About River

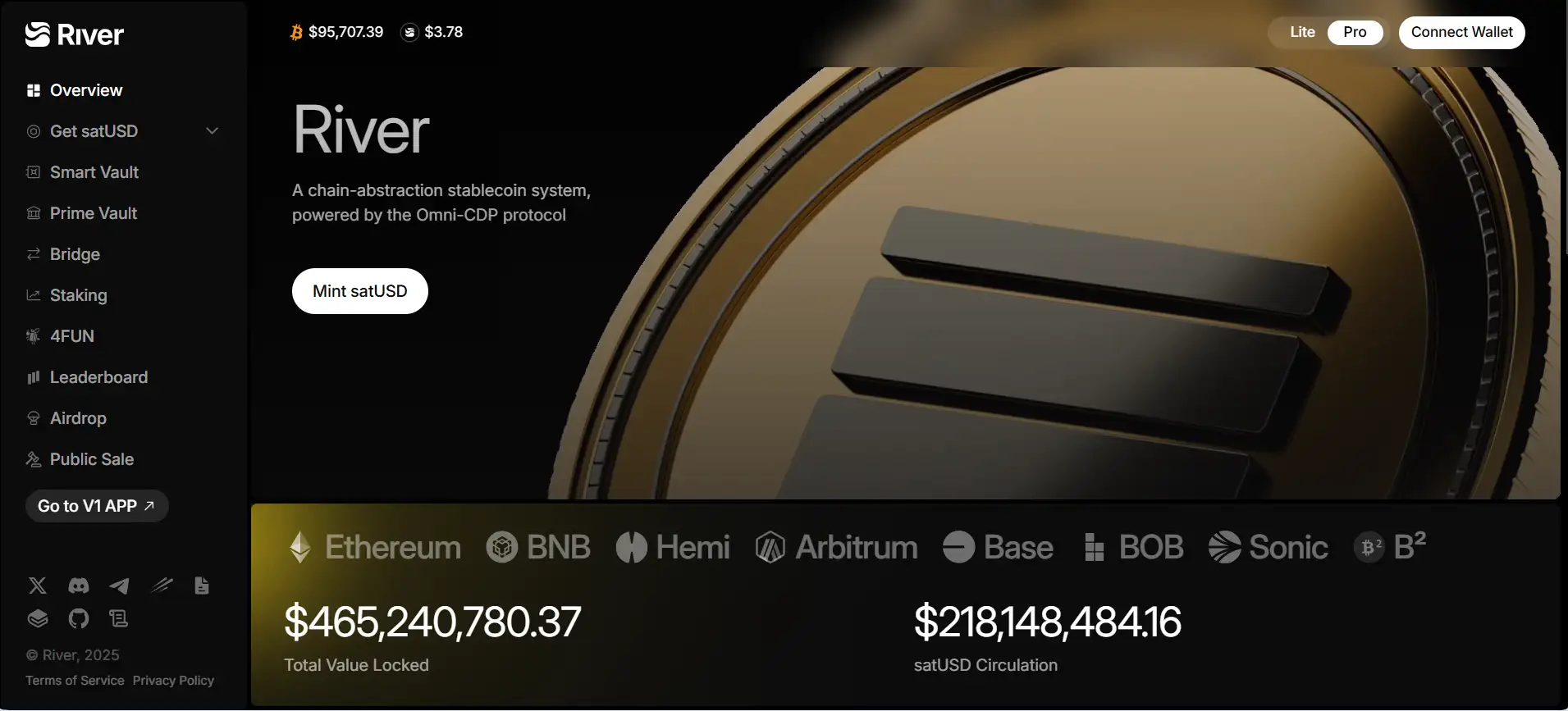

River is pioneering the development of a chain-abstraction stablecoin system that enables native cross-chain liquidity without the need for traditional bridges or wrapped tokens. At the heart of River’s innovation is satUSD, an over-collateralized stablecoin that users can mint by depositing BTC, ETH, BNB, or liquid staking tokens (LSTs) on one chain and issuing the stablecoin on another. This native, omnichain interoperability is powered by LayerZero’s OFT standard, which underpins River’s omni-CDP module.

The project’s core mission is to eliminate liquidity fragmentation in DeFi ecosystems by enabling true capital efficiency and seamless movement of value across chains. Through modules like satUSD+ for yield-bearing staking and River4FUN for social engagement-based rewards, River creates an interconnected economy where assets, users, and incentives are synchronized. This stablecoin ecosystem is more than a tool—it’s a financial circulatory system, designed to let any asset, anywhere, contribute to value creation and yield.

River is a bold attempt to resolve the core inefficiencies of today’s fragmented multi-chain DeFi landscape. The project was launched to address the challenges of isolated capital pools, unstable stablecoin liquidity, and disjointed governance systems that fail to reward real contributions. At the center of River’s ecosystem is satUSD, a stablecoin backed by leading crypto assets such as BTC, ETH, BNB, and LSTs. It introduces an innovative concept called omni-CDP (Cross-Chain Collateralized Debt Positions), which enables users to deposit collateral on one blockchain and mint satUSD on another—without bridges or wrapping.

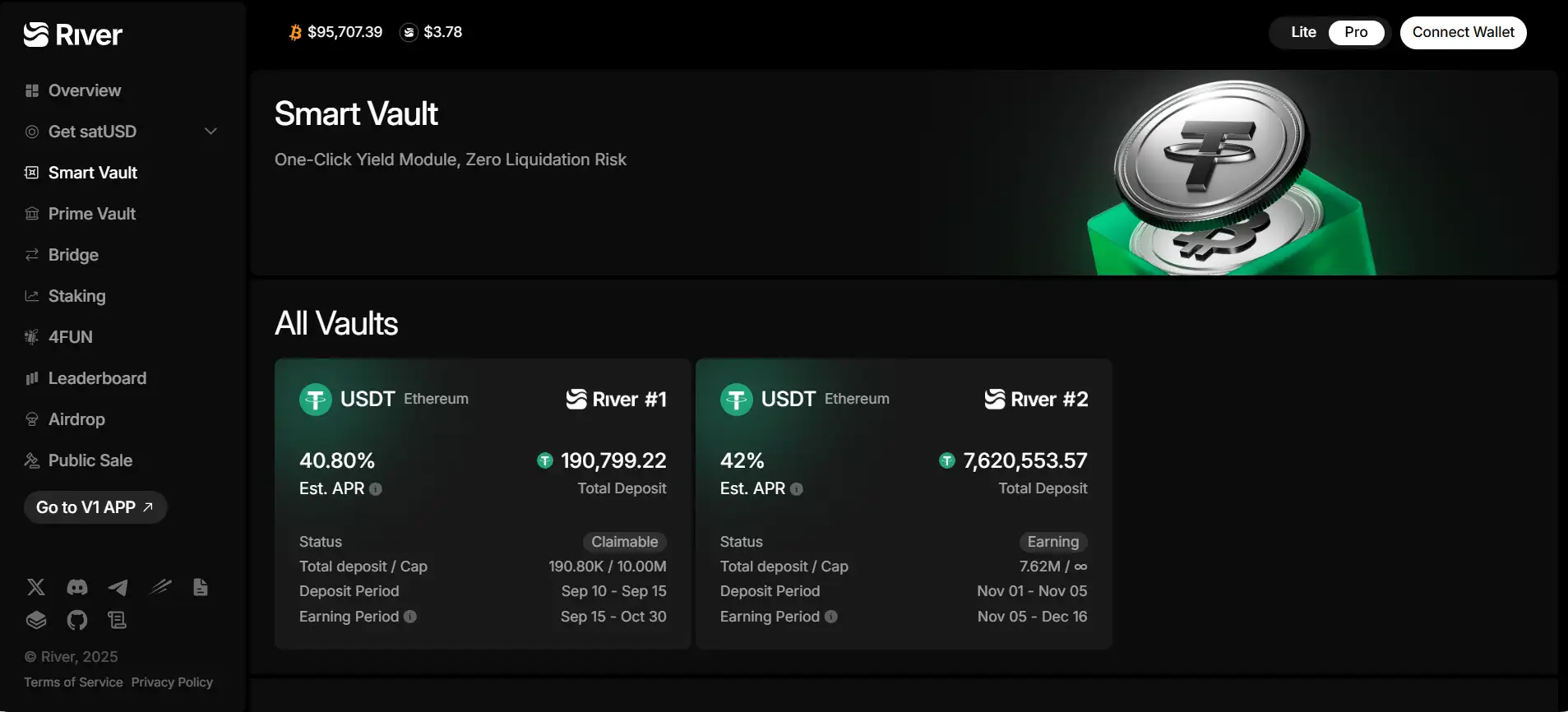

Unlike conventional stablecoin systems that rely on centralized backing or complicated cross-chain infrastructure, River leverages LayerZero's OFT standard to create seamless, real-time interoperability. The result is a stablecoin that functions as a universal liquidity layer across DeFi platforms. Users benefit from a native minting experience, low fees, and instant execution. In addition, River's satUSD+ offers a yield-bearing token variant that distributes protocol revenue to stakers, sourced from minting, redemption, and liquidation events. This model enables real yield without liquidation risk.

A unique component of River is the River4FUN module, a social layer where users earn River Pts for engagement like posting, voting, and referring others via their X (Twitter) accounts. These points are convertible to $RIVER tokens upon TGE (Token Generation Event), making it an innovative bridge between on-chain activity and social capital.

River has already launched its V2 platform, which improves BTC liquidity through integration with solvBTC, LBTC, and other LSTs. With the ability to mint stablecoins across networks like BEVM, BOB, BSquared, and Bitlayer, River’s infrastructure is expanding quickly. The protocol has also undergone multiple security audits by Scalebit, Supremacy, and Billh, further reinforcing user trust.

In terms of similar projects, Liquity also offers zero-interest loans using ETH as collateral, while Sky Money and its DAI stablecoin provide decentralized over-collateralized loans. River differentiates itself with native omnichain functionality, no interest fees, and an emphasis on cross-chain liquidity abstraction—making it an advanced evolution in the stablecoin space.

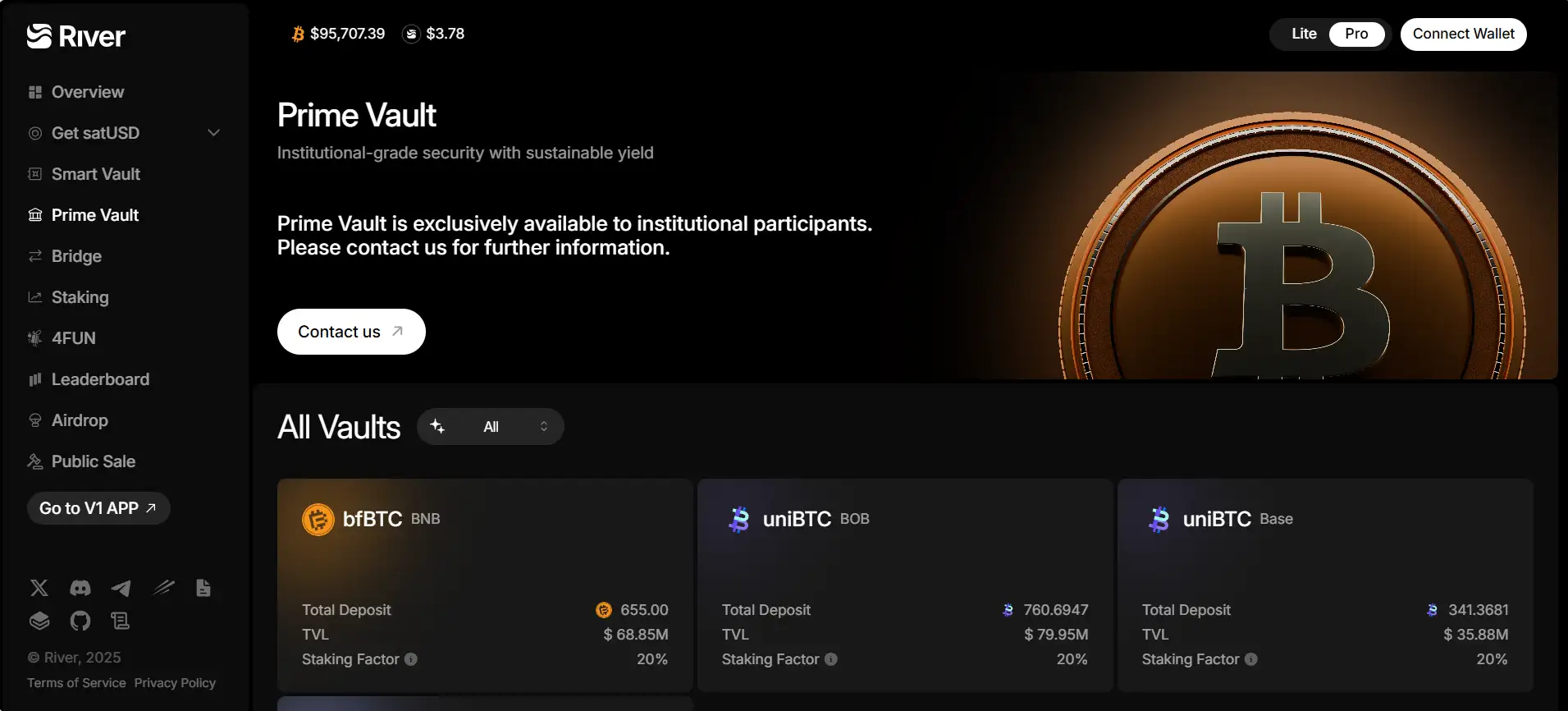

River provides numerous benefits and features that make it a standout project in the decentralized finance ecosystem:

- Omni-CDP Technology: Enables users to collateralize assets like BTC, ETH, BNB, and LSTs on one chain and mint satUSD on another—without bridges or wrappers.

- Yield-Bearing Stablecoin (satUSD+): Stake satUSD to earn protocol revenue through satUSD+, which distributes earnings from minting, redemption, and liquidation events.

- Zero Interest Loans: Mint satUSD with a one-time fee ranging from 0.5% to 5% and 0% interest, maximizing capital efficiency.

- River4FUN Social Layer: Engage through social media to earn River Pts, which can convert into governance tokens—integrating social capital into protocol incentives.

- Multi-Chain Compatibility: Currently live on BEVM, BOB, BSquared, and Bitlayer, with support for additional chains underway.

- Security & Transparency: Multiple third-party audits by Scalebit, Supremacy, and Billh ensure protocol safety and robustness.

- Capital Efficiency: Use crypto assets to unlock liquidity without selling, maintain healthy collateral ratios, and avoid liquidation risks.

River provides a seamless onboarding experience for users to mint stablecoins, earn yield, and engage for rewards. Here’s how to get started with River:

- Step 1 – Go to the Mint Page: Visit the mint interface. Choose your collateral asset (BTC, ETH, BNB, or LSTs) and the source network.

- Step 2 – Input Your Parameters: Specify the amount of collateral and satUSD you want to mint. Then select your destination chain for the satUSD.

- Step 3 – Confirm Minting: Review the minimum collateral ratio (MCR) and applicable minting fees. Confirm the transaction to receive your satUSD on the destination chain.

- Step 4 – Stake for Yield: Head to the staking page to convert satUSD into satUSD+ and start earning protocol revenue.

- Step 5 – Join River4FUN: Visit River4FUN, connect your X (Twitter) account, and start posting, voting, and staking tokens to earn River Pts.

- Step 6 – Explore Use Cases: Use satUSD across supported platforms like Pendle, PancakeSwap, Segment, and LayerBank for added utility and 5–25× River Pts multipliers.

River FAQ

The omni-CDP system on River evaluates each mint request based on the source chain, collateral type, and the destination network the user selects. Instead of routing liquidity through bridges, the protocol uses LayerZero messaging to sync collateral position data and mint instructions across chains instantly. This ensures satUSD is minted natively on the target chain while the collateral remains locked on the original chain. Liquidity conditions do not change the mint destination; instead, River maintains unified accounting using cross-chain state updates, ensuring accurate debt tracking, collateral ratios, and position health across all supported networks.

When users transfer satUSD between chains, River uses LayerZero’s OFT (Omnichain Fungible Token) standard, allowing satUSD to burn on the source chain and mint on the destination chain without wrapped assets. This preserves a single canonical supply of the stablecoin. River maintains accuracy through deterministic message passing, where each chain receives synchronized updates containing the exact state change, ensuring total supply integrity and cross-chain consistency. Because nothing is “bridged,” River avoids liquidity fragmentation and instead maintains one unified on-chain accounting system across the entire ecosystem.

River4FUN connects directly to a user’s X (Twitter) account and uses multiple layers of verification to ensure authentic engagement. The system checks for valid posting behavior, interaction history, and timestamp matching to confirm the content originates from the connected account. It also uses rate‑limits, bot‑pattern detection, and cross-referenced on‑chain actions to prevent fake activity. All earned River Pts are tied to the user’s verified identity and their staked assets inside River4FUN, making it extremely difficult to artificially boost rewards without real contributions.

BTC LSTs such as solvBTC and LBTC expand the range of assets that can secure satUSD within River’s omni-CDP framework. These assets provide a yield-bearing version of Bitcoin, giving users more collateral flexibility while improving capital efficiency. By accepting LSTs, River increases the protocol’s collateral robustness, diversifies risk exposure, and enables additional liquidity inflows. Their integration also allows River to tap into multiple ecosystems simultaneously, making cross-chain stability more resilient during market volatility.

The stability of satUSD relies on a combination of over-collateralization, an instant liquidation module, and built-in arbitrage incentives. If satUSD dips below $1, arbitragers can redeem it for $1 worth of collateral, restoring peg pressure. If satUSD trades above its target range, users can mint new satUSD at a defined Minimum Collateral Ratio and sell it, pushing price downward. Because all positions and supply data are synchronized globally through LayerZero, the system can respond cohesively even when volatility happens across multiple chains. This keeps satUSD stable across environments without fragmentation.

You Might Also Like