About Moola Market

Moola Market is a decentralized, non-custodial liquidity protocol built on the Celo blockchain. It allows users to lend, borrow, and earn interest on their crypto assets, providing an accessible and efficient financial solution. By leveraging Celo’s mobile-first technology and low transaction fees, Moola Market enhances financial inclusion, especially for users in emerging markets who lack access to traditional banking services.

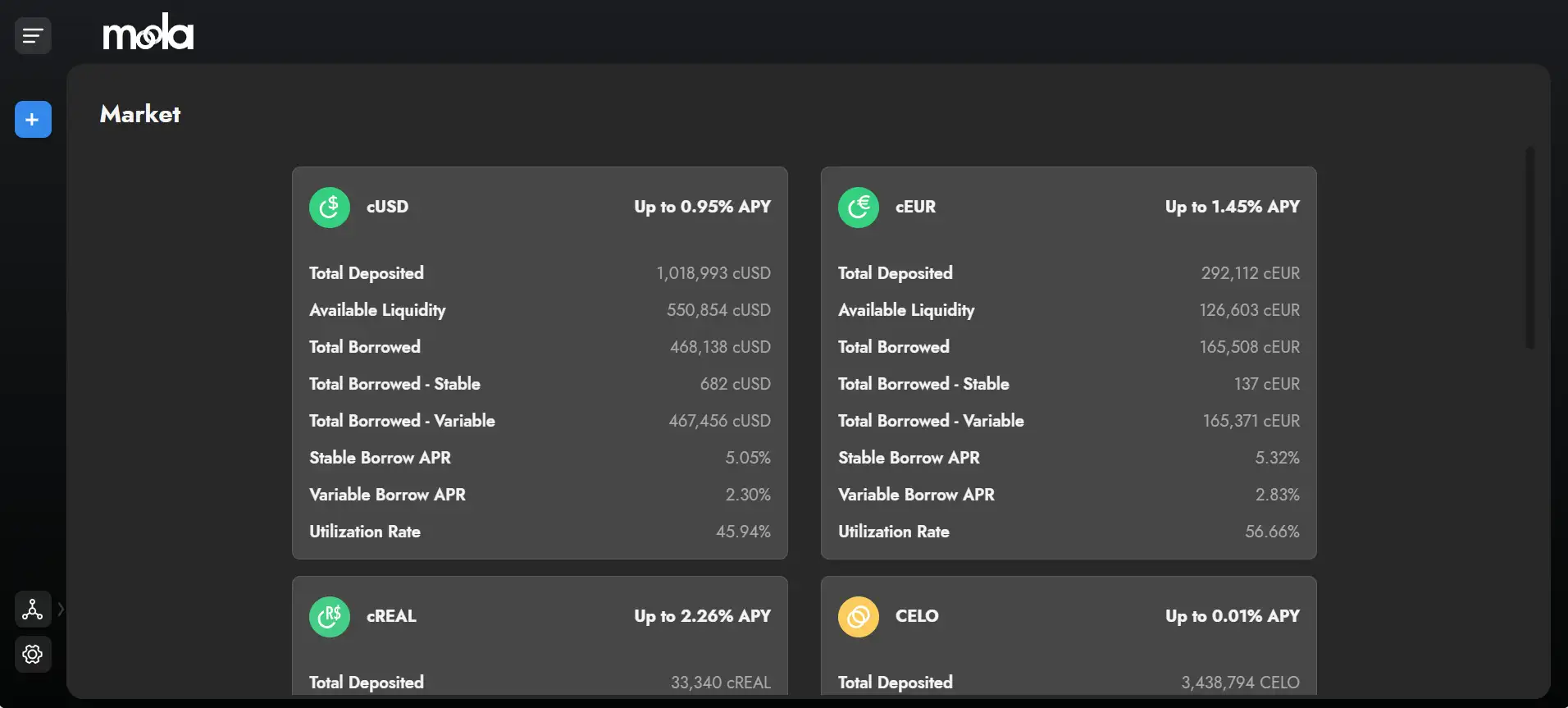

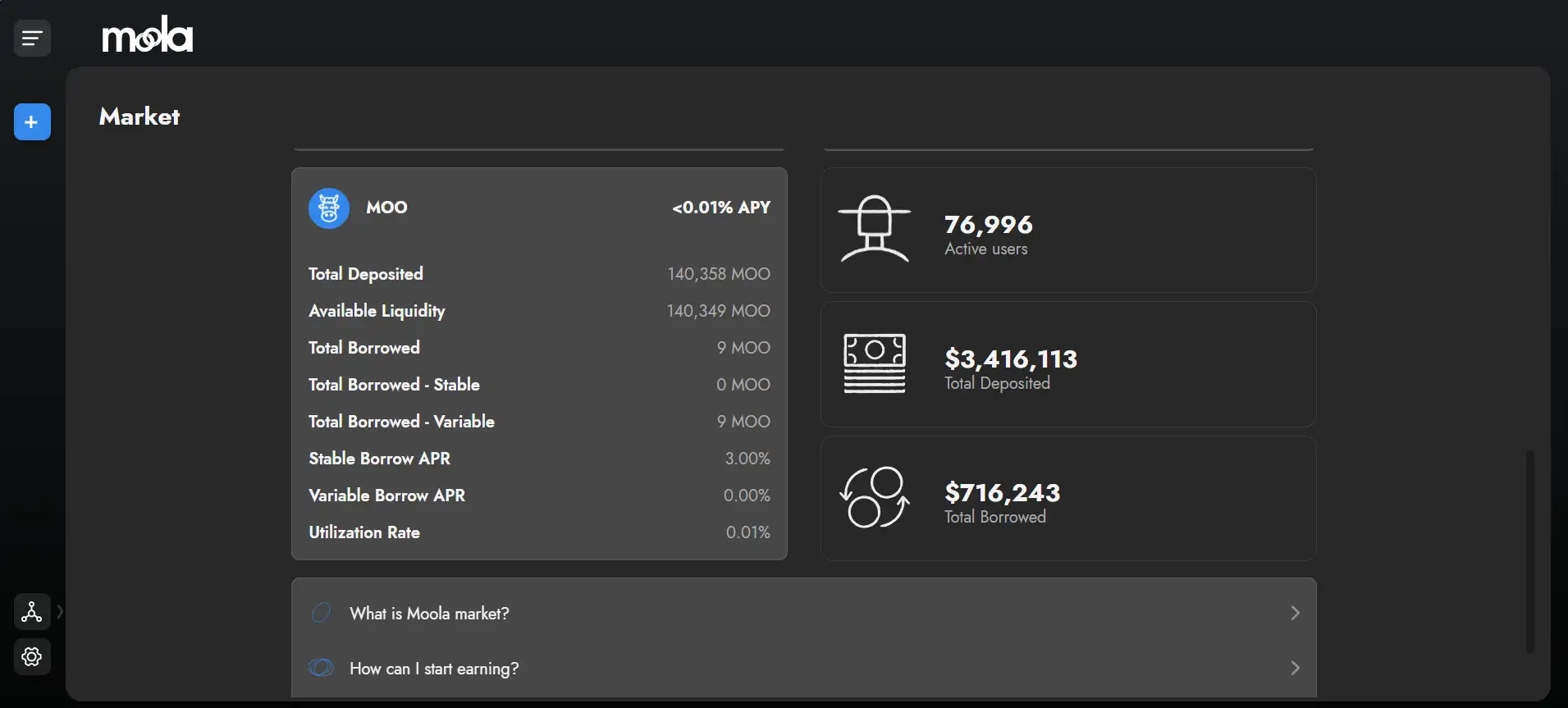

Through its decentralized lending system, users can deposit assets to earn passive income or use them as collateral to borrow other cryptocurrencies. The platform’s over-collateralization model ensures that lenders are protected while maintaining a secure and transparent ecosystem. Additionally, Moola Market supports multiple assets, including CELO, cUSD, and cEUR, making it a valuable tool for both retail and institutional investors.

Moola Market is an innovative DeFi lending and borrowing platform designed to provide a seamless experience within the Celo ecosystem. By utilizing an algorithmic interest rate model, the platform dynamically adjusts borrowing and lending rates based on supply and demand. This ensures that Moola Market remains a fair and efficient marketplace for users seeking liquidity or passive income opportunities.

One of the key advantages of Moola Market is its mobile-first design, which aligns with Celo’s mission of bringing DeFi to global users. Unlike lending platforms such as Aave and Compound, which operate on Ethereum, Moola Market benefits from low transaction fees and fast confirmations on the Celo blockchain. This makes it an attractive choice for users in developing regions who face high gas fees and slow transaction times on Ethereum-based platforms.

Users interacting with Moola Market receive interest-bearing mTokens (such as mCELO, mCUSD, and mCEUR), which appreciate in value as they accrue interest. Borrowers, on the other hand, can lock collateral to access liquidity while ensuring the security of lenders’ funds. Moola Market follows industry-best security practices, including smart contract audits, open-source code transparency, and decentralized governance to involve the community in protocol decisions.

The platform is governed by its community, allowing users to vote on protocol upgrades, fee structures, and other important developments. This decentralized governance structure ensures that the project evolves based on user needs. With its deep integration into Celo’s ecosystem and a focus on financial empowerment, Moola Market continues to be a major player in the DeFi lending space, providing a sustainable and efficient solution for both borrowers and lenders.

Moola Market offers a range of benefits and features that make it a powerful solution in the DeFi lending market:

- Decentralized Lending and Borrowing: Users can lend assets to earn passive income and borrow liquidity without intermediaries.

- Mobile-Optimized Experience: Built on the Celo blockchain, Moola Market offers a seamless mobile-friendly interface.

- Low Transaction Fees: Unlike Ethereum-based lending platforms, Moola Market benefits from fast and cost-effective transactions.

- Interest-Bearing mTokens: Depositors receive mTokens (mCELO, mCUSD, mCEUR), which automatically earn interest.

- Over-Collateralized Loans: Ensures secure lending while protecting lenders from defaults.

- Decentralized Governance: Users can vote on protocol upgrades, fostering a community-driven platform.

- Security and Transparency: Moola Market follows best security practices, including smart contract audits and open-source development.

Getting started with Moola Market is easy. Follow these steps to begin lending, borrowing, and earning interest:

- Visit the official platform: Head to the Moola Market website.

- Connect a wallet: Use a Celo-compatible wallet such as Valora, MetaMask, or Ledger.

- Deposit assets: Add supported tokens such as CELO, cUSD, or cEUR to start earning interest.

- Borrow assets: Use your deposited funds as collateral to access liquidity.

- Manage your portfolio: Monitor loans and interest earnings through the Moola Market dashboard.

Moola Market FAQ

Moola Market prioritizes security through multiple layers of protection. The platform uses over-collateralization to ensure that loans remain backed by sufficient assets, reducing the risk of defaults. Additionally, all smart contracts on Moola Market undergo rigorous audits by security experts to identify and eliminate vulnerabilities. Being an open-source protocol, its code is available for public scrutiny, adding an extra level of transparency.

Over-collateralization is a crucial safeguard in Moola Market. When borrowing funds, users must deposit assets worth more than the amount they borrow. This ensures that lenders' funds remain secure, even if the borrower’s asset value fluctuates. If the collateral value drops too much, an automatic liquidation mechanism is triggered to repay the loan and protect the system’s stability.

Moola Market is built on the Celo blockchain because of its low transaction fees, mobile-first approach, and focus on financial inclusion. Unlike Ethereum, where gas fees can be prohibitively high, Celo’s efficient infrastructure ensures that transactions remain fast and affordable, making it ideal for users in emerging markets who rely on mobile access.

If your collateral value falls below the minimum collateralization ratio, the system will automatically initiate a liquidation process. This means that a portion of your collateral will be sold to repay the outstanding debt. To prevent liquidation, borrowers can add more collateral or repay part of their loan before reaching the critical threshold.

Yes! Moola Market is optimized for mobile users and works seamlessly with Celo-compatible wallets such as Valora. Users can lend, borrow, and manage their assets directly from their smartphones, making DeFi more accessible than ever.

You Might Also Like