About SparkLend

Spark is a decentralized finance platform built to power stablecoin-driven savings, lending, and liquidity deployment across multiple blockchains. As part of the Sky Ecosystem, it gives users simple access to earning yield on stablecoins like USDC, USDS, and DAI through fully non-custodial smart contracts.

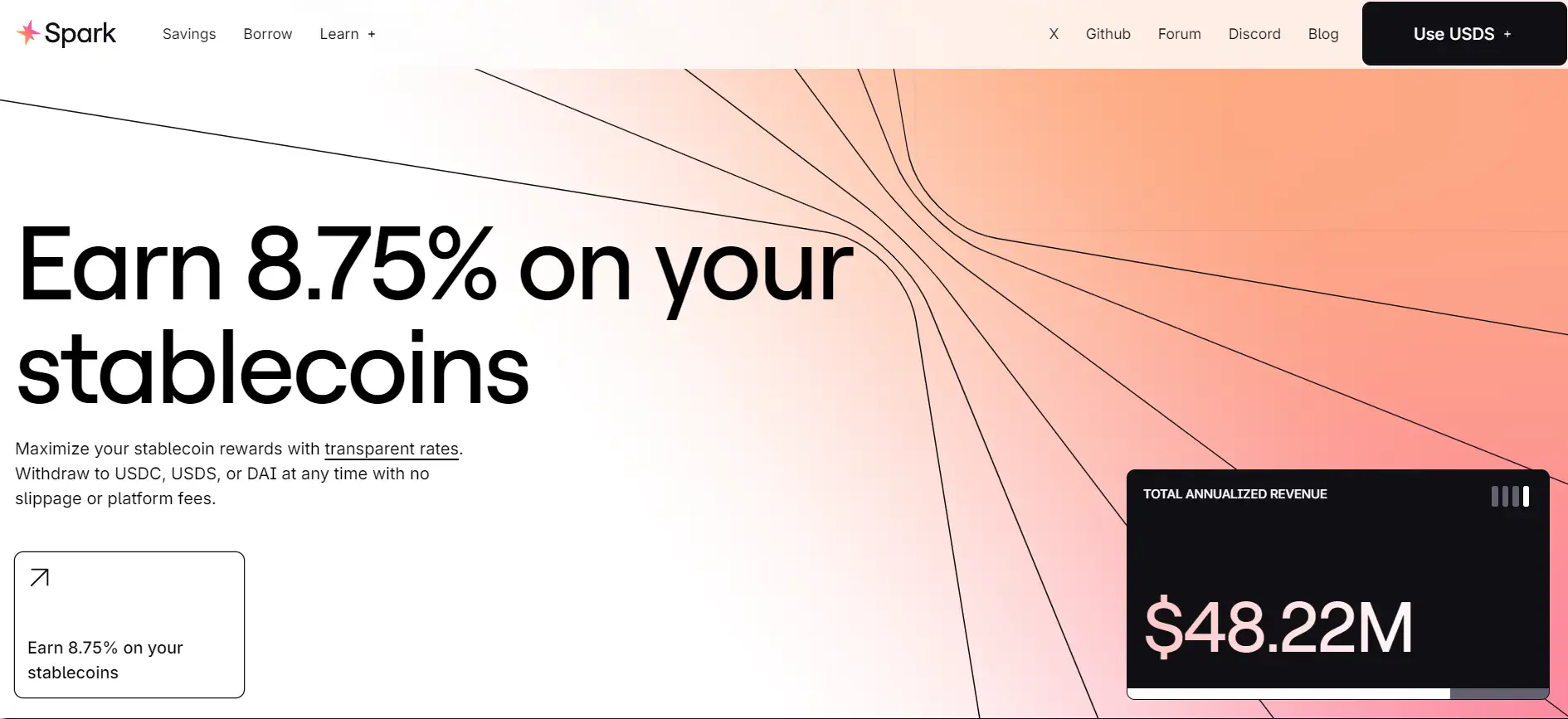

Spark offers users stable and transparent yields via the Sky Savings Rate, managed by community governance. Its primary products—Savings, SparkLend, and the Liquidity Layer—enable both casual savers and DeFi power users to earn, borrow, and supply assets with minimal friction and maximum on-chain visibility.

Spark is a permissionless DeFi protocol focused on simplifying stablecoin savings and borrowing through seamless integrations with the Sky Protocol. It consists of three core components: Savings, where users earn yield on stablecoins; SparkLend, a decentralized money market for borrowing and lending; and the Spark Liquidity Layer, which automates stablecoin deployment across chains and protocols.

Spark is designed with transparency at its core. Yield rates are determined by Sky governance rather than pool utilization, giving users more predictable earnings. Its sUSDS savings token grows in value as protocol earnings accumulate. Meanwhile, borrowers benefit from clearly defined transparent rates and real-time monitoring of account health via dashboards.

Unlike competitors such as Aave, Morpho, or Ethena, Spark differentiates itself through its vertical integration with Sky, giving it access to large-scale protocol-controlled stablecoin reserves and enabling fast, scalable growth. With support for Ethereum, Base, and more chains, Spark offers cross-network liquidity while preserving trustless control via audited smart contracts and open governance.

With over $3.9B in savings TVL and growing, Spark is positioning itself as the leading infrastructure for predictable, on-chain stablecoin yield in DeFi. The platform is audited by leading firms such as ChainSecurity and Cantina, and supported by a massive bug bounty program offering rewards up to $5M, underlining its commitment to security and decentralization.

Spark delivers several powerful features and advantages that make it stand out in the stablecoin DeFi sector:

- Transparent Governance-Set Rates: Savings and borrow rates are determined by Sky Governance, not supply-demand fluctuations.

- Zero Slippage Withdrawals: Users can withdraw from Spark into USDC, USDS, or DAI with no slippage or platform fees.

- sUSDS Token: Earn predictable yield through a yield-bearing token that increases in value as rewards are distributed.

- Multi-Chain Support: Spark operates across Ethereum, Base, and more via the Spark Liquidity Layer, which ensures deep liquidity and easy access.

- Security-First Design: All smart contracts are formally audited by leading firms and backed by one of DeFi’s largest bug bounty programs.

- Flexible Borrowing: Users can borrow USDS and DAI against collateral, with transparent or variable rates and no repayment deadlines.

- Permissionless Access: No KYC, no centralized control—Spark is open and fully non-custodial.

Spark is designed to make your DeFi savings journey as simple as possible:

- Connect a Wallet: Visit spark.fi and click “Connect Wallet” in the top-right corner. Select from popular wallets like MetaMask.

- Select a Network: Ensure you're on a supported network like Ethereum Mainnet or Gnosis Chain. Use the network switcher in the top right corner.

- Start Saving: Head to the Savings section to deposit stablecoins and receive sUSDS in return. Your tokens start earning via the Sky Savings Rate immediately.

- Borrow Funds: In the Borrow section, deposit collateral and borrow USDS or DAI. Adjust or monitor your borrow health in the dashboard.

- Use Sandbox Mode: Click the three dots menu next to “Connect Wallet” to try Sandbox Mode, which creates a temporary test wallet with fake funds so you can explore Spark risk-free.

- Monitor & Manage: Use the dashboard to track your portfolio, borrowing power, and health factor. You can repay or add collateral anytime.

SparkLend FAQ

Unlike most DeFi protocols that rely on fluctuating market-driven interest rates, Spark offers a governance-defined rate called the Sky Savings Rate. This stable rate is set by community voting and isn’t influenced by liquidity utilization, providing users with predictable earnings on their stablecoins like USDS, USDC, or DAI.

sUSDS is a yield-bearing stablecoin that represents your deposit in the Sky Savings Rate. When you deposit USDS or other stablecoins into Spark, you receive sUSDS in return. Its value increases over time as interest accrues. You can transfer, stake, lend, or withdraw sUSDS into USDC, USDS, or DAI at any time with no slippage.

Spark uses non-custodial smart contracts that are audited by ChainSecurity and Cantina, ensuring transparency and decentralization. Funds are never held by Spark or Sky directly. While all smart contracts carry some risk, Spark minimizes it with open-source code, audits, and a $5M bug bounty. Users should still practice safe DeFi habits and verify contracts before interacting.

The Spark Liquidity Layer (SLL) allows seamless deployment of stablecoin liquidity across multiple blockchains like Ethereum and Base. It provides consistent yield via sUSDS on any supported network, automatically routes liquidity to high-performing DeFi markets, and ensures there’s always sufficient capital for exits. All parameters are defined by Sky Governance, ensuring transparency and scalability.

Spark is designed for on-demand liquidity. Users can withdraw from sUSDS into USDC, DAI, or USDS at any time, with no slippage or withdrawal fees. Sky maintains 25% of reserves in cash equivalents to guarantee access even for large-volume exits. The protocol is architected to prioritize both stability and accessibility for all users.

You Might Also Like