About Ostrich

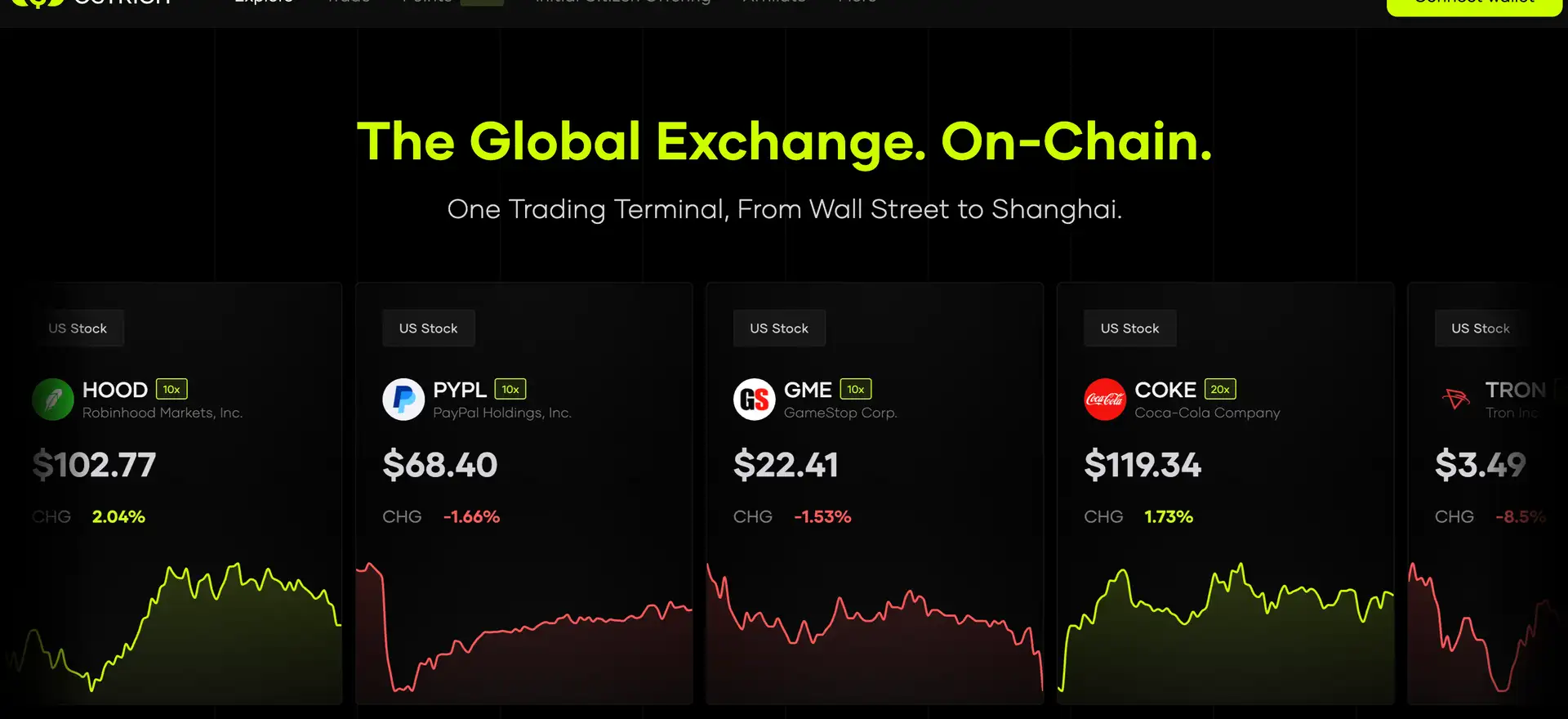

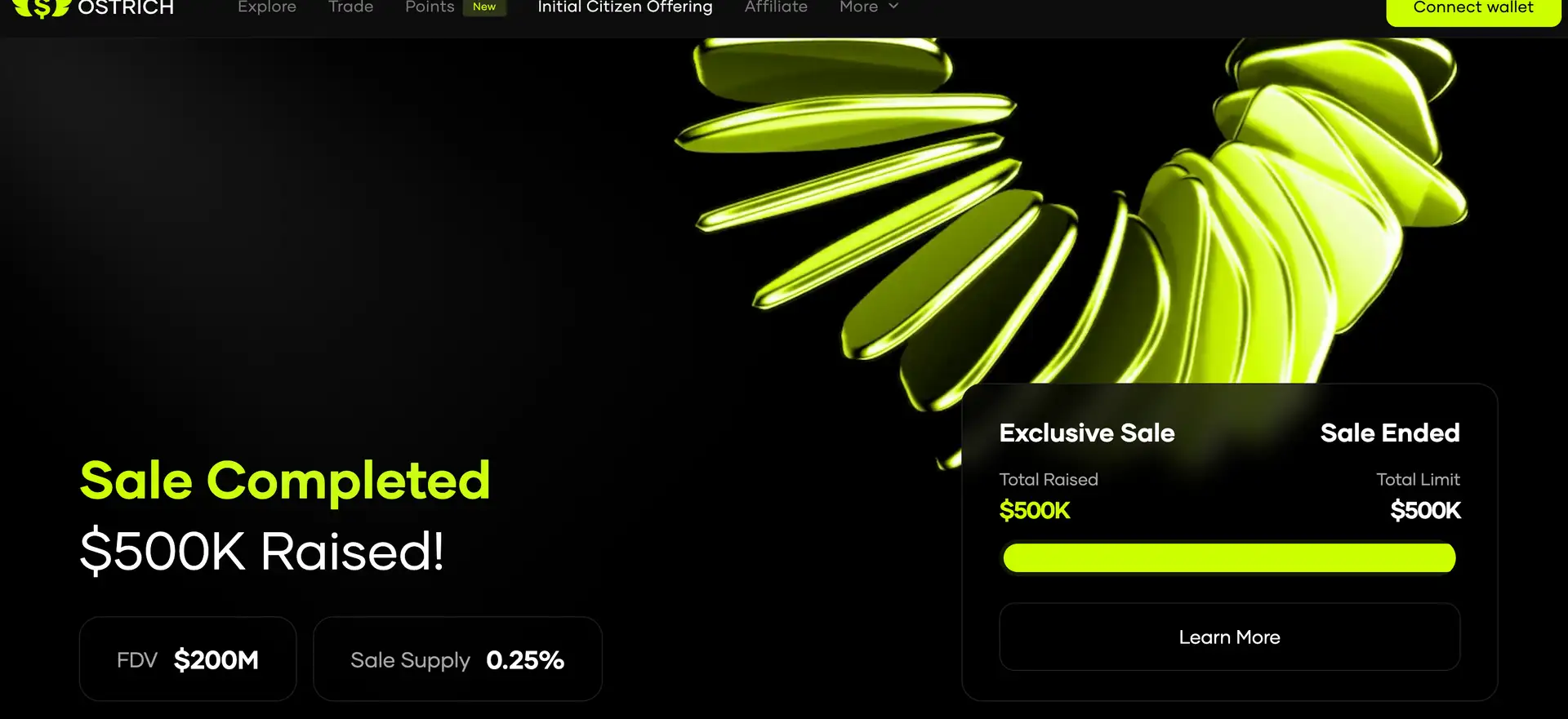

Ostrich is a decentralized, borderless trading platform that enables permissionless access to real-world financial markets—all onchain. Built on Arbitrum, Ostrich allows anyone with a crypto wallet to trade global equities, metals, commodities, forex, and crypto perpetuals with zero intermediaries. There are no brokers, no custodians, and no KYC. Just your wallet, oracle-powered pricing, and frictionless market access.

The platform uses a novel Payment for Order Flow (PFOF) model to connect traders with trusted execution venues, offering seamless access and deep liquidity without traditional liquidity pools. Ostrich reimagines trading as a transparent, decentralized experience—rewarding users for participation while offering real exposure to macro assets, not synthetic wrappers. It’s designed for global citizens ready to move beyond borders and intermediaries.

Ostrich is transforming how the world accesses financial markets by merging the composability of DeFi with real-world asset exposure. Traditional brokers and trading platforms often come with regional restrictions, KYC requirements, and custodial models that compromise user control. Ostrich removes these barriers by offering onchain perpetual contracts for international equities, forex pairs, metals, and more—all collateralized by USDC and priced via tamper-proof oracles.

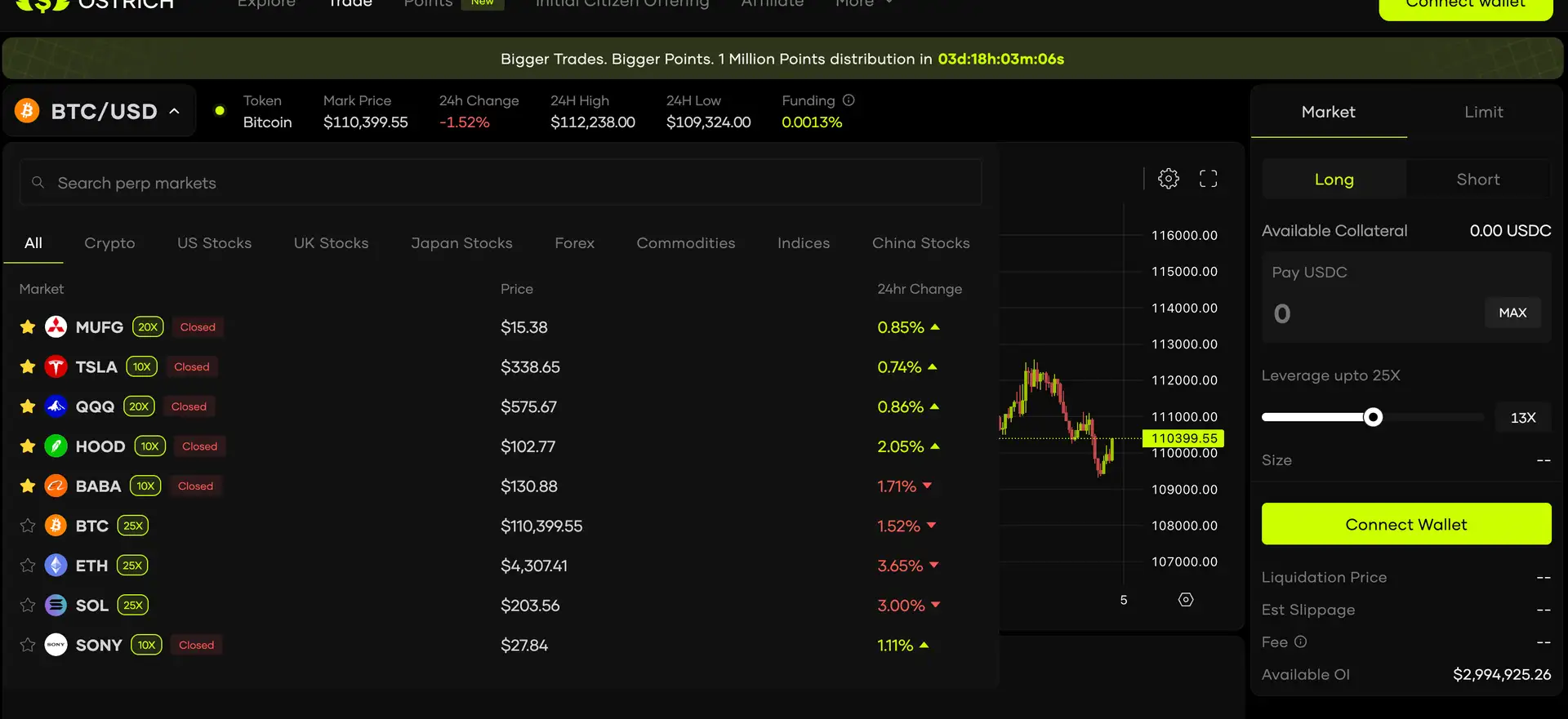

The platform supports trading on markets like US tech stocks, China blue chips, European equities, gold, silver, and crypto assets. All trades are settled through a PFOF engine, where execution partners like CEXs and MMs route orders efficiently, offering users zero slippage from internal liquidity and potentially tighter spreads. Users maintain custody of their assets while enjoying capital-efficient trading with leverage and no platform fees.

Ostrich stands out from traditional DEXs like dYdX, Perpetual Protocol, or Gains Network by not operating liquidity pools or internal books. Instead, it focuses on routing, execution quality, and analytics—closer to TradFi platforms like Robinhood and Wealthsimple but fully decentralized. This hybrid approach leverages crypto’s composability while maintaining trading efficiency.

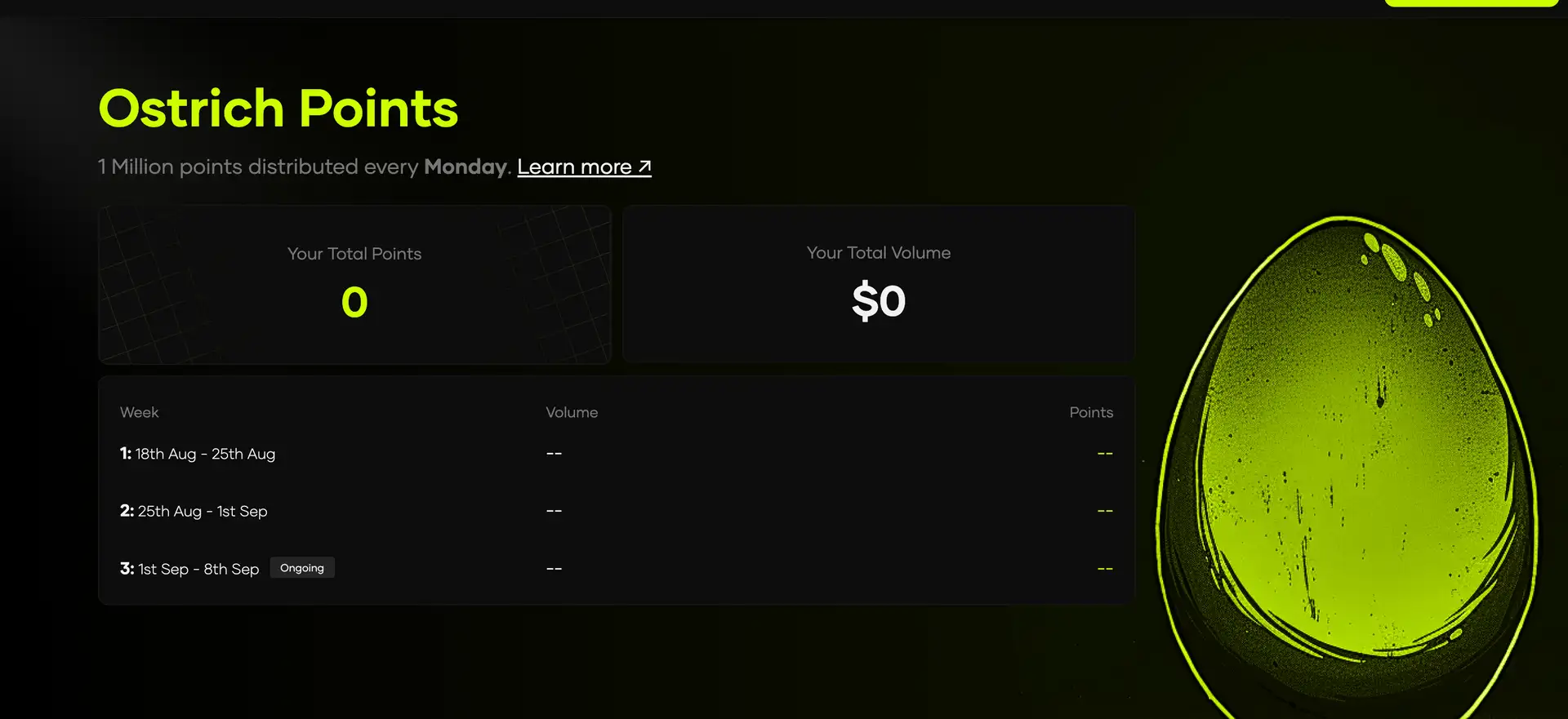

The platform's roadmap includes a wide range of features: TP/SL automation, mobile apps, advanced routing algorithms, developer SDKs, and user incentive programs. With an expanding asset base and real-time analytics dashboards, Ostrich is building the foundational infrastructure for a unified, permissionless, and globally accessible onchain exchange—aligning user incentives with execution transparency and market fairness.

Ostrich provides numerous benefits and features that make it a standout platform in the onchain real-world asset trading space:

- Global Market Access: Trade US, China, UK, and German equities, commodities, metals, forex, and crypto with no geographic restrictions.

- Oracle-Powered Pricing: Real-world asset prices are sourced from secure, tamper-proof oracles instead of broker feeds, ensuring transparency and fairness.

- No KYC, No Custody: Trade directly from your wallet—no intermediaries, no custodial risk, and no identity verification.

- Payment for Order Flow Model: Orders are routed to trusted execution partners, offering seamless trading with external liquidity and small rebates that power the protocol.

- Gasless Transactions: Trades on Ostrich are gasless—no signing, no fees, just fast execution through optimized Arbitrum L2 rails.

- Real-Time Trade Management: Track your PnL, funding rates, and XP earnings live onchain with complete visibility into your performance.

- Points Program: Earn points for every trade to qualify for future incentives, airdrops, and leaderboard rewards.

Getting started with Ostrich is easy, fast, and requires only your Web3 wallet:

- Visit the App: Go to app.ostrich.exchange.

- Connect Your Wallet: Click “Connect Wallet” and approve the connection. Recommended options include MetaMask, Coinbase Wallet, Rabby, or WalletConnect.

- Switch to Arbitrum: Ensure your wallet is connected to the Arbitrum Layer 2 network for low-cost, fast execution.

- Deposit USDC: Fund your Arbitrum wallet with USDC to start trading. Use bridges if necessary to transfer funds from Ethereum.

- Select Your Market: Navigate to “Trade” and choose an asset: equities (e.g., $TSLA, $BABA), forex (e.g., USD/JPY), or metals (e.g., $GOLD).

- Place Your Trade: Choose long or short, enter trade size in USDC, adjust leverage, and place your order. No gas or wallet signature required.

- Manage Open Positions: View all active positions, add margin, close positions partially or fully, and monitor real-time PnL and fees via the dashboard.

Ostrich Reviews by Real Users

Ostrich FAQ

Ostrich offers exposure to real-world assets like stocks, metals, and forex through oracle-powered perpetual contracts rather than tokenizing the underlying assets. This approach bypasses the legal and regulatory complexities of asset tokenization and provides immediate access to global markets without needing to wrap, custody, or issue synthetic tokens. Prices are sourced from tamper-proof oracles, allowing users to trade based on real-time market data while staying fully onchain.

Ostrich uses a PFOF (Payment for Order Flow) model to route trades to execution partners such as market makers or CEXs. Unlike DEXs that rely on internal AMM liquidity pools, Ostrich doesn’t hold liquidity or act as a market maker. This model allows for better execution prices, higher liquidity depth, and gasless trading while still keeping user custody intact. It's a blend of TradFi execution logic with DeFi transparency and user control.

Ostrich is built on the principle of self-custody and permissionless access. Users trade directly from their wallets—no KYC, no email, no bank required. Security is maintained through onchain smart contracts that handle trade settlement, margin, and funding rates. Additionally, all pricing is oracle-sourced, and trades are gasless, minimizing wallet exposure and improving UX while keeping the platform fully decentralized and borderless.

Ostrich doesn’t rely on internal liquidity or AMMs, which often lead to high slippage. Instead, it routes orders to trusted execution partners offering tight bid-ask spreads and better fill rates. Trades are executed externally via the most efficient venues, and pricing is validated by oracle feeds that meet or exceed NBBO-equivalent pricing standards. This ensures that users receive fair, transparent execution on every trade.

Ostrich uses USDC as the sole collateral for simplicity, transparency, and trust. Many platforms require users to trade using volatile tokens or derivatives that may have low liquidity or unclear backing. USDC is widely accepted, stable, and easy to bridge to Arbitrum. It also eliminates the complexity of managing synthetic assets, making it easier for traders to track margin, PnL, and risk in a straightforward way while maintaining DeFi-native composability.

You Might Also Like