About OpenCover

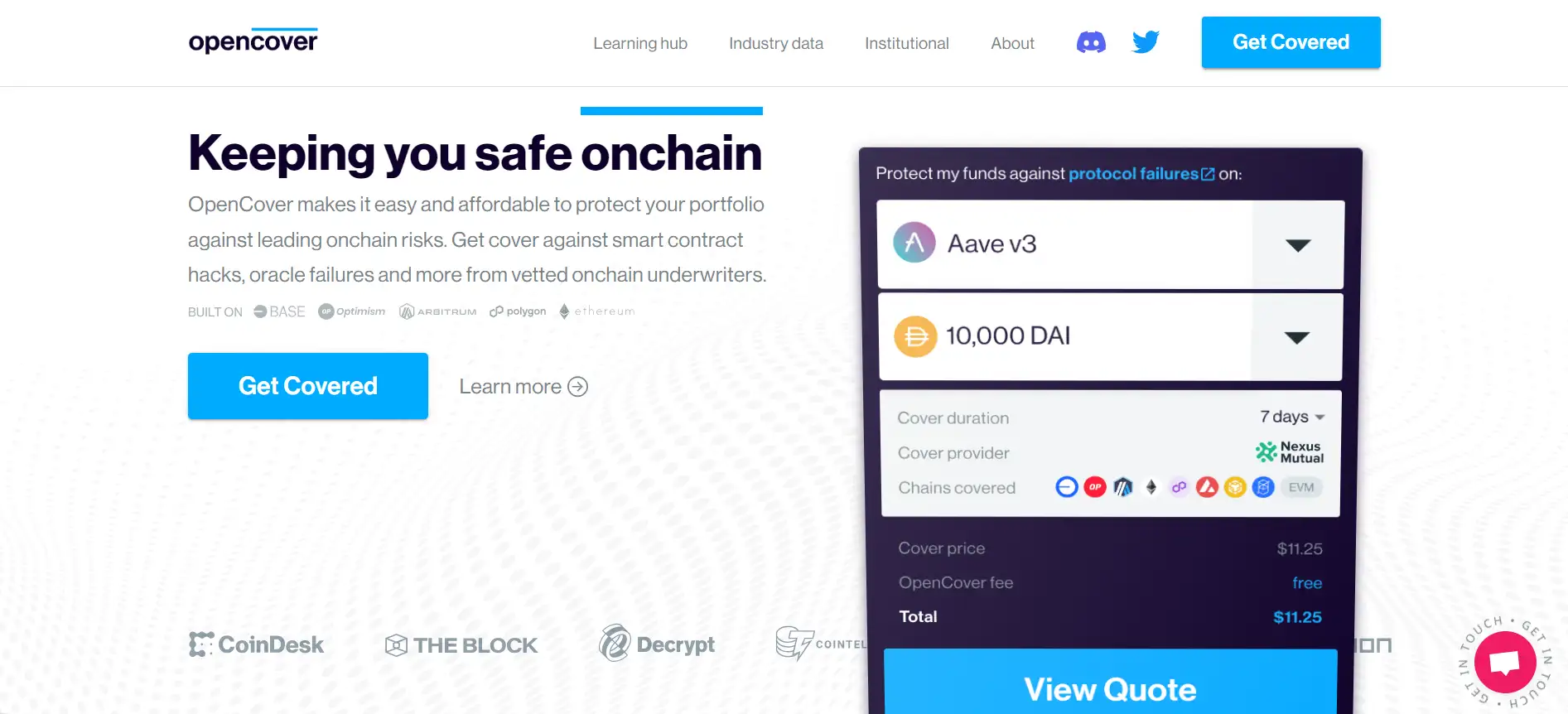

OpenCover is a decentralized insurance aggregator designed to provide seamless access to DeFi insurance. As the decentralized finance ecosystem continues to expand, the risks associated with smart contract vulnerabilities, hacks, and protocol failures remain a significant concern. OpenCover addresses this issue by connecting users with multiple blockchain-based insurance providers, allowing them to compare and purchase coverage in a decentralized manner.

By eliminating reliance on traditional insurance models, OpenCover enhances transparency, accessibility, and security in the DeFi insurance market. Instead of centralized intermediaries, claims and policies are managed through smart contracts, ensuring efficient claims processing and reducing costs for users. Whether you are a yield farmer, liquidity provider, or an institutional investor, OpenCover offers a critical layer of protection against potential financial losses in the Web3 space.

OpenCover is an innovative DeFi insurance aggregator that simplifies access to decentralized risk protection. Unlike conventional insurance models, which rely on centralized entities with complex approval processes, OpenCover streamlines the experience by aggregating policies from multiple on-chain insurance providers. This approach ensures that DeFi participants can find the best coverage options tailored to their specific needs.

How OpenCover Works

The platform operates as a bridge between DeFi users and established blockchain insurance providers like Nexus Mutual, InsurAce, and Risk Harbor. Users can browse different insurance policies, compare coverage options, and purchase insurance in a few simple steps. Smart contracts handle claim processing, ensuring fair and automated payouts.

Competitors and Market Position

While the decentralized insurance industry is still evolving, OpenCover faces competition from several key projects.

- Nexus Mutual – A pioneering DeFi insurance platform that operates as a mutual risk-sharing pool.

- InsurAce – Offers multi-chain insurance coverage with a focus on affordability and capital efficiency.

- Risk Harbor – A fully automated insurance protocol that processes claims without human intervention.

OpenCover provides numerous benefits and features that make it a standout solution in the DeFi insurance industry:

- Decentralized Insurance Aggregation: Unlike traditional insurers, OpenCover connects users with multiple DeFi insurance providers, allowing them to compare and select the best policies.

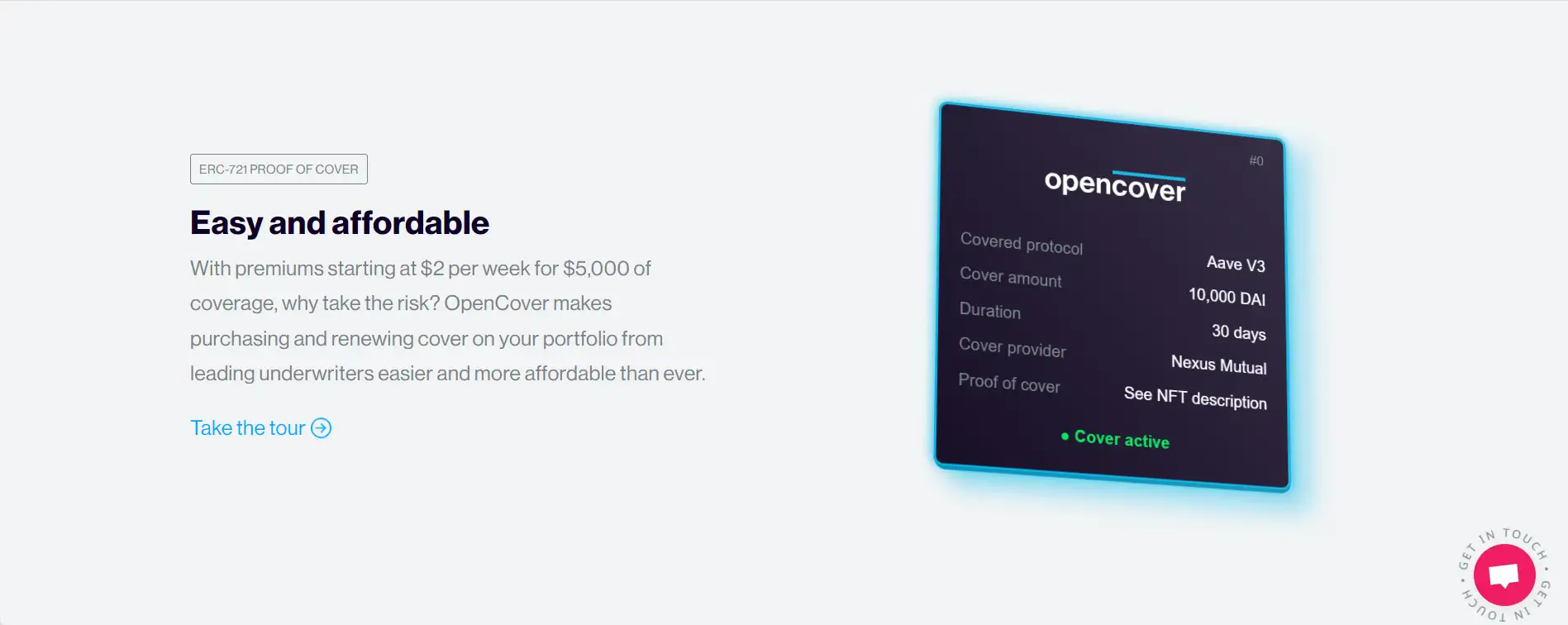

- Seamless Web3 Integration: Users can access OpenCover using their preferred blockchain wallets, making the process of purchasing insurance easy and efficient.

- Protection Against Smart Contract Exploits: Covers risks associated with protocol failures, security breaches, and fund losses.

- Fast and Transparent Claims Processing: Decentralized mechanisms ensure fair claims handling without intermediaries.

- Flexible Coverage Options: Users can customize their insurance based on the protocols they interact with, ensuring tailored protection.

Getting started with OpenCover is simple. Follow these steps to purchase decentralized insurance:

- Visit the OpenCover platform.

- Connect your Web3 wallet (e.g., MetaMask, WalletConnect).

- Browse available insurance policies from providers like Nexus Mutual and InsurAce.

- Select a policy that fits your needs and budget.

- Confirm the transaction and pay the premium using your preferred cryptocurrency.

- Monitor your coverage details through the OpenCover dashboard.

OpenCover FAQ

OpenCover utilizes smart contracts and decentralized protocols to ensure a transparent and automated claims process. Instead of relying on centralized decision-makers, claims are evaluated based on predefined criteria, removing human bias and inefficiencies. OpenCover integrates with providers like Nexus Mutual and Risk Harbor, which have automated claims processing mechanisms to ensure fair payouts.

Yes! OpenCover allows users to purchase insurance policies tailored to specific DeFi protocols. Whether you’re staking in liquidity pools, borrowing on a DeFi lending platform, or yield farming, you can find policies that cover the exact risks associated with your investments. To explore available coverage options, visit the OpenCover platform.

While OpenCover aggregates policies from multiple DeFi insurance providers, each provider operates independently. If a provider refuses to pay a valid claim, the user may escalate the issue through the provider’s governance model or dispute resolution process. Some providers, like Risk Harbor, use fully automated claims verification, reducing the risk of unfair denials.

OpenCover is designed for both experienced DeFi users and newcomers. The platform features a user-friendly interface that simplifies the process of purchasing insurance, making it easy even for those who are new to DeFi security. Additionally, OpenCover provides educational resources to help users understand the importance of risk management in decentralized finance.

OpenCover functions as an insurance aggregator, allowing users to compare coverage options, premium costs, and claim procedures across multiple providers. Instead of visiting individual platforms, users can access a side-by-side comparison of policies within a single dashboard on OpenCover. This ensures that users get the most cost-effective and reliable protection for their DeFi investments.

You Might Also Like