About PlutusDAO

PlutusDAO is an Arbitrum-native DeFi governance aggregator that empowers users to maximize liquidity, rewards, and voting power through innovative staking and vault solutions. By introducing plsASSETs and plvASSETs, PlutusDAO ensures that users retain liquidity while participating actively in governance and earning superior yields. The protocol acts as the "Governance Blackhole" of Layer 2 by centralizing governance power around the PLS token without sacrificing user flexibility.

Focused on collaboration and integrations, PlutusDAO works alongside top-tier projects such as Camelot, Radiant, GMX, and Stryke (formerly Dopex) to offer governance aggregation, productive vaults, and yield optimization strategies tailored for Arbitrum users.

PlutusDAO operates through a dual-product ecosystem featuring plsASSETs and plvASSETs. plsASSETs enable users to remain liquid while accruing voting rights and rewards associated with veTokens from partner protocols like Radiant and Stryke. Meanwhile, plvASSETs are vault products that optimize underlying yield streams, such as plvGLP, providing an enhanced user experience and building essential DeFi infrastructure on Arbitrum. PlutusDAO has positioned itself as a critical player in consolidating governance and liquidity flows across the Layer 2 ecosystem.

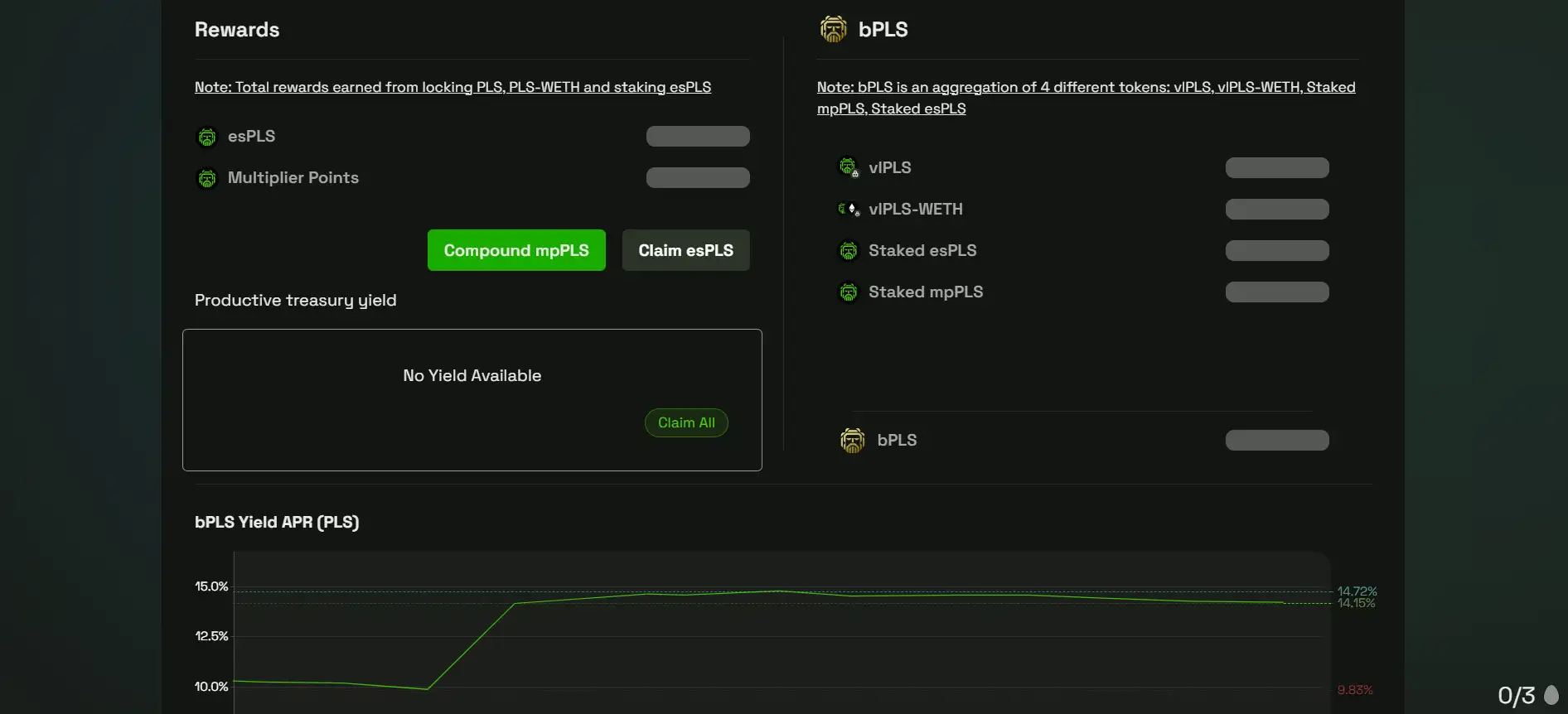

The PLS token is the backbone of the platform, representing aggregated governance power and serving as the primary reward token. It features a carefully managed supply structure with allocations for liquidity mining, operational incentives, bonding, and treasury building. The non-rebase bonding model strengthens the protocol without introducing unnecessary inflation, preserving long-term value for PLS holders.

Fees from underlying yields, including assets like xSYK, dLP, veSPA, and GLP, are collected into the Plutus treasury to further expand ecosystem growth. PlutusDAO distinguishes itself by not only maximizing user rewards but also enabling strategic asset accumulation and liquidity provisioning through its vaults and bonding mechanisms.

In the governance aggregator and liquid staking arena, PlutusDAO competes with protocols such as Hidden Hand by Redacted Cartel, and Yearn Finance in terms of yield optimization. However, PlutusDAO sets itself apart by concentrating solely on Arbitrum governance consolidation and offering unmatched liquidity advantages via its innovative products.

PlutusDAO delivers numerous benefits and features that redefine governance aggregation and liquidity management on Arbitrum:

- Liquid Governance Participation: Stake in governance without sacrificing asset liquidity through plsASSETs.

- Vault-Optimized Yields: Maximize returns on assets like GLP and RDNT with plvASSETs, tailored for Arbitrum DeFi.

- Non-Rebase Bonding: Accumulate strategic assets without inflating PLS supply or diluting holder value.

- Comprehensive Partner Network: Integrated with Radiant, GMX, Camelot, Stryke, Jones DAO, and others.

- Productive Treasury: Revenue from fees is reinvested to strengthen PlutusDAO’s ecosystem and treasury growth.

- Flexible User Experience: Easy staking, vault participation, reward collection, and governance involvement.

- Security & Sustainability: Designed to be Arbitrum-native, scalable, and aligned with long-term user and protocol interests.

Getting started with PlutusDAO is straightforward and designed for both DeFi newcomers and experienced users:

- Visit the Website: Head to plutusdao.io and connect your Web3 wallet.

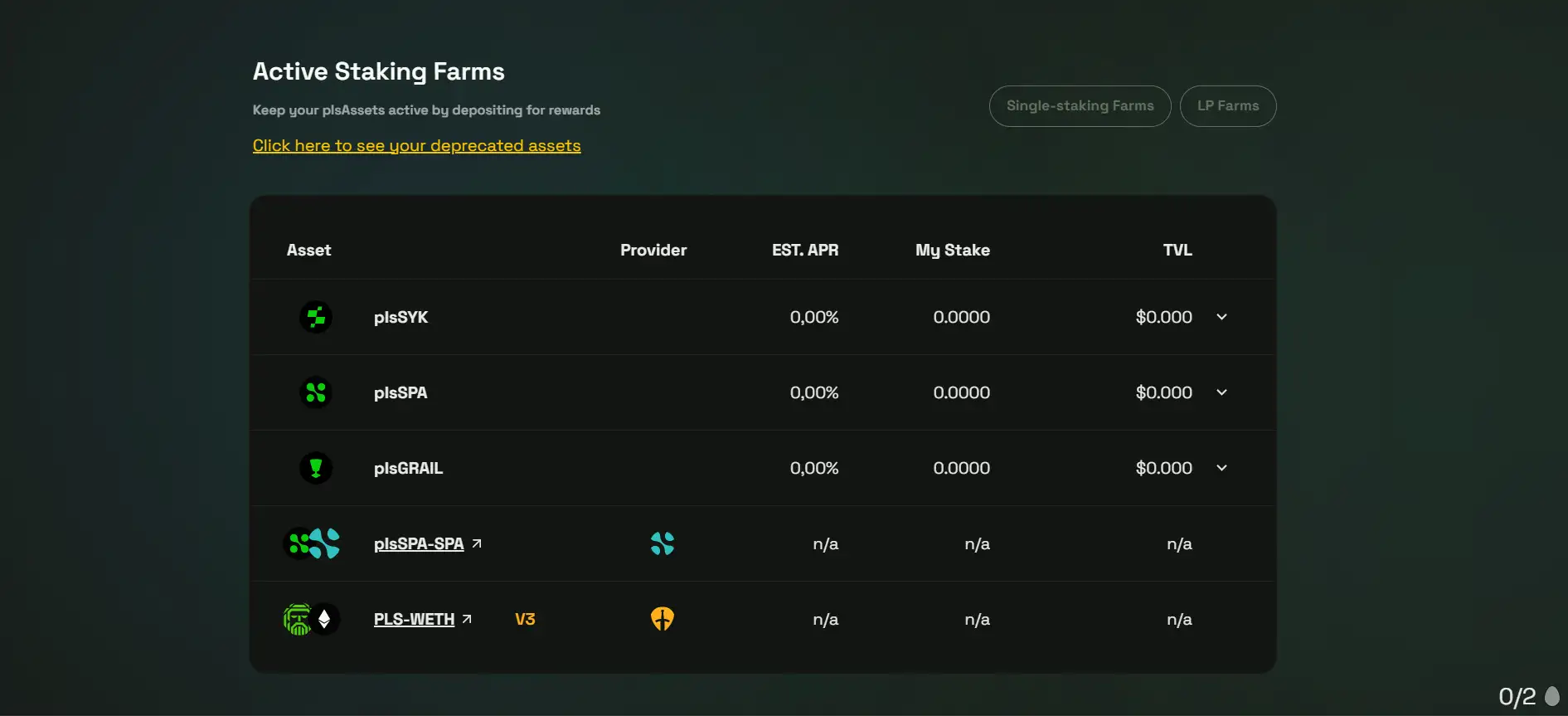

- Stake PLS or Deposit Assets: Stake your PLS tokens or deposit assets into available plsASSETs and plvASSETs vaults.

- Earn Rewards: Start earning yield while retaining voting power in partner protocols without locking up your liquidity.

- Participate in Governance: Use your plsASSETs to influence governance outcomes across partner projects while staying fully liquid.

- Track Performance: Monitor your rewards and vault performance through the “Stats” section of the platform.

- Join the Community: Stay updated and engage with the PlutusDAO community on Discord and Twitter.

- Deepen Learning: Explore the detailed documentation for technical insights and new product releases.

PlutusDAO FAQ

PlutusDAO introduces plsASSETs, which represent veTokenized assets but retain liquidity for users. By staking into PlutusDAO’s contracts, users earn rewards and governance rights without locking or losing access to their tokens, providing both flexibility and maximized yields.

plsASSETs focus on governance aggregation, enabling users to maintain liquidity and voting rights on projects like Radiant and Camelot. plvASSETs, meanwhile, are vault-optimized yield products that maximize returns through strategies like plvGLP staking. Both products are critical to PlutusDAO’s mission of becoming the governance and yield layer for Arbitrum.

PlutusDAO’s non-rebase bonding model avoids issuing inflationary rewards, preserving the value of PLS over time. Only a limited supply (10% of total PLS) is reserved for strategic bonding, ensuring that asset accumulation strengthens PlutusDAO’s treasury without flooding the market and harming existing PLS stakeholders.

PlutusDAO generates revenue by collecting fees on yield-producing assets like xSYK, dLP, veSPA, and GLP. A portion of these fees are directed to the treasury, which supports protocol development, incentive programs, and strategic asset accumulation. This model ensures sustainable growth and strengthens PlutusDAO’s DeFi infrastructure over the long term.

You Might Also Like