About Odos

Odos is an advanced multi-route decentralized exchange (DEX) aggregator designed to optimize token swaps across multiple liquidity sources. Unlike traditional aggregators that rely on simple pathfinding, Odos uses an intelligent algorithm to execute trades with the most efficient routing, minimal slippage, and lowest fees. The platform enables users to swap tokens seamlessly while ensuring the best possible execution price.

By leveraging its unique multi-route technology, Odos splits trades across several decentralized exchanges (DEXs) and liquidity pools, increasing capital efficiency and reducing costs. The platform is ideal for traders seeking optimal token swaps, liquidity providers looking for better yield opportunities, and projects integrating seamless DeFi solutions. Odos enhances the DeFi trading experience with its intuitive interface, deep liquidity access, and cutting-edge routing technology.

Odos is a next-generation DEX aggregator that optimizes token swaps by dynamically routing transactions across multiple liquidity sources. The platform is built to maximize capital efficiency, reduce slippage, and lower trading fees for DeFi users. Unlike traditional single-path aggregators, Odos uses a sophisticated multi-route system to split trades across multiple pools and protocols, ensuring the best execution price.

At its core, Odos connects to leading decentralized exchanges (DEXs) such as Uniswap, Curve, and Balancer, among others. By splitting orders across different platforms, Odos helps traders achieve the most cost-effective swaps with reduced impact on individual liquidity pools.

The platform’s intelligent algorithm continuously scans liquidity sources to find the most efficient trade execution. Whether swapping small amounts or executing large trades, Odos ensures users get the best possible deal by minimizing slippage and transaction costs.

As a leading DEX aggregator, Odos competes with other prominent platforms, including:

- Matcha – A DEX aggregator built by 0x that sources liquidity across multiple platforms.

- 1inch – A well-known DEX aggregator that provides optimized token swaps with low fees.

- ParaSwap – A high-speed DEX aggregator offering multi-path swaps.

- CoW Swap – A DEX that optimizes order execution through batch auctions.

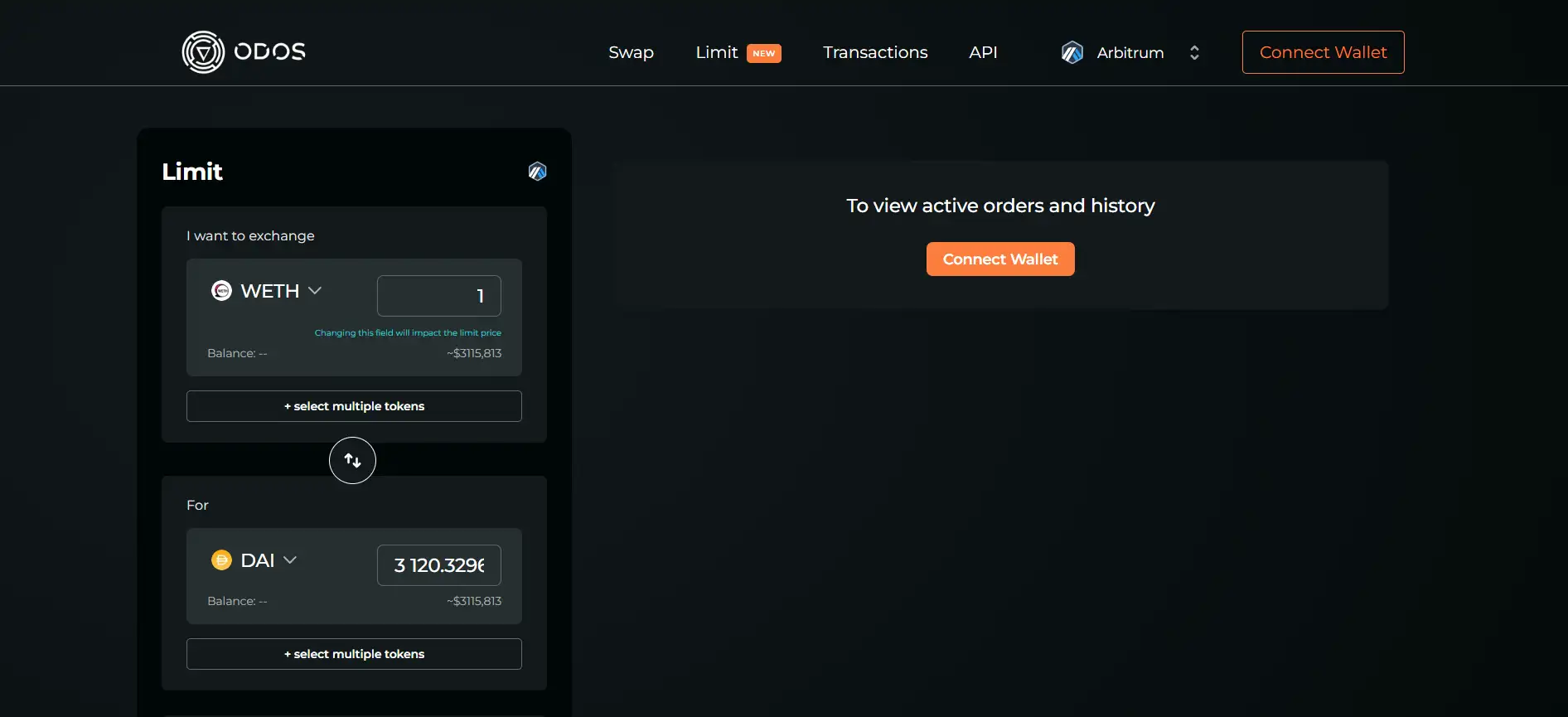

Odos provides several innovative features and benefits that enhance the DeFi trading experience:

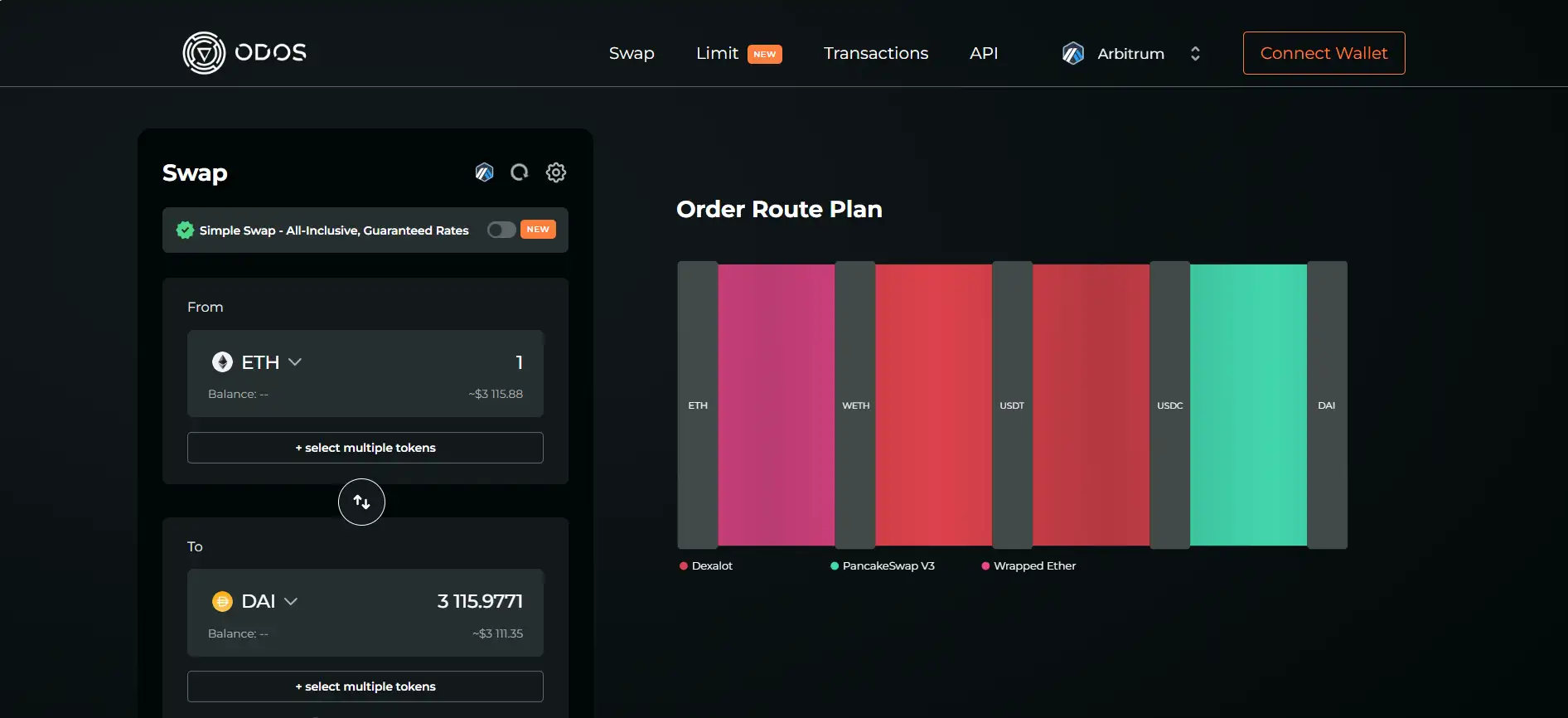

- Multi-Route Trade Execution: Splits swaps across multiple liquidity pools to maximize efficiency and reduce costs.

- Reduced Slippage: Optimized routing ensures that trades have minimal price impact and better execution.

- Lower Gas Fees: Efficient smart contract execution minimizes gas costs compared to standard swaps.

- Deep Liquidity Access: Aggregates liquidity from multiple DEXs, ensuring users can trade even large volumes seamlessly.

- User-Friendly Interface: Simple and intuitive UI allows for easy token swaps with real-time price comparisons.

- Integration with DeFi Protocols: Projects and developers can integrate Odos for seamless on-chain trading.

Getting started with Odos is quick and straightforward for both beginners and experienced DeFi users.

- Visit the Official Website: Go to Odos to access the platform.

- Connect a Wallet: Use a compatible Web3 wallet like MetaMask or Coinbase Wallet to interact with the platform.

- Select Tokens for Swapping: Choose the token you want to trade and the token you wish to receive.

- Review and Confirm: Odos will display the best available routes with estimated fees and slippage. Confirm the transaction.

- Complete the Swap: Approve the transaction in your wallet and receive your tokens instantly.

Odos FAQ

Odos enhances swap efficiency by utilizing a multi-route trading algorithm that splits a single transaction across multiple liquidity sources. This approach helps find the optimal execution path, reducing costs and improving capital efficiency. By intelligently routing trades, Odos minimizes slippage and maximizes the value users receive.

Slippage occurs when a large order impacts the price of a token. Odos reduces this by distributing orders across multiple liquidity pools, preventing any single pool from experiencing excessive price impact. This method ensures that large transactions execute with minimal price movement, resulting in more favorable trade outcomes.

Odos primarily operates as a DEX aggregator within a single blockchain ecosystem, optimizing trades across multiple liquidity sources. However, as interoperability between chains evolves, Odos is expected to integrate cross-chain functionalities to support swaps across different blockchains.

Gas fees on Odos depend on network congestion, transaction complexity, and smart contract execution. Since Odos uses an efficient contract design, gas fees are optimized compared to manual swaps. However, trading during peak network activity can still lead to higher costs, so users should monitor gas prices for the best execution.

You Might Also Like