About STAB Protocol

The STAB Protocol, developed and maintained under the governance of the ILIS DAO, is a groundbreaking initiative designed to introduce a stable asset named STAB to the Radix DLT ecosystem. STAB is not just another stablecoin; it offers a unique approach to stability that distinguishes it from traditional stablecoins like USDC. Instead of being pegged to a fiat currency at a fixed value, STAB is designed to provide relative stability through a dynamic interest rate mechanism. This innovative model makes STAB both versatile and sustainable, enabling it to respond flexibly to market demands and maintain its value effectively.

STAB serves as a reliable medium of exchange and a store of value within the Radix DLT ecosystem. By leveraging advanced mechanisms such as over-collateralized borrowing and a variable interest rate system, the protocol provides a solution to the volatility that often plagues digital assets. This system ensures that STAB remains accessible and functional across a variety of use cases while retaining its integrity as a stable asset. Designed for long-term utility, STAB seeks to empower users with a fair-priced and dynamic stable asset that fosters trust and reliability in decentralized finance (DeFi).

The STAB Protocol is a revolutionary stability solution built on the Radix DLT ecosystem and spearheaded by the ILIS DAO. The protocol’s core innovation lies in the introduction of the STAB token, a stable asset with relative price stability governed by a dynamic interest rate system. Unlike conventional stablecoins, which are pegged to a fixed fiat currency value, STAB adopts a variable mechanism that adjusts its internal price through an interplay of supply and demand forces. This creates a more resilient and adaptive model of stability, capable of thriving in the volatile digital asset space.

The ILIS DAO, a decentralized, community-governed organization incorporated in the Marshall Islands, oversees the development and governance of the STAB Protocol. The DAO’s transparent and inclusive model ensures that stakeholders have a say in the protocol’s evolution. As the first project launched by the ILIS DAO, the STAB Protocol represents a significant milestone in the DAO’s mission to advance decentralized finance by offering sustainable and innovative financial tools.

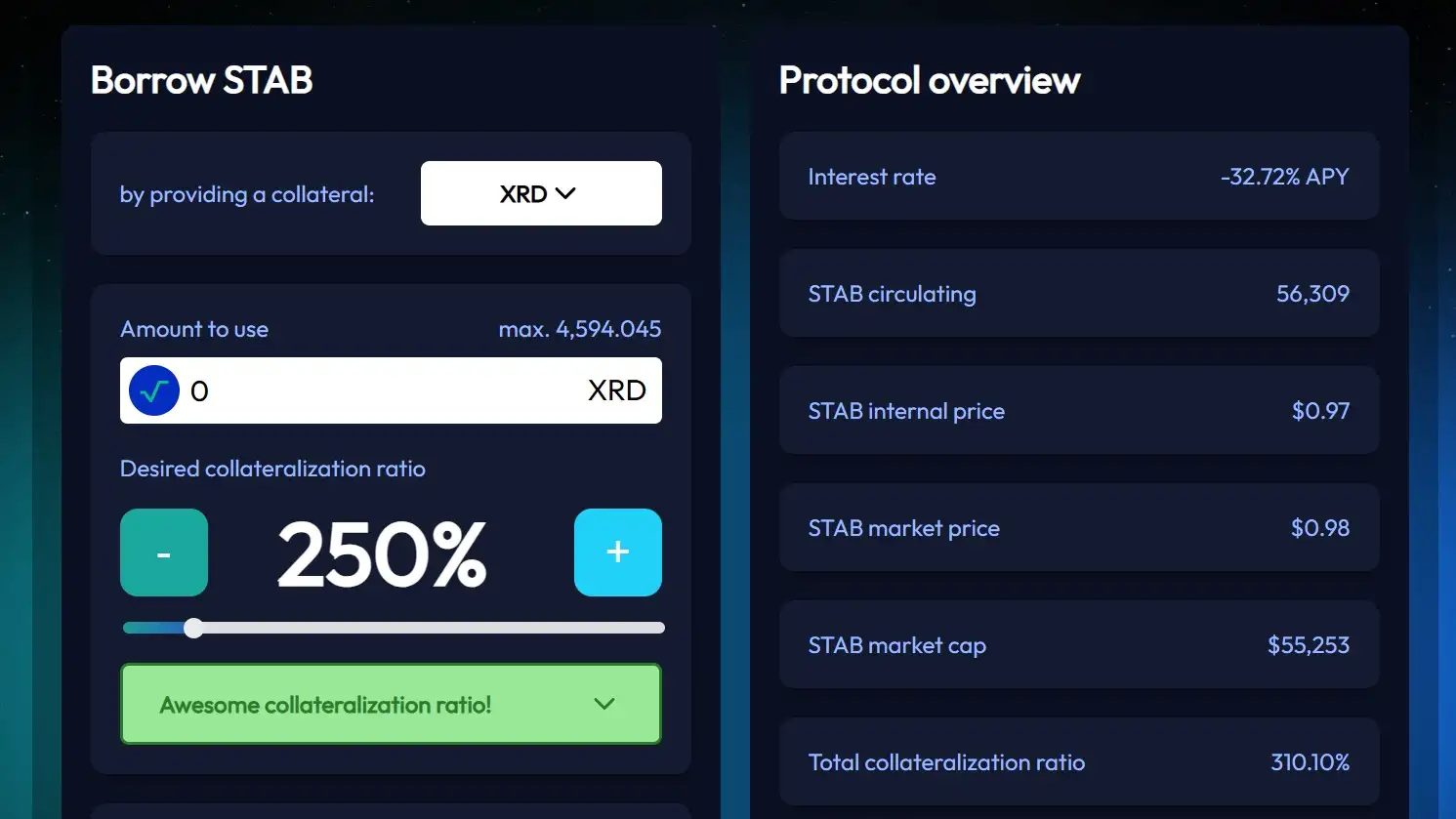

The protocol enables users to borrow STAB by depositing collateral in the form of XRD tokens. To ensure the stability and security of the system, all borrowing requires over-collateralization at a minimum ratio of 150%. This ensures that the value of borrowed STAB remains adequately backed, even in volatile market conditions. The borrowed STAB is subject to a variable interest rate that ranges from -33.33% to +50% annually, determined by market dynamics. This interest rate mechanism ensures that STAB remains stable by incentivizing borrowing or holding behavior based on market conditions.

To maintain stability, the protocol incorporates mechanisms such as redemptions and forced minting. These features create arbitrage opportunities that encourage market participants to balance the token’s supply and demand. Redemptions allow users to close under-collateralized loans by paying off debts in exchange for collateral, while forced minting helps correct imbalances in the system. These stability mechanisms are key to ensuring the long-term sustainability of the STAB token.

- Dynamic Interest Rate Mechanism: The most distinguishing feature of the STAB Protocol is its dynamic interest rate system. Unlike traditional stablecoins, which rely on fixed fiat pegs, STAB’s value is regulated by an interest rate that can range from -33.33% to +50% annually. This rate is determined by market conditions, allowing the protocol to incentivize borrowing or holding based on supply and demand. The dynamic rate mechanism ensures STAB’s stability while maintaining flexibility in various market scenarios.

- Over-Collateralized Borrowing: To borrow STAB, users must deposit collateral valued at a minimum of 150% of the desired STAB amount. This over-collateralization provides a robust safety net for the protocol, ensuring that all STAB tokens in circulation are adequately backed by collateral. This approach minimizes the risk of systemic failures and enhances user confidence in the stability of the token.

- Stability Mechanisms: The protocol employs innovative mechanisms like redemptions and forced minting to maintain the relative stability of STAB. Redemptions allow users to close under-collateralized loans by paying off debts in exchange for collateral. Forced minting, on the other hand, helps correct supply-demand imbalances, ensuring that the token’s value remains within acceptable parameters.

- Community Governance: The protocol is governed by the ILIS DAO, a decentralized organization that ensures transparency, inclusivity, and fairness in decision-making. This governance model empowers the community to shape the future of the protocol, making it a truly decentralized and community-driven initiative.

- Integration with Radix Ecosystem: As part of the Radix ecosystem, the STAB Protocol benefits from Radix’s high scalability, security, and user-friendly design. This integration ensures that the protocol is well-positioned to serve a growing user base while leveraging the advanced features of the Radix platform.

- Alternative to Fixed Pegs: By offering a variable interest rate mechanism, STAB provides a unique alternative to fixed-peg stablecoins like USDC. This model enhances resilience and adaptability, making STAB a compelling option for users seeking stability without the constraints of a fixed fiat peg.

- Access the STAB Application: Begin your journey with STAB by visiting the official STAB Protocol Application. The app serves as the gateway to all protocol features, including borrowing, managing loans, and swapping assets.

- Borrow STAB: Navigate to the “Borrow” section of the app. Provide collateral in the form of XRD tokens, ensuring that the collateral value meets the minimum 150% requirement. Once the collateral is secured, initiate the borrowing process to receive STAB tokens directly in your wallet.

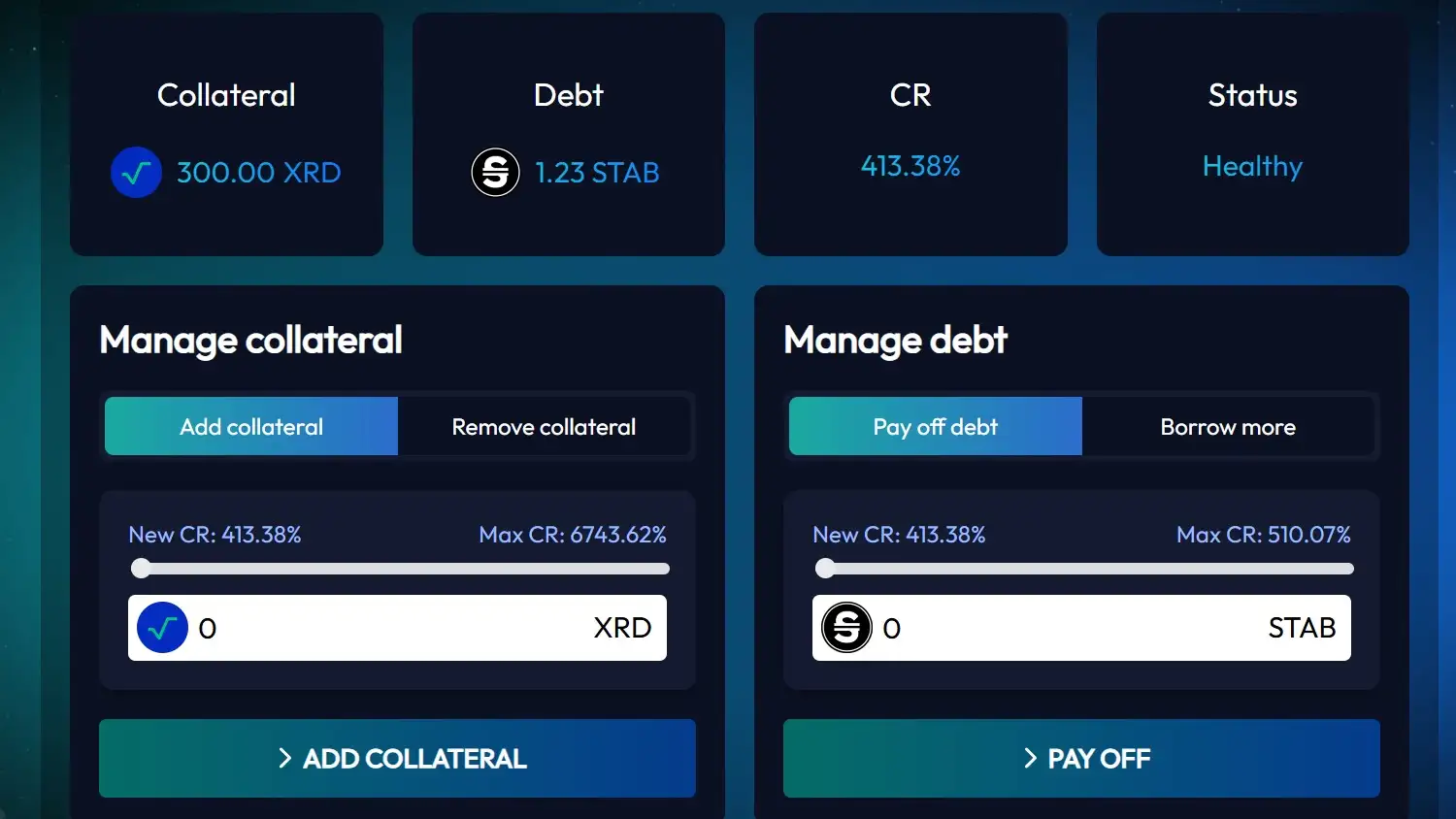

- Manage Loans: Use the "Manage Loans" feature to monitor your collateral ratio, adjust your collateral, or repay your STAB debt. This feature allows you to stay in control of your borrowing position and avoid liquidation risks.

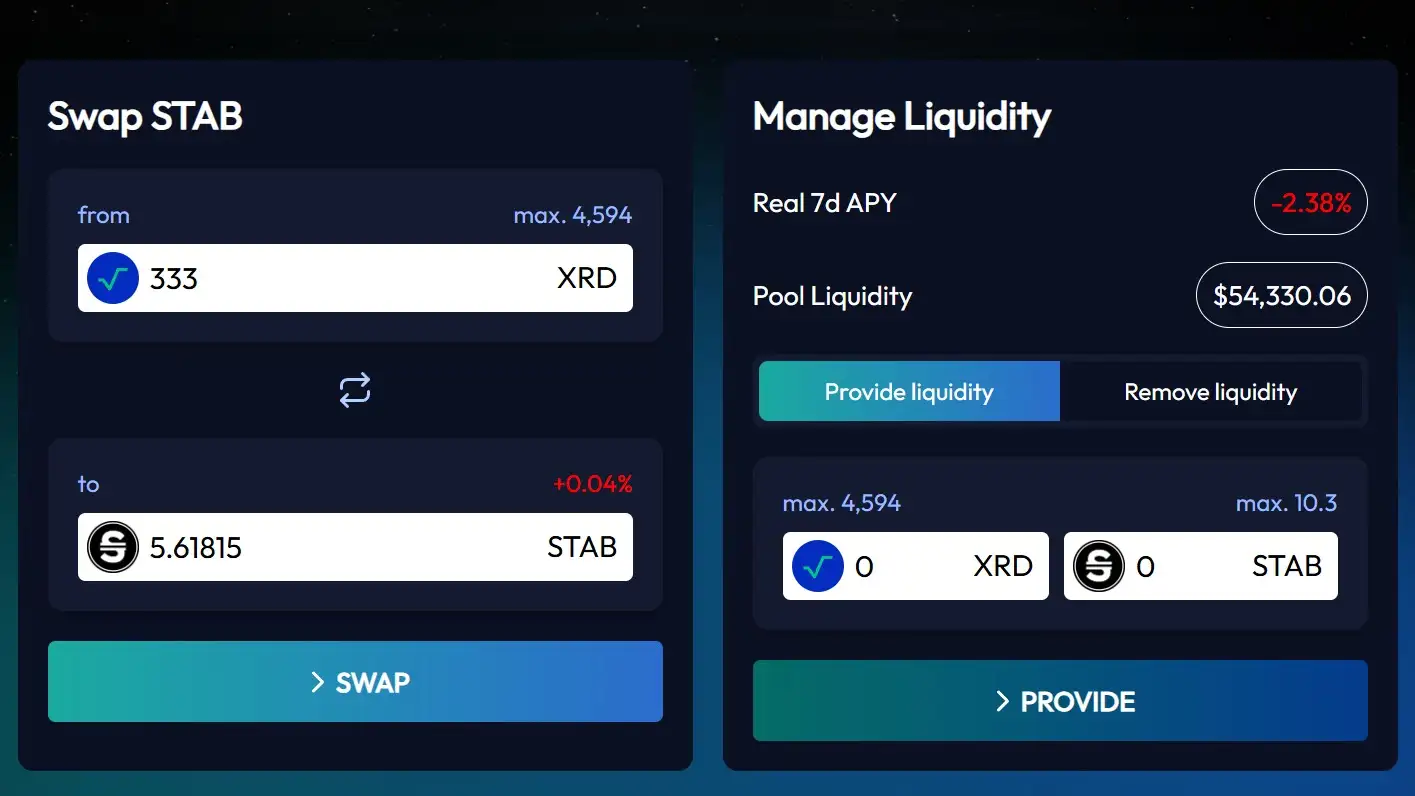

- Swap Assets: If you need to exchange XRD for STAB or vice versa, utilize the "Swap" function within the app. Additionally, you can participate in the XRD/STAB liquidity pool and earn rewards by providing liquidity.

- Participate in Governance: Engage with the ILIS DAO by participating in community discussions and governance votes. This allows you to have a say in the protocol’s future developments and enhancements.

- Understand Risks: Before borrowing or holding STAB, familiarize yourself with the potential risks involved. The protocol’s documentation outlines risks such as smart contract vulnerabilities and liquidation scenarios, helping you make informed decisions.

For detailed guidance and tutorials, refer to the STAB Protocol Documentation. The documentation provides step-by-step instructions and insights into all aspects of the protocol, ensuring a seamless onboarding experience.

STAB Protocol Reviews by Real Users

STAB Protocol FAQ

The dynamic interest rate system of the STAB Protocol adjusts based on market conditions to stabilize the value of STAB. When there is excess demand for borrowing, the interest rate increases, making borrowing more expensive and encouraging repayment. Conversely, if there is low demand, the interest rate decreases, incentivizing borrowing and maintaining liquidity. This unique approach replaces the need for a fixed fiat peg, making STAB a more resilient and adaptive stable asset.

If the value of your collateral falls below the minimum required 150% threshold, the protocol may liquidate your position to ensure the stability of the system. This process involves auctioning your collateral to repay the STAB debt, protecting other users and the protocol from systemic risk. To avoid liquidation, you can add more collateral or repay part of your debt before the threshold is breached.

The STAB Protocol is governed by the ILIS DAO, a decentralized organization that oversees its development, upgrades, and overall direction. The ILIS DAO enables community-driven governance, ensuring that decisions are made transparently and inclusively. Token holders can participate in governance proposals and votes, playing an active role in shaping the protocol’s future.

Yes, you can earn rewards by participating in the XRD/STAB liquidity pool. By depositing tokens into the pool, you receive LPSTAB tokens, representing your share of the pool. These tokens entitle you to a portion of the trading fees and any additional rewards distributed by the protocol. This incentivizes users to maintain liquidity within the system, ensuring smooth trading and borrowing operations.

The STAB Protocol employs multiple safeguards to ensure sustainability. Key mechanisms include over-collateralized borrowing, which requires collateral valued at 150% or more of the borrowed STAB, and redemptions, which allow users to close under-collateralized loans through arbitrage. Additionally, the protocol’s dynamic interest rate adjusts to maintain balance between supply and demand, further reducing systemic risk.

You Might Also Like