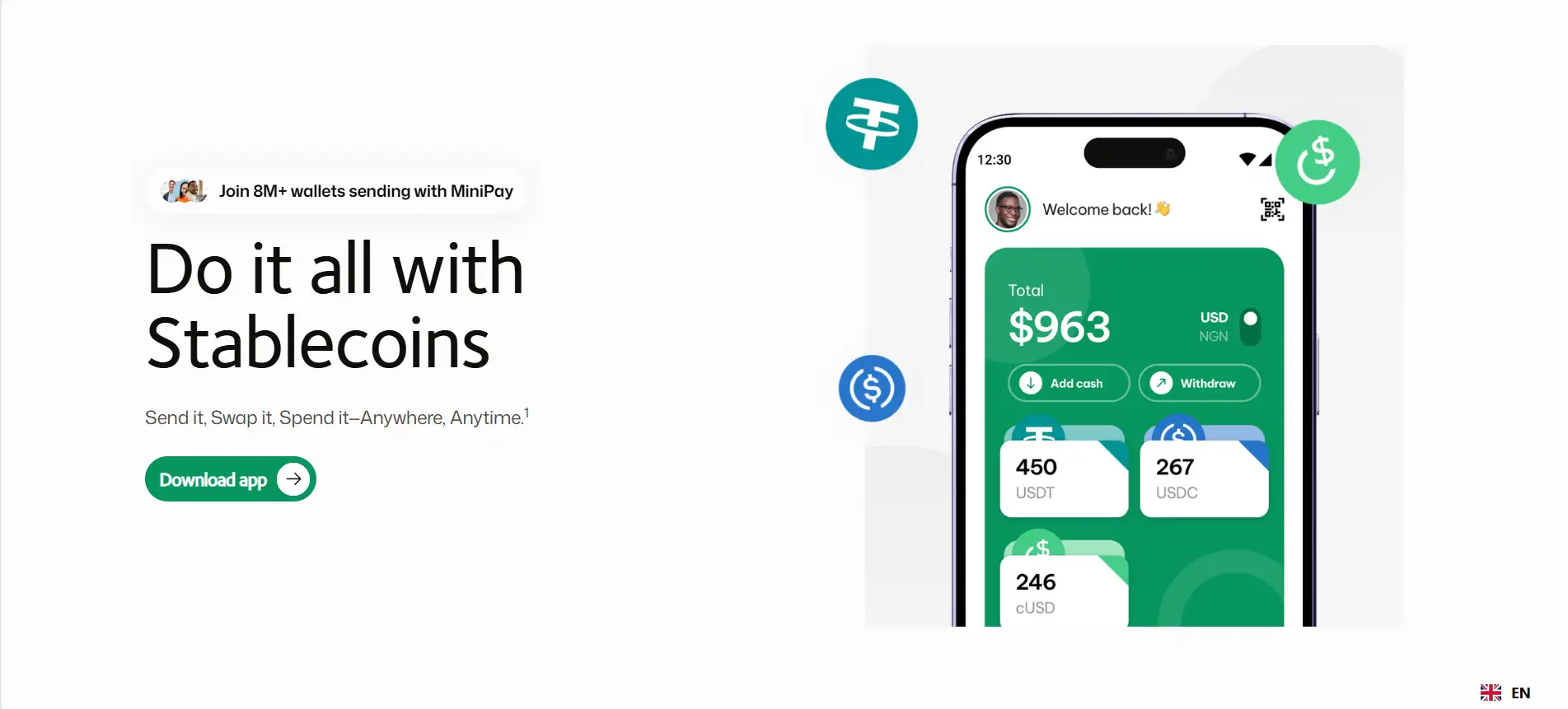

MiniPay is a modern, lightweight, and user-friendly stablecoin wallet built on the Celo blockchain, enabling users to send, swap, and spend stablecoins globally with ease. Designed for simplicity and scale, it brings financial tools to mobile-first users across 50+ countries by turning phone numbers into wallet addresses. Every MiniPay wallet is self-custodial and mapped to a verified phone number, ensuring both security and usability.

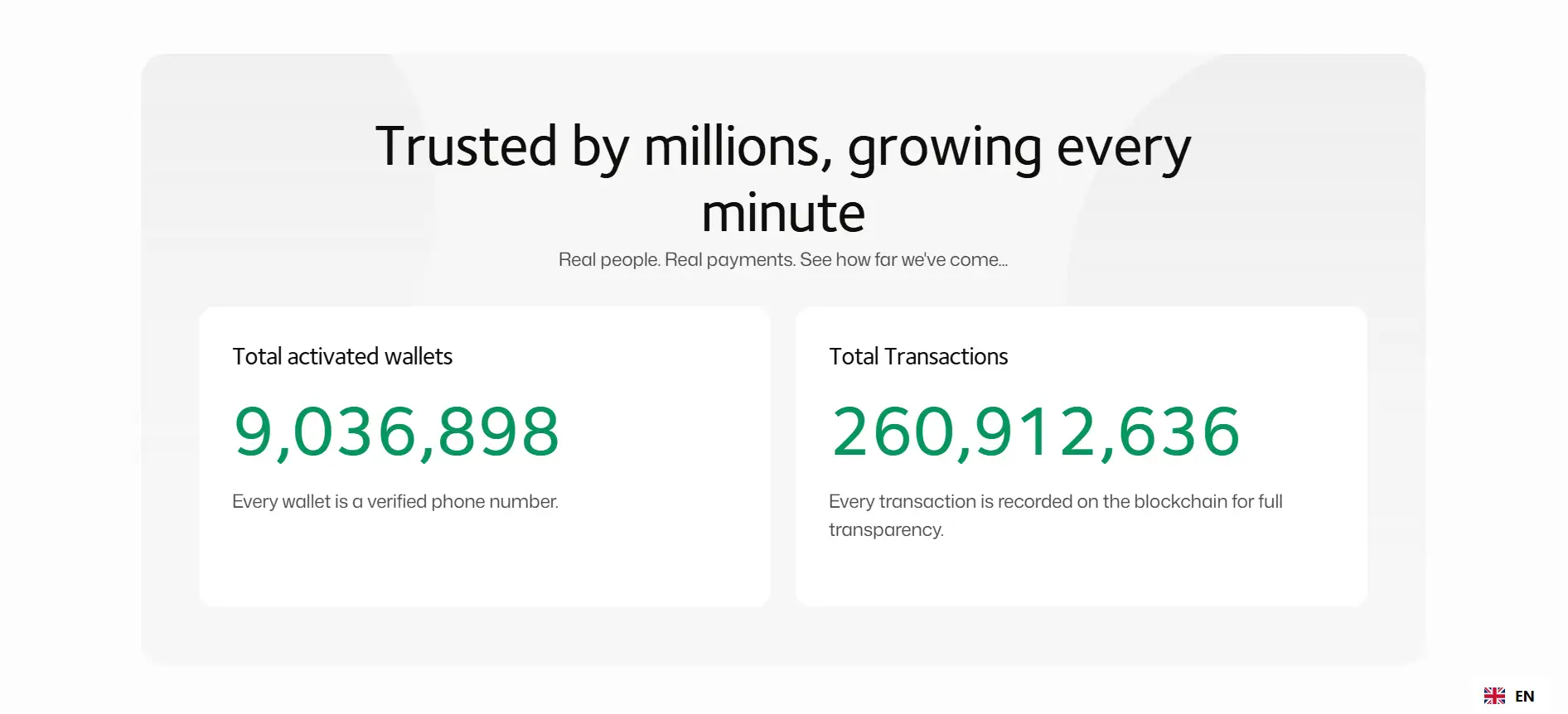

From Africa to Europe and beyond, MiniPay is trusted by over 9 million activated wallets, enabling near-instant peer-to-peer stablecoin transfers with sub-cent fees. Whether you’re topping up with mobile money, bank transfers, Apple Pay, or card, MiniPay ensures seamless conversion between local currencies and USD-based stablecoins such as USDC, USDT, and cUSD. All transactions are transparent and recorded on-chain.

MiniPay emerged in 2023 as an initiative by Opera, one of the world’s most widely used mobile browsers, to democratize access to stablecoin-powered digital payments. First launched in Nigeria and now integrated into Opera Mini across Africa, MiniPay has expanded into a global platform with a standalone mobile app for Android and iOS. With a footprint in over 50 countries and more than 260 million recorded blockchain transactions, MiniPay redefines how everyday users interact with crypto.

What sets MiniPay apart is its ability to provide near-zero transaction fees, achieved through fee abstraction on the Celo blockchain. Transactions cost under $0.01, and users can send stablecoins with the simplicity of texting, using only a recipient’s phone number. The platform supports a wide range of local on/off-ramp options, thanks to partnerships with providers like Cashramp, Transak, BitGifty, and Pretium. These integrations enable fast and frictionless exchange between fiat and stablecoins in over 35 local currencies.

A core part of the ecosystem is Mini Apps, a feature that lets users access real-world tools—like bill payment, savings, games, and donations—natively inside the MiniPay app without needing separate accounts or installations. These dApps run directly inside the wallet, utilizing the stablecoin infrastructure and benefiting from millions of active users. Developers can build and deploy Mini Apps using standard web technologies and instantly scale through MiniPay's built-in distribution.

Security is central to MiniPay’s design. It’s a non-custodial wallet, meaning users hold their private keys. Additional safety layers include biometric authentication, full blockchain transaction transparency, and Google backup integration to protect against data loss. By combining accessibility, stability, and powerful developer tooling, MiniPay is fast becoming the preferred wallet for stablecoin adoption in emerging markets and beyond.

Competitors to MiniPay include Trust Wallet, MetaMask, Coinomi, and Rabby Wallet. However, unlike these multi-chain solutions, MiniPay is optimized specifically for stablecoin usability, fast local transfers, and Mini App integrations—making it uniquely user-focused and mobile-native.

MiniPay provides numerous benefits and features that make it one of the most accessible stablecoin wallets in the world:

- Phone Number-Based Transfers: Send stablecoins as easily as sending a text—just enter a verified mobile number.

- Sub-Cent Transaction Fees: Built on Celo, transactions cost less than $0.01, making international payments truly affordable.

- Self-Custodial Design: Users hold their own keys, with added protection from biometric security and Google backup.

- Zero-Fee On/Off-Ramps: In select markets, users can buy and sell stablecoins like USDT, USDC, and cUSD with no extra charges.

- Cash Links: Send money via link—recipients claim funds instantly, no account required.

- Pockets: Easily swap between multiple stablecoins with a simple drag-and-drop interface.

- Hold & Earn: Users can earn up to 2% per week just by holding stablecoins in supported markets.

- Mini Apps: Access and use dApps inside the wallet for everyday actions—pay bills, buy airtime, or donate—without extra setup.

MiniPay offers a highly intuitive onboarding process designed for first-time crypto users and power users alike:

- Download the App: Visit MiniPay and download the standalone Android or iOS app, or use it inside Opera Mini on Android devices.

- Create a Wallet: Sign up using your phone number and link your Google or Apple account. This enables instant wallet recovery and sync.

- Buy Stablecoins: Top up using mobile money, card, Apple Pay, or bank transfers via partnered providers like Transak or Cashramp.

- Send or Swap: Use phone numbers to send funds instantly, or drag and drop stablecoins between USDC, USDT, and cUSD using the Pockets feature.

- Explore Mini Apps: Access tools like bill payments, savings platforms, recharge top-ups, and more directly inside the app—no extensions required.

- Enable Security Features: Set up biometric authentication and check that Google Backup is enabled for safety and recovery.

- Earn Rewards: In select markets, opt into reward programs and earn daily yields just by holding stablecoins.

- Developer Mode (for builders): Developers can deploy their own Mini Apps inside MiniPay by following official MiniPay documentation.

MiniPay FAQ

MiniPay maps each wallet to a verified phone number, transforming how people send stablecoins. Instead of copying and pasting long wallet addresses, users simply input the recipient’s mobile number—just like sending a text message. This makes the wallet more accessible to first-time crypto users and accelerates adoption in mobile-first regions. Every MiniPay transaction is self-custodial and recorded on-chain for transparency.

Cash Links are a unique MiniPay feature that lets users send stablecoins via a shareable link. These links can be delivered through text or email, allowing the recipient to claim funds instantly—even if they haven’t set up a wallet yet. This breaks down typical onboarding friction and enables crypto gifting, donations, or emergency transfers with ease. Try Cash Links via MiniPay.

Yes! With MiniPay's Hold & Earn feature, users can earn up to 2% weekly rewards just by maintaining a stablecoin balance in supported markets. There are no staking requirements, lock-up periods, or complicated DeFi interactions—just hold your funds and watch them grow. The rewards are automatically credited and fully accessible at any time. Learn more directly in the MiniPay app.

Through the Mini App ecosystem, MiniPay enables developers to embed dApps directly into the wallet—no separate installs or wallet connections needed. Mini Apps get instant visibility inside the MiniPay Explore section, gaining access to millions of users with native stablecoin rails. This makes it easier than ever to launch, test, and scale Web3 apps in real-world markets.

MiniPay offers integrated Google backup for seamless recovery. Your private key is encrypted and stored securely, allowing you to restore your wallet simply by logging in with your Google account and verified phone number. This ensures you never lose access to your funds, even in the event of device loss or app deletion. Learn more at MiniPay.

You Might Also Like