About Minswap

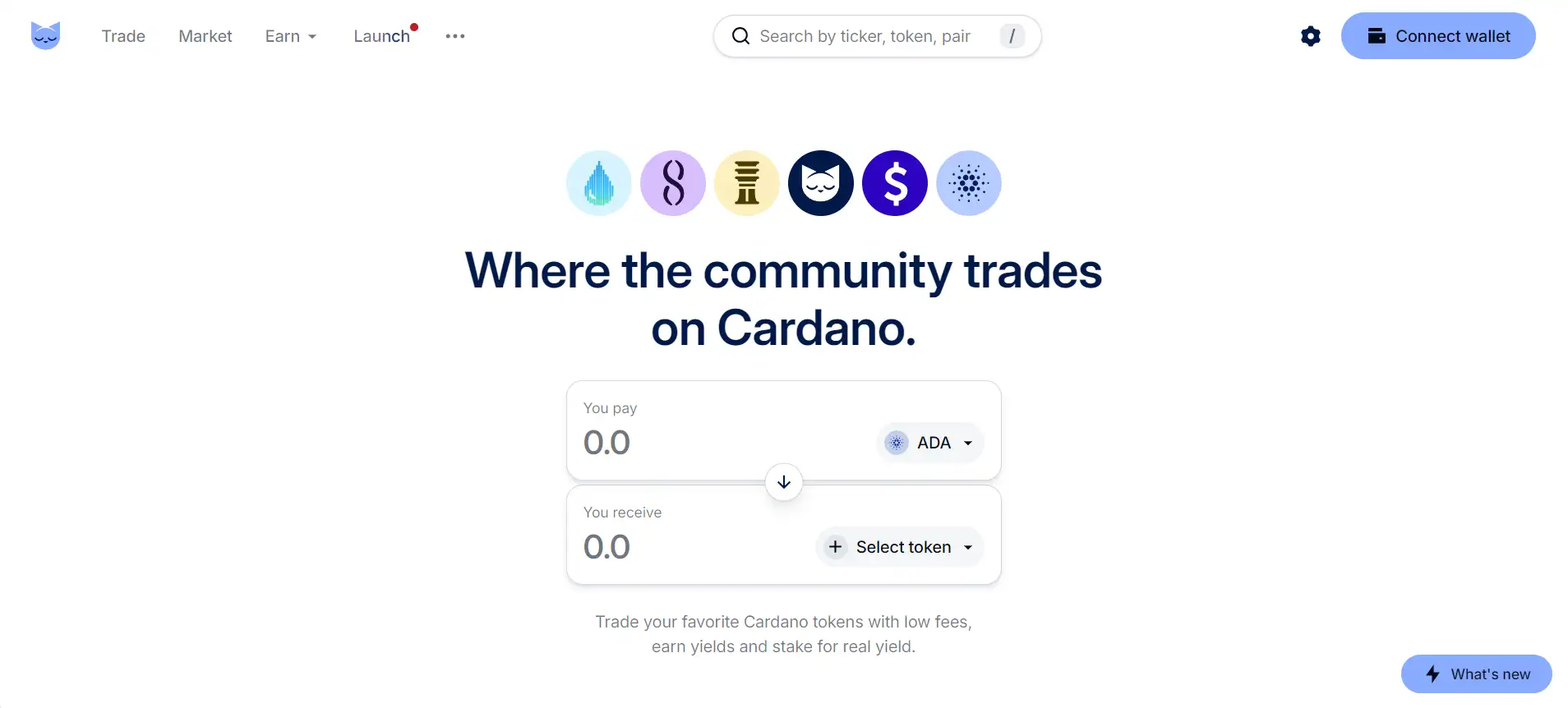

Minswap is a leading decentralized exchange (DEX) built on the Cardano blockchain, designed to facilitate secure, low-cost, and permissionless token swaps. Unlike centralized exchanges, Minswap enables users to trade directly from their wallets without the need for intermediaries, ensuring complete control over their assets. With its Automated Market Maker (AMM) model, the platform provides deep liquidity and efficient trading, making it a crucial part of the growing Cardano DeFi ecosystem.

One of the key differentiators of Minswap is its commitment to fair and community-driven governance. Unlike many other projects that favor venture capitalists, Minswap was launched through a fair mechanism that prioritizes decentralization. The platform also integrates multi-pool liquidity solutions, enhancing efficiency for traders and liquidity providers alike. With competitive alternatives like SundaeSwap and WingRiders, Minswap continues to innovate by offering a seamless, cost-effective, and fully decentralized trading experience.

Minswap is a next-generation decentralized exchange (DEX) built on Cardano, aiming to provide an efficient and permissionless trading environment. Launched with the vision of being a fully community-owned platform, Minswap eliminates the need for intermediaries, ensuring users maintain full control over their assets. The platform operates on an Automated Market Maker (AMM) model, which allows for instant token swaps, reducing slippage and optimizing liquidity.

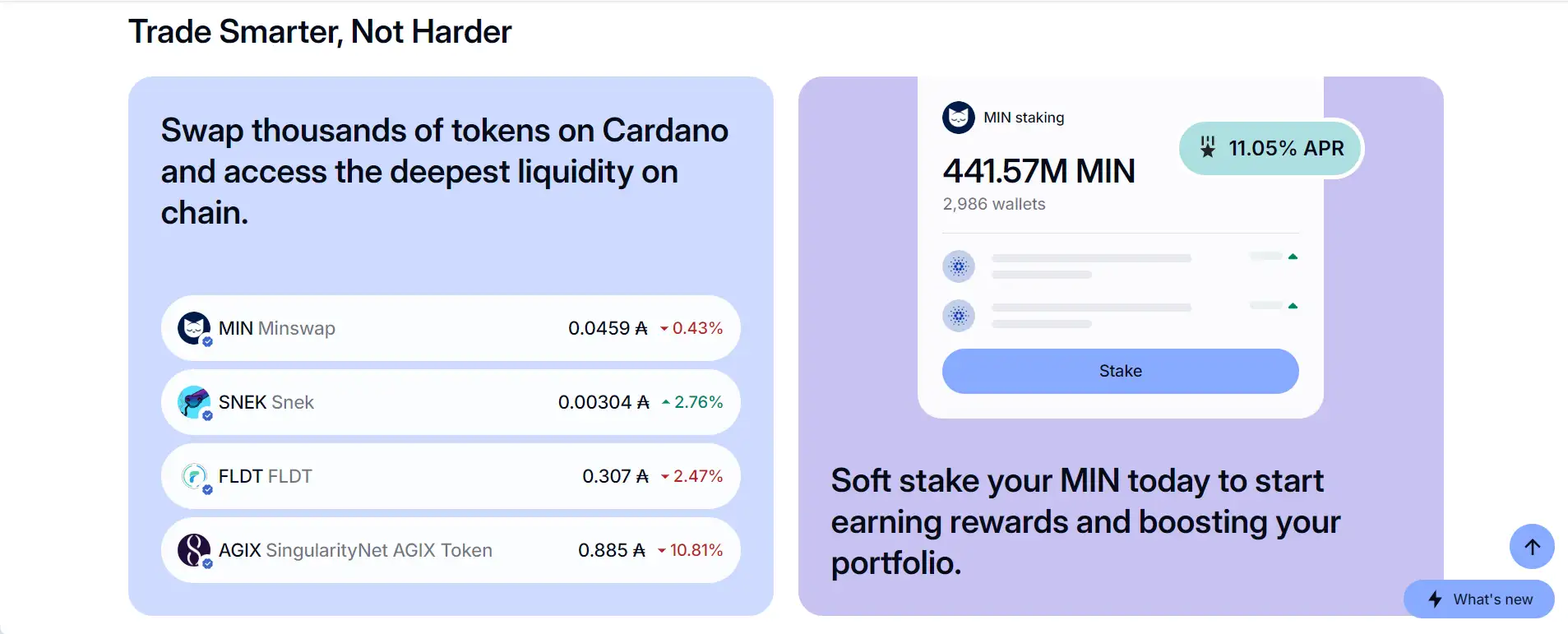

A standout feature of Minswap is its multi-pool liquidity model, which integrates various types of liquidity pools, such as Constant Product Pools, StableSwap Pools, and Multi-Asset Pools. This innovation allows traders to access deeper liquidity while giving liquidity providers more options to maximize their returns. Unlike other Cardano DEXs, Minswap is committed to decentralization, enabling governance decisions to be made by the community rather than a centralized entity.

Compared to competitors like SundaeSwap and WingRiders, Minswap stands out due to its lower transaction fees, fair launch model, and advanced yield farming mechanisms. Additionally, Minswap benefits from Cardano’s scalable and secure infrastructure, ensuring fast transactions with minimal costs. The platform also undergoes regular security audits to protect user funds, making it one of the safest DEXs in the Cardano DeFi ecosystem.

By offering a user-friendly interface, extensive liquidity pools, and community-driven governance, Minswap has positioned itself as a key player in the decentralized finance space. Whether you're looking to swap tokens, provide liquidity, or participate in yield farming, Minswap delivers a seamless and rewarding experience.

Minswap provides numerous features and benefits that make it a standout decentralized exchange within the Cardano DeFi ecosystem:

- Fully Decentralized: Minswap is governed entirely by its community, ensuring that no centralized entity controls the platform.

- Multi-Pool Liquidity Model: Users can leverage various liquidity pool types, such as StableSwap Pools for stablecoins and Constant Product Pools for high-volatility assets.

- Low Trading Fees: Thanks to Cardano’s efficient blockchain, Minswap offers lower fees compared to many Ethereum-based DEXs.

- Yield Farming: Liquidity providers can stake their LP tokens to earn additional rewards, making it a profitable option for passive income.

- Secure & Transparent: The platform undergoes regular security audits to protect user funds and ensure reliability.

- Non-Custodial Trading: Users retain full control over their assets, eliminating the need to trust third-party custodians.

- Community-Driven Governance: Users can vote on platform upgrades and new features, making Minswap one of the most decentralized DEXs in the industry.

Getting started with Minswap is easy and requires only a few steps:

- Set Up a Cardano Wallet: Install a Cardano-compatible wallet such as Nami Wallet, Eternl, or Flint.

- Fund Your Wallet: Purchase ADA or other Cardano-native tokens from an exchange and send them to your wallet.

- Connect to Minswap: Visit Minswap and connect your wallet to begin trading.

- Swap Tokens or Provide Liquidity: Instantly trade tokens or contribute to liquidity pools to earn rewards.

- Join Yield Farming: Stake your LP tokens to earn extra rewards and maximize your profits.

Minswap FAQ

When you remove your liquidity from Minswap, your unclaimed farming rewards will be lost. To ensure you receive your earned rewards, always claim them before withdrawing liquidity. The platform does not auto-claim rewards, meaning users must manually retrieve them to maximize their returns.

No, you need a small amount of ADA in your wallet to cover transaction fees. Since Minswap operates on the Cardano blockchain, all transactions require a minimal ADA fee. Make sure your wallet has enough ADA before attempting a swap to avoid failed transactions.

Impermanent loss is an inherent risk of providing liquidity in Automated Market Maker (AMM) models like Minswap. The platform does not eliminate impermanent loss, but liquidity providers can mitigate it by choosing stable pairs, diversifying investments, or participating in yield farming to offset potential losses. Users should assess risks before committing funds to liquidity pools.

Transaction speed on Minswap depends on network congestion, liquidity availability, and the complexity of the swap. During high activity periods, transactions may take longer to confirm. Additionally, if a swap involves low-liquidity tokens, the platform may require more time to process the trade efficiently.

If your transaction is stuck on Minswap, first check the Cardano blockchain explorer to see if it has been processed. If it remains pending, try increasing the transaction fee (if supported by your wallet) or resubmitting the transaction. In rare cases, network congestion may cause delays, and waiting for confirmation might be necessary.

You Might Also Like