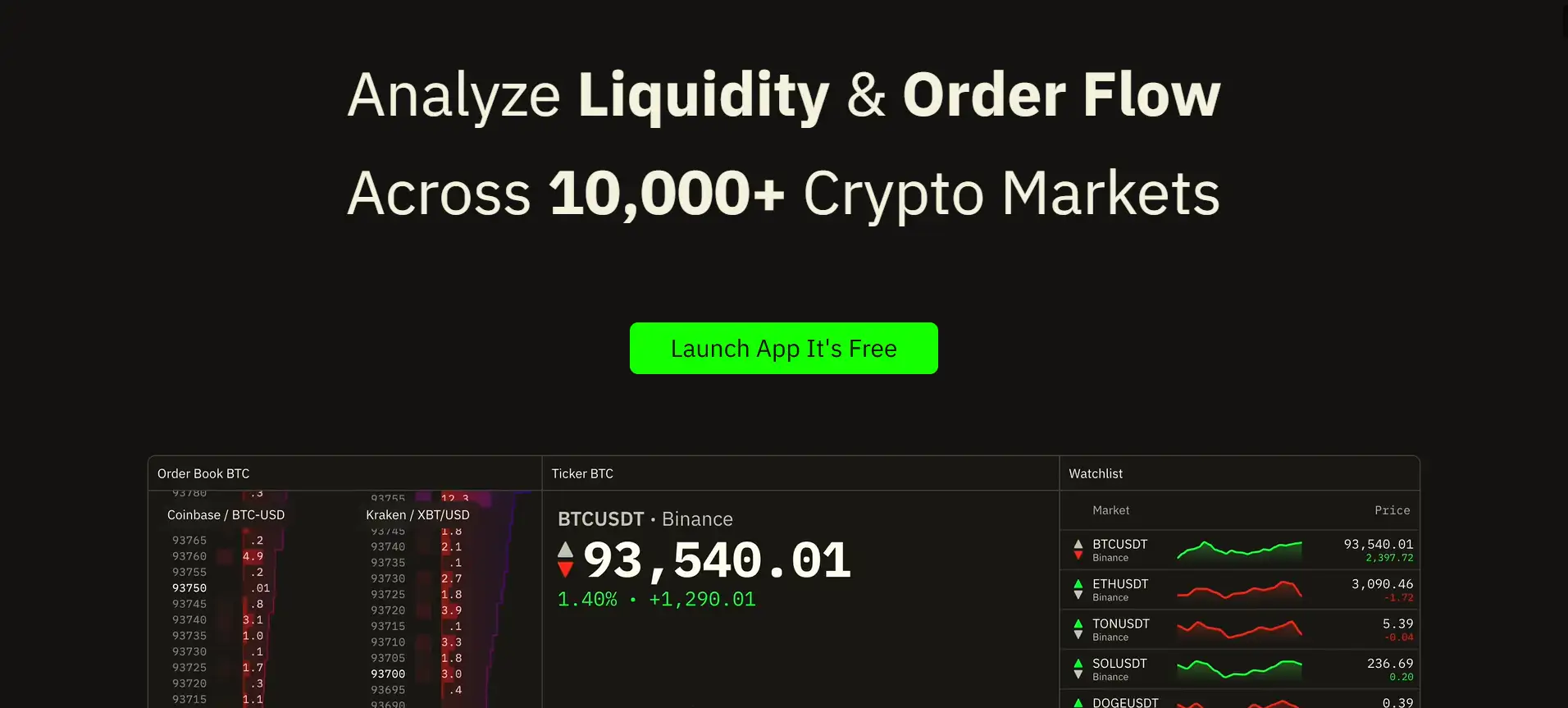

About Okotoki

Okotoki is a high-performance crypto data analytics platform designed to help traders and analysts visualize and understand liquidity, order flow, and market activity across 10,000+ spot and derivatives markets. By aggregating live and historical data from major exchanges into a single coherent interface, it allows users to assess trade behavior, detect order book imbalances, and react faster to changing market dynamics.

Whether you’re a professional trader, algo strategist, or just want to make more informed decisions, Okotoki gives you access to recent trades, real-time liquidations, multi-market order books, and customizable dashboards. With support for over 1,900 assets including BTC, ETH, SOL, and emerging tokens, it offers a bird’s-eye view of the crypto landscape in motion.

Okotoki bridges the data gap between fragmented centralized crypto exchanges and user decision-making with a unified visualization platform. It offers a fast, real-time interface to monitor more than 11,000 markets across top exchanges like Binance, Coinbase, Kraken, OKX, Deribit, and more. Its visual data layers include order book depth, aggregated trade feeds, and liquidation alerts, designed for use by retail traders, hedge funds, and quant researchers alike.

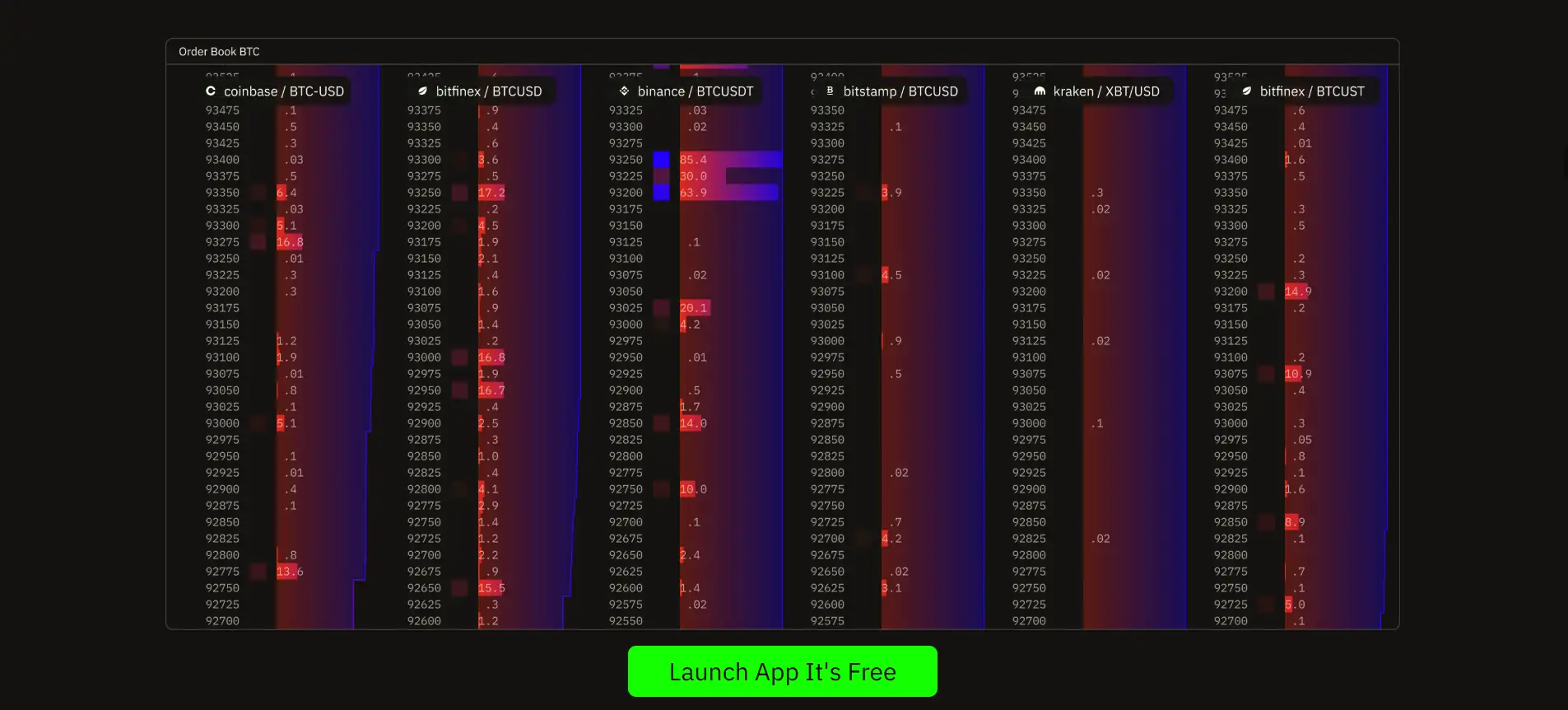

The platform’s flagship features include a powerful multi-market order book that combines data from dozens of exchanges and trading pairs into one unified view. Users can easily switch between aggregated or individual market modes, apply zoom and tick filters, visualize cumulative or per-level liquidity, and spot imbalances with the built-in heatmap. This makes Okotoki especially useful for scalpers, liquidity providers, and short-term swing traders.

Okotoki also delivers a real-time feed of recent trades and liquidations, color-coded by buy/sell direction and customizable with trade size filters. Traders can track aggressive orders, detect large block trades, or focus on liquidations across both spot and derivatives markets. The pricing module shows current asset prices, 24-hour trends, volume stats, and basic order book liquidity for quick context. A flexible theme and layout system ensures the platform fits the workflow of any user type.

The application supports popular coins like BTC, ETH, SOL, XRP, ADA, DOGE, LINK, BNB, AVAX, SHIB, and more—spanning over 1,900 assets. You can also save custom watchlists, analyze historical order book heatmaps, and soon receive price alerts via Telegram bots. Unlike basic charting tools or traditional terminals, Okotoki emphasizes actionable depth data and real-time order flow, setting it apart from platforms like Coinalyze or TradingLite.

Okotoki delivers several unique features that make it a valuable tool for market participants:

- 11,000+ Market Coverage: Aggregates spot and derivatives data for over 1,900 assets across top CEXs including Binance, Coinbase, Kraken, OKX, Deribit, and more.

- Advanced Order Book Visualization: View liquidity imbalances, group price levels, toggle cumulative data, and analyze tick-size configurations across multiple markets.

- Real-Time Trades & Liquidations Feed: Monitor buy/sell pressure, filter by trade size, and track high-impact events like large liquidations or market sweeps.

- Price & Trend Indicators: Get quick asset insights with live prices, 24h trends, order book stats, and volume-based signals.

- Custom Dashboards & Layouts: Tailor the interface to your workflow using theme options, flexible resizing, and adjustable granularity.

- Heatmap View (Coming Soon): Analyze historical order book depth to spot support and resistance zones.

- Telegram Price Alerts (Coming in 2025): Get notified when markets cross user-defined price levels.

- Fair Pricing: Access all features for $29/month (annually) or $49/month (monthly), with one-time crypto payment options available.

Okotoki is built for anyone who needs to track crypto market structure and liquidity in real-time. Here's how to get started:

- Visit the platform: Go to okotoki.com and explore the real-time interface—no download needed.

- Start a free trial: Register for an account and try out the full dashboard before committing to a plan.

- Subscribe: Choose between $29/month (billed annually) or $49/month (billed monthly). Crypto payments are supported for annual plans.

- Customize your view: Set theme preferences, watchlists, order book configurations, and trade filters to personalize your workspace.

- Track markets: Use the combined order book, liquidation tracker, and real-time trade feed to stay ahead of market moves.

- Stay updated: Follow Okotoki on Twitter or connect via Telegram for news, feature updates, and community support.

Okotoki FAQ

Okotoki aggregates order book depth data across multiple centralized exchanges into a single interface. Users can toggle between individual market books or enable a combined multi-market view to see total liquidity across all supported venues. This gives a more accurate picture of supply and demand than looking at just one exchange.

Yes. Okotoki includes a powerful trade and liquidation feed that supports filtering by minimum size. You can define thresholds to view only large trades or high-volume liquidations—separately for spot, derivatives, and liquidation events. This allows you to track significant market moves while ignoring smaller noise.

Okotoki offers a highly customizable order book dashboard with features like real-time updates, zoomable depth charts, tick size control, cumulative data toggles, and cross-market heatmaps. These tools allow traders to spot liquidity imbalances and anticipate market shifts with more clarity than traditional charting terminals.

Yes. A Telegram bot alert system is scheduled to launch in 2025. This feature will allow users of Okotoki to receive real-time notifications when selected market prices go above or below user-defined thresholds, providing a valuable layer of reactivity without constant monitoring.

Okotoki is built to serve both professional and retail users. Its real-time infrastructure, multi-market depth, and customizable layout tools make it a powerful analytics platform for quant funds, prop traders, and institutional analysts, while still being intuitive enough for active retail investors looking to upgrade their trading view.

You Might Also Like