About Momentum

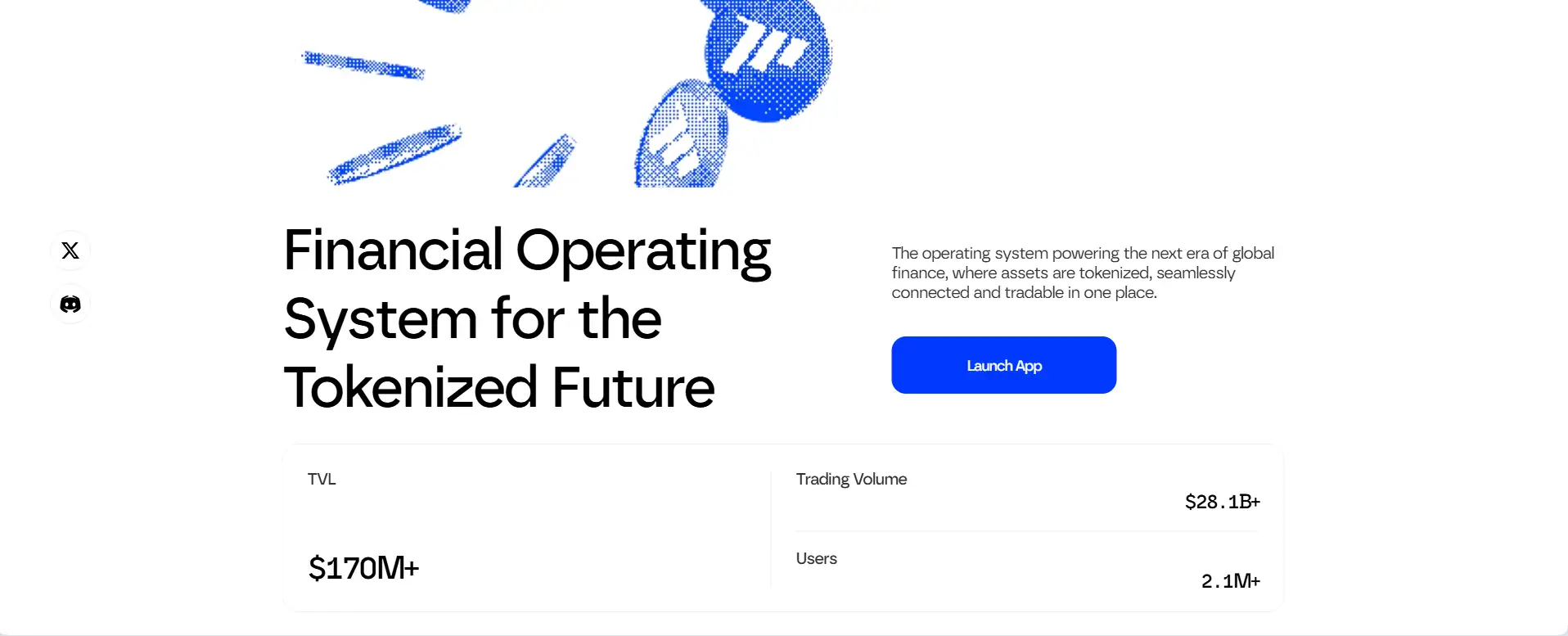

Momentum is a next-generation financial operating system built to unify decentralized and traditional finance by enabling the seamless trading of both crypto-native and real-world tokenized assets. At its core, it is designed to be the infrastructure layer for a tokenized future—one where all assets, from cryptocurrencies to equities, commodities, and intellectual property, can move and be traded freely on a single platform. With a multi-phase roadmap, Momentum is strategically evolving from a Sui-native liquidity hub into a full-fledged global marketplace for tokenized assets.

The platform combines cutting-edge tools like a CLMM-based DEX, automated vaults, liquid staking with xSUI, the MSafe multi-sig solution, and institutional compliance with Momentum X. These components are tightly integrated to serve a wide range of users—from retail DeFi traders to institutional investors. Powered by Sui’s high-performance blockchain and the Wormhole interoperability layer, Momentum aims to reshape how assets are created, managed, and traded in a secure, compliant, and composable environment.

Momentum is an all-in-one tokenized financial infrastructure platform launched to address the fragmentation and inefficiencies that exist in both decentralized and traditional markets. Built on the Sui blockchain, Momentum seeks to create a fully connected, on-chain ecosystem where any asset—whether a digital token or real-world security—can be traded and managed seamlessly. Its phased roadmap positions it as the “Robinhood of the tokenized era,” progressively integrating deeper functionality and broader asset classes over time.

Phase One focuses on establishing a robust Sui-native foundation. Key live products include Momentum DEX, a CLMM-based exchange with over $600M TVL and $25B in trading volume; xSUI, a capital-efficient liquid staking solution; and MSafe, a secure multi-sig wallet that supports treasury management and token vesting. These components anchor Momentum’s DeFi offering, providing users with high-speed, low-fee, and secure infrastructure.

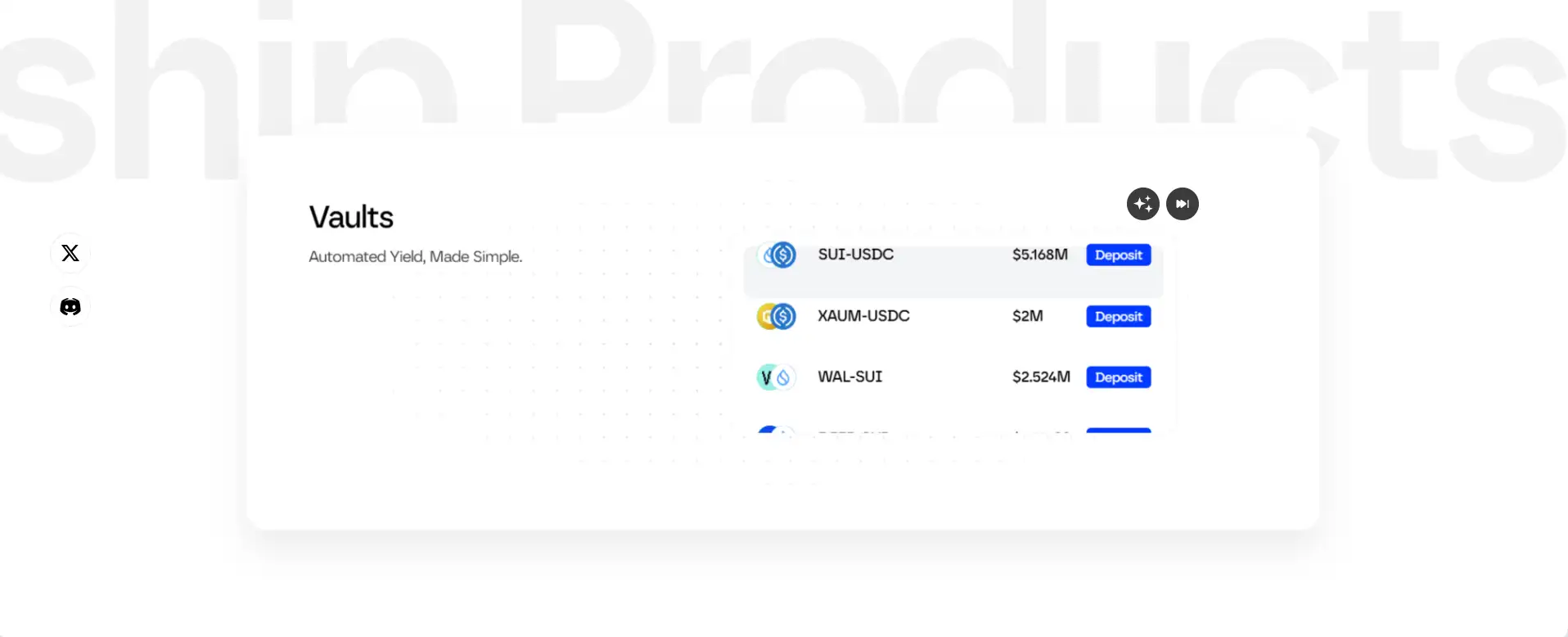

In Phase Two, Momentum expands beyond Sui to support cross-chain assets through Wormhole’s universal messaging layer. This allows users to bridge and trade tokens from ecosystems like Ethereum and Solana, removing the silos between chains. Automated yield vaults also roll out in this phase—ranging from simple rebalancing strategies to complex, multi-asset strategies. These features not only enhance capital efficiency but also attract sticky liquidity from both retail and institutional players.

Phase Three introduces Momentum X, a compliance-first trading and identity layer enabling real-world assets (RWAs) like tokenized stocks and commodities to co-exist with crypto assets. Features include programmable KYC/AML enforcement, cross-chain compliance, and a unified trading interface, solving major institutional hurdles like identity re-verification and fragmented liquidity. This phase also lays the groundwork for derivatives trading, further strengthening Momentum’s institutional appeal.

Momentum competes with platforms like dYdX (for derivatives and compliance), and Curve Finance (for liquidity and vault strategies). What differentiates Momentum is its fully integrated suite, unifying trading, compliance, staking, and real-world asset tokenization—all governed through veMMT incentives. By aligning capital efficiency, compliance, and accessibility, Momentum is positioned to onboard the next billion users and institutions into DeFi.

Momentum offers a wide array of benefits and features that make it a dominant player in the evolving tokenized finance ecosystem:

- Unified Financial OS: Momentum acts as the central operating system for DeFi and traditional finance, allowing seamless trading of both crypto and real-world assets.

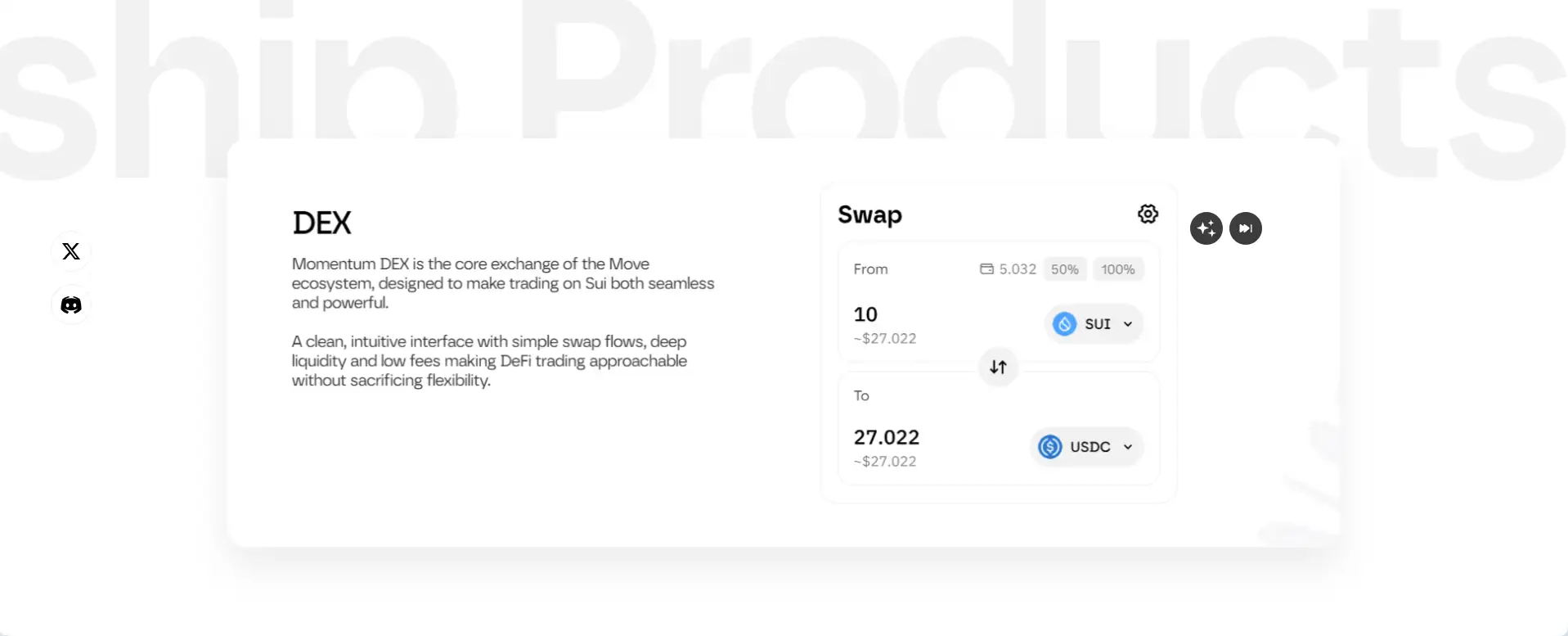

- Momentum DEX: Built on a CLMM model, the DEX offers tighter spreads, deeper liquidity, and capital-efficient trading for both retail and institutions.

- xSUI Liquid Staking: Users can stake SUI and receive xSUI, enabling yield generation across multiple DeFi protocols while contributing to network security.

- MSafe Multi-Sig: Institutional-grade treasury and token management with support for flexible access control across multiple chains like Aptos, IOTA, and Movement.

- Momentum X Compliance Layer: Introduces KYC/AML-enforced trading for tokenized assets, providing regulatory-grade access without compromising decentralization.

- Automated Vault Strategies: Offers high-yield DeFi strategies, from auto-rebalancing to leveraged farming, making sophisticated yields accessible to all.

- Token Generation Lab (TGL): Launchpad for bluechip projects with no upfront fees and built-in community incentives for early adopters and veMMT holders.

- Cross-Chain Liquidity: Wormhole integration enables asset interoperability across ecosystems like Ethereum and Solana, vastly increasing market access.

- Institutional Features: Optional proof-of-reserves, audit trails, and custody integrations ensure institutional-grade infrastructure.

Momentum provides a streamlined onboarding process for both retail users and institutions who want to engage with its DeFi ecosystem:

- Step 1 – Visit the Official Site: Go to Momentum’s website and click on “Launch App” to access the dashboard.

- Step 2 – Connect Your Wallet: Use a compatible wallet (such as Martian, Suiet, or Ethos) that supports the Sui blockchain. You may need to approve connection requests.

- Step 3 – Choose Your Feature: Navigate to DEX, Vaults, Liquid Staking, or Token Launchpad. The interface is user-friendly and provides tooltips for guidance.

- Step 4 – Stake or Trade: For liquid staking, go to the xSUI section and deposit your SUI to receive xSUI. To trade, use the Momentum DEX's swap interface for low-fee, high-liquidity swaps.

- Step 5 – Explore Vaults: Choose automated vaults based on your preferred strategies—rebalancing, leverage, or cross-chain—to start earning yield.

- Step 6 – Earn Rewards: Participate in governance with veMMT, provide liquidity, or refer users to accumulate rewards and access beta features.

- Documentation: For in-depth guidance, refer to the official Momentum documentation.

Momentum FAQ

Momentum achieves a balance between regulatory compliance and DeFi composability through Momentum X, its institutional-grade trading and compliance layer. Using zero-knowledge identity systems and on-chain programmable access control, the platform enables users to complete KYC/AML verification once and access tokenized assets globally—without centralized intermediaries. This setup allows full compliance for tokenized RWAs while ensuring that users retain self-custody and composability across DeFi protocols.

xSUI transforms staked SUI into a liquid, composable asset that continues to earn staking rewards while remaining active across DeFi protocols. Users can stake once and then utilize xSUI in trading, lending, and liquidity provisioning—making it a powerful building block for Momentum’s capital efficiency. The synergy between xSUI and Momentum DEX incentivizes deeper liquidity and higher DeFi utility, positioning xSUI as essential to Sui’s long-term financial scalability.

MSafe, Momentum’s institutional-grade multi-sig treasury management tool, enables secure governance workflows across chains like Sui, Aptos, and IOTA. It underpins DAO operations by offering configurable access control, on-chain execution, and vesting automation, helping decentralized teams and protocols maintain transparency and operational trust. On Momentum, MSafe acts as the secure bridge between institutional needs and DeFi flexibility, making it a cornerstone of scalable governance.

The Token Generation Lab (TGL) bypasses traditional VC-led launches by prioritizing distribution to real users—including DEX participants and NFT holders within the Momentum ecosystem. TGL avoids upfront fees and dumps by locking launchpad token rewards for 12 months and redirecting fees to over 150,000 community participants. This structure creates an alignment between projects and long-term contributors, not just speculative investors.

Momentum's auto-rebalancing vaults simplify yield farming by passively managing liquidity in concentrated ranges on Momentum DEX. These vaults adapt to market conditions in real time, maintaining optimal exposure while reducing impermanent loss. For users, this means institutional-grade returns without micromanagement. For the DEX, it results in deeper books and tighter execution, effectively making vaults a dual engine for trading performance and passive income.

You Might Also Like