About mySwap

mySwap is a decentralized exchange (DEX) built on the Starknet network, leveraging a Concentrated Liquidity Automated Market Maker (AMM) to enhance trading efficiency and liquidity provision. This platform is designed to maximize capital efficiency by allowing liquidity providers to focus their liquidity in specific price ranges, which minimizes slippage and maximizes returns. The use of Starknet’s layer-2 technology offers users significantly lower gas fees compared to Ethereum’s mainnet, making mySwap a cost-effective solution for DeFi participants.

The platform’s core innovation lies in its ability to concentrate liquidity where it is most needed, ensuring that large trades can be executed with minimal price impact. This makes mySwap particularly appealing to professional liquidity providers who seek to optimize their capital deployment. Additionally, the user experience is prioritized with a seamless, user-friendly interface that caters to both novice and experienced DeFi users. The platform's advanced analytics provide valuable insights, helping users make informed decisions regarding their trading and liquidity strategies.

mySwap is a significant player in the emerging DeFi landscape on the Starknet network, focusing on optimizing liquidity provision through its Concentrated Liquidity AMM model. Unlike traditional Automated Market Makers (AMMs) that distribute liquidity across a wide price range, mySwap allows liquidity providers to allocate their capital more precisely within specific price bands. This targeted approach increases the efficiency of liquidity usage, resulting in better trading conditions for users.

Starknet, the layer-2 scaling solution on which mySwap is built, plays a crucial role in the platform’s operation. By offering significantly lower gas fees and higher transaction throughput compared to Ethereum’s mainnet, Starknet enables mySwap to deliver a more efficient and cost-effective trading experience. This is especially beneficial in the highly competitive DeFi space, where users are constantly seeking platforms that offer the best returns with the lowest costs.

Since its launch, mySwap has continuously evolved, incorporating user feedback and enhancing its features to stay ahead in the DeFi market. The platform's development team is committed to ongoing innovation, ensuring that mySwap remains a top choice for liquidity providers and traders alike. The focus on user experience, combined with advanced tools and analytics, further differentiates mySwap from other DEXs.

In terms of competition, mySwap’s primary rivals include other Starknet-based DEXs like JediSwap, which also offers a similar approach to liquidity provision. On other blockchains, competitors include DEXs like Uniswap and SushiSwap, both of which have implemented or are exploring concentrated liquidity models. However, mySwap’s integration with Starknet’s unique capabilities positions it strongly against these competitors, particularly in terms of cost efficiency and scalability.

For more details, you can visit the mySwap official website.

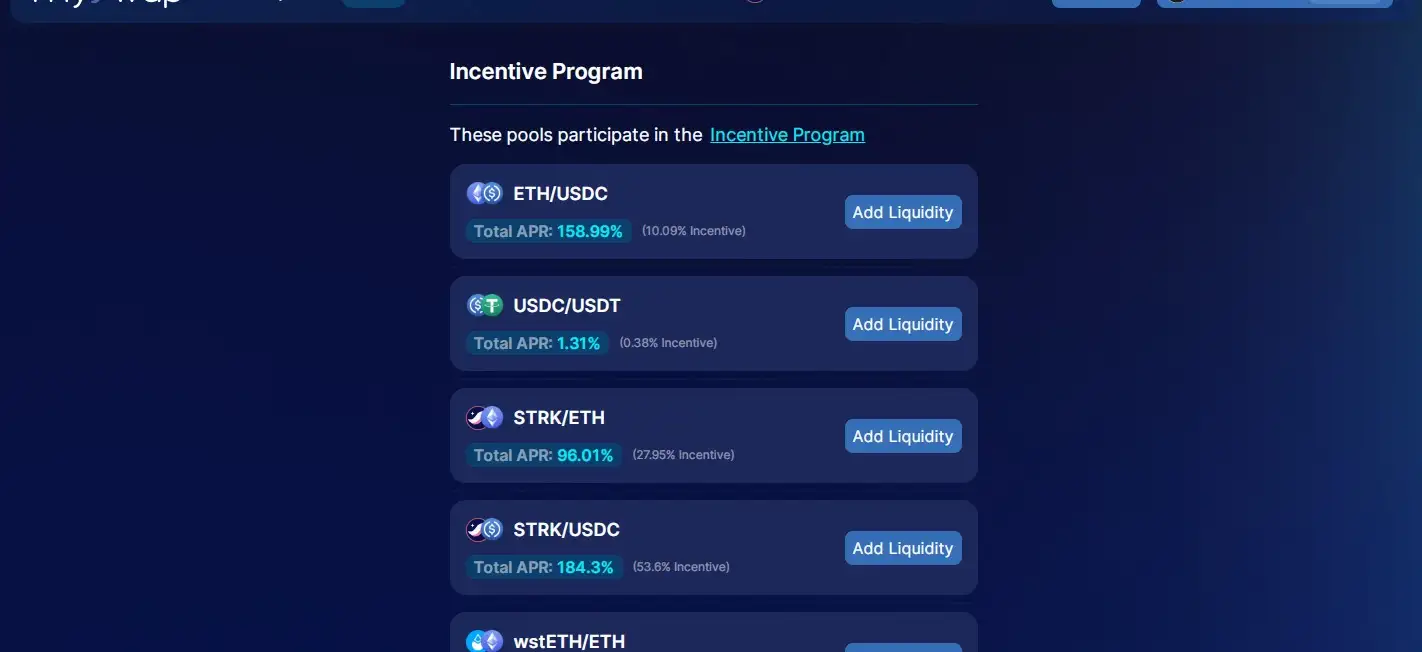

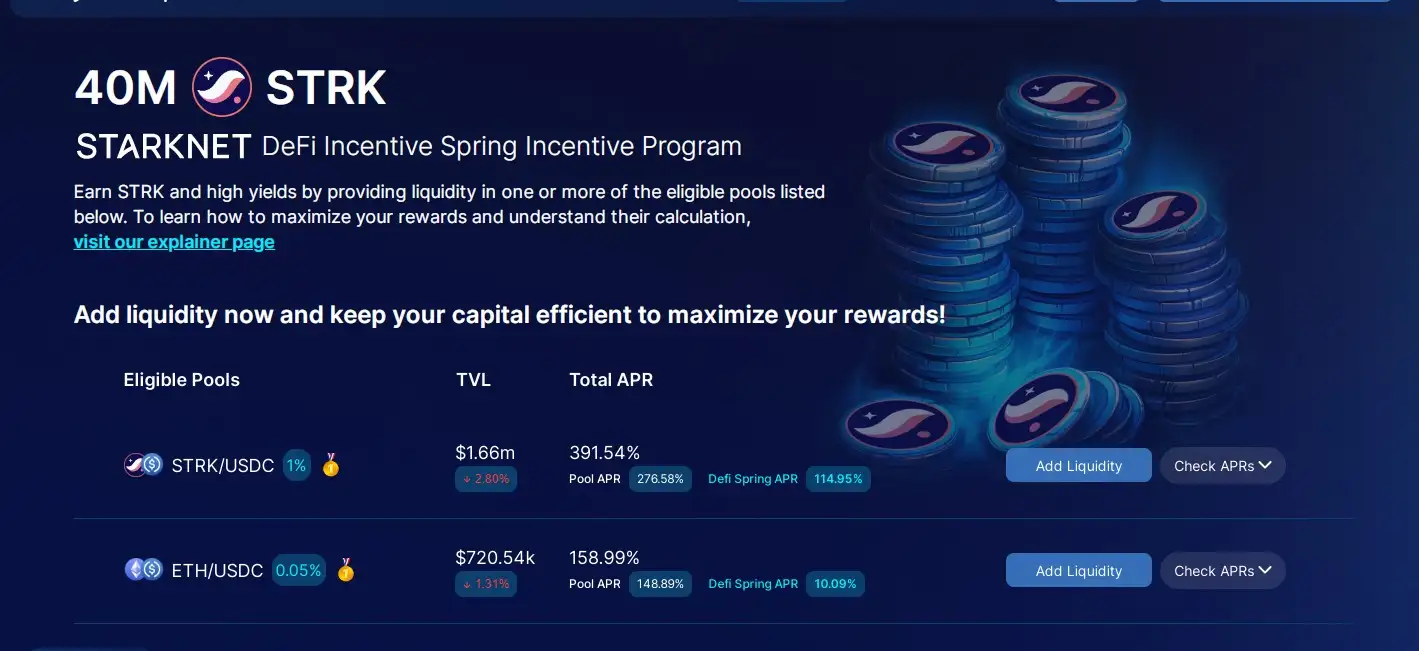

mySwap offers several key benefits and features that set it apart in the DeFi space:

- Concentrated Liquidity: Liquidity providers can focus their capital in specific price ranges, enhancing capital efficiency and reducing slippage.

- Low Gas Fees: By operating on the Starknet network, mySwap ensures lower transaction costs compared to Ethereum-based DEXs.

- High Scalability: Leveraging Starknet’s technology, mySwap can handle a high volume of transactions without compromising on speed or efficiency.

- User-Friendly Interface: The platform is designed to be intuitive, making it accessible to both novice and experienced users.

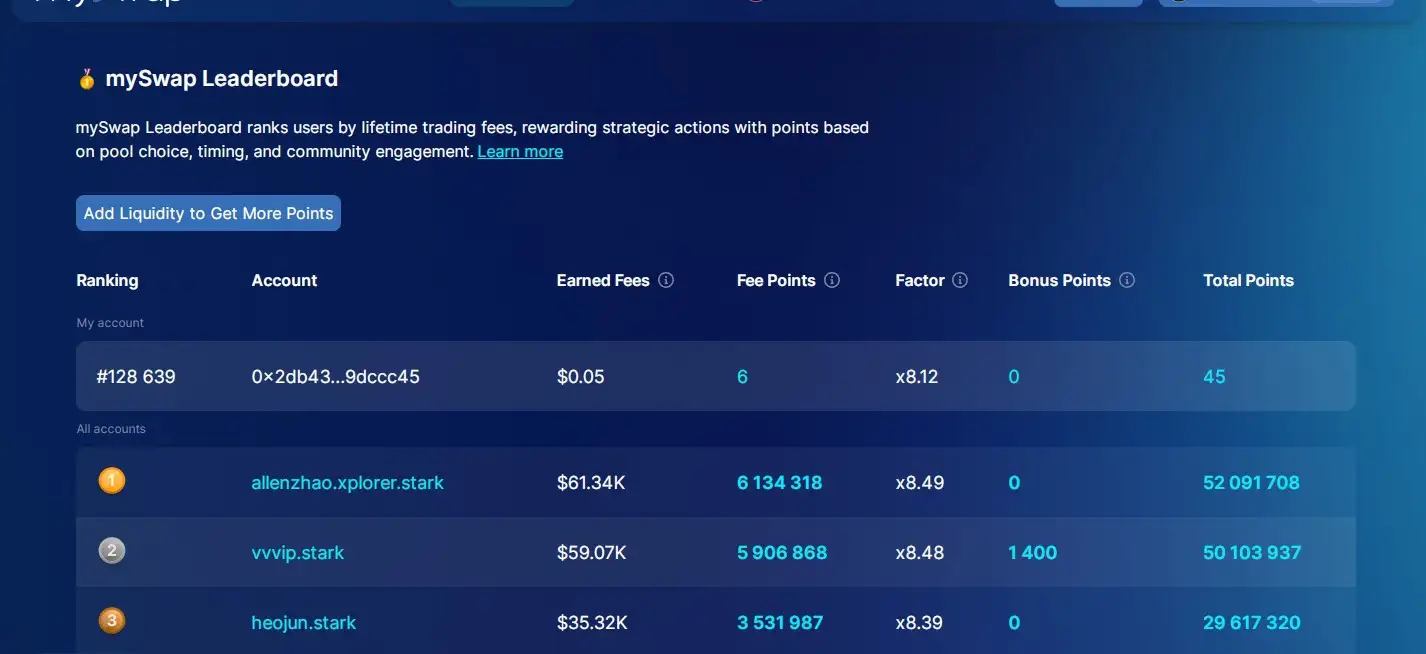

- Advanced Analytics: mySwap provides detailed analytics and tools to help users optimize their trading and liquidity provision strategies.

- Security and Transparency: mySwap employs robust security measures and transparent operations to build user trust and ensure the safety of assets.

- Community-Driven Development: The platform actively involves its community in decision-making processes, ensuring that user needs and feedback are incorporated into future developments.

- Multi-Chain Support (Future Development): mySwap plans to expand its offerings across multiple blockchains, further enhancing liquidity and accessibility for users.

These features collectively make mySwap a highly competitive option in the decentralized finance landscape. Visit the official mySwap website to learn more.

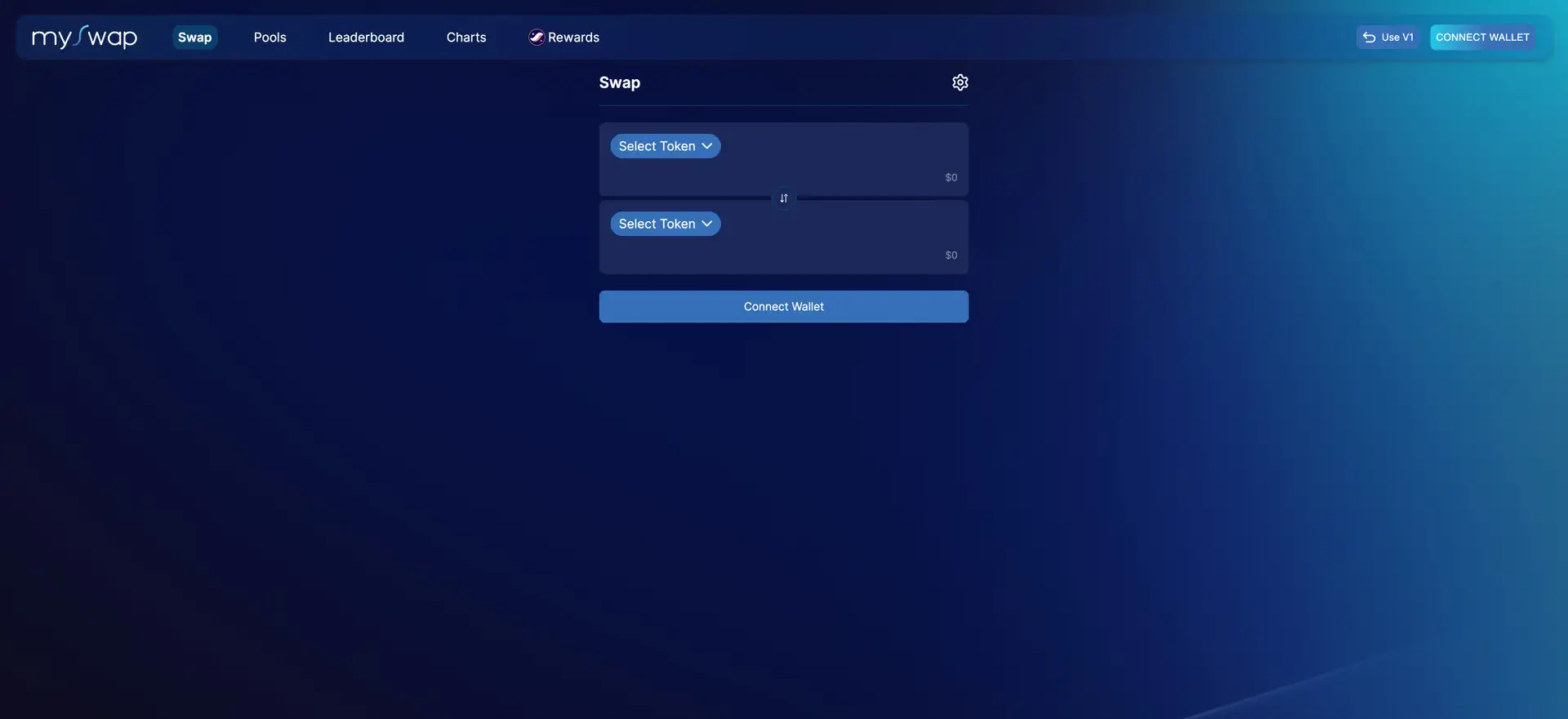

To get started with mySwap, follow these steps:

- Connect Your Wallet: Visit the mySwap website and connect a Starknet-compatible wallet, such as Argent X.

- Deposit Funds: Ensure that you have sufficient funds in your Starknet wallet. If needed, you can bridge assets from Ethereum to Starknet using services like StarkGate.

- Provide Liquidity or Trade: Choose to provide liquidity by selecting a trading pair and setting your desired price range, or start trading directly on the platform. Make sure to review the fee structures and trading conditions before proceeding.

- Manage Your Positions: Utilize the platform's analytics and management tools to monitor and adjust your liquidity positions as needed. Regularly review your strategies to optimize your returns.

- Explore Advanced Features: Take advantage of mySwap’s advanced features such as analytics, leaderboard tracking, and community governance. These tools can help you refine your DeFi strategies and stay ahead of market trends.

- Stay Informed: Join the mySwap community on social media and participate in governance discussions to stay updated on the latest developments and improvements.

For detailed guides and further assistance, you can visit the official mySwap documentation.

mySwap Reviews by Real Users

mySwap FAQ

mySwap utilizes a Concentrated Liquidity AMM, allowing liquidity providers to focus their funds within specific price ranges. This targeted liquidity improves capital efficiency, reducing slippage for trades and maximizing returns. Unlike traditional AMMs that spread liquidity thinly across all prices, mySwap’s approach ensures that liquidity is available where it’s most needed.

mySwap offers unique advantages like concentrated liquidity, lower gas fees due to its operation on Starknet, and a user-friendly interface designed for both beginners and experienced traders. Additionally, mySwap’s advanced analytics tools help users optimize their trading strategies. These features collectively make it a competitive option in the DeFi space.

Starknet, as a layer-2 scaling solution, offers mySwap enhanced scalability and significantly lower gas fees compared to Ethereum’s mainnet. This allows mySwap to process a high volume of transactions quickly and cost-effectively, making trading more efficient and accessible. Explore the benefits of Starknet on the mySwap platform.

To optimize liquidity provision on mySwap, focus on specific price ranges where you expect the most trading activity. Use the platform’s advanced analytics tools to track market trends and adjust your positions accordingly. This strategy will help you maximize returns while minimizing exposure to less active price ranges. Discover more strategies on the mySwap website.

While mySwap currently operates on Starknet, the platform has plans to support multi-chain functionality in the future. This will allow users to access liquidity and trading opportunities across different blockchains, further enhancing the platform’s versatility and reach.

You Might Also Like