About Oku Trade

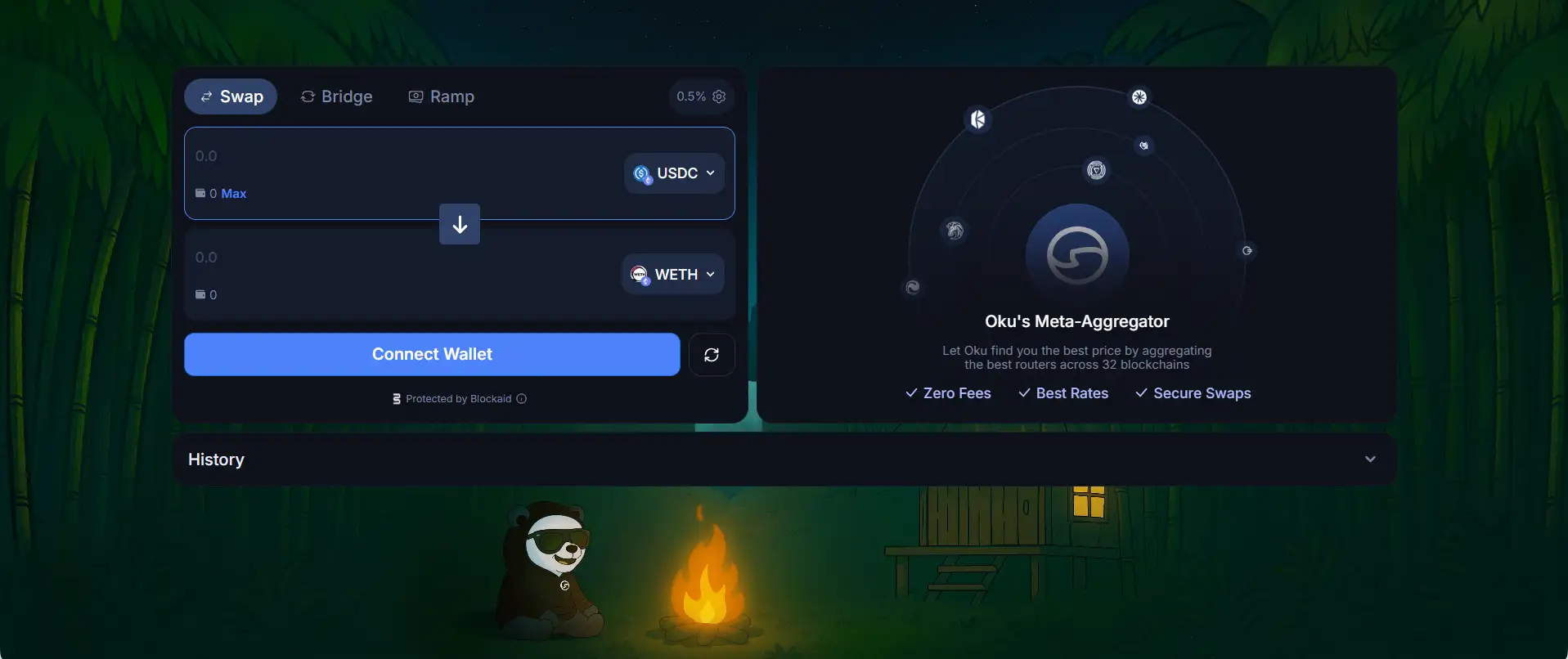

Oku Trade is a decentralized trading platform and DeFi meta-aggregator that delivers secure, efficient, and low-cost access to swaps, vaults, bridging, and on-chain yield. Built to simplify user experience while maximizing returns, Oku Trade connects users with optimal routes across 32+ blockchains through its smart aggregation engine—eliminating the need to compare across aggregators manually.

By routing trades through top-performing liquidity sources like 1inch, 0x, ParaSwap, and more, Oku Trade guarantees the best execution without charging any platform fees. It's a fully integrated environment where users can swap assets, access vaults powered by Morpho, earn yield, and interact with protocols—all while protected by Blockaid’s on-chain security framework.

Oku Trade is redefining the way users interact with DeFi by offering a powerful, no-fee trading experience enhanced by its deep integration with multiple aggregation protocols and on-chain vaults. Developed by GFX Labs, Oku serves as both a user-facing DeFi terminal and a programmable layer that interfaces with liquidity routers, vault systems, and cross-chain bridges.

The heart of Oku's value lies in its Meta-Aggregator—a smart system that evaluates swap quotes from top DEX aggregators and routing protocols, including 0x, 1inch, ParaSwap, OpenOcean, AirSwap, and others. This system ensures users get the best token price, lowest slippage, and optimal gas efficiency across supported chains. By abstracting the technical complexity, Oku Trade makes DeFi accessible to both casual users and experienced on-chain traders.

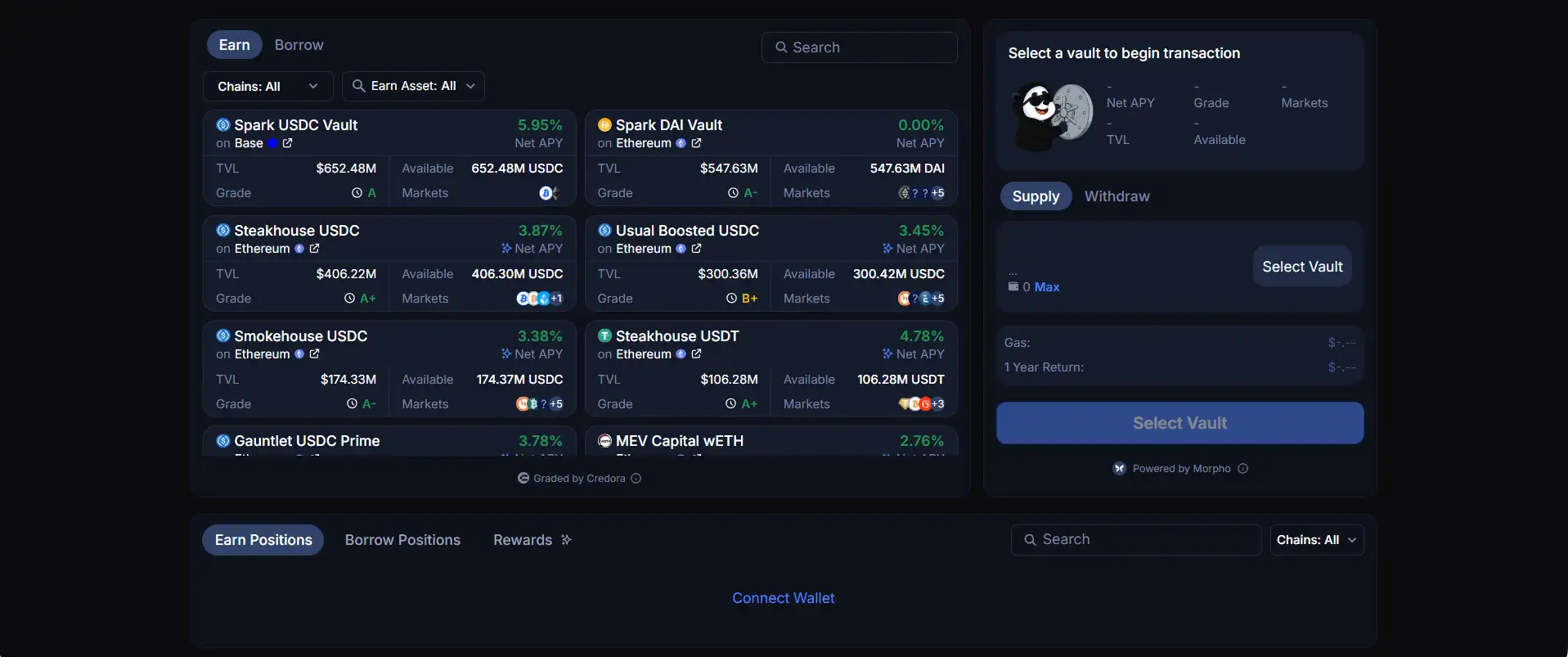

Oku’s platform supports more than just swaps. Its Vault Dashboard is integrated with Morpho, allowing users to supply assets like USDC, USDT, DAI, and RUSD into curated vaults with optimized yields. Each vault includes key metrics such as Net APY, TVL, Available Liquidity, Protocol Grades (via Credora), and supported markets. The vaults span across Ethereum and L2s like Base and World Chain.

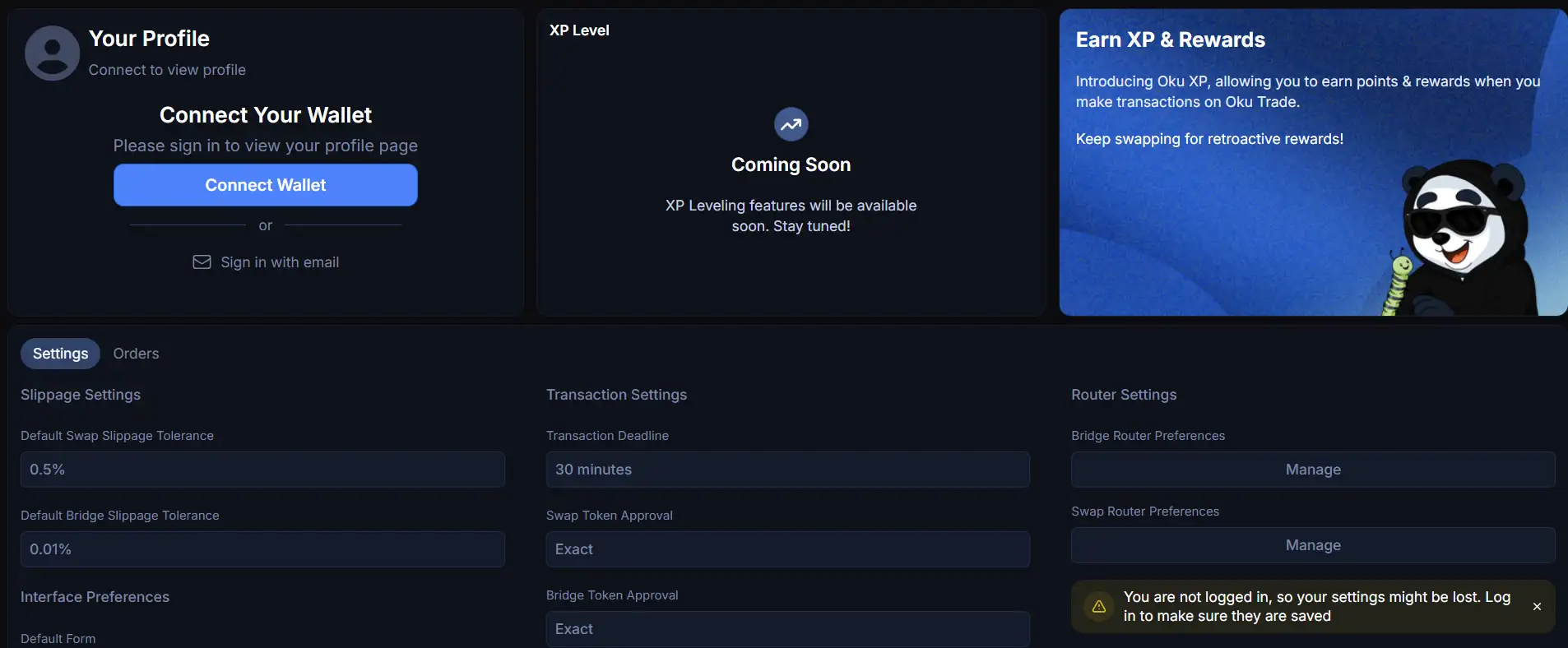

For those bridging assets, Oku offers a router-agnostic bridge interface, letting users transfer assets across networks using the best available route with minimal fees. Everything is done transparently through audited smart contracts and supported by customizable settings for slippage, transaction deadlines, and approval behavior. The platform’s interface also supports wallet-less exploration, seamless wallet connection, and personalized settings management.

Unlike other DeFi terminals such as Matcha or Rango Exchange, Oku Trade goes a step further by combining advanced routing, yield generation, and cross-chain functionality—without charging platform fees. As the platform expands, users can expect XP-based reward systems and continued integration with vault strategies and AI-powered tools.

Oku Trade offers a comprehensive set of features that make DeFi access smarter, faster, and more efficient:

- Meta-Aggregator Routing: Routes trades through 0x, ParaSwap, 1inch, KyberSwap, AirSwap, OpenOcean, and others for best execution across 32+ blockchains.

- Zero Platform Fees: Users benefit from swap optimization without paying additional fees to Oku.

- Secure by Design: All interactions are protected by Blockaid, a leading Web3 transaction security service.

- Vault Access with Morpho: Supply assets to Morpho-powered vaults with transparent APY, TVL, and protocol risk grades.

- Cross-Chain Bridging: Swap and bridge assets using the best route across multiple chains with low slippage and gas optimization.

- Customizable Transaction Settings: Set swap slippage, bridge slippage, approval scope, confirmation prompts, and router preferences.

- XP & Rewards System: Earn points and retroactive rewards by completing swaps and interactions (coming soon).

- Pro Interface: Switch to advanced views with deeper liquidity insights and enhanced control for power users.

Oku Trade makes it easy to begin trading, earning, and exploring DeFi—no matter your experience level. Here’s how to get started:

- Visit the platform: Go to oku.trade and connect your wallet via MetaMask or supported providers.

- Make your first swap: Use the Swap tab to enter token amounts and let Oku find the best execution route.

- Explore vaults: Navigate to the Vaults section and browse high-yield vaults powered by Morpho. View data like Net APY, TVL, and asset availability.

- Use bridge functionality: Head to the Bridge tab to move assets across chains at the best available rate and with optimized slippage control.

- Adjust settings: Customize slippage tolerance, approval types, router preferences, and UI layouts via the Settings panel.

- Track performance: Access your profile dashboard to view past transactions and, in the future, XP level and rewards earned.

- Need support? Use the Support Center or check the official Blog for platform updates and feature guides.

Oku Trade FAQ

Oku Trade leverages a Meta-Aggregator engine that searches top DeFi routers like 0x, 1inch, ParaSwap, OpenOcean, KyberSwap, and more. It scans routes across 32+ blockchains in real-time, automatically selecting the path that delivers the highest token output and lowest slippage for every trade.

The vault system on Oku Trade gives users access to optimized DeFi yield opportunities through Morpho-powered strategies. These vaults are rated with Credora risk grades and display data like Net APY, TVL, and market exposure—allowing users to make informed decisions while earning passive income from their deposited assets.

No. Oku Trade charges zero platform fees for both swaps and bridge transactions. All costs incurred during trades—like network gas or protocol fees—come directly from the integrated liquidity providers or bridges. This makes Oku Trade one of the most cost-efficient DeFi tools available.

Every interaction on Oku Trade is secured by Blockaid, a Web3 security protocol that verifies transactions in real time. This layer of protection ensures that users avoid phishing, malicious approvals, and unexpected contract interactions—enhancing the overall safety of DeFi trading.

Users on Oku Trade can earn points through the Oku XP system by executing swaps, using vaults, and participating in on-chain activity. These points may qualify for retroactive airdrops, vault incentives, and tiered loyalty rewards. The XP and rewards system is in its early stages, with expanded benefits coming soon.

You Might Also Like