About Onmeta

Onmeta is a leading fiat-crypto infrastructure provider focused on enabling seamless, compliant, and developer-friendly on/off ramps, cross-border payments, checkout systems, and KYC infrastructure across India and Southeast Asia. Built by a passionate team of blockchain innovators, Onmeta empowers developers and platforms to integrate stablecoin conversions, fiat deposits, and INR/PHP settlements into their products with minimal effort.

As a fully FIU-IND registered entity, Onmeta ensures the highest level of compliance and performance across its infrastructure. Its plug-and-play tools allow wallets, exchanges, dApps, DAOs, and enterprise apps to easily add buy/sell crypto flows, stablecoin checkouts, and INR payouts — while the platform handles everything from KYC to AML to backend treasury. This makes Onmeta one of the most reliable partners for Web3 expansion in regulated fiat markets.

Onmeta was founded with the goal of solving one of Web3's most pressing bottlenecks: simple, compliant access to digital assets via local currencies. The team recognized the complexities of onboarding users in countries like India and the Philippines, where payment systems such as UPI and GCash dominate, but lack native integration with blockchain ecosystems. Through its suite of developer tools and APIs, Onmeta bridges this critical infrastructure gap.

The core product lineup includes:

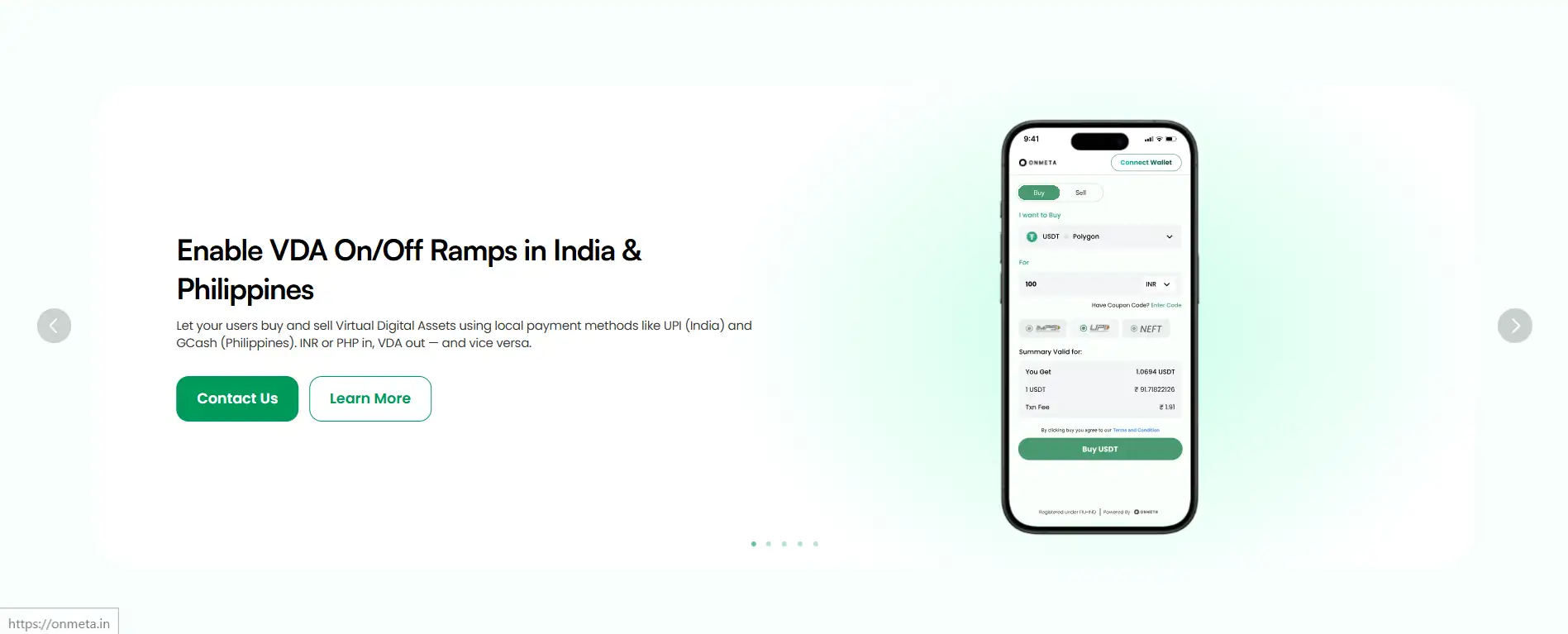

- On/Off-Ramps: Convert INR or PHP to USDT and vice versa via UPI, GCash, or local banking rails. Supports both on-ramp (fiat → crypto) and off-ramp (crypto → fiat) flows in under 2–30 minutes.

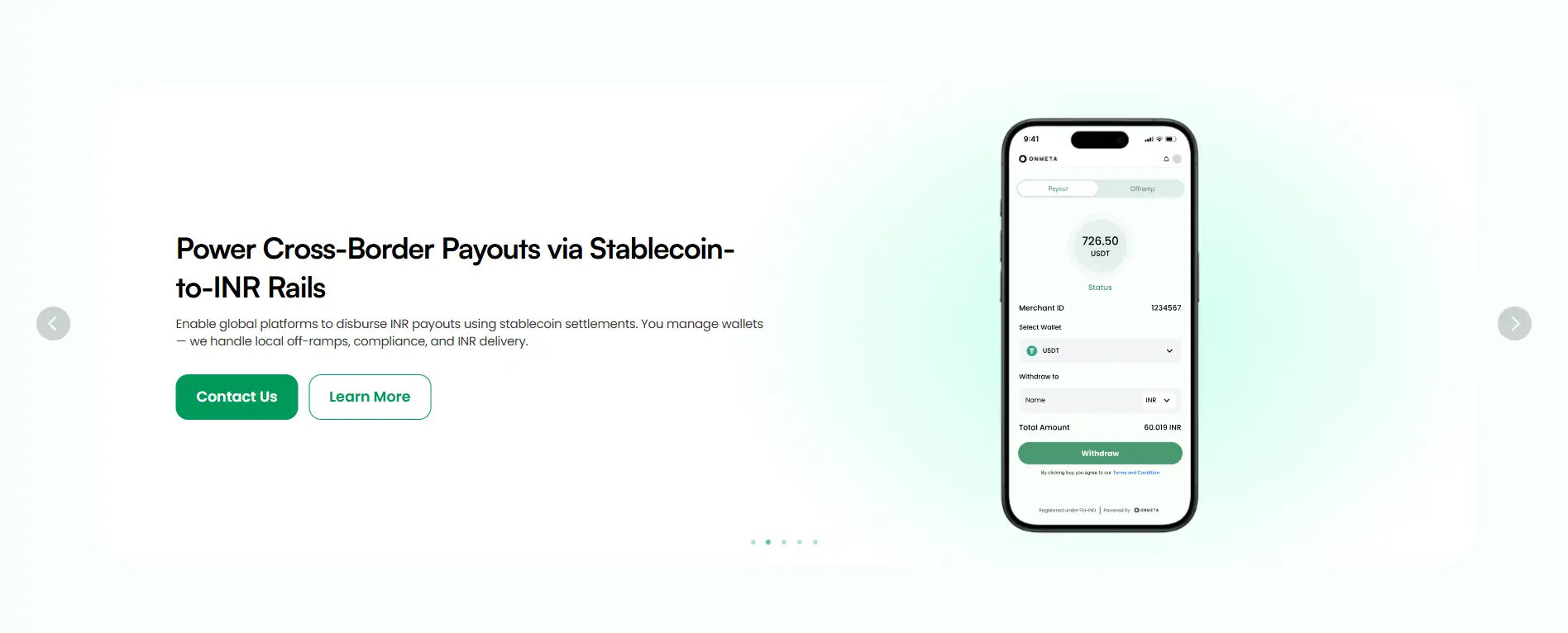

- Cross-Border Payouts: Allow global platforms to send USD or USDC to Indian recipients, with fully compliant INR bank settlement within 30 minutes.

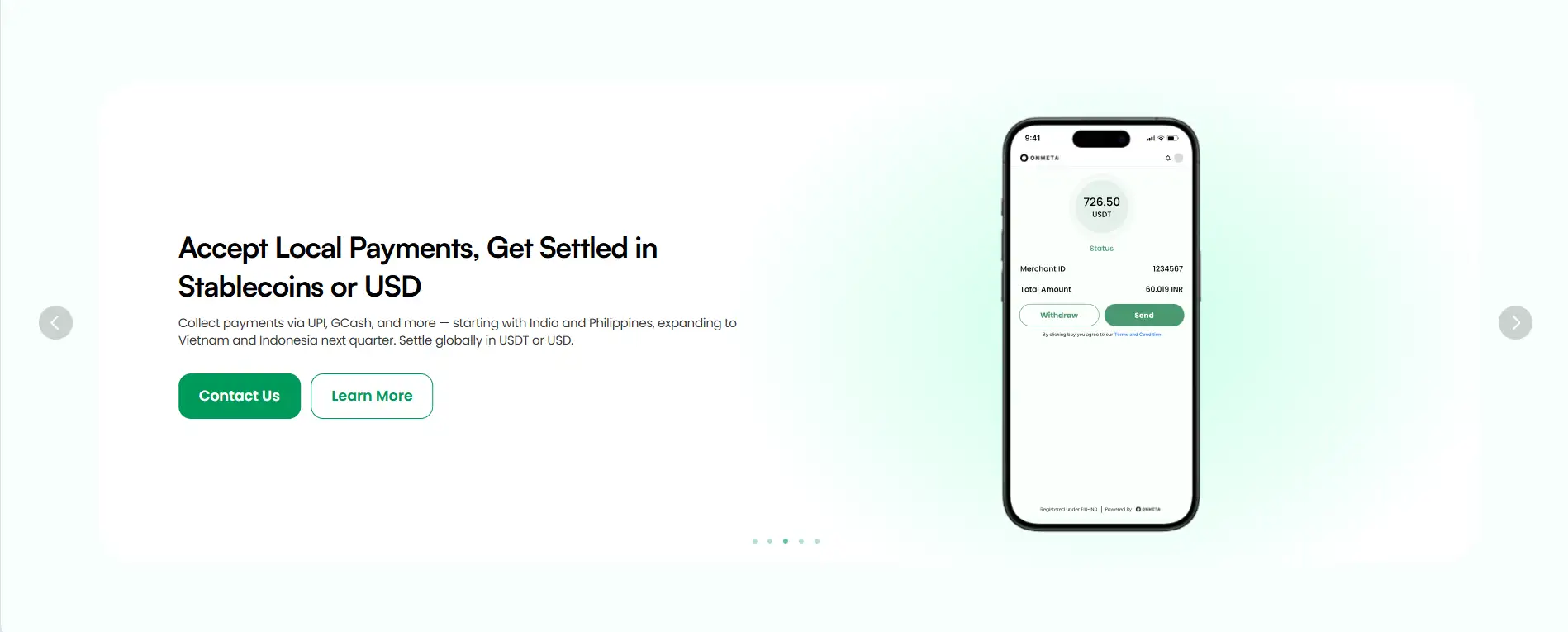

- Checkout: Accept payments in INR or PHP and settle in stablecoins like USDT or USDC. Perfect for gaming, NFT sales, and digital commerce.

- Compliance Stack: Built-in KYC, KYB, and AML infrastructure with fast decision-making, fallback systems, and full audit logs.

- White-Labeled Infra: Branded ramps and payment interfaces under your domain, while Onmeta handles backend infra, conversion, compliance, and reporting.

Each solution is designed with scalability, compliance, and developer experience at its core. Onmeta supports a wide range of integration options including iFrame widgets, JS SDKs, REST APIs, and even a batch upload dashboard for manual operations. Its platform supports 99.95%+ success rates and 99.99% uptime, making it enterprise-grade yet accessible to startups.

In the broader ecosystem, Onmeta's role is comparable to Ramp Network, Transak, and MoonPay, but with a distinct regional focus and tighter banking integration in India and Southeast Asia. Its support for regional standards like UPI, GCash, and localized KYC make it far more suitable for platforms targeting users in these emerging markets.

With SLA-backed settlement times, real-time monitoring, and enterprise-grade certifications like PCI DSS, SOC2, and SEAL-LV, Onmeta stands as a future-ready infrastructure layer for the next billion users entering Web3.

Onmeta offers a robust set of benefits and features for platforms building in the Web3 payment and fiat gateway ecosystem:

- Instant INR/PHP On-Ramps: Enable buy flows in under 2 minutes using UPI (India) or GCash (Philippines) with built-in compliance and settlement.

- Fast Off-Ramps: Sell tokens and withdraw to bank accounts in INR or PHP in under 30 minutes, with high SLA-backed success rates.

- Checkout APIs: Accept local payments and receive stablecoin settlements globally — optimized for NFT, gaming, SaaS, and digital commerce.

- Cross-Border USD → INR Payouts: Automate compliant remittance to Indian users — ideal for DAOs, creators, freelancers, and revenue share models.

- White-Labeled Gateway: Fully branded UI on your domain while Onmeta manages compliance, treasury, and backend ops.

- Regulatory-Ready Stack: FIU-approved entity with PCI DSS, SOC2 Type II, and SEAL-LV certifications plus robust AML pipelines.

- Flexible Integration: Choose from hosted widgets, SDKs, or full backend APIs to match your product's architecture.

- High Availability: Platform runs at 99.99% uptime with 24×7 monitoring and 99.95% first-attempt success rate.

Onmeta provides multiple ways for projects to integrate fiat rails into their Web3 products quickly and securely:

- Visit the Website: Go to onmeta.in to explore product options and documentation.

- Select Your Integration Path: Choose from on-ramp, off-ramp, checkout, cross-border payout, or compliance stack based on your needs.

- Pick Your Tooling: Use the iFrame widget for no-code setup, the JavaScript SDK for customizable UI, or the REST API for full backend control.

- Get Documentation Access: Request docs from the team to start building. Setup usually takes under 7 days from sandbox to production.

- Reach Out for Help: Contact the Onmeta team at [email protected] for partnership inquiries or support.

- Monitor and Manage: Use the Onmeta dashboard to view KYC approvals, payouts, refund logs, and webhook alerts.

Onmeta FAQ

Onmeta is fully registered under FIU-IND in India and operates in accordance with local financial laws. The platform maintains PCI DSS, SOC2 Type II, and SEAL-LV certifications, supports AES-256 encrypted data storage, and runs built-in KYC, KYB, and AML modules with real-time monitoring. These guardrails ensure end-to-end compliance for all fiat-to-crypto and crypto-to-fiat transactions across India and Southeast Asia.

Yes. Onmeta's White-Labeled Infra lets partners launch fully branded fiat on/off ramps under their own domain. This includes custom UI, logos, localized support flows, and domain-level integration — while Onmeta handles the backend payments, compliance, KYC, and conversion. It's ideal for projects looking to retain brand ownership without building costly infrastructure.

Onmeta Checkout supports INR and PHP payments through widely used methods like UPI and GCash, allowing platforms to accept local currency and receive USDT or USDC on settlement. This solves FX, compliance, and KYC challenges, while delivering real-time stablecoin payouts — making it perfect for NFTs, gaming, SaaS, and content-based platforms in high-growth markets.

Onmeta's cross-border payout infra enables platforms to send USD or USDC to Indian bank accounts with INR delivery in under 30 minutes. With 99.95% first-attempt success rates and SLA-backed reliability, the platform automates KYC, FX, and compliance checks to ensure fast, error-free settlements.

Onmeta offers multiple integration methods, including hosted widgets, JavaScript SDKs, REST APIs, and a dashboard for batch uploads. Each method supports complete onboarding, KYC, and transaction tracking. Most integrations can go live in under 7 days, with access to full documentation via onmeta.in.

You Might Also Like