About Overnight

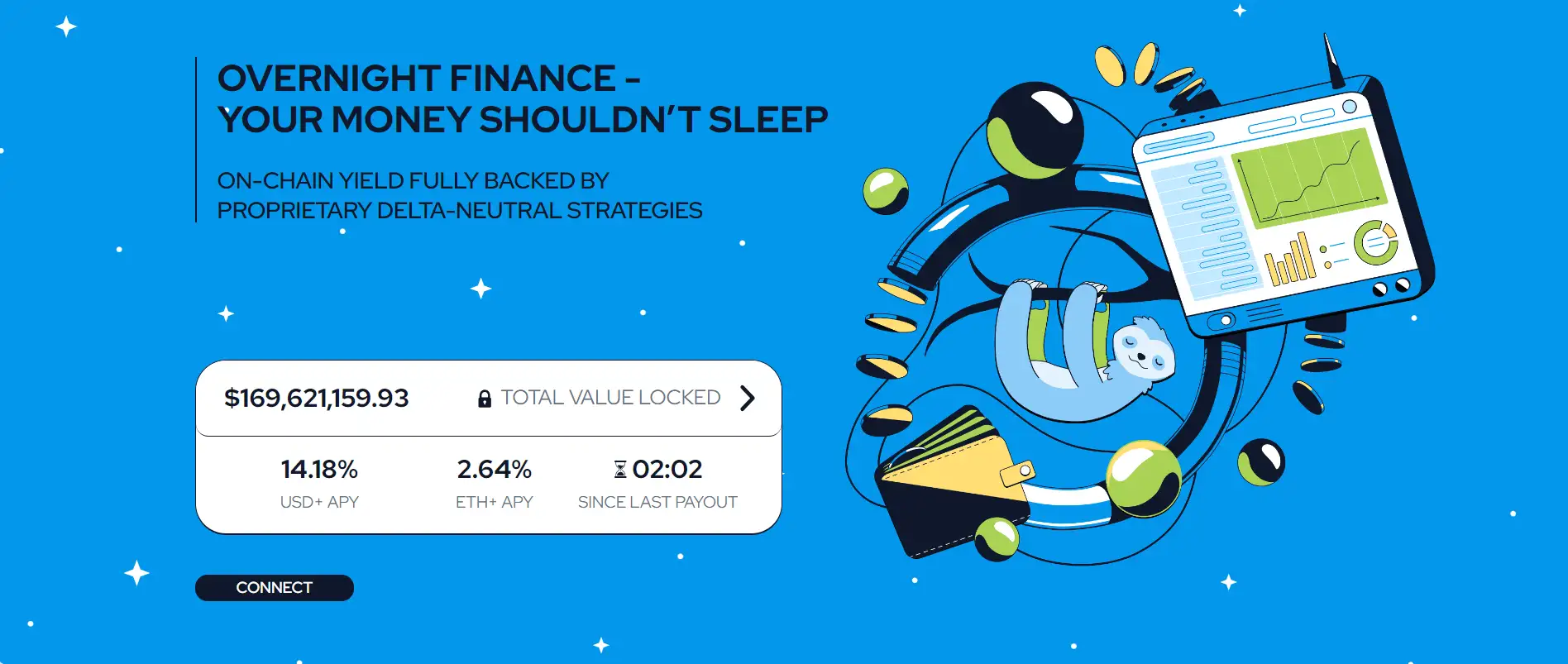

Overnight Finance is a decentralized finance (DeFi) protocol designed to provide users with yield-generating stablecoins through innovative on-chain investment strategies. The platform specializes in offering delta-neutral stablecoin strategies, ensuring low-risk returns while maintaining capital efficiency. Built to optimize passive income in DeFi, Overnight Finance is an ideal choice for users looking for stable yields without excessive volatility.

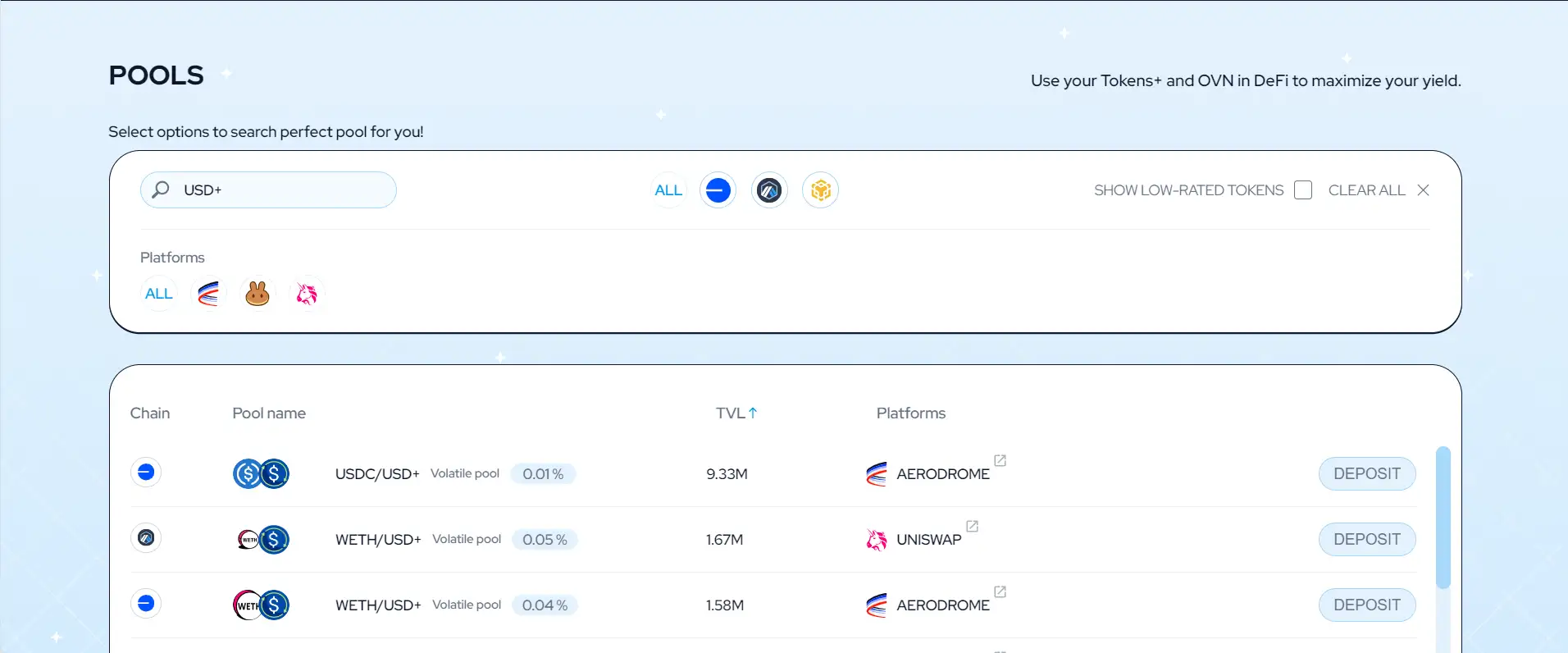

By leveraging smart contract automation, Overnight Finance offers an ecosystem where users can deposit stablecoins into specialized yield-bearing assets. These assets, such as USD+ and DAI+, are designed to generate sustainable rewards by allocating capital into low-risk DeFi strategies. With a focus on security, efficiency, and transparency, Overnight Finance enables users to earn passive income without the complexities of high-risk speculative investments.

Overnight Finance was developed to bridge the gap between traditional stablecoins and yield-generating DeFi protocols. Unlike standard stablecoins that remain idle in wallets, Overnight’s stable assets generate daily compounding rewards, making them a superior alternative for capital efficiency. The flagship product, USD+, is a yield-bearing stablecoin that operates on multiple chains, including Ethereum, BNB Chain, Arbitrum, and Optimism.

The core mechanism behind Overnight Finance involves delta-neutral strategies, which aim to maximize yield while minimizing exposure to market volatility. This is achieved through automated asset rebalancing, where funds are allocated across low-risk lending platforms, liquidity pools, and yield-generating DeFi protocols. Unlike high-risk yield farming strategies, Overnight’s approach ensures principal protection while delivering consistent returns.

A major differentiator for Overnight Finance is its ability to offer real yield rather than relying on unsustainable reward tokens. The platform’s stablecoins accrue interest through on-chain investments, allowing users to earn passive income without relying on speculative token appreciation. The seamless integration of USD+ and DAI+ across multiple DeFi protocols further enhances its usability, making it a valuable asset in the broader DeFi ecosystem.

In terms of competition, Overnight Finance is positioned against other yield-generating stablecoin solutions such as Frax Finance, Liquity, and Ampleforth. However, Overnight’s delta-neutral strategy, combined with its multi-chain availability, sets it apart by offering a risk-mitigated and transparent yield-generating solution.

Overnight Finance offers numerous features and benefits that make it an ideal choice for DeFi yield generation:

- Delta-Neutral Yield Strategies: Overnight Finance employs low-risk investment strategies to maximize stablecoin returns while minimizing exposure to volatility.

- Daily Compounding Rewards: Users holding USD+ or DAI+ automatically earn compounded interest without needing to stake or farm manually.

- Multi-Chain Accessibility: The platform operates on Ethereum, BNB Chain, Arbitrum, and Optimism, making it widely accessible across multiple DeFi ecosystems.

- Smart Contract Automation: Overnight Finance leverages automated rebalancing to optimize capital allocation across DeFi protocols.

- No Impermanent Loss: Unlike liquidity provision strategies, USD+ and DAI+ eliminate exposure to impermanent loss, providing a more stable earning model.

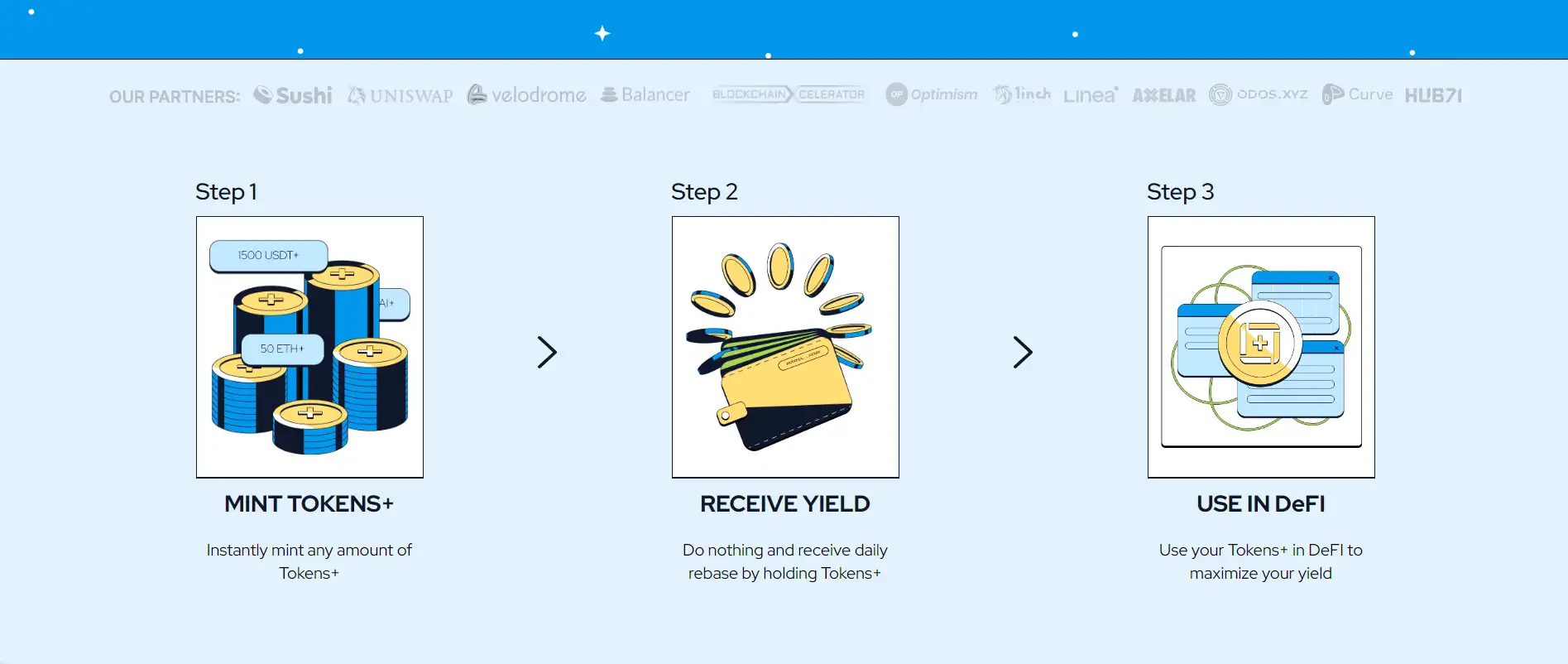

Getting started with Overnight Finance is simple and requires only a few steps:

- Set Up a Web3 Wallet: To use Overnight Finance, install a compatible wallet such as MetaMask or Rabby Wallet.

- Choose Your Network: Select the network you wish to operate on, such as Ethereum, BNB Chain, Arbitrum, or Optimism.

- Acquire Stablecoins: Obtain USDC or DAI from a centralized exchange or swap them on a DeFi exchange.

- Mint Yield-Bearing Stablecoins: Deposit USDC or DAI into the Overnight Finance platform to mint USD+ or DAI+.

- Earn Passive Yield: Your balance will automatically accrue daily interest, providing sustainable, compounding rewards.

Overnight FAQ

Overnight Finance maintains stable yield by using delta-neutral investment strategies. This means it carefully allocates funds across low-risk lending protocols and stablecoin yield pools while avoiding volatile assets. Unlike traditional yield farming, which relies on unsustainable rewards, Overnight Finance generates yield through real market-driven returns, ensuring consistent and reliable earnings.

USD+ and DAI+ are designed to minimize exposure to market fluctuations. If extreme volatility occurs, Overnight Finance automatically rebalances its liquidity pools and lending positions to protect users. Additionally, the platform maintains overcollateralized backing to ensure that USD+ and DAI+ remain stable, providing an extra layer of security for investors.

Yes! USD+ and DAI+ can be used as collateral on various DeFi lending protocols. Many lending platforms allow users to borrow other assets against their yield-generating stablecoins, meaning you can earn passive income while utilizing your capital. Check supported integrations on Overnight Finance to see which platforms accept USD+ and DAI+ as collateral.

Overnight Finance prioritizes transparency by offering fully on-chain, auditable investment strategies. Users can track their yield generation in real-time and monitor the smart contracts governing the protocol. Additionally, Overnight Finance provides detailed reports and analytics, ensuring that users always have visibility into how their assets are being utilized.

No, Overnight Finance allows users to deposit any amount to start earning yield. Whether you’re a beginner with a small balance or an institutional investor, Overnight Finance ensures that all users can participate in its stablecoin yield generation. The compounding mechanism works regardless of deposit size, making it accessible to everyone.

You Might Also Like