About Nami Insurance

Nami Insurance is a groundbreaking decentralized insurance protocol designed to mitigate risks associated with market volatility. Founded by Giap Van Dai, a veteran with over a decade of experience in the crypto market, Nami Insurance leverages blockchain technology to provide a transparent, efficient, and secure solution for insuring various financial assets. The primary mission of Nami Insurance is to transform trading risks into opportunities for profit, catering specifically to both spot assets and futures positions.

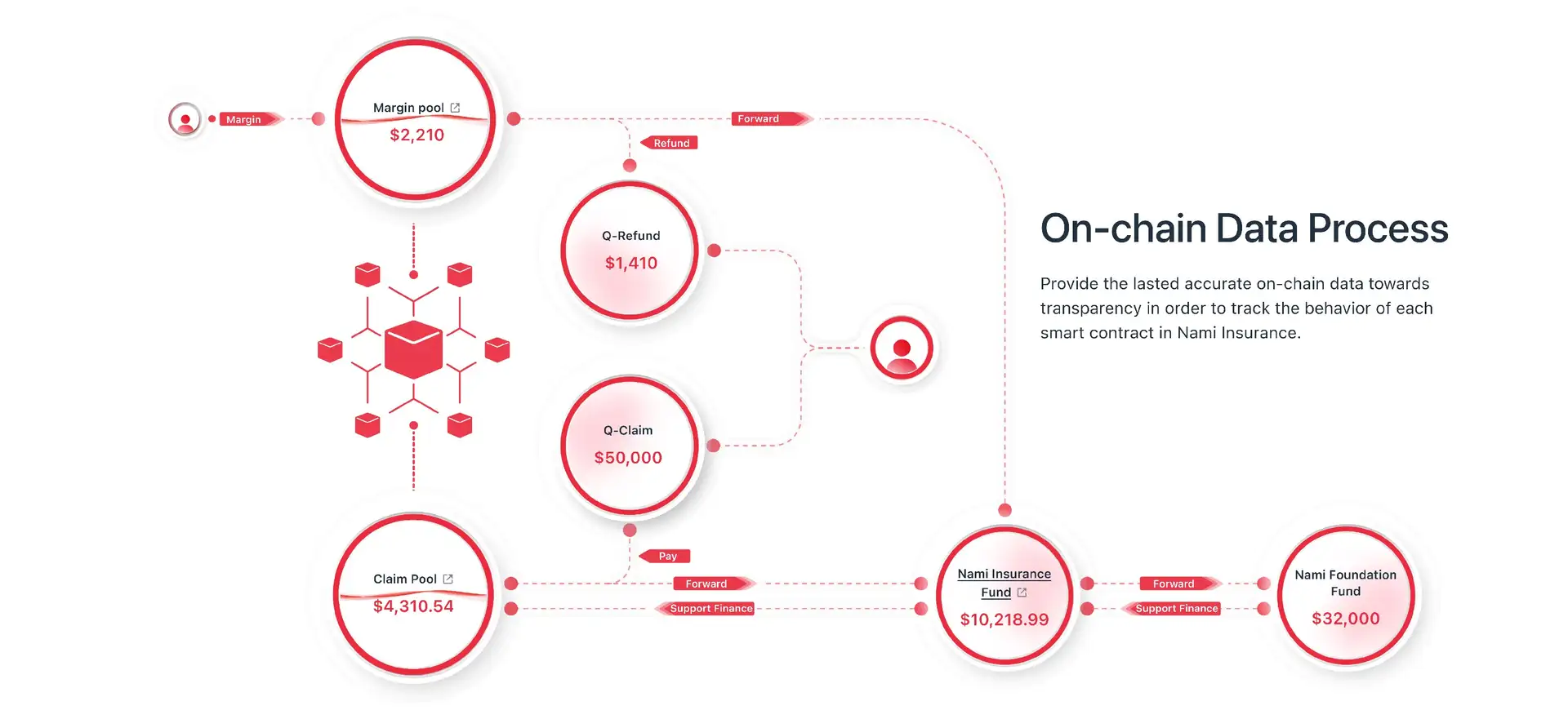

The platform addresses a critical need in the financial industry by offering an innovative approach to asset protection. Traditional insurance models are often plagued by inefficiencies, lack of transparency, and slow processing times. Nami Insurance counters these issues with a decentralized model that ensures all transactions are transparent, recorded on the blockchain, and accessible for verification. This transparency not only builds trust among users but also provides a robust framework for accurate and timely insurance payouts.

Nami Insurance was established with the objective of addressing the volatile nature of financial markets. The platform was developed by the Nami team in Vietnam, a group dedicated to continuous research and innovation in the field of decentralized finance. Since its inception, Nami Insurance has focused on providing a robust solution to mitigate risks associated with trading various financial assets, both in spot and futures markets.

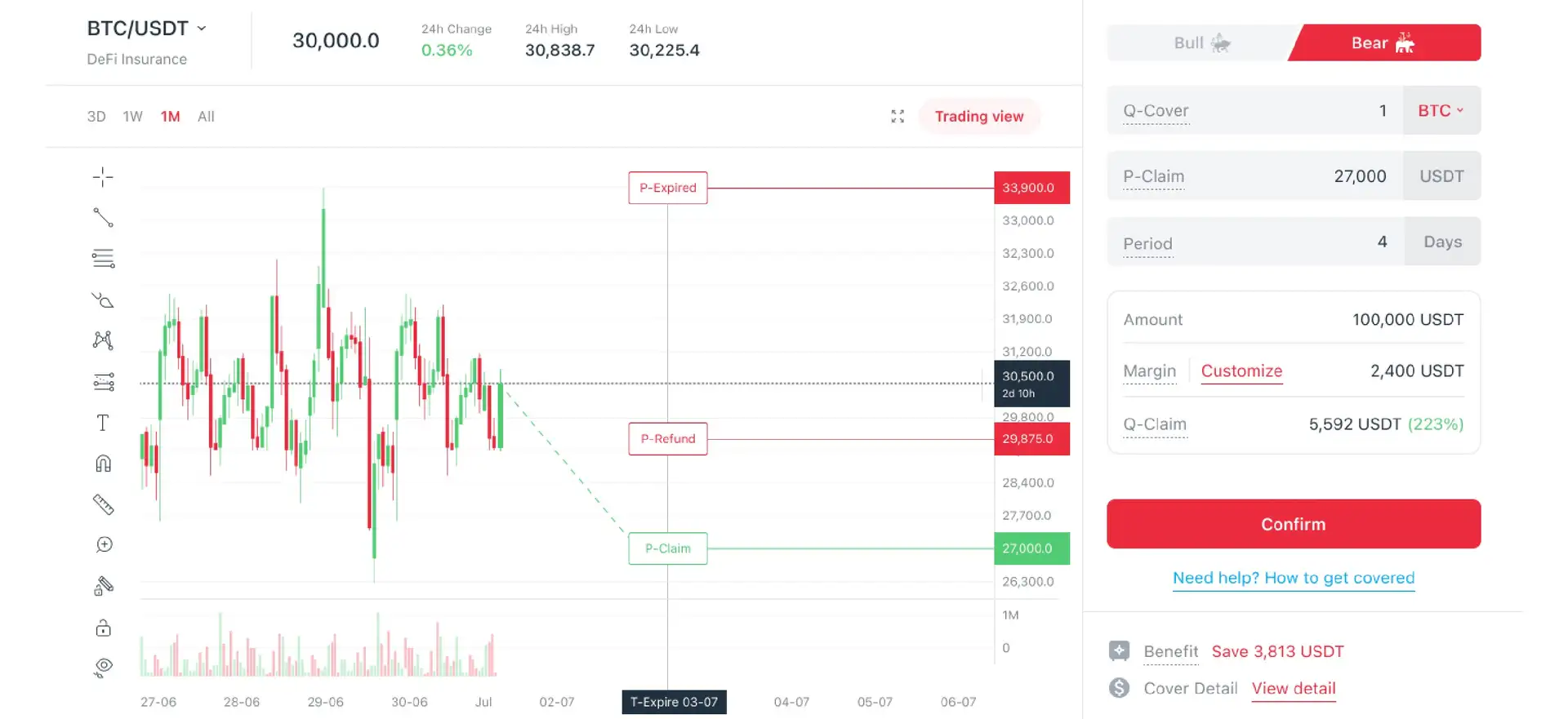

One of the key milestones in the development of Nami Insurance is the implementation of the Smart Robin Algorithm. This algorithm is designed to calculate precise insurance payouts based on real-time data, ensuring that users receive fair compensation for their insured assets. The platform also features a comprehensive Calculator tool, which helps users determine the appropriate level of insurance coverage for their assets. This tool is particularly useful for users who may not have extensive experience in the financial markets, providing them with a user-friendly interface to manage their insurance needs.

Nami Insurance stands out in the market due to its commitment to transparency and security. All transactions are recorded on the blockchain, providing a transparent and immutable record of all activities. This level of transparency is crucial in building trust among users, as it ensures that all claims and payouts are handled fairly and efficiently. Additionally, the decentralized nature of the platform means that there is no single point of failure, enhancing the security and reliability of the insurance products offered.

The project has also made significant strides in expanding its coverage options. Nami Insurance now offers coverage for over 120 different asset types, providing users with the flexibility to insure a diverse range of assets. This extensive coverage is complemented by the platform's advanced features, such as the Smart Robin Algorithm and the Calculator tool, which ensure that users receive accurate and fair insurance payouts.

Nami Insurance competes with other decentralized insurance platforms such as Nexus Mutual and InsurAce. However, it differentiates itself through its comprehensive asset coverage, advanced algorithmic calculations, and a strong focus on transparency and security. By integrating these features, Nami Insurance aims to provide a superior insurance solution that addresses the unique challenges of the financial markets.

Overall, Nami Insurance is a pioneering project that leverages blockchain technology to provide a transparent, efficient, and secure insurance solution for financial assets. With its advanced features, extensive coverage options, and commitment to transparency, Nami Insurance is well-positioned to become a leader in the decentralized insurance market.

- Decentralized Protocol: Ensures transparency and security by utilizing blockchain technology to record all transactions on an immutable ledger.

- Comprehensive Asset Coverage: Offers insurance for over 120 asset types, including spot assets and futures positions, providing users with diverse coverage options.

- Smart Robin Algorithm: An advanced algorithm that calculates precise insurance payouts based on real-time market data, ensuring fair compensation for insured assets.

- User-Friendly Calculator Tool: Helps users determine the appropriate level of insurance coverage for their assets, making it easy for both experienced and novice traders to manage their insurance needs.

- High Transparency: All transactions and claims are recorded on the blockchain, providing a transparent and accessible record of all activities. This transparency builds trust among users and ensures that all claims are handled fairly.

- Efficient Payouts: The use of blockchain technology ensures that insurance payouts are processed quickly and efficiently, minimizing delays and providing users with timely compensation.

- Secure and Reliable: The decentralized nature of the platform means that there is no single point of failure, enhancing the security and reliability of the insurance products offered.

- Flexible Coverage Options: Users can customize their insurance coverage based on their specific needs, allowing them to insure a diverse portfolio of assets.

- Innovative Technology: Nami Insurance continuously invests in research and development to enhance its platform and provide users with cutting-edge insurance solutions.

- Accessible Documentation: Comprehensive guides and documentation are available to help users understand and navigate the platform, ensuring a smooth and seamless experience.

- Create a Wallet:

- Install a wallet extension compatible with Nami Insurance, such as MetaMask or Trust Wallet.

- Follow the instructions to create a new wallet account. Ensure to back up your recovery phrase securely.

- Connect Wallet:

- Visit the Nami Insurance platform and select the option to connect your wallet.

- Follow the prompts to link your wallet to your Nami Insurance account securely.

- Deposit Funds:

- Deposit the necessary funds or tokens into your wallet. Ensure you have sufficient assets to cover your desired insurance coverage.

- You may need to acquire specific tokens if required by the platform.

- Choose Assets:

- Browse through the list of over 120 asset types available for insurance.

- Select the assets you wish to insure based on your portfolio and risk management strategy.

- Use the Calculator:

- Access the Calculator tool on the platform to determine the appropriate level of insurance coverage for your selected assets.

- Input relevant data to receive recommendations on coverage amounts and premiums.

- Open a Contract:

- Follow the steps provided on the platform to finalize and open your insurance contract.

- Review all details carefully before confirming the contract to ensure accuracy.

- Manage Insurance:

- Monitor your insurance contracts through the Nami Insurance dashboard.

- Make adjustments or renew contracts as needed based on changes in your portfolio or market conditions.

For more detailed guides and tutorials, visit the Nami Insurance Documentation.

Nami Insurance Reviews by Real Users

Nami Insurance FAQ

Nami Insurance utilizes the Smart Robin Algorithm, which analyzes real-time market data to provide precise and fair insurance payouts. This ensures that users receive compensation that accurately reflects their insured assets' current value.

With Nami Insurance, you can insure over 120 different asset types, including spot assets and futures positions. This wide range of options allows you to protect a diverse portfolio.

Nami Insurance leverages blockchain technology to provide a decentralized insurance model. This approach eliminates inefficiencies and increases transparency compared to traditional insurance, where processing times can be slow, and transparency is often lacking.

Using the Calculator tool on the Nami Insurance platform, you can easily adjust your insurance coverage by inputting relevant data to determine the appropriate amounts and premiums for your assets.

The value of your insured assets is continuously monitored, and payouts are adjusted accordingly using real-time data. This ensures that your insurance coverage remains accurate and reflective of the current market conditions.

You Might Also Like