About Orbiter Finance

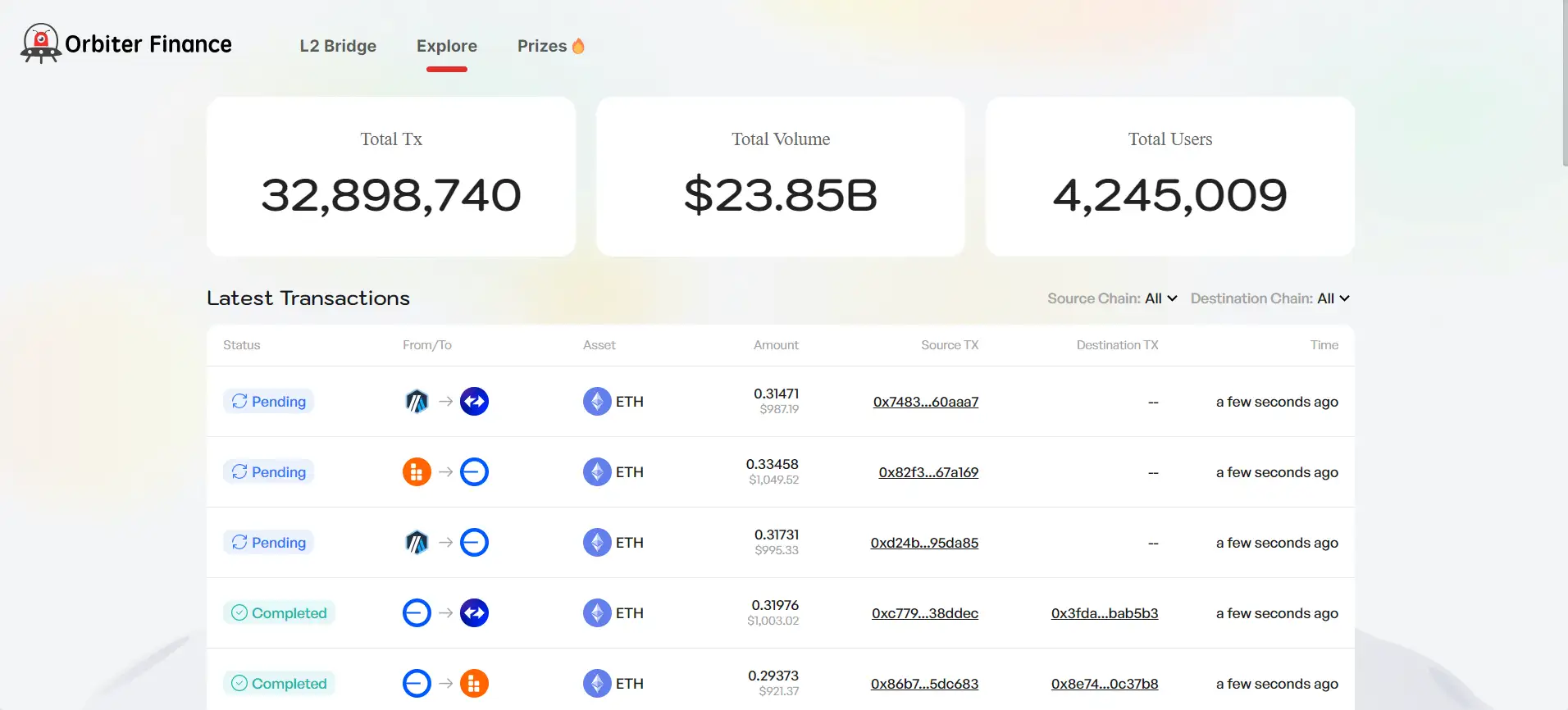

Orbiter Finance is a decentralized cross-rollup bridge designed to facilitate fast, low-cost, and secure transfers of assets across different Ethereum Layer 2 networks. By utilizing an innovative architecture, Orbiter Finance provides seamless interoperability between major scaling solutions like Optimistic Rollups and ZK-Rollups. This makes it a crucial infrastructure component in the growing multi-chain ecosystem.

The platform aims to solve critical issues related to high transaction fees and slow confirmation times on Ethereum by enabling fast asset transfers at a fraction of the cost. Unlike traditional cross-chain bridges that rely on liquidity pools, Orbiter Finance operates through a unique system of Maker and Sender roles, ensuring direct and trust-minimized transfers. This approach enhances security while maintaining decentralization, making it one of the most efficient and reliable solutions for Layer 2 interoperability.

Orbiter Finance is revolutionizing the way users transfer assets across Ethereum’s Layer 2 networks by providing a high-speed, low-cost bridge solution. Traditional blockchain bridges often rely on liquidity pools, which can expose users to smart contract risks, high slippage, and capital inefficiencies. However, Orbiter Finance eliminates these issues through its innovative peer-to-peer rollup bridge model, enabling seamless and direct transfers between supported networks.

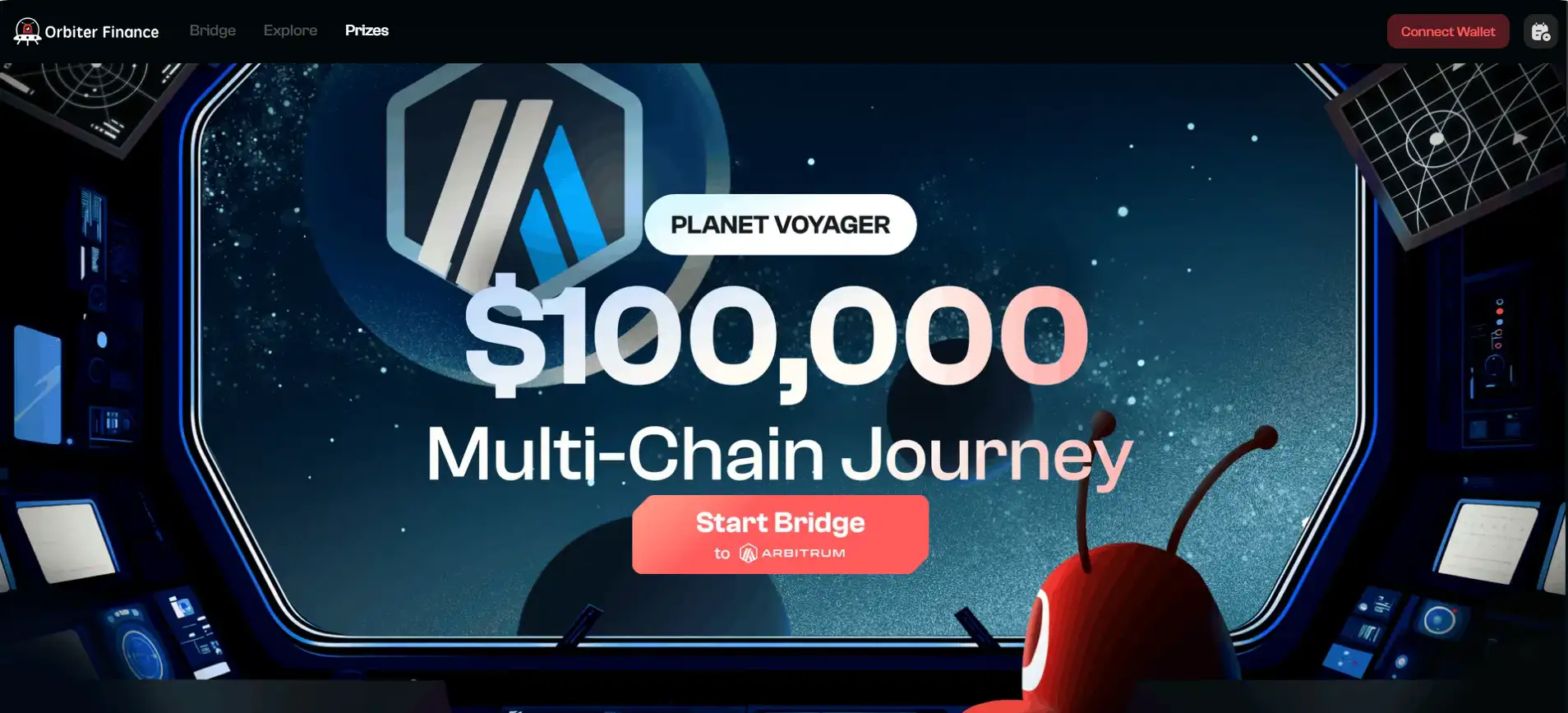

The platform currently supports major Layer 2 solutions, including Arbitrum, Optimism, zkSync, StarkNet, and Polygon zkEVM, allowing users to move assets with minimal friction. Its primary goal is to enhance the efficiency of the Ethereum ecosystem by reducing dependence on the Ethereum mainnet for transactions, significantly lowering gas fees and improving transaction speeds.

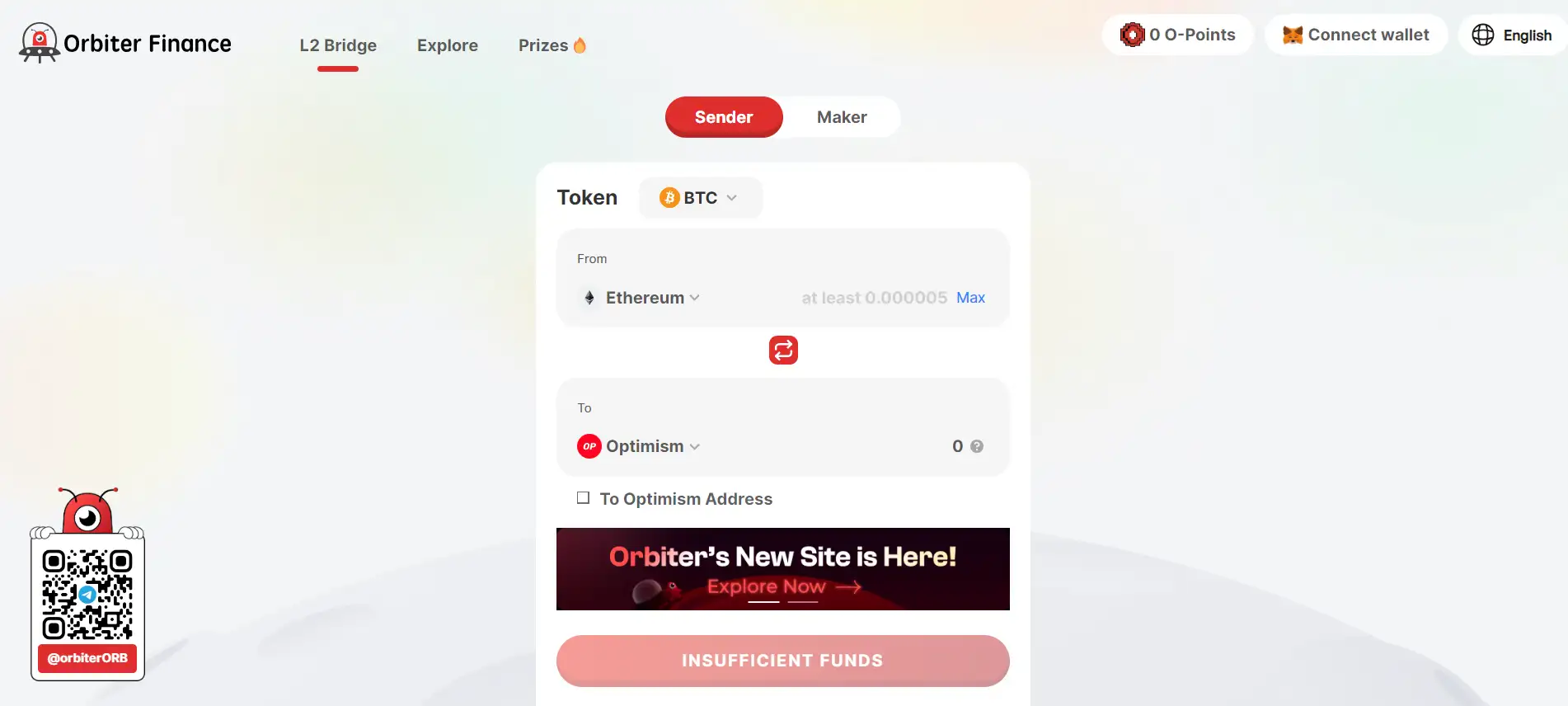

One of the key differentiators of Orbiter Finance is its reliance on a Maker-Sender model. In this system:

- Senders initiate transactions by sending assets on a source network.

- Makers monitor these transactions and transfer the equivalent amount to the recipient on the destination network.

This model ensures that transactions remain trustless and do not require liquidity pools, which reduces exposure to risks such as smart contract exploits and rug pulls. As a result, Orbiter Finance offers a highly secure and efficient method for transferring funds across Ethereum’s scaling solutions.

Comparing Orbiter Finance with other cross-chain solutions, it stands out due to its focus on Layer 2 rollups rather than traditional blockchain-to-blockchain bridges. Competing projects such as Hop Protocol, Stargate Finance, and Synapse Protocol also offer cross-chain transfers, but they often rely on liquidity pools or centralized mechanisms, making them less decentralized compared to Orbiter Finance.

By continuously improving its technology and expanding network support, Orbiter Finance aims to be the go-to solution for Ethereum Layer 2 interoperability. As the demand for efficient scaling solutions grows, its role in the blockchain ecosystem will only become more critical.

Orbiter Finance offers several key benefits that make it an essential tool for Ethereum Layer 2 interoperability:

- Fast and Low-Cost Transfers: Users can transfer assets across Layer 2 networks in seconds while paying significantly lower fees compared to Ethereum mainnet transactions.

- Trustless and Secure: The Maker-Sender model eliminates reliance on liquidity pools, reducing exposure to smart contract vulnerabilities.

- Multi-Chain Support: Orbiter Finance supports major Layer 2 rollups such as Arbitrum, Optimism, zkSync, StarkNet, and Polygon zkEVM.

- Scalability: By facilitating direct Layer 2 transfers, Orbiter Finance helps alleviate congestion on the Ethereum mainnet.

- Decentralization: The project operates in a non-custodial manner, ensuring users retain full control over their assets during transfers.

Using Orbiter Finance is simple and requires only a few steps to get started:

- Connect Your Wallet: Visit Orbiter Finance and connect your preferred Web3 wallet such as MetaMask or WalletConnect.

- Select the Networks: Choose the source network and destination network for your transfer.

- Enter the Amount: Specify the amount of assets you want to transfer.

- Confirm the Transaction: Review the details and approve the transaction in your wallet.

- Wait for Completion: Transactions typically complete in seconds, and your assets will arrive in the destination network without delay.

Orbiter Finance FAQ

Orbiter Finance ensures security by eliminating the need for liquidity pools, which are often targets for exploits. Instead, the platform uses a direct peer-to-peer transfer model, where a trusted Maker completes the transaction only when the corresponding deposit is detected on the source chain. This prevents front-running, smart contract vulnerabilities, and rug pulls. Additionally, all transactions are publicly verifiable on-chain, ensuring full transparency. Users can track their transactions directly on Orbiter Finance or via blockchain explorers.

The Maker-Sender model used by Orbiter Finance eliminates the need for liquidity pools, reducing the risks of impermanent loss, hacks, and capital inefficiency. Traditional bridges require users to deposit funds into smart contracts, which can be vulnerable to attacks. Instead, Orbiter’s model ensures that transactions are executed directly between two parties without storing assets in a contract. This allows for faster, cheaper, and more secure transfers between Ethereum Layer 2 networks.

No, failed transactions do not result in lost funds. If a transaction fails due to network congestion, insufficient gas fees, or any other issue, the assets remain in the sender’s wallet. Users can track transaction status on Orbiter Finance or use a blockchain explorer to check for pending or reverted transactions. If an issue persists, the Orbiter Finance team provides support through their Twitter.

Currently, Orbiter Finance only supports the transfer of fungible tokens such as ETH, USDC, and other supported assets. The platform is optimized for seamless Layer 2 interoperability and fast token transfers. However, future updates may include NFT bridging as Ethereum Layer 2 ecosystems evolve. For now, users looking to move NFTs between networks should explore dedicated NFT bridges.

Unlike centralized exchanges (CEXs), Orbiter Finance allows users to bridge assets directly between Layer 2 networks without relying on third parties. Centralized exchanges require users to deposit funds, trade to another asset, withdraw, and often pay multiple fees along the way. With Orbiter Finance, transfers are non-custodial, meaning users retain full control over their assets at all times. Additionally, bridging via Orbiter Finance is faster and cheaper since there are no exchange trading fees or withdrawal limits.

You Might Also Like