About Pulley

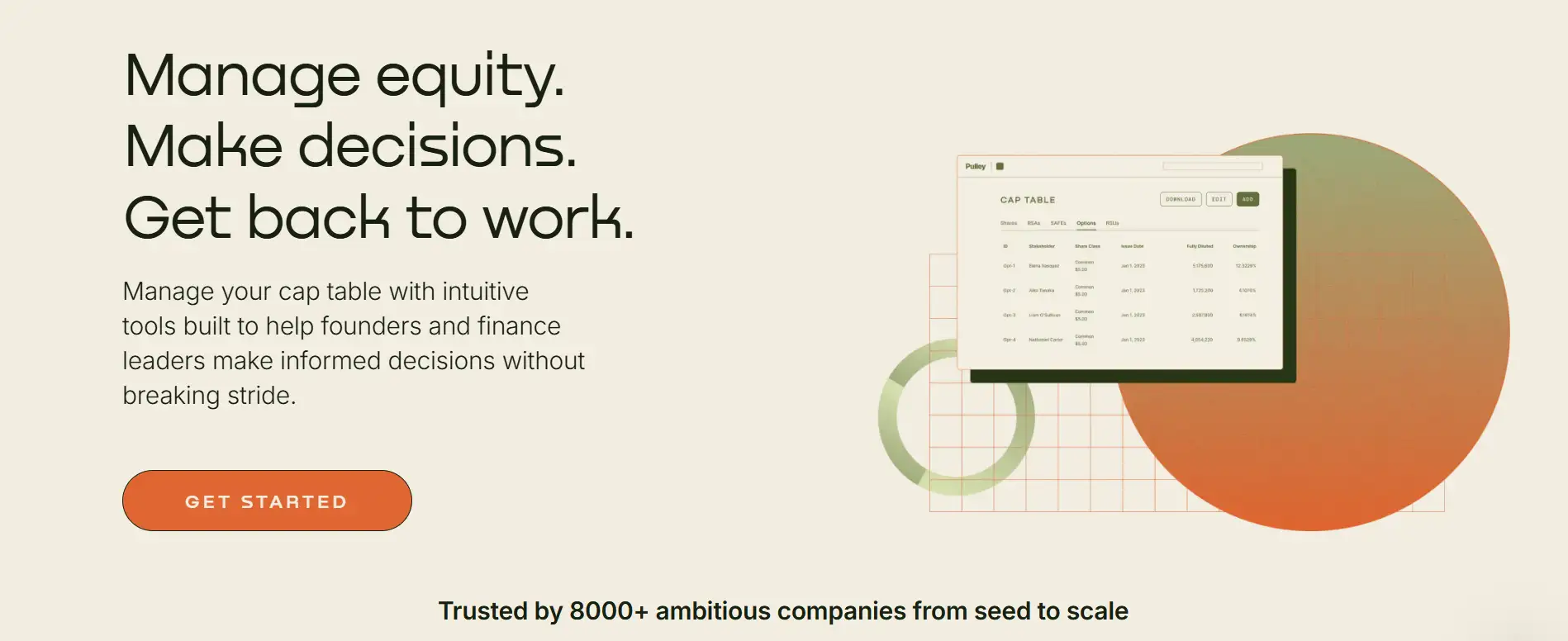

Pulley is an advanced equity and cap table management platform built for founders and finance teams navigating the complex world of ownership, compliance, and fundraising. Unlike generic platforms that try to serve investors, lawyers, and startups equally, Pulley focuses exclusively on empowering companies to manage their equity infrastructure with precision and confidence.

From early-stage startups to scaling companies, Pulley helps teams track equity, model fundraising rounds, handle token issuance, and prepare for liquidity events—all within an intuitive, transparent, and secure interface. With dedicated support, managed services, and integrations with accounting tools and Nasdaq Private Markets, Pulley offers everything you need to stay in control of your ownership journey.

Pulley is designed to simplify the increasingly complex task of equity management. Whether you're a solo founder issuing SAFEs or a scaling company preparing for an M&A event, Pulley’s infrastructure ensures your cap table remains accurate, auditable, and flexible. Its use cases range from cap table modeling and token issuance to 409A valuations and liquidity program management.

Unlike legacy platforms that serve multiple conflicting parties, Pulley is built for the company’s side of the table. This means founders and finance leaders can make faster decisions with access to real-time scenario modeling, advanced reporting (like ASC 718 and IFRS), and seamless stakeholder management. You’ll never need a paralegal just to update your cap table again. Every dashboard and feature is designed to be clear, actionable, and founder-friendly.

Pulley supports advanced financial planning tools, including round modeling, exit waterfall reports, and dilution simulation. Its integrations extend to Nasdaq Private Market, enabling companies to design liquidity programs for employees and early investors with ease. Additionally, Pulley’s token ops platform empowers crypto projects to manage token equity and distributions just like they would traditional shares—without compromising private keys or compliance.

Security and transparency are core to Pulley’s ethos. The platform is SOC 2 Type 2 certified, with every cap table reviewed by in-house equity experts. Pulley doesn’t monetize customer data and offers clear pricing structures, removing the guesswork and legal overhead often associated with cap table tools. As your team grows, Pulley scales with you—offering support for LLCs, law firms, private equity, and global compliance.

Competitors like Carta and Shareworks serve multiple stakeholders, but Pulley’s single focus on startups makes it leaner, faster, and more aligned with company goals. Its support for both equity and token management under one platform sets it apart in a space where crypto and traditional finance increasingly intersect.

Pulley provides numerous features and benefits tailored to startups, scaling teams, and crypto companies:

- Cap Table Management: Maintain a real-time, accurate cap table with complete stakeholder visibility and compliance tracking.

- 409A Valuations: Get audit-ready valuations directly through the platform, backed by Pulley’s experienced valuation team.

- Fundraising Modeling: Simulate dilution, SAFEs, and equity rounds with advanced round modeling tools and investor scenario planning.

- Token Ops Platform: Manage token equity with automated vesting schedules, unlocking rules, and distribution tracking—without compromising private keys.

- Liquidity Program Integration: Launch liquidity events with full cap table integration, thanks to Pulley's partnership with Nasdaq Private Market.

- Managed Services: Let Pulley’s equity administration team handle cap table updates, audits, new stakeholder onboarding, and compliance workflows.

- Real Support, Not Chatbots: Access human support from equity experts at every stage—whether you're raising funds or preparing for an exit.

- Simplified UI: Designed for non-lawyers, Pulley makes it easy to navigate complex equity structures without hours of training.

- Transparent Pricing: Straightforward annual pricing based on stakeholder count, with no hidden fees or data lock-in.

- Security & Privacy: SOC 2 Type 2 certified, with no data monetization and full control over your company's ownership information.

Getting started with Pulley is fast and intuitive—especially for teams switching from legacy platforms like Carta:

- Step 1 – Visit the Website: Go to Pulley.com and click “Get Started” to create your account or request a demo.

- Step 2 – Migrate Your Cap Table: If you’re switching from another platform, Pulley offers free onboarding and migration support, including secure import of data from Carta and Shareworks.

- Step 3 – Set Up Stakeholders: Add your founders, employees, investors, and advisors. Pulley will help you configure equity types, vesting schedules, and documents.

- Step 4 – Model Scenarios: Use the built-in modeling tools to explore fundraising rounds, SAFEs, dilution events, and exits.

- Step 5 – Stay Compliant: Schedule a 409A valuation, access ASC 718 reports, and integrate with your accounting software for audit readiness.

- Step 6 – Launch Liquidity (Optional): Partner with Nasdaq Private Market to launch a custom employee or investor liquidity event, fully backed by your Pulley cap table.

- Step 7 – Activate Managed Services (Optional): Need help? Pulley’s equity admin team can take care of daily management, stakeholder access, and compliance tracking.

- Explore More: Learn more through the Pulley Help Center and blog, or contact support for guided setup.

Pulley FAQ

Pulley offers a seamless migration process for companies transitioning from Carta or other equity platforms. The Pulley onboarding team provides free data import support, ensuring all shareholder information, equity grants, and vesting schedules are transferred accurately. This migration process is secure, transparent, and typically completed within a few business days, allowing teams to continue managing their cap table without interruption.

Pulley provides a unified dashboard for equity and token management. Startups operating in the Web3 or crypto space can track token allocations, manage vesting and unlocking schedules, and document token issuance events—all alongside traditional equity. Unlike manual spreadsheets, Pulley ensures accurate documentation and regulatory compliance for token distributions while never storing private keys. This makes it the go-to solution for hybrid equity-token companies.

Pulley replaces static spreadsheets with dynamic scenario modeling tools that simulate real-world fundraising events. Founders can model dilution, SAFEs, convertible notes, and exit waterfalls in real time, ensuring they fully understand ownership changes before signing a term sheet. The platform provides clear visualizations of equity distribution across rounds, helping startups make informed decisions while saving thousands in legal and advisory costs.

Yes. Pulley includes built-in compliance tools such as ASC 718 reporting, GAAP and IFRS support, and 409A valuation services. It integrates directly with accounting systems to streamline audits and reduce the risk of human error. Pulley’s managed services team also reviews every cap table for accuracy, ensuring founders and finance leaders are always audit-ready and compliant with changing regulations.

Security and privacy are core to Pulley’s mission. The platform is SOC 2 Type 2 certified and employs end-to-end encryption for all sensitive data. Unlike some competitors, Pulley does not monetize user data and gives customers full control over their ownership records. Access permissions can be customized for each stakeholder, and the system undergoes regular third-party audits to maintain the highest standards of information security.

You Might Also Like