About Rectoverso

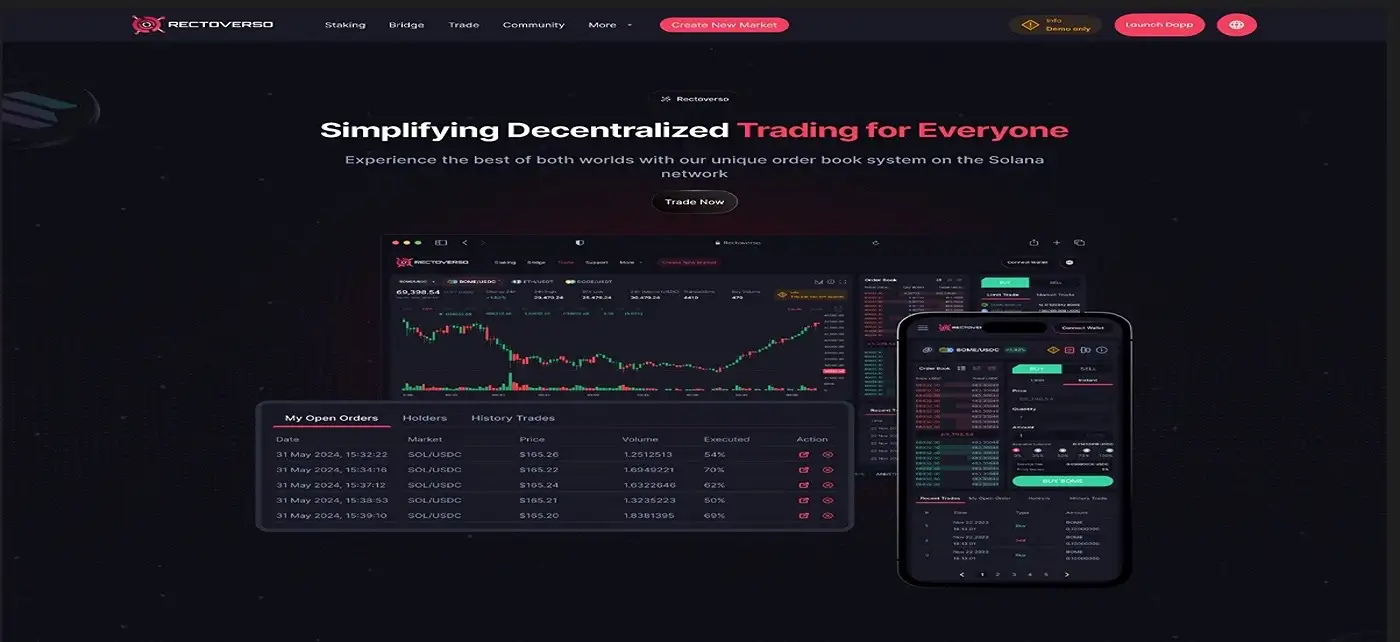

RectoVerso is a next-generation DeFi trading platform built on the Solana blockchain. It merges the efficiency of centralized exchanges (CEX) with the freedom and security of decentralized exchanges (DEX). The platform offers an on-chain spot limit order book, enabling users to place trades without ever losing custody of their assets. RectoVerso provides advanced trading tools, staking opportunities, and a transparent Launchpad for new projects, ensuring a seamless experience for traders and developers.

With features like cross-DEX liquidity integration, advanced order types, and a developer-friendly asset listing system, RectoVerso aims to simplify decentralized trading while maintaining full transparency. The platform caters to both beginners and experienced traders by offering a secure and efficient trading environment powered by Solana’s fast blockchain network.

RectoVerso is redefining decentralized finance (DeFi) by offering an advanced trading infrastructure that ensures security, efficiency, and self-custody. Unlike traditional DEXs that rely on automated market makers (AMM), RectoVerso introduces an on-chain spot limit order book that provides full market depth visibility. This allows users to execute trades with precision while retaining control over their assets.

One of the core advantages of RectoVerso is its integration of centralized exchange (CEX) features into a decentralized ecosystem. It supports limit orders, stop-limit orders, and conditional orders, giving traders better control over their strategies. The platform’s cross-DEX liquidity routing ensures optimal trade execution by sourcing liquidity from multiple decentralized exchanges. This minimizes slippage and enhances the overall trading experience.

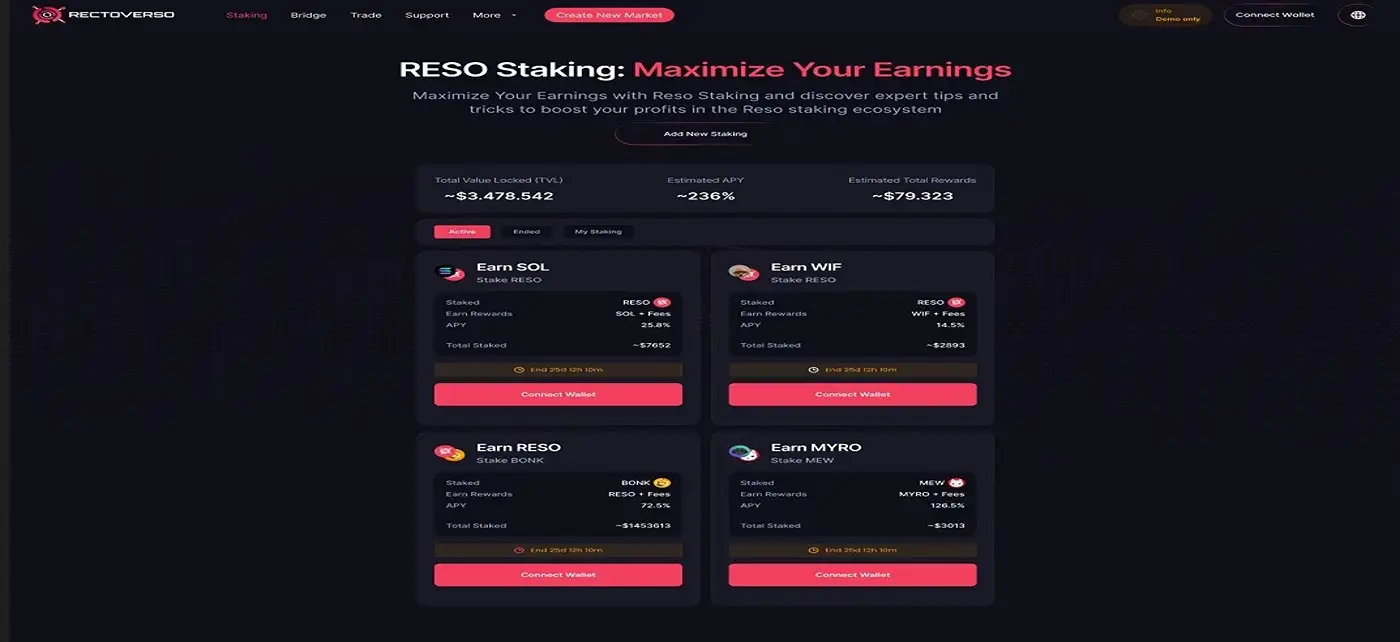

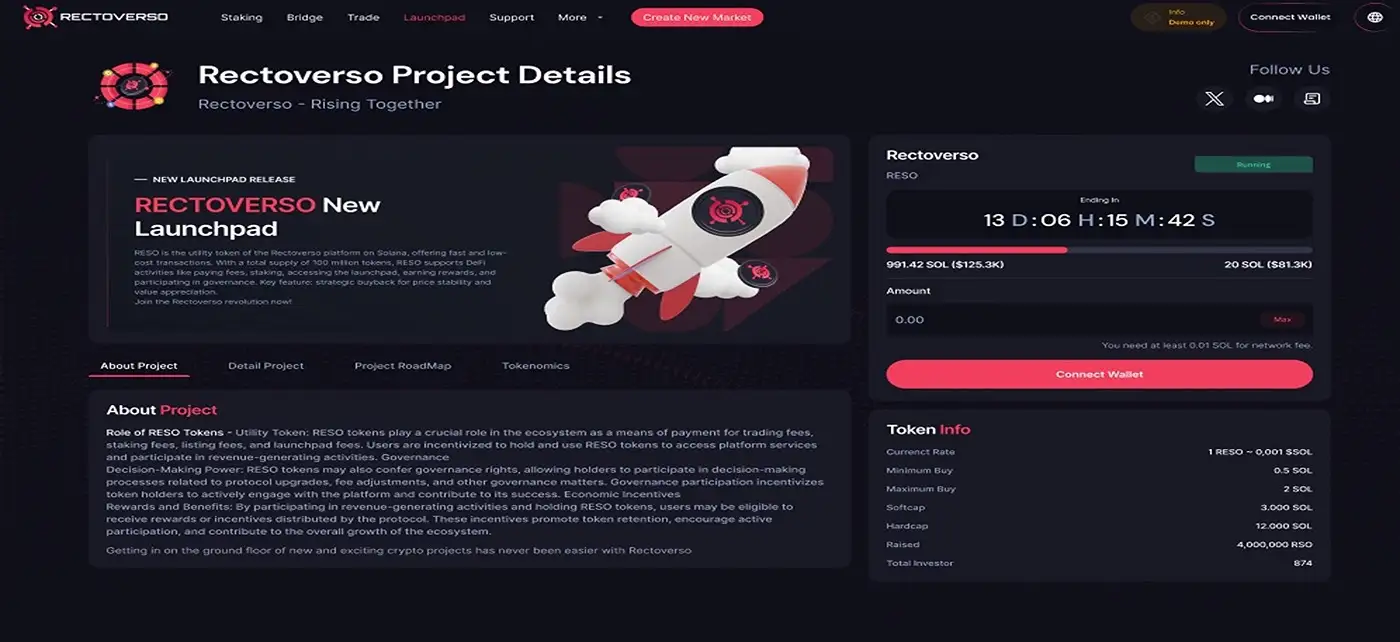

Beyond trading, RectoVerso offers robust staking mechanisms, allowing users to stake their tokens in various developer-created programs. Users can choose between fixed-term staking for higher rewards or flexible staking for liquidity. Additionally, the platform’s Launchpad provides a transparent and efficient way for developers to launch new projects, conduct Initial DEX Offerings (IDOs), and gain exposure within the Solana ecosystem.

By combining these powerful features, RectoVerso competes with major DeFi trading platforms such as Raydium, and Jupiter Exchange. With its focus on security, transparency, and ease of use, the platform aims to be the go-to solution for traders and developers looking to engage with the DeFi ecosystem.

RectoVerso provides numerous benefits and features that enhance the trading and staking experience:

- On-Chain Spot Limit Order Book: Enables users to place limit orders with full control over execution prices, ensuring a professional-grade trading experience.

- Cross-DEX Liquidity Integration: Sources liquidity from multiple decentralized exchanges (DEXs) to provide the best prices and minimize slippage.

- Advanced Trading Tools: Supports limit orders, stop-limit orders, and market depth analysis to give traders better control.

- Instant Trade Execution: Market orders are executed immediately at the best available price with minimal latency.

- Staking Rewards: Users can stake tokens in fixed-term or flexible staking pools, earning rewards based on program conditions.

- Secure Asset Listing: Developers can list new tokens easily while maintaining the transparency of a DEX.

- Launchpad for New Projects: Provides a fair and transparent environment for projects to conduct IDO rounds and gain immediate market access.

- Transparent Order Book: All trading activities are recorded on the Solana blockchain, ensuring full transparency and security.

Getting started with RectoVerso is simple and efficient. Follow these steps to begin trading, staking, or launching your project:

- Visit the Official Website: Go to the RectoVerso website to explore the platform.

- Create an Account: Sign up and connect a compatible crypto wallet such as Phantom or Solflare.

- Deposit Funds: Transfer SOL or other supported assets to your wallet for trading and staking.

- Start Trading: Use the on-chain spot limit order book to place limit or market orders with full transparency.

- Stake Your Tokens: Choose a staking program to earn rewards based on your preferred staking strategy.

- Launch a Project: Developers can submit their projects for token listing or participate in the RectoVerso Launchpad.

- Stay Updated: Follow official RectoVerso channels to keep up with new listings, updates, and rewards.

Rectoverso Reviews by Real Users

Rectoverso FAQ

Unlike traditional decentralized exchanges (DEXs) that rely on Automated Market Makers (AMMs), RectoVerso features a fully on-chain spot limit order book. This system allows traders to place limit orders at specific prices, providing more control over execution and reducing price slippage. Since all orders are recorded on the Solana blockchain, the platform offers complete transparency and prevents hidden manipulations often seen in traditional market-making models.

RectoVerso integrates a powerful cross-DEX liquidity routing mechanism, which sources liquidity from multiple decentralized exchanges to offer users the best possible trade execution. This feature minimizes slippage, enhances order fulfillment rates, and ensures that even large trades are executed efficiently. Instead of being limited to a single DEX’s liquidity pool, traders benefit from aggregated liquidity across different platforms, leading to better pricing and market efficiency.

The RectoVerso Launchpad is designed with fairness and transparency in mind. All token listings and Initial DEX Offerings (IDOs) follow a structured process where projects must submit detailed information, including their whitepaper, roadmap, and team credentials. Additionally, developers can set locked sale proceeds, ensuring funds remain secure for a set duration. Every listing and IDO transaction is recorded on-chain, preventing fraud and increasing investor confidence.

RectoVerso offers both fixed-term staking and flexible staking options to accommodate different investment strategies. With fixed-term staking, users lock their tokens for a predetermined period in exchange for higher rewards. Flexible staking allows users to stake and unstake tokens at any time, providing liquidity while still earning rewards. Additionally, developers can create custom staking programs with unique incentives, allowing projects to engage their communities through tailored staking mechanisms.

Yes, RectoVerso supports instant market orders for users who prioritize speed over precise price execution. Instead of waiting for a limit order to be filled, market orders execute immediately at the best available price. Additionally, the platform offers quick swaps using aggregated liquidity from multiple DEXs, ensuring fast and efficient trading for users who need immediate transactions.

You Might Also Like