About Rise Works

Rise Pay is an innovative payment platform designed to revolutionize the way transactions are conducted in both personal and business contexts. This platform aims to provide a seamless, secure, and efficient payment experience, making it easier for users to manage their financial transactions. By integrating various payment methods and employing advanced security measures, Rise Pay App seeks to address common challenges faced by traditional banking systems and modern fintech solutions. The mission of Rise Pay App is to enhance financial inclusivity and convenience, offering users a reliable and user-friendly solution for all their payment needs.

Rise Pay was created to address the growing need for a comprehensive and efficient payment solution in today's fast-paced digital world. The project has a rich history of development and innovation, with a focus on enhancing user experience and providing robust features that cater to the evolving needs of the financial sector.

From its inception, Rise Pay aimed to bridge the gap between traditional banking systems and modern fintech solutions. The platform was designed to offer users a seamless and secure way to conduct transactions, whether for personal or business purposes. Key milestones in the development of Rise Pay include the launch of its multi-method payment support, the implementation of advanced security measures, and the continuous improvement of its user interface to ensure accessibility and ease of use.

Rise Pay has positioned itself as a significant player in the payment solutions market, competing with traditional banks and other fintech companies. Its unique selling points include a wide range of supported payment methods, real-time transaction processing, and a comprehensive analytics suite that allows businesses to optimize their payment processes. Similar platforms in the market include PayPal, Square, and Stripe, each offering different features and capabilities. However, Rise Pay differentiates itself through its emphasis on security, user experience, and flexibility.

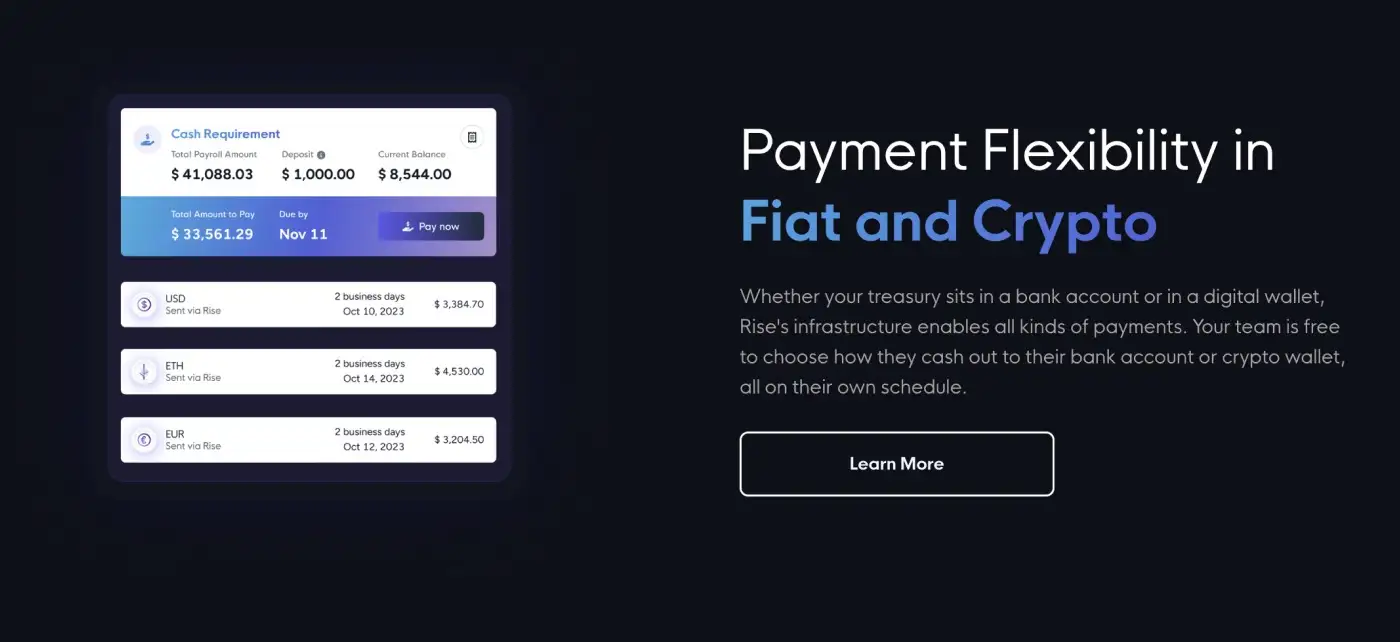

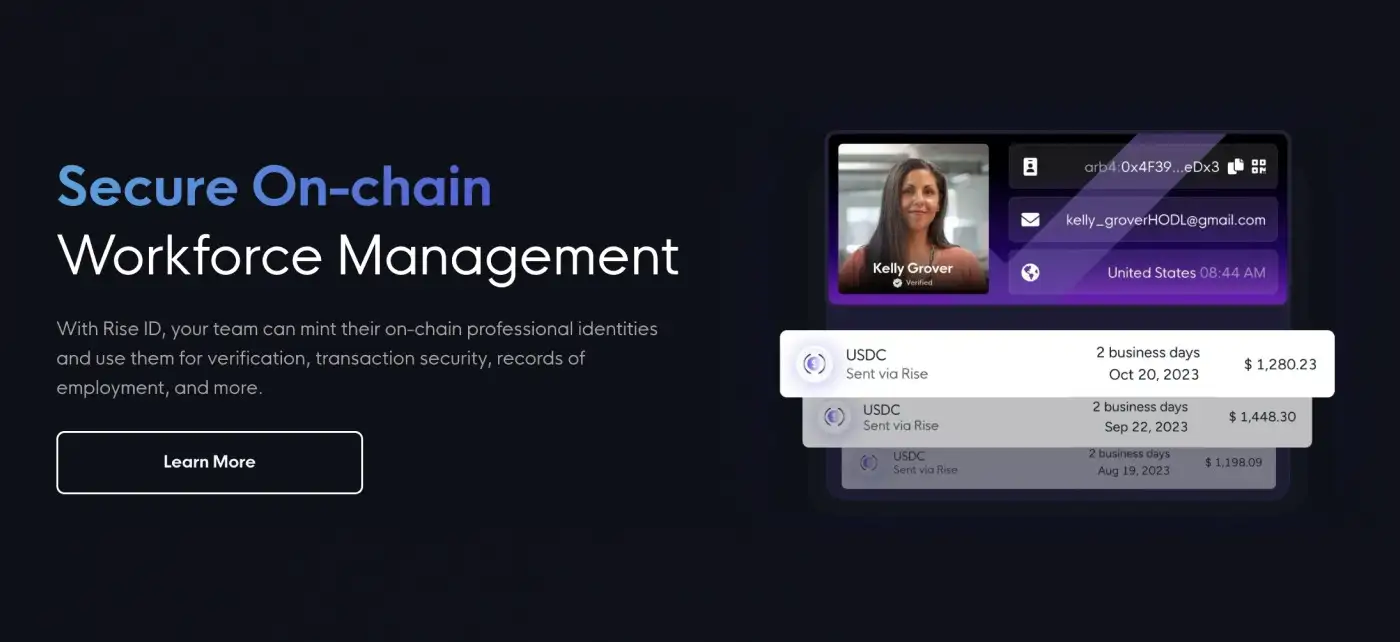

The platform's development has been driven by a commitment to user feedback and continuous improvement. Regular updates and feature enhancements ensure that Rise Pay stays ahead of the curve, meeting the changing demands of its users. The integration of cutting-edge technologies, such as blockchain and AI, further enhances the platform's capabilities, making it a robust and reliable solution for modern payment needs.

Overall, Rise Pay's history and development reflect a dedication to providing a superior payment experience. The platform's success can be attributed to its innovative approach, user-centric design, and unwavering commitment to security and efficiency.

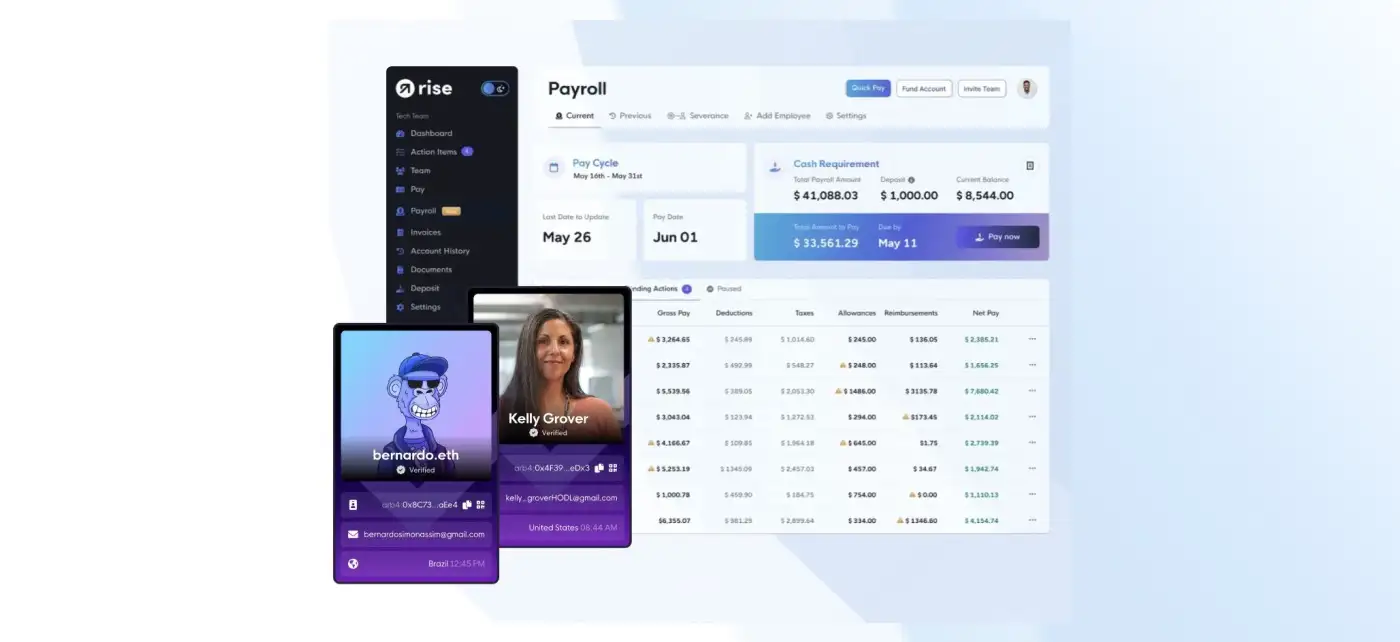

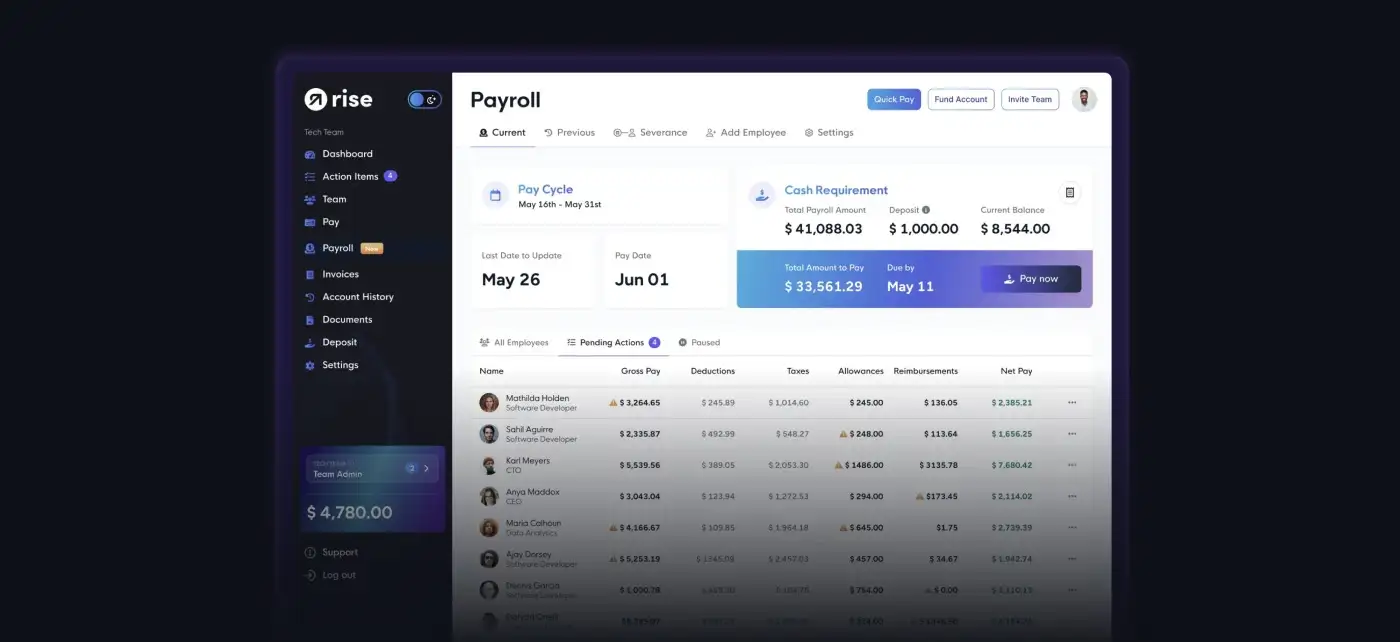

- Multi-Method Payment Support: Rise Pay supports a variety of payment methods, including credit cards, bank transfers, and digital wallets, providing flexibility to users. This ensures that users can choose their preferred payment method, enhancing convenience and accessibility.

- Enhanced Security: The platform employs state-of-the-art security protocols, including encryption and fraud detection, to protect users' financial information and prevent unauthorized transactions. This commitment to security ensures that users can trust Rise Pay with their sensitive data.

- User-Friendly Interface: Designed with the end-user in mind, Rise Pay features an intuitive interface that simplifies the payment process. Users can easily navigate the platform, manage their accounts, and conduct transactions with minimal effort.

- Seamless Integration: Businesses can easily integrate Rise Pay into their existing systems using the provided API documentation and support. This ensures a smooth transition and minimal disruption to business operations, allowing for a more efficient payment process.

- Real-Time Transactions: Users benefit from real-time transaction processing, which enhances efficiency and reduces waiting times. This feature is particularly beneficial for businesses that require quick payment confirmation and settlement.

- Comprehensive Analytics: The platform offers detailed analytics and reporting tools, enabling businesses to track and optimize their payment processes. These insights help businesses identify trends, improve financial management, and make informed decisions.

- Loyalty and Rewards Program: Rise Pay includes a loyalty and rewards program, allowing users to earn rewards through various activities and redeem them for discounts and exclusive offers. This incentivizes engagement and fosters a loyal user base.

- Create an Account: Visit the Rise Pay website and sign up for an account by providing the necessary personal or business information. This initial step is straightforward and only takes a few minutes.

- Verify Your Identity: Complete the identity verification process to ensure the security of your account. This typically involves providing proof of identity and address, which is a standard procedure for financial platforms.

- Set Up Payment Methods: Link your preferred payment methods, such as bank accounts or digital wallets, to your Rise Pay account. This can be done easily through the account settings, ensuring that you can start making transactions immediately.

- Integrate with Business Systems: If you are a business, integrate Rise Pay into your existing systems using the provided API documentation and support. This step is crucial for businesses to streamline their payment processes and ensure a seamless transition.

- Access Features: Start using Rise Pay's features to manage and process transactions efficiently. The platform offers a range of tools and functionalities designed to simplify financial management and enhance user experience.

- Utilize Support Resources: Refer to the available guides and tutorials on the Rise Pay website for any additional setup help or troubleshooting. The support resources are comprehensive and designed to assist users at every step of the way.

For further details, downloads information and to sign up, visit Rise Pay. Also, check Rise Works reviews below by real users.

Rise Works Reviews by Real Users

Rise Works FAQ

Rise Pay or Risworks enhances transaction security by employing state-of-the-art encryption and fraud detection protocols. These measures ensure that users' financial information remains protected and that unauthorized transactions are prevented.

Rise Pay or Riseworks app supports a wide variety of payment methods, including credit cards, bank transfers, and digital wallets, providing users with flexibility and convenience.

Rise Pay or Riseworks app processes transactions in real-time, ensuring quick payment confirmations and settlements, which is particularly beneficial for businesses needing immediate transaction validation.

The Rise Pay or Riseworks app's interface is designed to be highly intuitive, allowing users to easily navigate, manage accounts, and conduct transactions with minimal effort.

Yes, Rise Pay or Riseworks app supports international transactions, making it a versatile payment solution for users around the globe.

Yes, Rise Pay by Riseworks includes built-in reporting and analytics tools. Businesses can track transactions, monitor financial trends, and generate custom reports directly from the Riseworks dashboard to gain meaningful financial insights and support data-driven decisions.

Absolutely. Rise Pay by Riseworks is accessible via the Riseworks mobile app, allowing users to manage accounts, view transaction history, and process payments directly from their smartphones. This ensures full platform access anytime, anywhere.

Yes, Rise Pay by Riseworks supports automated recurring payments for subscriptions, invoices, or other recurring billing needs. This helps businesses streamline workflows, improve cash flow, and reduce the risk of missed or late transactions.

Rise Pay by Riseworks offers multi-channel support, including live chat, email assistance, and an in-app help center. Whether users need help with technical issues, transaction inquiries, or account configuration, the support team is available to ensure smooth operation.

You Might Also Like